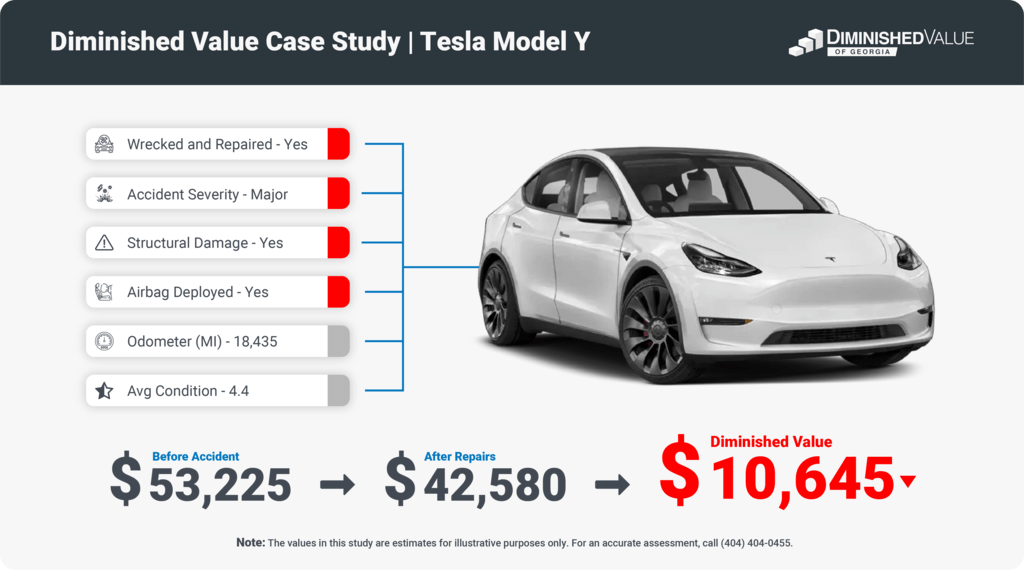

Diminished value is an essential concept for car owners, especially those involved in accidents. The fair market value of a vehicle drops significantly even after complete repairs, which can have a long-term financial impact.

For policyholders with Liberty Mutual, knowing how to file a diminished value claim could mean recovering part of this loss. In this comprehensive guide, we’ll walk you through everything you need to know about Liberty Mutual’s diminished value claims, maximizing your compensation, and avoiding common errors.

What is Diminished Value?

Diminished value refers to the loss in your vehicle’s market value following an accident. Even with top-notch repairs, a car with a history of damage is often worth less than one that’s never been in an accident.

There are three primary types of diminished value:

- Inherent Diminished Value: This is the most common type and refers to the depreciation in value simply because the vehicle has a documented accident history.

- Immediate Diminished Value: This type happens right after the accident but before any repairs are made. It reflects the visible damage to the vehicle.

- Repair-Related Diminished Value: This occurs when the repairs made to the vehicle are not up to standard, leaving behind imperfections or unresolved issues.

