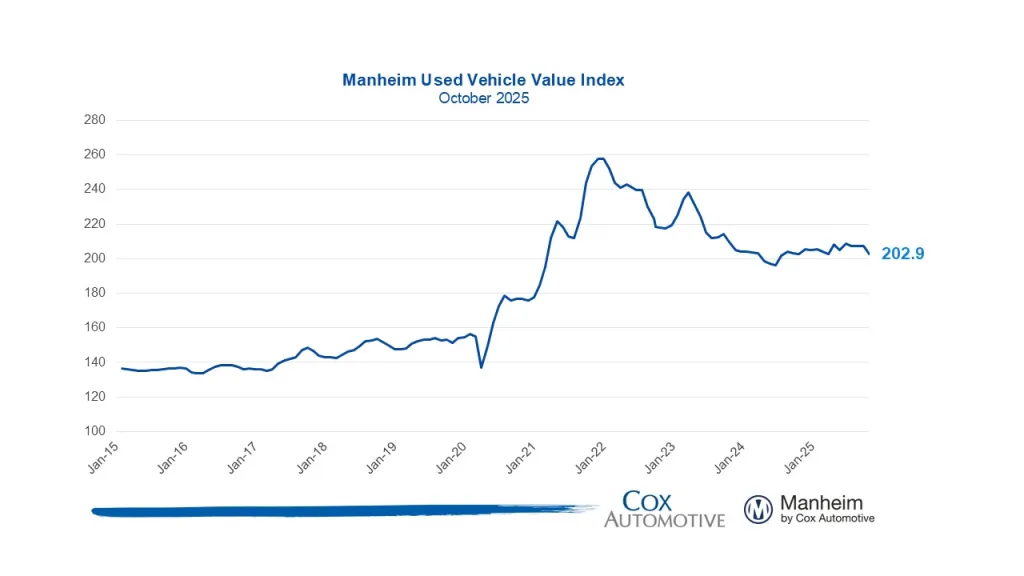

The Manheim Used Vehicle Value Index (MUVVI) is the wholesale market’s bellwether, calculated from millions of auction transactions and adjusted so month-to-month readings aren’t distorted by vehicle mix.

It’s a powerful context for your diminished value (DV) or total loss negotiations, but it’s not a VIN-specific price. We use it alongside comps, condition, and timing to keep your number defensible.

What the Manheim Index actually measures

Manheim applies statistical analysis to 5M+ wholesale transactions each year to produce a seasonally adjusted monthly index that shows the direction and magnitude of wholesale prices independent of shifts in the mix of vehicles sold. It’s published on the fifth business day of each month, with occasional mid-month reads.

Why you should care

Carriers, attorneys, dealers, and economists use MUVVI to understand trend and momentum. It won’t tell you what your exact car is worth, but it can expose when a valuation is out of step with the current market.

Where prices are right now?

