Introduction

In the automotive appraisal and resale industry, Condition Reports (CR) play a crucial role in determining a vehicle’s market value. While CR is widely used in auction settings, its impact on Diminished Value (DV) calculations is often overlooked. Understanding how CR ratings correlate with market pricing is essential for accurately quantifying the loss in value due to prior accident damage.

This article explores how CR ratings are assigned, how they impact vehicle pricing, and how they are directly integrated into Diminished Value appraisals.

What is a Condition Report (CR)?

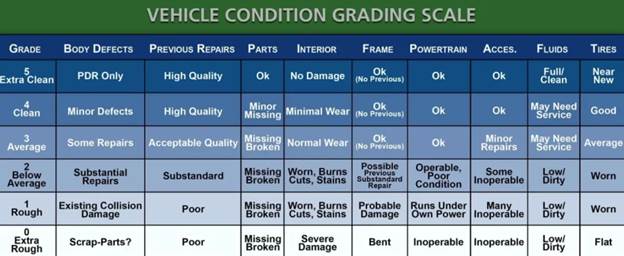

A Condition Report (CR) is a numerical grading system used in auto auctions, particularly by Manheim Auctions, to provide buyers with a standardized assessment of a vehicle’s condition. The CR score ranges from 0.0 to 5.0, with 5.0 representing a new or like-new vehicle and 0.0 indicating a severely damaged or salvage vehicle.

The CR grading system considers:

- Exterior Condition: Paint condition, dents, scratches, and panel alignment.

- Interior Condition: Upholstery wear, dashboard, and electronics functionality.

- Mechanical Condition: Engine, transmission, suspension, and brake performance.

- Structural Integrity: Frame, unibody, and prior accident repairs.

These factors directly influence the vehicle’s wholesale market value in the auction environment, and thus, they are a reliable indicator of how prior damage affects pricing.

