The Alabama Department of Insurance (ALDOI) provides resources and support for consumers dealing with insurance-related issues. Filing an Alabama Insurance Commissioner Complaint can help resolve disputes with insurance companies, agents, or adjusters. The department works to enforce state insurance laws and protect consumers’ rights.

How to File an Alabama Insurance Commissioner Complaint

1. File Online

The fastest way to file a complaint is through the Alabama Department of Insurance Online Complaint Portal. This method allows you to provide necessary details, such as your insurance company, claim number, and a description of your issue.

2. File by Mail or Fax

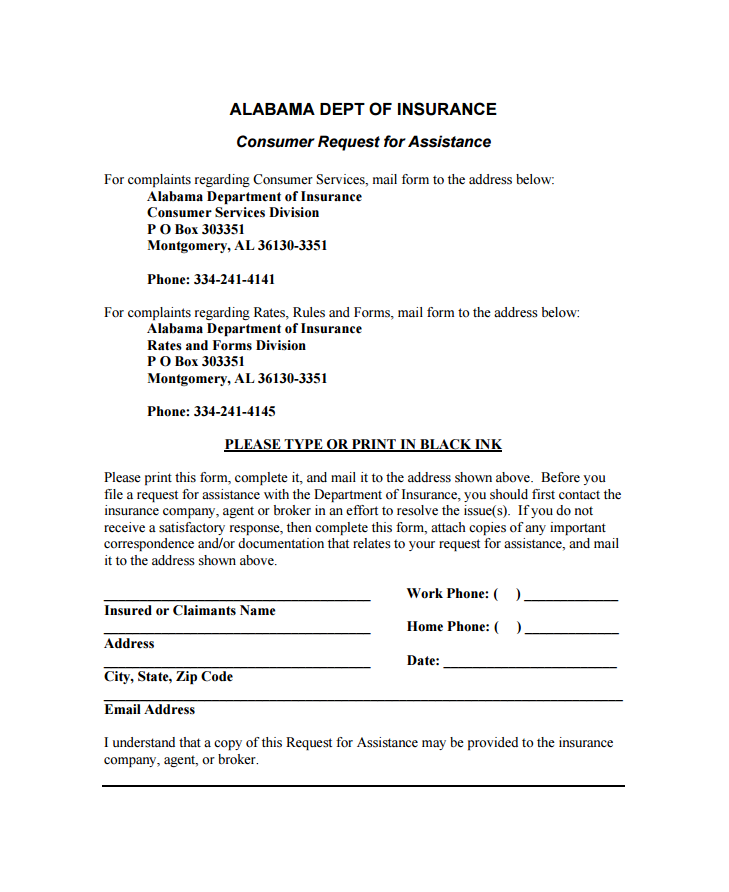

If you prefer to file a complaint manually, download the Alabama Department of Insurance Complaint Form (PDF), fill it out, and send it along with any supporting documentation to:

Mailing Address:

Alabama Department of Insurance

P.O. Box 303351

Montgomery, AL 36130-3351

Fax Number: (334) 956-7932

Section 8-33-11

Enforcement provisions.

(a) The commissioner may conduct examinations of warrantors, administrators, or other persons to enforce this chapter and protect warranty holders in this state. Upon request of the commissioner, a warrantor shall make available to the commissioner all accounts, books, and records concerning vehicle protection products sold by the warrantor that are necessary to enable the commissioner to reasonably determine compliance or noncompliance with this chapter.

(b) The commissioner may take action that is necessary or appropriate to enforce this chapter, the commissioner’s rules and orders, and to protect warranty holders in this state. If a warrantor engages in a pattern or practice of conduct that violates this chapter and that the commissioner reasonably believes threatens to render the warrantor insolvent or cause irreparable loss or injury to the property or business of any person or company located in this state, the commissioner may do any of the following:

(1) Issue an order directed to that warrantor to cease and desist from engaging in further acts, practices, or transactions that are causing the conduct.

(2) Issue an order prohibiting that warrantor from selling or offering for sale vehicle protection products in violation of this chapter.

(3) Issue an order imposing a civil penalty on that warrantor.

(4) Issue any combination of the foregoing, as applicable.

