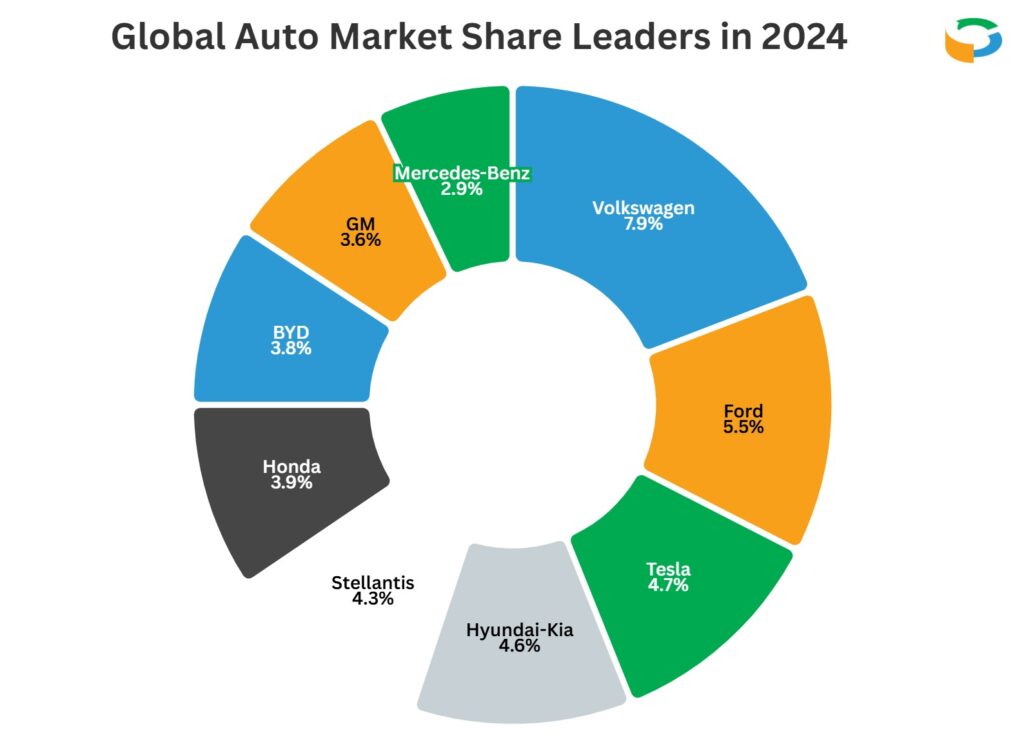

Global Auto Market Share Leaders in 2024

The 2024 automotive landscape saw fierce competition as brands raced to adapt to EV mandates, supply chain shifts, and changing consumer preferences. Here are the top 10 brands by global market share:

| Rank | Brand | Market Share | Key Driver |

|---|---|---|---|

| 1 | Toyota | 10.8% | Hybrid dominance, Corolla/RAV4 |

| 2 | Volkswagen | 7.9% | ID.4 EV surge, China recovery |

| 3 | Ford | 5.5% | F-Series trucks, Mustang Mach-E |

| 4 | Tesla | 4.7% | Model Y (world’s top-selling EV) |

| 5 | Hyundai-Kia | 4.6% | Affordable EVs (e.g., Kia EV9) |

| 6 | Stellantis | 4.3% | Jeep, Ram, Peugeot electrification |

| 7 | Honda | 3.9% | CR-V Hybrid, U.S. loyalty |

| 8 | BYD | 3.8% | China’s EV champion |

| 9 | GM | 3.6% | Silverado EV, Cadillac Lyriq |

| 10 | Mercedes-Benz | 2.9% | EQS luxury EV adoption |

Key Trends Reshaping 2024’s Market

- EVs Drive Growth:

- Tesla and BYD captured 28% of the global EV market, while legacy automakers struggled to match their margins.

- Stat to Watch: EVs accounted for 18% of all auto sales (up from 12% in 2023).

- China’s Domestic Surge:

- BYD overtook Volkswagen as China’s top-selling brand, claiming 14% market share domestically.

