Automotive Affordability Crisis: A Global Perspective

The landscape of the automotive market is undergoing a significant transformation, with rising vehicle prices in the US and Europe leaving budget-conscious consumers with limited options for affordable cars.

This phenomenon is exacerbated by the increasing prominence of premium-priced electric vehicles (EVs) entering the market. As legacy automakers shift away from the entry-level segment, a white space opportunity emerges for new, lower-cost manufacturers to fill the void.

The Decline of Affordable Cars in the US and Europe (PDF)

The Changing Dynamics in the US Market

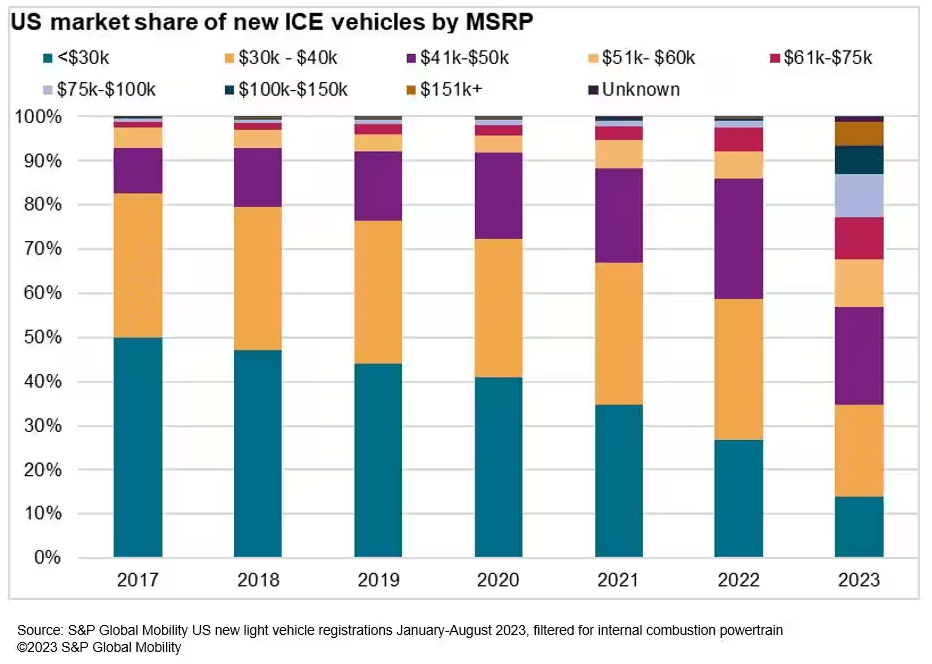

Over the past decade, the affordability of new vehicles in the US has seen a drastic decline. What was once possible to acquire for less than $20,000 is now pushing the boundaries of $30,000 as the lowest transaction price for a so-called “low-priced” vehicle. S&P Global Mobility’s analysis reveals a significant decrease in the share of new vehicles below the $30,000 price point, with only a quarter of the market falling within this range.

The definition of an “affordable” vehicle, based on an MSRP below $30,000, underscores the evolving pricing landscape. Adjusting for inflation, the US market now has 16 fewer affordable models compared to 2017. Notably, some vehicles that were previously excluded from the affordable category now make the cut, signaling a shift in consumer affordability thresholds.

The European Scenario: A- and B-Segment Challenges

In Europe, the A- and B-segments, once vibrant markets for entry-level buyers, have witnessed a decline in both variety and marketing efforts. The number of A- and B-segment vehicles has decreased from 190 models in 2014 to 160 in 2023, with further predictions of decline to 124 models in 2024.

The departure of popular, low-priced vehicles like the Ford Fiesta and Citroen C1, coupled with the shift toward more profitable C-segment crossovers, reflects a changing landscape.

The Exodus from Affordable Cars: Factors at Play

Several factors contribute to the exodus from affordable cars, including two years of higher-than-average nominal vehicle price growth. This growth is attributed to additional vehicle content, a focus on higher trim levels for increased profits, and adjustments made during the low-inventory pandemic years. The elimination of base trim levels for C-segment vehicles in the US further restricts options for budget-conscious consumers.

Regulatory pressures, particularly in the form of Corporate Average Fuel Economy (CAFE) standards, have influenced manufacturers to phase out sedans in favor of SUV-shaped crossovers. Sedans face more stringent fuel economy targets, making them less attractive to manufacturers seeking compliance. The adoption of Stop/Start or hybrid technologies to meet emissions standards has contributed to the decline of internal combustion engine (ICE) powertrains in favor of more expensive hybrids and battery-electric vehicles.

EV Affordability Challenges

While the global market embraces electrification, affordable electric vehicles remain a challenge to find. Most original equipment manufacturers (OEMs) prioritize building premium-priced EVs before aiming for economies of scale.

Currently, only three affordable EV options exist in the US market, reflecting consumer concerns about EV affordability as the primary reason against adoption.

Opportunities for Mainland Chinese Automakers

The departure of legacy OEMs from the entry segment opens opportunities for low-price models to enter the US and European markets through non-traditional channels.

Mainland Chinese automakers, in particular, could design vehicles built in and imported from Mexico, bypassing tariffs on vehicles assembled in China. This trend is not limited to affordable internal combustion vehicles but also extends to the nascent affordable electric vehicle niche.

Outlook and Opportunities:

The A- and B-segments in Europe may experience a cyclical rebound, with Renault’s recent decision to introduce a gas-only version of its Clio supermini indicative of potential market shifts. However, the thin profit margins in these segments pose challenges, and the opportunity to offer affordable small cars may be short-lived if more players enter the market.

Affordability, beyond the vehicle transaction price, encompasses incentives, trade-in value, taxes, fuel economy, and loan rates. Average annual car payments as a percentage of income have been on the rise since 2021, driven by slower income growth, steadily increasing vehicle prices, lower purchase incentives, and elevated vehicle loan rates.

Looking ahead, as OEMs achieve economies of scale in EV production, consumers may benefit from lower EV prices. Leasing, once considered an entryway for budget-conscious consumers, has seen a decline, with EV leasing gaining traction. As incentives rise and EV inventories improve, affordability concerns may ease, offering relief to consumers in a market characterized by elevated interest rates and prices.