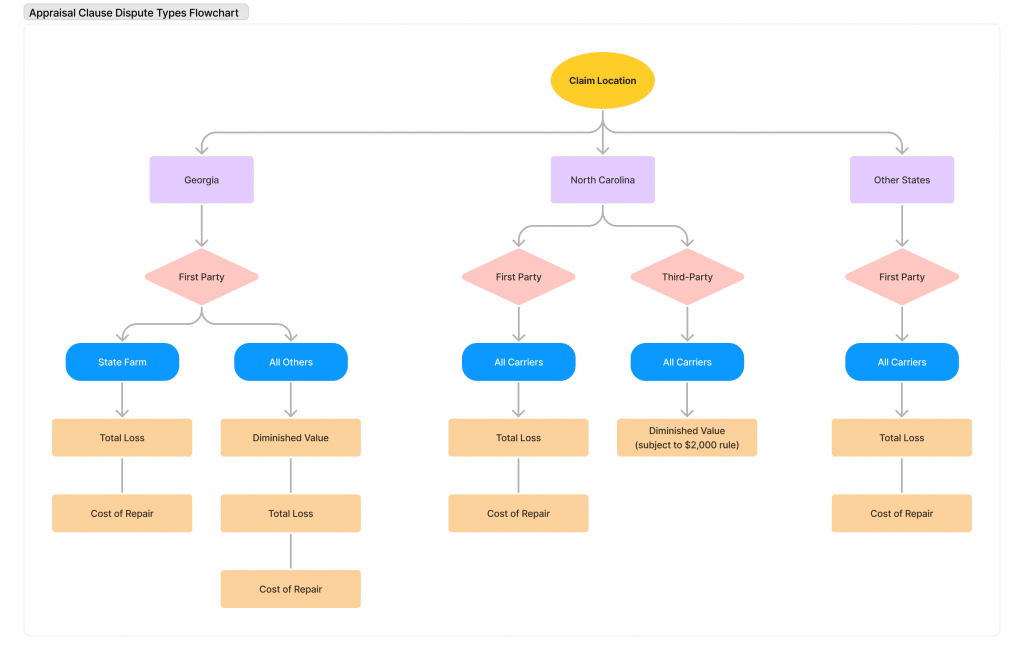

In the case of Liberty Mutual, you may be able to file a diminished value claim if you were involved in an accident. In Georgia, unlike many states, you can file both first-party and third-party diminished value claims.

This means that even if you were at fault in the accident, you can still pursue compensation under your own Liberty Mutual policy for the loss in value. However, if the other driver was at fault, you can file a third-party claim against their insurance. Understanding which applies is crucial to determining your path forward.

How Liberty Mutual Handles Diminished Value Claims

When filing a diminished value claim with Liberty Mutual, the process can be straightforward, but there are nuances to keep in mind. Liberty Mutual acknowledges diminished value claims in certain cases, particularly when the policyholder is not at fault. However, it is crucial to understand how the company approaches these claims and what factors they consider.

Eligibility Criteria for Diminished Value Claims

For insurance-related purposes, not all vehicles that have undergone damage qualify as having diminished value. If your car was not worth much, to begin with, or if the accident did not inflict significant damage, the amount that the vehicle decreased in value may be too insignificant to file a claim.

This list includes several circumstances which may disqualify you from making a diminished value claim for your car:

- Your vehicle does not have a substantial market value (cars under $7,000)

- You’ve already signed a release of liability form

- The accident caused minimal damage (usually under $500)

- The vehicle has excessive mileage (more than 30K miles per year)

- Your vehicle is too old (normally 10 years or older)

- Your vehicle has a branded title (salvage or rebuilt)

- Your vehicle had multiple previous accidents with greater damage

- Your vehicle was declared a total loss

- The statute of limitation has lapsed

- If you’re outside Georgia and courts have ruled against DV

How Liberty Mutual Evaluates Claims

When you file a diminished value claim with Liberty Mutual, an adjuster will be assigned to manage your case. Their responsibility includes conducting a comprehensive assessment of the situation, taking into account the car’s condition before the accident, the level of damage, and the quality of repairs.

In some cases, Liberty Mutual may request an external appraisal to obtain a more accurate understanding of the car’s lost market value after the collision, ensuring all factors are carefully considered.

Independent Appraisal and the Appraisal Clause

If you find Liberty Mutual’s assessment unsatisfactory, your policy might include an appraisal clause that allows both sides to hire independent appraisers. These appraisers will each provide their valuations, and if they don’t agree, an impartial umpire will be brought in to finalize the amount.

Engaging an independent appraiser is often beneficial since their evaluation tends to be more accurate and unbiased compared to the insurer’s estimate, particularly in cases where the initial offer is low.

How to Maximize Your Liberty Mutual Diminished Value Claim

While filing a diminished value claim with Liberty Mutual is straightforward, maximizing your compensation can be more complex. Here are a few tips to help you get the most out of your claim:

