UAW Strike Impact and High-Interest Rates: US Auto Sales in Decline

The US automotive market has had an eventful year in 2023. Several significant factors, including the six-week UAW strike, high interest rates, elevated vehicle prices, and fluctuating inventory levels, have created a dynamic landscape for both automakers and consumers.

This article will delve into the key events and trends that have shaped the industry this year.

Factors Impacting the US Automotive Market in 2023: A Closer Look (PDF)

Sales Performance

Ford and Mazda reported their first sales declines of 2023, while Toyota, Kia, and Hyundai had their smallest gains of the year. In October, US light-vehicle sales inched up by only 1.8 percent, according to GlobalData, reflecting a cooling retail demand for new vehicles. These underwhelming results were influenced by the lingering impacts of the UAW strike against the Detroit 3 automakers.

Toyota, Kia, and Hyundai, three major players in the industry, recorded their smallest gains of the year, with increases of 1.8 percent, 1.5 percent, and 0.3 percent, respectively. Ford Motor Co. faced a significant setback, with sales dropping by 5.2 percent, snapping a streak of 10 consecutive monthly gains.

The strike had a profound impact on the production and availability of key Ford models, including the Ranger and Bronco. Mazda, too, saw its sales volume decline for the first time in a year, with both car and light-truck sales affected. Additionally, fleet shipments, which had seen double-digit growth throughout the year, dropped in October, largely due to the strike.

Recovery Amid Challenges

The US automotive industry had been projecting a 3 to 4 percent increase in new light-vehicle sales for October, driven by a recovery from the chronic inventory shortages caused by microchip supply issues. However, combined sales of the seven automakers reporting monthly results rose by 5.5 percent, outperforming the earlier expectations.

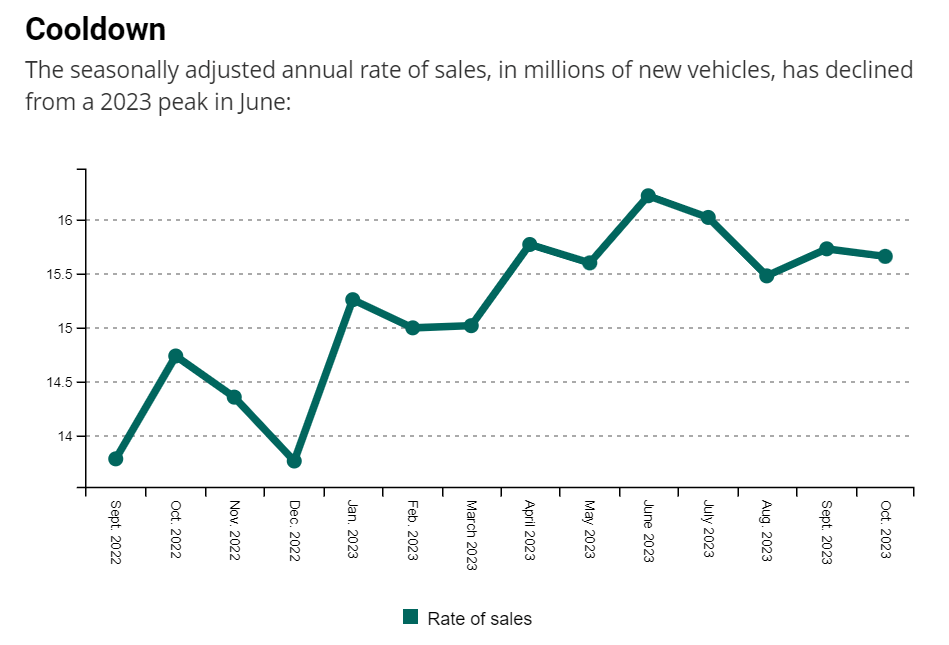

While the third quarter and the first nine months of the year saw sales rise by 17 percent and 14 percent, respectively, October presented a more complex scenario. GlobalData estimated that the daily sales rate fell to 48,000 vehicles in October from 51,600 in September, marking the lowest level since February.

Several factors have contributed to this decline, including the restart of student loan repayments, high-interest rates, sticky inflation, and supply chain disruptions.

Outlook for the Future

GlobalData adjusted its 2023 forecast for US light-vehicle sales to 15.4 million after initially lowering it to 15.3 million at the start of the UAW strike. The company remains cautious about the industry’s recovery potential in 2024, maintaining its sales outlook at 16 million. David Oakley, manager of sales forecasting for the Americas at GlobalData, notes that the economy’s overall risk and general affordability issues might limit the market’s recovery potential.

Luke Junk, a senior research analyst at Baird, suggests that the impacts of the strike could become more visible in November, emphasizing that while the US auto buyers remain resilient, external factors like high-interest rates and geopolitical uncertainties may temper their enthusiasm.

A Mixed Bag Among Brands

In October, various brands experienced varying degrees of success. Ford division and Lincoln sales were down by over 5 percent and 4.5 percent, respectively. Key models such as the Ford F-Series pickups, Ranger, and Bronco faced substantial declines, whereas others like the Explorer, Bronco Sport, and Escape recorded modest gains. The strike impacted output and sales of several Ford models, resulting in fluctuating inventory levels.

Toyota, still grappling with low inventories, reported mixed sales results for its top-selling models. The Corolla saw a significant increase of 34 percent, while the Prius and Camry faced declines of 51 percent and 17 percent, respectively. The 4Runner, Tundra, and Tacoma had varying performances. Toyota outsold General Motors in October for the first time since July 2022, a testament to the brand’s resilience.

Honda, hindered by supply constraints for some models, managed to achieve a 33 percent increase in October sales. The Honda brand and Acura experienced substantial growth, with core models like the Civic, Accord, and CR-V posting significant gains. Honda is focusing on customer loyalty through incentives, as many devoted Honda owners have been waiting for inventory to recover.

Hyundai and Kia’s Performance

Hyundai’s slight rise in October was attributed to five nameplates with double-digit gains, offsetting declines in four models. Hyundai’s CEO, Randy Parker, expressed confidence in their future performance, noting strong marketing efforts and promotions.

Kia, on the other hand, achieved a 1.5 percent increase in deliveries in October, setting a new record for the month. Despite some core models experiencing sales drops, Kia’s electric vehicle sales surged by 83 percent. Eric Watson, vice president of sales operations at Kia America, believes the company is on track for a record-breaking annual sales performance for 2023.

Conclusion

The US automotive market in 2023 is marked by resilience, challenges, and a complex interplay of factors. The UAW strike, high interest rates, and fluctuating inventory levels have tested the industry’s adaptability.

As the year comes to a close, automakers and consumers alike will be closely watching the market, and the ability to offer attractive incentives and adapt to changing economic conditions will play a significant role in determining success in the coming months.