(c) Prior to the effective date of any order issued pursuant to subsection (b), the commissioner must provide written notice of the order to the warrantor and the opportunity for a hearing to be held within 10 business days after receipt of the notice, except prior notice and hearing shall not be required if the commissioner reasonably believes that the warrantor has become, or is about to become, insolvent.

(d) A person aggrieved by an order issued under this section may request a hearing before the commissioner. The hearing request shall be filed with the commissioner within 20 days after the date the commissioner’s order is effective, and the commissioner must hold such a hearing within 15 days after receipt of the hearing request.

(e) At the hearing, the burden shall be on the commissioner to show why the order issued pursuant to this section is justified. The provisions of the Alabama Department of Insurance Administrative Code Chapter 482-1-065 shall apply to a hearing request under this section.

(f) The commissioner may bring an action in any court of competent jurisdiction for an injunction or other appropriate relief to enjoin threatened or existing violations of this chapter or of the commissioner’s orders or rules. An action filed under this section also may seek restitution on behalf of persons aggrieved by a violation of this chapter or orders or rules of the commissioner.

(g) A person who is found to have violated this chapter or orders or rules of the commissioner may be ordered to pay to the commissioner a civil penalty in an amount, determined by the commissioner, of not more than five hundred dollars ($500) per violation and not more than ten thousand dollars ($10,000) in the aggregate for all violations of a similar nature. For purposes of this section, violations shall be of a similar nature if the violation consists of the same or similar course of conduct, action, or practice, irrespective of the number of times the conduct, action, or practice that is determined to be a violation of this chapter occurred.

(h) This chapter does not create a separate civil cause of action.

(Act 2006-600, p. 1638, §11.)

Code of Alabama – Vehicle Protection Product Act:

Section 8-33-9

Prohibited acts.

(a) Unless licensed as an insurance company, a vehicle protection product warrantor shall not use in its name, contracts, or literature, any of the words “insurance,” “casualty,” “surety,” “mutual,” or any other words descriptive of the insurance, casualty, or surety business or deceptively similar to the name or description of any insurance or surety corporation, or any other vehicle protection product warrantor. A warrantor may use the term “guaranty” or a similar word in the warrantor’s name.

(b) A vehicle protection product seller or warrantor may not require as a condition of sale or financing that a retail purchaser of a motor vehicle purchase a vehicle protection product that is not installed on the motor vehicle at the time of sale.

(Act 2006-600, p. 1638, §9.)