- Western brands like GM and Ford fell below 8% combined in China amid rising nationalism.

- U.S. Truck Wars:

- Ford’s F-Series (14% U.S. share) narrowly beat Ram (12%) and Silverado (11%), but Rivian’s R1T gained ground with 4% of electric truck sales.

- Europe’s Green Shift:

- Stellantis led with 11% EU share, fueled by Peugeot e-208 and Opel Astra EV.

- Volkswagen’s ID.4 became Europe’s #2 EV, trailing only Tesla Model Y.

Biggest Winners & Losers

▲ Rising Stars:

- BYD: +2.1% global share (2023–2024) via $11K Seagull EV.

- Tesla: Regained momentum with Cybertruck and Model 3 refresh.

▼ Declining Brands:

- Nissan: Fell to 12th place (-1.3%) due to delayed EV launches.

- Subaru: U.S. share dropped to 3.1% (-0.8%) amid hybrid shortages.

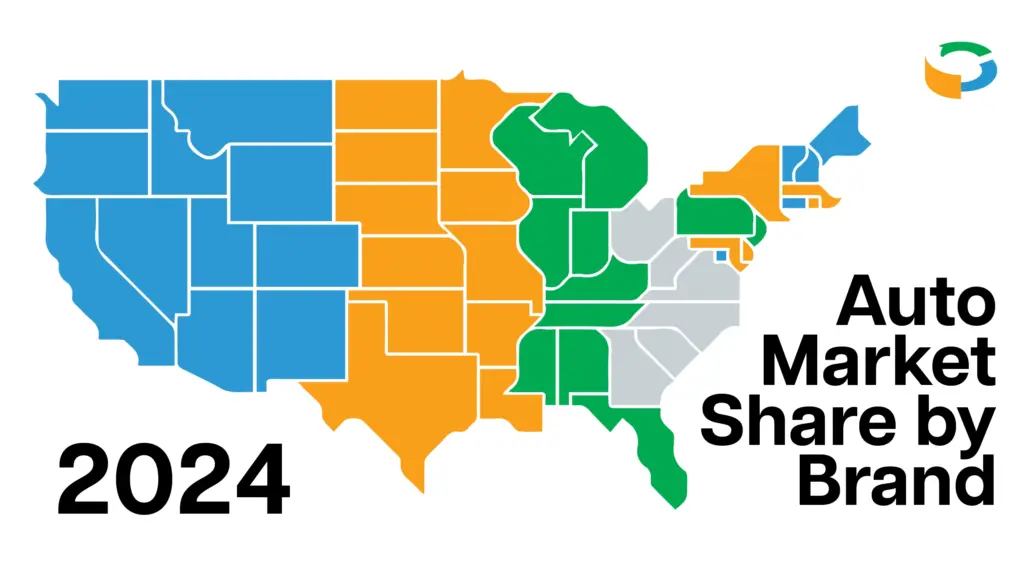

Regional Breakdown

| Region | Top Brand | Market Share | Key Model |

|---|---|---|---|

| U.S. | Ford | 12.6% | F-150, Mustang Mach-E |

| China | BYD | 14.0% | BYD Seagull, Han EV |

| Europe | Stellantis | 11.2% | Peugeot 208, Opel Astra |

| India | Maruti Suzuki | 41.5% | Swift, Brezza |

Why Toyota Still Dominates

- Hybrid Hedge: 60% of Toyota’s sales were hybrids (e.g., RAV4 Hybrid), sidestepping EV battery costs.

- Global Reach: #1 in Southeast Asia (32% share) and Africa (28%).

- Supply Chain Agility: Avoided 2023 chip shortages better than rivals.

2025 Predictions

- BYD Overtakes Tesla: Projected to lead global EV sales by Q3 2025.

- Legacy Automaker Shakeups: GM and Ford may spin off EV divisions to compete.

- Autonomous Push: Mercedes and Waymo partnerships could redefine luxury market share.

Need a Data-Driven Market Analysis?

Download our FREE 2024 Auto Market Report → Track brand strategies, regional shifts, and EV forecasts.