October 2025

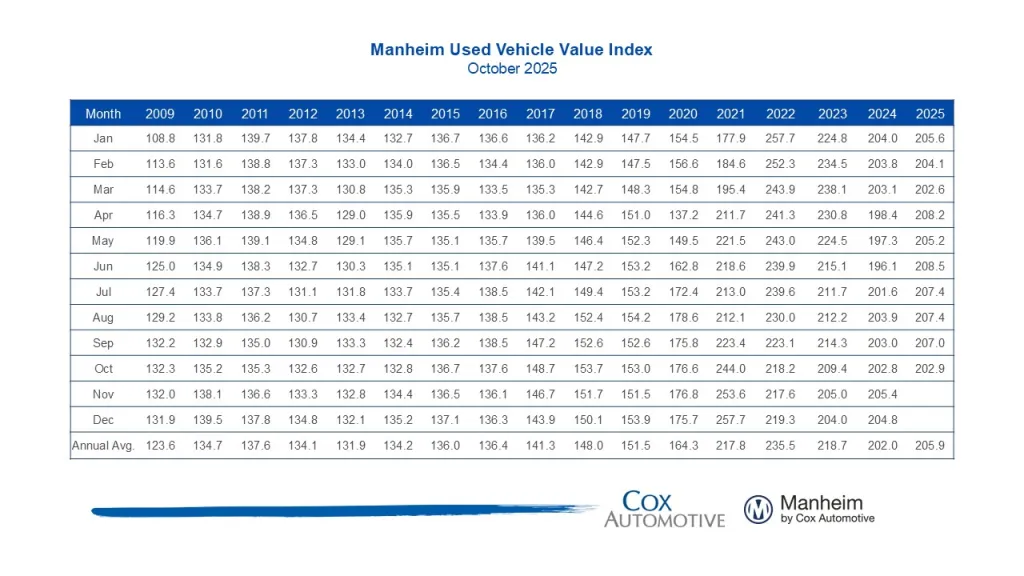

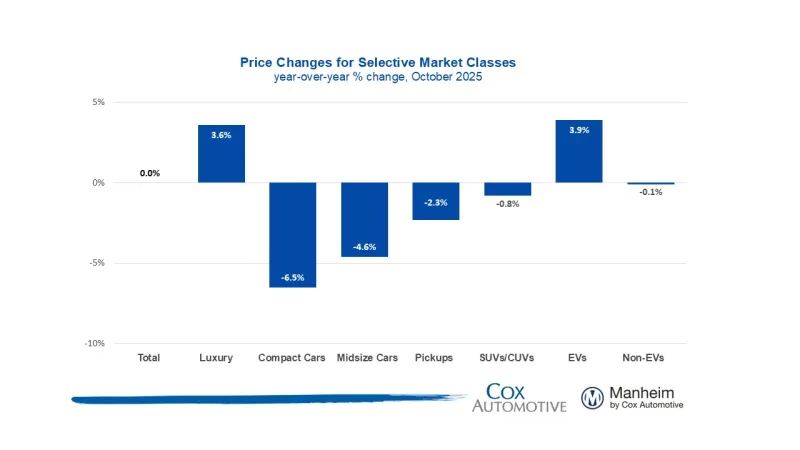

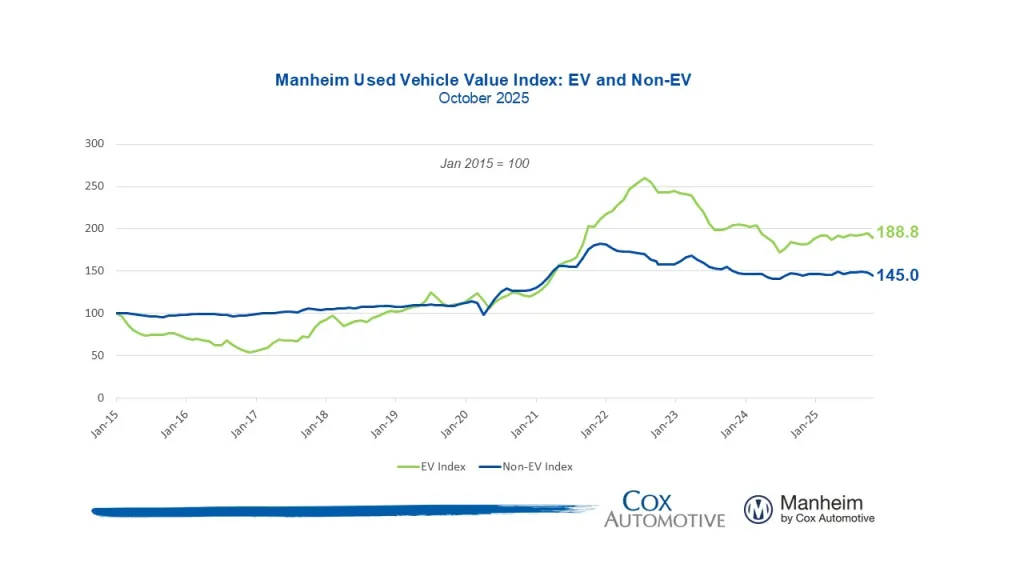

Manheim reports the Index at 202.9, a 2.0% month-over-month decline (seasonally adjusted) and roughly flat versus October 2024. Non-adjusted wholesale prices fell 3.7% from September and sat about 0.2% higher year over year. Manheim notes October often shows the steepest depreciation seasonally.

Market color from Cox Automotive’s team: declines in October are typical as dealers pace into winter and new-model mix grows; tighter retail inventory late in the month slowed depreciation.

DVGA expert note: We never “plug the Index in” as a price. We use it to check whether the carrier’s valuation reflects the market trend around your loss/valuation date. If it doesn’t, we document the delta.

What pushes the Index up or down

- Supply: new-vehicle availability, off-lease return volume, and fleet remarketing.

- Demand: credit conditions and interest rates that change buyer affordability.

- Policy & shocks: tariffs and regulatory shifts can jolt wholesale prices quickly; 2025 coverage linked tariff effects to notable year-over-year moves.

How this fits into diminished value and total loss claims

Diminished Value: DV is the difference between the vehicle’s value without accident history and with it—today. A rising market can still show a stigma discount; a softening market can magnify it. We pair MUVVI trend with like-kind comps, repair scope, structural/airbag flags, and local demand to quantify your real discount. (Manheim)

Total Loss: Wholesale trends influence ACV and salvage dynamics. If the Index and current comps contradict a low carrier ACV, that’s leverage to correct it—especially when their data window is stale.

Georgia specifics you should know

- Deadline: Georgia’s statute of limitations for property damage (which includes DV) is four years from when the claim accrues (O.C.G.A. § 9-3-31). This is general information, not legal advice.

- Precedent: In State Farm v. Mabry (Ga. 2001), insurers were ordered to evaluate first-party physical damage claims for DV using an appropriate methodology, not a one-size-fits-all formula.

DVGA tip: If an adjuster presents a “worksheet” that caps DV by a fixed percentage, ask for the legal authority. Mabry requires a proper evaluation supported by evidence, not a rigid template.

How DVGA uses indices (and what we never do)

- Trend control: we document whether wholesale prices were rising, flat, or falling in the 30–60 days around your loss/valuation date. (Manheim)

- Triangulation: MUVVI direction + like-kind comps (trim/options/mileage) + condition narrative (repair scope, structural/airbag status) + regional demand = a defensible figure.

- Carrier challenge: when a valuation relies on stale guidebook snapshots or inflexible formulas, we submit current market evidence step by step.

DVGA tip: Keep the repair estimate, parts list, photos, and any frame/airbag notes. These details materially affect buyer perception and your DV.

Common misconceptions (fast answers)

“If the Index is up, I didn’t lose value.”

Not true. Diminished value is about stigma and marketability after repairs, not just the general tide of prices.

“I can use the Index number as my settlement price.”

No. It’s a trend gauge, not a VIN-specific retail/wholesale price. You still need an appraisal with comps and condition evidence.

“That 10% formula is Georgia law.”

No. Georgia’s high court requires proper evaluation, not a fixed cap. Evidence beats rules of thumb.