Auto Industry Recap

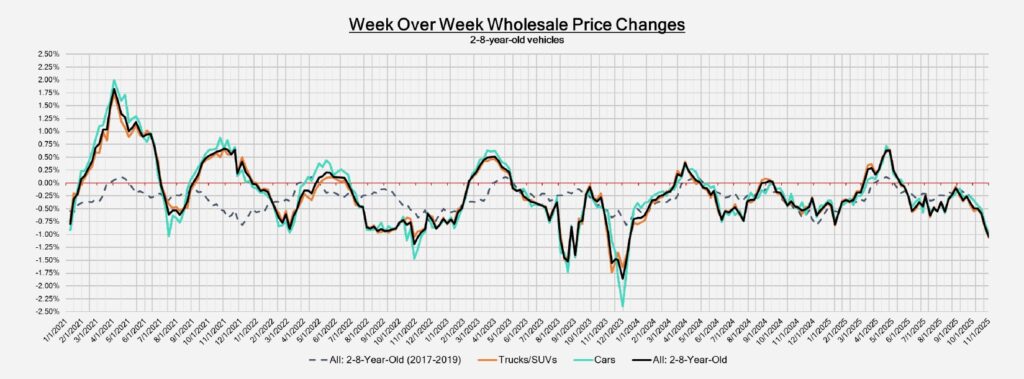

The depreciation trend that started two weeks ago continued to accelerate last week, with overall market values dropping by more than 1%.

Vehicles aged between 0 and 2 years experienced the sharpest decline, with values down by 1.07%. Older models, in the 8–16-year range, also continued to lose value, though at a slower rate of 0.66%.

On a volume-weighted basis, car values fell by 0.97%, compared to a 0.79% decrease the previous week. The truck segment mirrored this pattern, posting a 1.06% drop versus 0.86% the week before.

Meanwhile, wholesale prices continued to soften, with the overall conversion rate holding steady at 58%—a slight improvement from the prior week.

Market Overview

The depreciation pattern that began two weeks ago continued to accelerate last week, as overall market values dropped by more than 1%.

Vehicles aged 0–2 years experienced the steepest declines, falling by 1.07%, while older models between 8 and 16 years also saw additional softening, though to a lesser degree, at -0.66%.

| Segment | This Week | Last Week | 2017–2019 Avg (Same Week) |

|---|---|---|---|

| Car Segments | -0.97% | -0.79% | -0.57% |

| Truck & SUV Segments | -1.06% | -0.86% | -0.51% |

| Market Average | -1.04% | -0.84% | -0.54% |

Car Segments

On a volume-weighted basis, overall car prices dropped by 0.97%, following a 0.79% decline the week before.

- Newer 0–2-year-old vehicles decreased by 1.18%, while 8–16-year-old models declined by 0.67%.

- All nine car categories recorded losses during the week.

- Sub-Compact Cars led the downturn, plunging 2.44%—the sharpest weekly drop seen since 2022.

- Newer 0–2-year-old Sub-Compacts were down 3.05%, following a 2.86% dip the previous week.

- Older 8–16-year-old units slipped a milder 0.71%.

- Compact Cars aged 0–2 years fell 1.87%, following a 1.62% drop the prior week, while 2–8-year-old models decreased 1.34%.

Truck and SUV Segments

The combined Truck and SUV category decreased by 1.06%, compared to 0.86% in the prior week.

- 0–2-year-old vehicles were down 1.04%, while older 8–16-year-old models declined 0.65%.

- Every truck category posted a decline in value.

- Minivans were relatively steady, with 0–2-year-old units dipping 0.25%, mid-aged vehicles (2–8 years) down 0.37%, and older models effectively flat.

- Compact Crossovers aged 0–2 years posted the largest single-week decline on record at 1.67%, surpassing even early-pandemic levels. Mid-aged units fell 1.48%, and older ones dropped 0.71%.

Wholesale Price Trends

The charted index (page 3) tracks the movement of 2–6-year-old vehicles, benchmarked to the first week of the year. The index is adjusted to maintain a consistent average age mix to reflect true price trends.

Recent data shows ongoing downward movement for 2025 compared to 2024, with a more pronounced softening than seen in pre-pandemic years.

Used Retail Pricing

Retail prices have become more transparent across dealerships due to widespread fixed-pricing practices, enabling improved tracking of market activity.

Based on roughly two million active U.S. dealer listings, retail prices for 2–6-year-old vehicles continue to decline modestly, with 2025 performance trending below 2024 levels (see chart on page 4).

Inventory and Sales Activity

Used Retail:

The Used Retail Active Listing Volume Index—covering both independent and franchised dealers—shows that inventory levels have remained relatively steady year-to-date. The average days-to-turn stands at approximately 37 days, indicating moderate retail velocity.

Wholesale:

Wholesale values continued to soften, with an average conversion rate of 58%, slightly higher than the previous week.

- Car values declined by 0.97%, accelerating from 0.79% the week prior.

- Truck values fell 1.06%, compared to 0.86% the previous week.

- Compact and Sub-Compact segments saw the most pressure, reflecting higher-than-normal supply.

- Luxury and sporty models were more resilient, with only small week-over-week fluctuations.

Market activity reflected typical seasonal softening, marked by cautious bidding and disciplined pricing behavior.

Analyst Note

Market analysts continue to closely monitor pricing dynamics, segment-specific trends, and buyer sentiment across both retail and wholesale environments. Early Q4 patterns indicate that elevated inventory and buyer selectivity will likely continue influencing values through the remainder of the year.