From Peaks to Plateaus: Examining the Current State of Used Truck Prices

In recent times, the used truck market has experienced significant fluctuations, driven by a myriad of factors, most notably the global pandemic. However, recent data from Price Digests suggests that the market may finally be stabilizing after two and a half years of uncertainty.

This article delves into the current state of the medium and heavy-duty used truck market, exploring key indicators such as average prices, age, and mileage. Join us as we analyze the trends and provide insights into whether the market is indeed returning to normalcy.

Are Used Trucks Market Getting Back to Normal? A Detailed Analysis (PDF)

Medium Duty Trucks: Finding Equilibrium

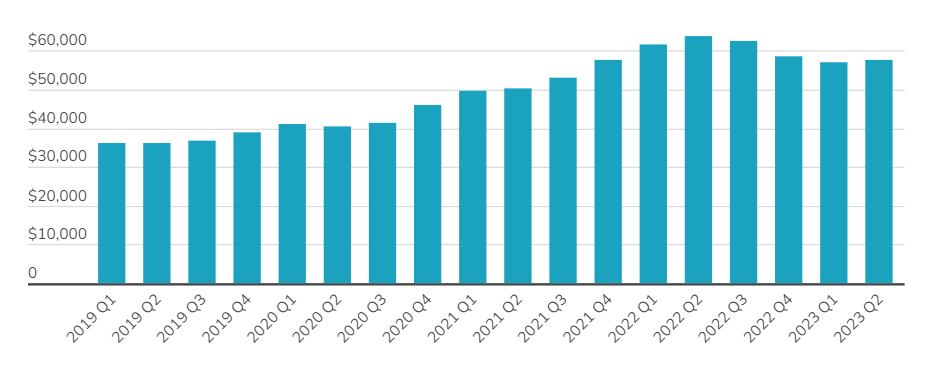

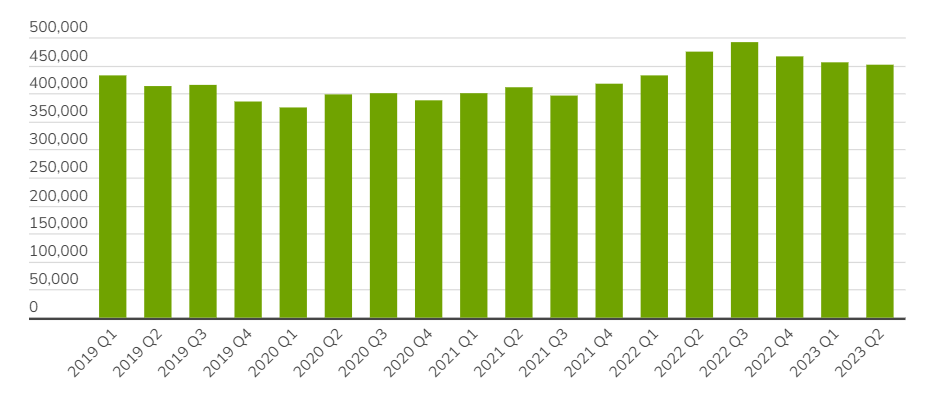

Average Prices: A Welcome Stagnation

After a tumultuous two years of roller-coaster inventory issues, the medium-duty truck market is showing signs of stability. Average resale prices have fallen by 10% since their peak in Q2 of 2022.

The silver lining lies in the fact that retail asking values have remained stagnant in the current year, indicating a possible return to normalcy. As inventory availability improves, the industry may witness a gradual correction in pricing.

