Car ownership is a cornerstone of modern life, offering convenience and freedom. However, the costs associated with owning a vehicle can vary dramatically depending on where you live. From insurance premiums and gas prices to registration fees and maintenance costs, the state you reside in plays a pivotal role in determining how much you’ll spend annually.

If you’re looking to save money in 2025, this comprehensive guide will reveal the least expensive states to own a car. We’ll dive deep into the factors that influence car ownership costs, provide a detailed breakdown of the top 10 most affordable states, and offer expert tips to help you minimize expenses.

Whether you’re planning a move or simply want to optimize your budget, this guide has you covered.

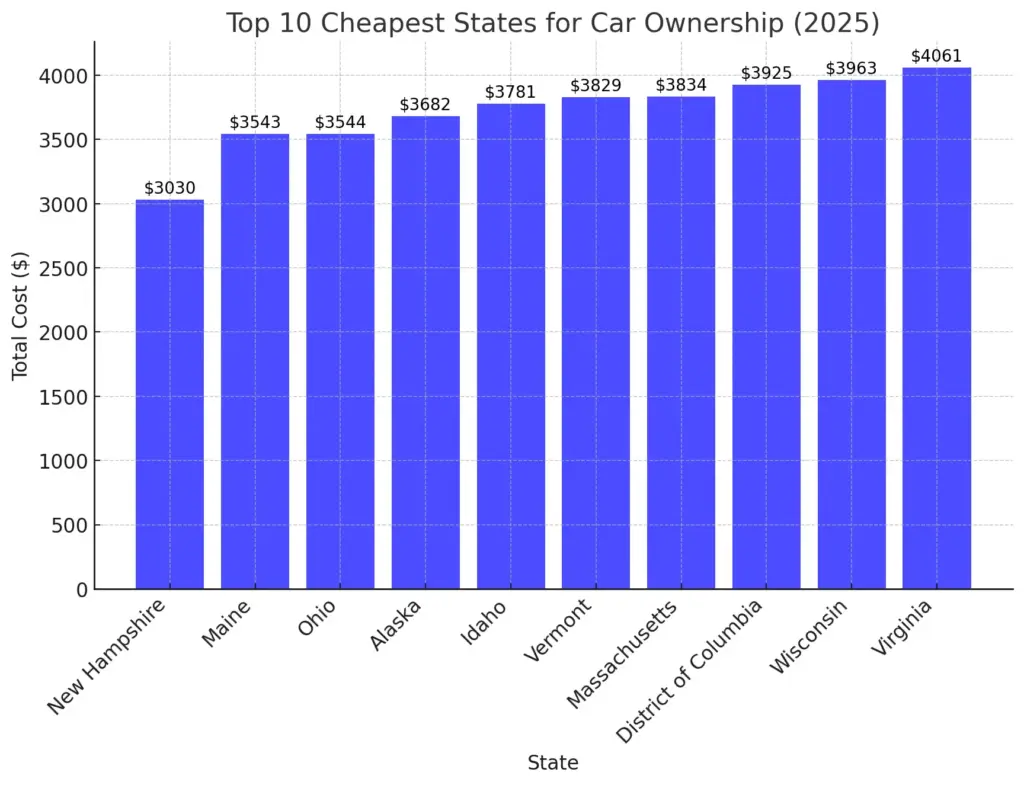

Top 10 Cheapest States to Own a Car in 2025

1. New Hampshire

New Hampshire is the most affordable state for car ownership, thanks to its lack of sales tax and relatively low insurance rates. Fuel prices and repair costs remain competitive, making it the best state for budget-conscious drivers.

- Total Annual Cost: $3,030

- Average Annual Insurance Cost: $1,278

- Fuel Costs: $1,381

- Sales Tax: $0

- Annual Repair Costs: $371

2. Maine

Maine offers low insurance rates and moderate fuel costs. While there is a small sales tax, the overall expenses are still among the lowest in the country.

- Total Annual Cost: $3,543

- Average Annual Insurance Cost: $1,243

- Fuel Costs: $1,721

- Sales Tax: $230

- Annual Repair Costs: $349

3. Ohio

Ohio is another affordable state for drivers, featuring reasonable insurance costs and repair expenses. Fuel prices are moderate, making it an excellent choice for cost-conscious car owners.

- Total Annual Cost: $3,544

- Average Annual Insurance Cost: $1,373

- Fuel Costs: $1,515

- Sales Tax: $303

- Annual Repair Costs: $354

4. Alaska

Despite its remote location, Alaska ranks high for affordability, largely due to low sales tax and moderate fuel costs. Insurance rates are slightly higher, but the overall cost remains low.

- Total Annual Cost: $3,682

- Average Annual Insurance Cost: $1,694

- Fuel Costs: $1,525

- Sales Tax: $76

- Annual Repair Costs: $387

5. Idaho

Idaho’s low insurance rates and moderate fuel costs make it one of the best places for car owners looking to save money. Repair expenses are also relatively low.

- Total Annual Cost: $3,781

- Average Annual Insurance Cost: $1,330

- Fuel Costs: $1,810

- Sales Tax: $252

- Annual Repair Costs: $389

6. Vermont

Vermont boasts affordable car insurance and fuel costs, with reasonable repair and sales tax expenses. This makes it a cost-effective state for drivers.

- Total Annual Cost: $3,829

- Average Annual Insurance Cost: $1,283

- Fuel Costs: $1,905

- Sales Tax: $266

- Annual Repair Costs: $374

7. Massachusetts

Massachusetts keeps car ownership costs low with reasonable insurance and fuel expenses. Sales tax is moderate, but repair costs are among the lowest in the nation.

