How Insurance Determines Your Car is Totaled

When your car is declared a total loss, it’s because the cost of repairs exceeds a certain percentage of the car’s Actual Cash Value (ACV). The threshold for determining if a car is totaled varies by state but typically ranges between 50% and 75% of the car’s ACV.

Insurance companies look at how much it would cost to repair the vehicle and compare it to its current market value. If repairing the car is deemed too expensive or unsafe, it is considered totaled.

What Does “Totaled Car” Mean?

A car is considered “totaled” when the cost to repair it exceeds its Actual Cash Value (ACV), or when the damage makes it unsafe to drive. Insurance companies assess the condition of key components like the frame, engine, and safety features such as airbags.

If repairing these parts costs more than the vehicle’s worth, or compromises its safety, it’s declared a total loss. Your vehicle is totaled if: Cost of Repair + Salvage Value > ACV. For more signs that your car may be totaled, check out this guide on signs your car is totaled after an accident.

State-Specific Thresholds for Total Loss

The threshold for determining whether a car is totaled varies by state. Most states set a specific percentage of the vehicle’s Actual Cash Value (ACV) as the benchmark.

For example, in Georgia, the total loss threshold is typically 75% of the ACV, meaning if the repair costs plus salvage value exceed 75%, the car is declared a total loss.

In Florida, the decision is more circumstantial but generally follows an 80% threshold, while in Texas, the total loss rule is 100%, meaning the repair cost must equal or exceed the car’s ACV for it to be totaled. For more on Georgia’s rules, you can check out Rule 120-2-52-.06

Actual Cash Value (ACV) Explained

The Actual Cash Value of your vehicle is crucial in determining your insurance payout if your car is totaled. ACV represents the market value of your car at the time of the accident, factoring in depreciation. This value is calculated based on the car’s age, mileage, condition, and other factors like recent upgrades or repairs.

For a more accurate assessment, insurers and appraisers typically gather comparable vehicles to determine the value by comparing similar cars in the local market. The ACV is usually lower than what you originally paid for the car, as it reflects wear and tear over time.

What’s the Insurance Payout for a Totaled Car?

When your car is declared a total loss, the insurance payout is generally based on the Actual Cash Value of the vehicle at the time of the accident. This value reflects the car’s market worth, accounting for depreciation, mileage, and overall condition.

The payout is typically the ACV minus any applicable deductibles. If you decide to keep the car, the salvage value—what the car is worth in its damaged state—is subtracted from your payout.

However, 80% of the time, the insurance company may offer a payout lower than your vehicle’s true worth. To ensure a fair and accurate valuation, contacting a licensed appraiser for a second opinion can help you secure a higher payout. An appraiser provides an unbiased assessment of your vehicle’s value, often leading to better compensation.

Do you need a second opinion? Get a Free Total Loss claim review from our experts!

Factors That Influence Insurance Payout for a Totaled Car

Several key factors impact how much your insurance payout will be after your car is declared a total loss:

- Vehicle’s Condition Before the Accident: The car’s mileage, maintenance history, and any upgrades or repairs influence its value. Well-maintained vehicles with lower mileage will have a higher ACV, increasing your payout.

- Market Value and Comparable Cars: Insurance companies use comparables to assess your vehicle’s market value. This involves comparing it to similar cars in your local area based on factors like make, model, trim level, and mileage.

- Salvage Value: If you choose to keep your totaled vehicle, the salvage value (the car’s worth in its damaged state) will be deducted from the insurance payout. This value is determined by salvage auctions and depends on the car’s condition

What Happens to a Totaled Car After an Accident?

Once your car is declared a total loss, several important steps occur that will determine both your insurance payout and what happens to the vehicle. Understanding this process can help you make informed decisions.

Insurance Claim Process for Totaled Cars

The first step after your car is declared a total loss is to file a claim with your insurance company. They will inspect the vehicle and offer you an amount based on its ACV. However, 80% of the time, the initial offer might be lower than the car’s true value.