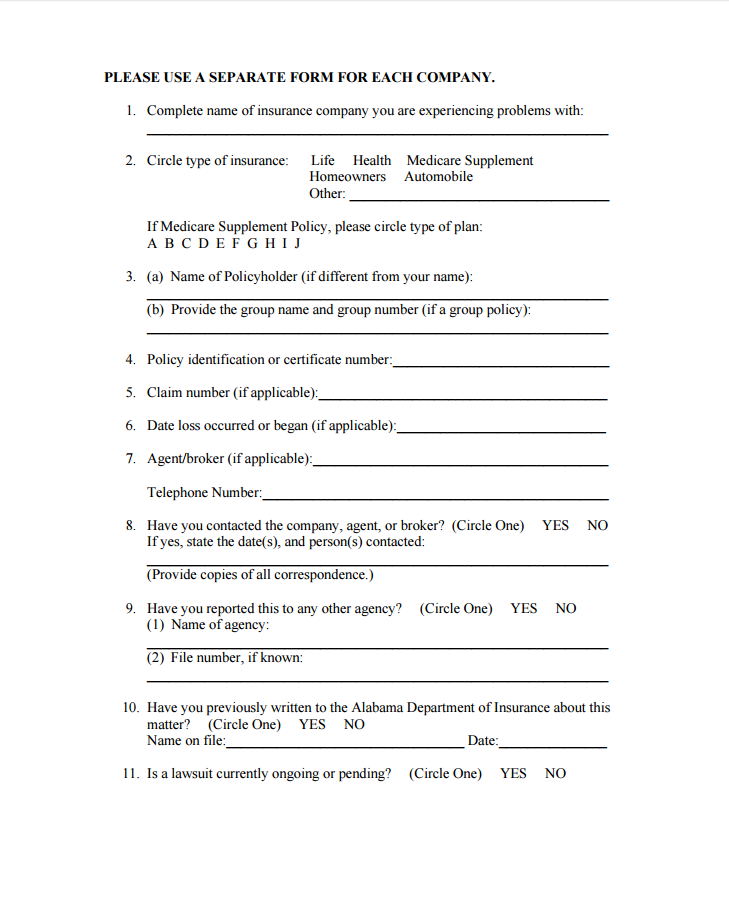

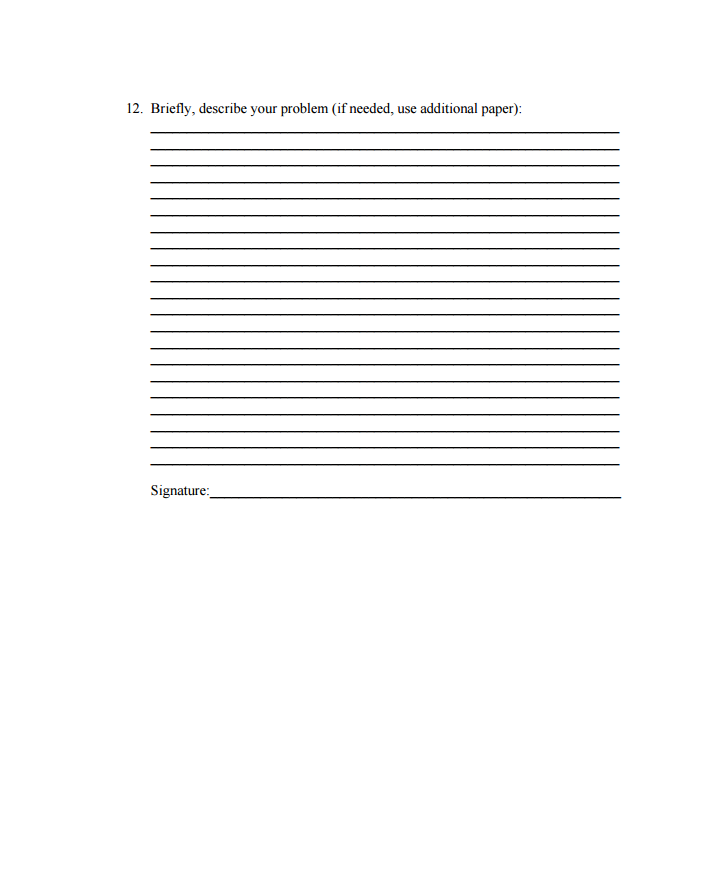

Information Required to File an Alabama Insurance Commissioner Complaint

To ensure your complaint is processed efficiently, include the following information:

- Your full name, address, and contact information

- Name of the insurance company involved

- Policy number and claim number (if applicable)

- Agent or adjuster’s name

- Date of occurrence

- A brief description of the issue or dispute

Providing accurate and complete information helps the department review and address your concerns promptly.

Enforcement and Consumer Protection

The Alabama Insurance Commissioner has the authority to enforce insurance laws, investigate complaints, and take corrective action against warrantors or insurance companies that violate state regulations. Actions may include:

- Issuing cease-and-desist orders.

- Imposing civil penalties of up to $10,000 for repeated violations.

- Conducting hearings to review violations.

The department aims to ensure compliance and protect consumers from deceptive practices.

Contact Information for Assistance

For questions or further assistance, contact the Alabama Department of Insurance:

- Main Office Phone: 334-269-3550

- Main Office Fax: 334-241-4192

- Email: Insdept@insurance.alabama.gov

For fire-related issues, contact the State Fire Marshal:

- Phone: 334-241-4166

- Fax: 334-241-4158

- Email: Firemarshal@insurance.alabama.gov

Conclusion

The Alabama Department of Insurance is committed to helping consumers resolve their insurance disputes and ensuring companies comply with state laws. Filing an Alabama Insurance Commissioner Complaint provides an avenue to address your concerns and receive assistance in resolving them. Whether you choose to file online, by mail, or by fax, the department is here to support you every step of the way. Don’t hesitate to reach out for guidance or additional information.