CR Ratings and Their Impact on Market Value

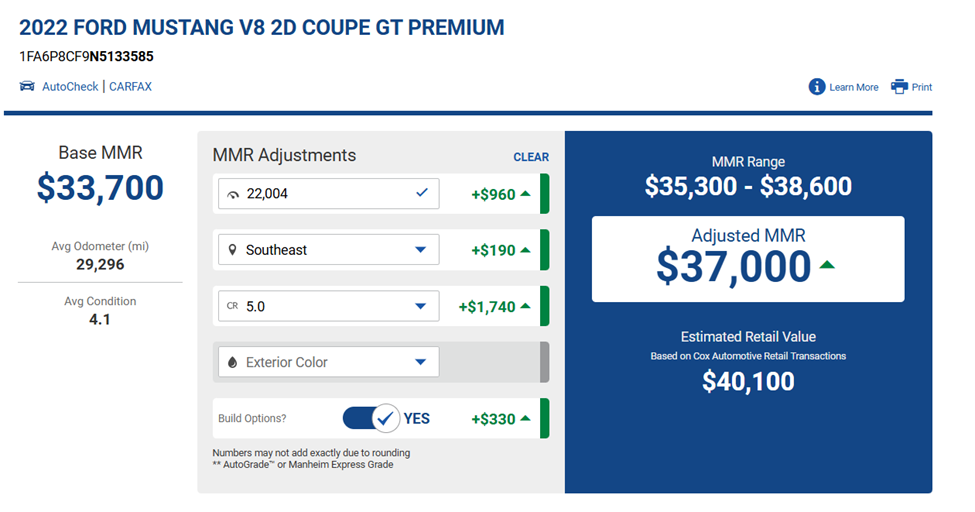

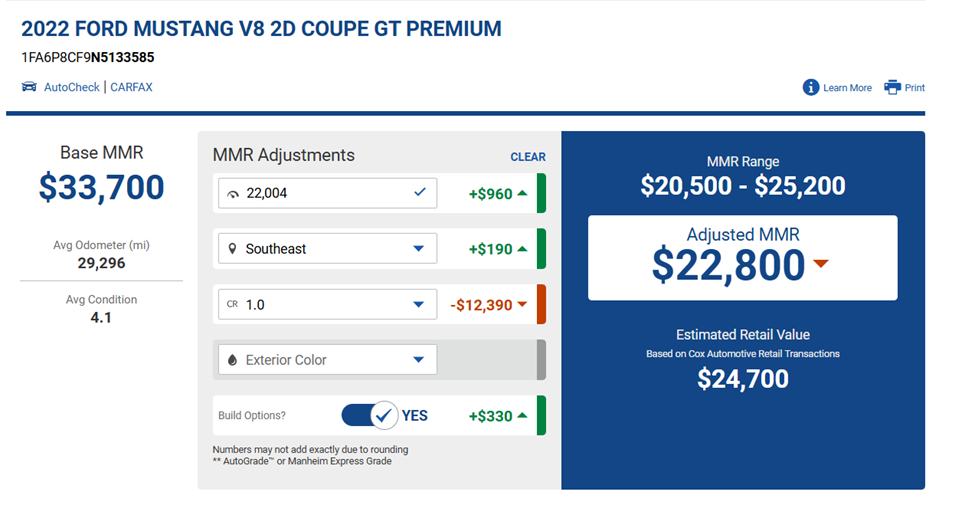

Auction houses, dealers, and valuation platforms (such as Manheim Market Report, or MMR) use CR ratings to adjust vehicle pricing. The difference in MMR values between a high-CR vehicle (e.g., 5.0) and a low-CR vehicle (e.g., 1.0) quantifies the impact of accident history and repairs.

For example, consider the following real-world data from Manheim MMR for a 2022 Ford Mustang GT:

| CR Rating | Adjusted MMR |

| 5.0 (Excellent Condition, No Prior Damage) | $37,000 |

| 1.0 (Severe Collision Damage History) | $22,800 |

This $14,200 difference represents the market’s devaluation due to prior collision damage. Even if a vehicle is fully repaired, buyers discount the price due to accident history, structural repairs, and perceived reliability concerns.

How CR is Used in Diminished Value Calculations

Diminished Value (DV) refers to the loss in a vehicle’s resale value due to prior damage, even after full repairs. The patent-pending DV methodology (US20210056597A1) quantifies this loss by integrating CR adjustments into the valuation model.

Step 1: Establish Pre-Loss Market Value

Before assessing DV, the vehicle’s pre-accident fair market value (FMV) is determined using data sources like Black Book, NADA, or MMR.

Step 2: Apply the Damage Coefficient Model

A Damage Coefficient (DC) is calculated based on:

- Repair Cost vs. Pre-Loss Value (Damage-to-Value Coefficient – DTVC)

- Labor Hours Required for Repairs (Labor Coefficient – LC)

- Structural Damage Severity (Structural Damage Coefficient – SDC)

Step 3: Determine the Market Adjustment from CR

Using auction data, CR adjustments are applied. If the market discounts a CR 1.0 vehicle by $14,200 compared to a CR 5.0 vehicle, this differential is used to benchmark the DV calculation.

Step 4: Calculate the Final Diminished Value

By multiplying the damage coefficient by the loss range, the final Diminished Value is derived:

∗∗DV=(LossRange)×(DC/100)∗∗**DV = (Loss Range) × (DC/100)**

This process ensures that DV calculations reflect real-world market impact rather than subjective estimates.

Why CR-Based DV Calculations Are More Accurate

Many insurers attempt to calculate DV using simplistic formulas, often ignoring real-world market data. However, using CR-based adjustments ensures:

- Objective and market-driven DV calculations.

- Statistical validity through executed auction data.

- Standardized valuations using industry-accepted grading scales.

By integrating CR ratings into DV calculations, appraisers can provide clear, data-backed evidence of how prior damage impacts resale value.

Conclusion

A vehicle’s Condition Report (CR) score is one of the most accurate predictors of Diminished Value. By using auction-driven pricing models, we can objectively quantify the true financial impact of collision damage. The difference in MMR values across CR ratings serves as direct proof of diminished value, making this approach far superior to outdated, formulaic methods.

For professionals in appraisals, insurance claims, and auto resale, leveraging CR-based DV calculations is the best way to ensure fair, transparent, and data-backed valuations.

Exhibits A – MMR Price adjusted by CR :

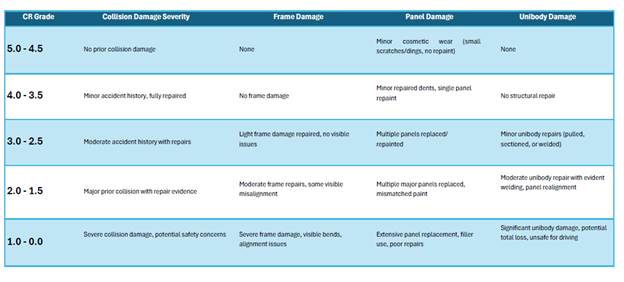

Exhibit B: CR Grades by Collision Severity

Exhibit C: Vehicle Condition Grading Scale