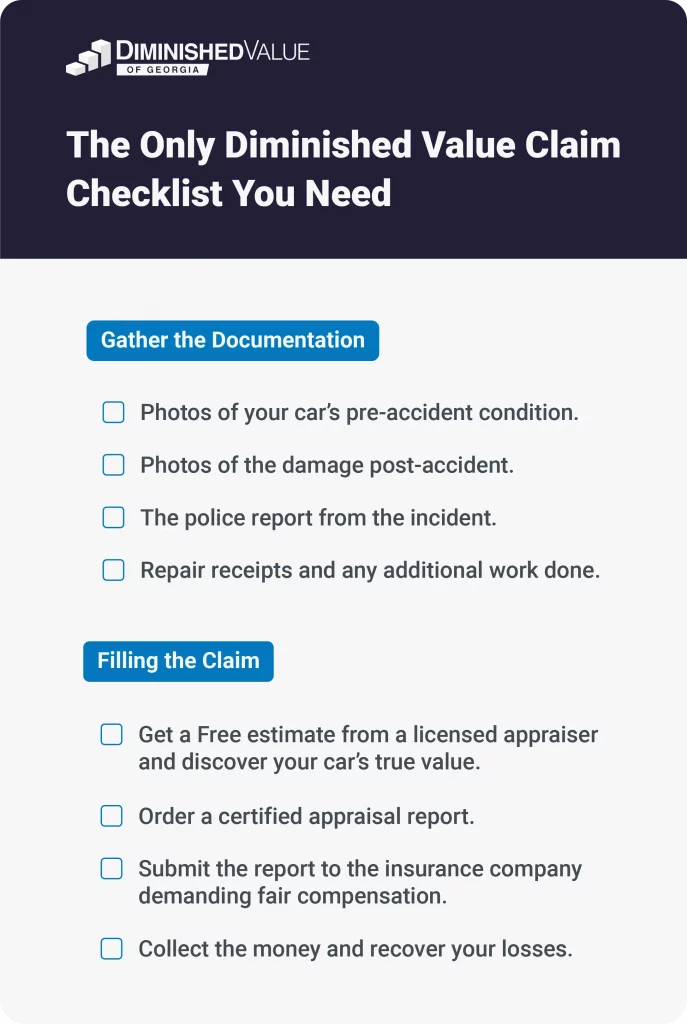

1. Gather Documentation

Ensure that you have all the necessary documents to support your claim. This includes:

- A copy of the police report

- Repair estimates and invoices

- Photos of the vehicle before and after the accident

- A diminished value appraisal from a certified appraiser

The more comprehensive your documentation, the stronger your case will be.

2. Obtain an Independent Diminished Value Appraisal

An independent appraisal is crucial when filing a diminished value claim. While Liberty Mutual may provide its own valuation, this is often lower than the actual diminished value of your vehicle. Insurance companies often use the 17c Formula to calculate Diminished Value, which may not take into account the unique characteristics of your vehicle, potentially undervaluing your claim.

By hiring an independent appraiser, you ensure an objective and accurate evaluation. This can help you in negotiations with the claims adjuster and prevent lowball offers.

3. Understand Your Policy and State Laws

Each state has different laws regarding diminished value claims, so it’s important to familiarize yourself with your local regulations. For example, in Colorado, you can only file a diminished value claim against a third party, meaning you cannot claim against your own insurance unless you have uninsured motorist coverage. Make sure to review your Liberty Mutual policy and understand how it applies to your situation.

Common Pitfalls When Filing a Claim with Liberty Mutual

Filing a diminished value claim can be complex, and there are several common mistakes that policyholders make, which can cost them compensation. Here are some pitfalls to avoid:

Mistakes to Avoid

- Not hiring an independent appraiser: It can result in a low settlement offer if you rely solely on Liberty Mutual’s assessment. To increase your chances of a higher payout, it’s important to have an independent appraiser provide an objective third-party valuation.

- Accepting the First Offer: Liberty Mutual may try to settle your claim quickly with a low initial offer. Don’t accept the first offer without thoroughly evaluating your vehicle’s actual diminished value.

- Trusting the Insurance Company: Remember, Liberty Mutual is not your friend, don’t trust that they are going to give you the best compensation for your claim.

- Not negotiate: You have the power to negotiate with them to get what you deserve. You will be more successful with the proper documentation, such as an appraisal report and supporting documents, to demand fair payment.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion

Managing a diminished value claim with Liberty Mutual doesn’t have to be overwhelming. By staying well-informed, gathering the right evidence, and obtaining an independent appraisal, you significantly increase your chances of obtaining a fair settlement for your vehicle’s depreciation.

The claims process might seem complicated, but with a strategic and persistent approach, you can navigate it successfully. To maximize your compensation, it’s important to be well-prepared, understand your policy, and take proactive steps at every stage of the claims process.