- Total Annual Cost: $3,834

- Average Annual Insurance Cost: $1,740

- Fuel Costs: $1,446

- Sales Tax: $261

- Annual Repair Costs: $386

8. District of Columbia

Despite being an urban area, D.C. offers low fuel costs, helping to keep total car ownership expenses down. However, insurance rates are slightly higher than other top-ranking states.

- Total Annual Cost: $3,925

- Average Annual Insurance Cost: $2,371

- Fuel Costs: $892

- Sales Tax: $251

- Annual Repair Costs: $411

9. Wisconsin

Wisconsin ranks among the cheapest states for car ownership with affordable insurance, moderate fuel prices, and low repair costs.

- Total Annual Cost: $3,963

- Average Annual Insurance Cost: $1,616

- Fuel Costs: $1,748

- Sales Tax: $238

- Annual Repair Costs: $361

10. Virginia

Virginia rounds out the top 10 with low insurance rates, moderate fuel prices, and manageable repair costs, making it a great choice for cost-conscious drivers.

- Total Annual Cost: $4,061

- Average Annual Insurance Cost: $1,684

- Fuel Costs: $1,735

- Sales Tax: $241

- Annual Repair Costs: $401

Why Car Ownership Costs Vary by State

Understanding why car ownership costs differ across states is the first step to saving money. Several key factors contribute to these variations:

1. Car Insurance Rates

Car insurance is one of the most significant expenses for drivers, and premiums can vary widely by state. States with higher traffic congestion, accident rates, or instances of auto theft typically have higher insurance costs.

For example, Michigan is known for its expensive insurance rates due to its no-fault insurance system, while states like Mississippi and Iowa offer some of the lowest premiums.

2. Gas Prices

Fuel costs are another major expense for car owners. Gas prices fluctuate based on state taxes, proximity to refineries, and local demand. States with higher fuel taxes, such as California and Pennsylvania, tend to have more expensive gas, while states like Alabama and Missouri benefit from lower taxes and cheaper fuel.

3. Registration and Tax Fees

Vehicle registration fees and annual taxes can add up quickly. Some states, like California and Washington, charge hefty fees for registration, while others, like Arizona and Kentucky, keep these costs low. Additionally, some states impose personal property taxes on vehicles, which can significantly increase your annual expenses.

4. Maintenance and Repair Costs

The cost of maintaining a car can vary depending on the state’s climate and road conditions. States with harsh winters, such as Minnesota and Wisconsin, often see higher maintenance costs due to salt damage and potholes. In contrast, states with mild weather, like Alabama and Georgia, tend to have lower repair costs.

5. Cost of Living

The overall cost of living in a state can also impact car ownership expenses. States with a lower cost of living, such as Mississippi and Arkansas, typically have cheaper labor rates for repairs and maintenance, as well as lower insurance premiums.

Key Factors That Make These States Affordable

Low Insurance Rates

Car insurance is one of the most significant expenses for drivers. States like Mississippi and Oklahoma have some of the lowest premiums in the country, thanks to fewer accidents and lower population densities.

Affordable Gas Prices

Gas prices vary widely by state due to taxes and local supply chains. States like Alabama and Missouri benefit from low fuel taxes and proximity to refineries, keeping prices at the pump low.

Minimal Registration and Tax Fees

Some states charge exorbitant fees for vehicle registration and annual taxes. However, states like Tennessee and Kentucky keep these costs low, making car ownership more affordable.

Cost-Effective Maintenance and Repairs

The cost of maintaining a car can vary depending on the state’s climate and road conditions. States with mild weather, like Alabama, tend to have lower maintenance costs.

Expert Tips to Save on Car Ownership in 2025

1. Compare Insurance Quotes

Insurance rates can vary significantly between providers. Use comparison tools to find the best rates in your state.

2. Opt for Fuel-Efficient Vehicles

Choosing a car with good gas mileage can save you hundreds of dollars annually, especially in states with higher fuel costs.

3. Take Advantage of State Incentives

Some states offer incentives for electric or hybrid vehicles, such as tax credits or reduced registration fees. Research your state’s programs to see if you qualify.

4. Maintain Your Vehicle Regularly

Regular maintenance can prevent costly repairs down the line. Simple actions like oil changes and tire rotations can extend the life of your car.

5. Drive Less

Reducing your mileage can lower your gas and maintenance costs. Consider carpooling, using public transportation, or working remotely when possible.

The Impact of Electric Vehicles (EVs)

Electric vehicles are becoming increasingly popular, and they can significantly reduce car ownership costs in certain states. Many states offer incentives for EV owners, such as tax credits, reduced registration fees, and access to carpool lanes. Additionally, EVs have lower maintenance costs compared to traditional gasoline-powered vehicles.

The Role of Public Transportation

In states with robust public transportation systems, such as New York and Massachusetts, car ownership may not be necessary. Utilizing public transit can save you money on gas, insurance, and maintenance.

The Importance of Credit Scores

Your credit score can impact your car insurance rates. Maintaining a good credit score can help you secure lower premiums, especially in states where insurance companies use credit-based insurance scores.

The Benefits of Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. If you own a home or rent an apartment, consider bundling your policies to save money.

The Impact of Driving Habits

Your driving habits can also affect your car ownership costs. Avoiding aggressive driving, speeding, and frequent braking can improve your fuel efficiency and reduce wear and tear on your vehicle.

Conclusion

Owning a car doesn’t have to break the bank, especially if you live in one of the least expensive states to own a car in 2025. States like Mississippi, Arkansas, and Oklahoma offer low insurance rates, affordable gas prices, and minimal fees, making them ideal for budget-conscious drivers.

By following the expert tips outlined in this guide, you can further reduce your car ownership costs and enjoy the freedom of the open road without financial stress.

Whether you’re planning a move or simply looking to save money, consider these states for affordable car ownership in 2025. Start comparing costs today and take control of your car-related expenses!