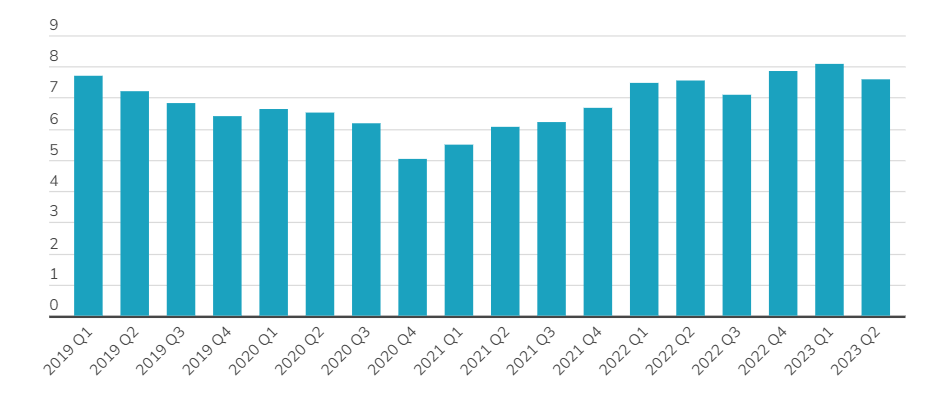

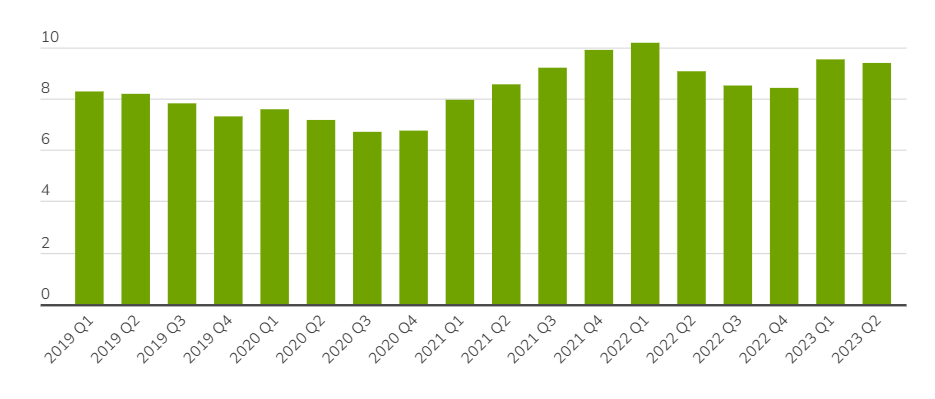

Average Age: A Dip to Familiar Levels

The average age of medium-duty trucks, after a steady increase, dipped in Q2 of 2023, returning to levels not seen in a year. The overall average age has settled at 7.57, mirroring the pre-pandemic levels of Q2 2019 when the average age was 7.69. This shift suggests a potential normalization in the market.

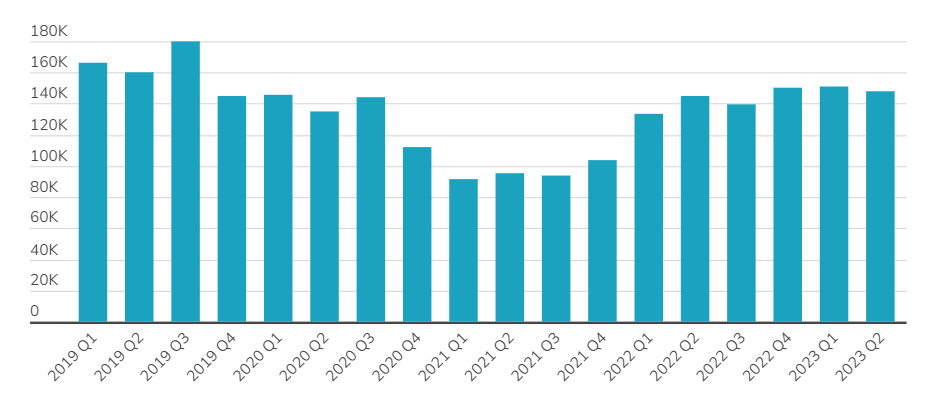

Average Mileage: Returning to Pre-Pandemic Norms

In contrast to the previous year’s steady increase, the current year shows a leveling out of mileage. The last three quarters have witnessed only modest movements, and like the average age, the mileage for medium-duty trucks has returned to pre-pandemic levels. This trend signifies a balance in the wear and tear of these vehicles.

Heavy Duty Trucks: Navigating Challenges

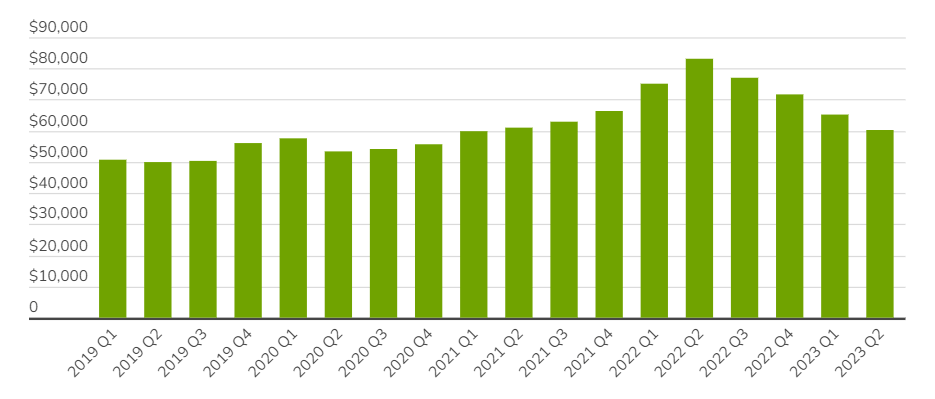

Average Prices: Correcting the Course

Prices for heavy-duty trucks have continued to decline in the current year, reverting back to levels observed almost two years ago. Although still higher than pre-pandemic figures, the resale prices are gradually correcting themselves from the artificial highs witnessed in Q2 of 2022.

Average Age: Balancing Act

After a dip late last year, the average age of used heavy-duty trucks remains on the higher side at 9.3. While not reaching the peak of 9.9 reported in Q4 of 2021, it still exceeds pre-pandemic levels. This persistent elevation suggests ongoing challenges in resolving inventory issues for new heavy-duty trucks.

Average Mileage: Reflecting Trends

Mileage for heavy-duty trucks aligns with the age of the vehicles, maintaining a steady but slightly decreasing trend. The combination of increased mileage and elevated average age indicates that the industry is still grappling with lingering inventory issues, particularly in the realm of new heavy-duty trucks.

Conclusion

The used truck market appears to be finding its footing, with medium-duty trucks leading the charge towards stability. The stagnation in average prices, coupled with a return to pre-pandemic levels in age and mileage, signals a potential normalization in this segment.

However, challenges persist in the heavy-duty sector, where prices are gradually correcting, but age and mileage trends suggest ongoing inventory challenges. As the market continues to evolve, stakeholders should stay vigilant and adapt to emerging trends in this ever-changing landscape.