To ensure you receive a fair payout, it’s beneficial to contact a licensed appraiser who can issue an appraisal report. This report provides proof of your vehicle’s actual worth and can help you negotiate a higher payout with the insurance company.

Keeping a Totaled Vehicle: What You Need to Know

If you decide to keep your totaled car, the insurance payout will be reduced by the salvage value. While keeping the car can be a viable option, it often comes with additional complications, such as obtaining a salvage title and passing inspections before the vehicle can be driven again. For more insights, check out this guide on whether you should keep your totaled vehicle.

How to Maximize Your Insurance Payout for a Totaled Car

After your car is declared a total loss, it’s essential to make sure you’re getting the highest payout possible. There are several strategies you can use to increase the amount offered by your insurance company.

1. Get an Independent Appraisal

One of the most effective ways to maximize your insurance payout after your car is totaled is by getting an independent appraisal. Insurance companies often undervalue vehicles when calculating Actual Cash Value. A licensed appraiser can provide an unbiased, professional assessment of your car’s true market value.

This appraisal report serves as essential proof that you can use to challenge the insurer’s offer and negotiate for a higher payout. By presenting a detailed report that reflects the accurate condition and worth of your vehicle, you increase your chances of securing a fair settlement

2. Negotiate With Your Insurance Company

If the insurance company’s initial offer seems too low, don’t hesitate to negotiate. Use the appraisal report from the independent appraiser as evidence to support your claims. By presenting the true value of your vehicle, you can highlight discrepancies between the insurance company’s offer and the actual market value of your car.

Additionally, providing documents such as maintenance records, recent upgrades, or other relevant information can further strengthen your case. Many policyholders find that negotiation, backed by solid evidence, results in a higher payout.

3. Understand Your Insurance Policy

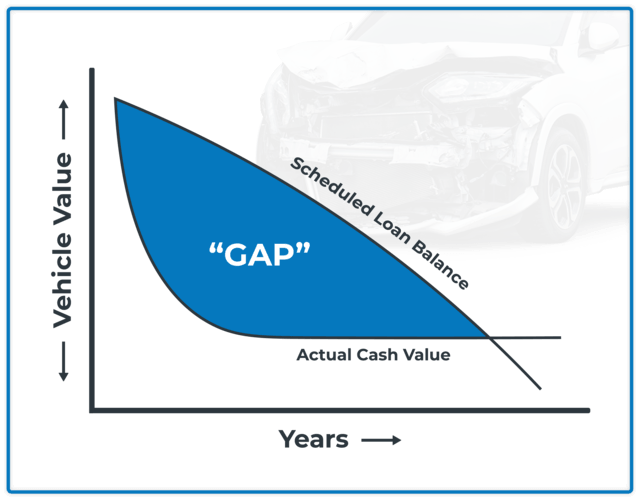

Before accepting any settlement offer, it’s important to thoroughly review your insurance policy to understand the coverage you have. Some policies may include additional benefits, such as GAP insurance, which covers the difference if the insurance payout is lower than what you owe on the vehicle loan.

Without this coverage, you could end up paying out-of-pocket to cover the remaining balance. Understanding these terms helps you maximize your payout and avoid financial surprises. For more details on GAP insurance and whether it’s worth it, check out this article.

Wrapping Up: What You Need to Remember

Dealing with a totaled car isn’t just about understanding your insurance policy—it’s about making the right choices that suit your specific situation. Whether you’re looking for the quickest route to a settlement or aiming to squeeze every possible dollar out of your payout, knowing your options makes all the difference. Beyond the financials, it’s crucial to remember that your car, even when totaled, is an asset. How you handle it—whether by negotiating, seeking appraisals, or deciding to keep it—depends on your long-term goals.

Every claim is unique. While the payout is a significant part of the process, don’t overlook other aspects, like deciding if retaining the vehicle is worthwhile, or if opting for a replacement vehicle makes more sense. In the end, it’s about finding a solution that aligns with both your immediate needs and your future plans. Stay informed, consult professionals when necessary, and make decisions based on what’s best for you—not just what’s offered on paper.