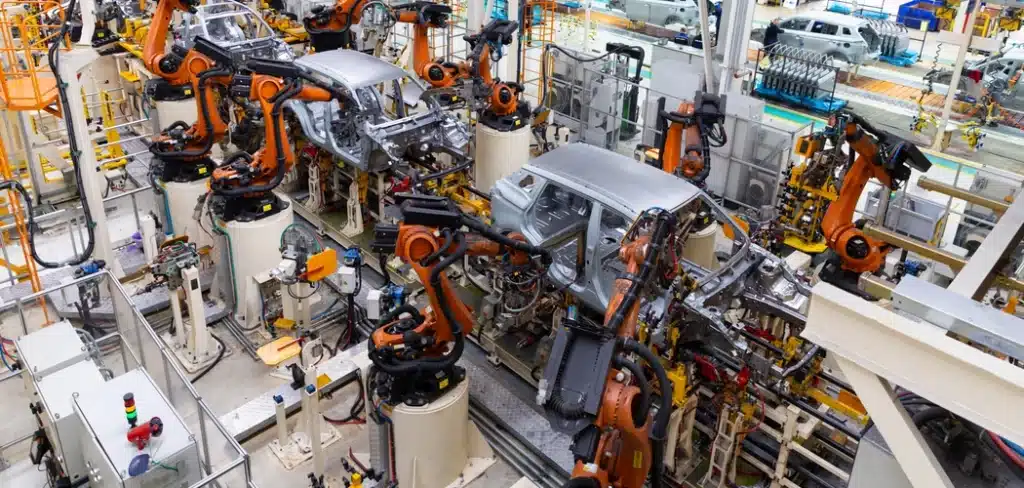

The automotive industry is on the brink of a major transformation, with electric vehicles (EVs) gradually taking center stage. However, this shift is not without its challenges. One of the most pressing issues is the projected underutilization of North American auto factories by 2030.

As automakers navigate the complexities of balancing internal combustion engine (ICE) and EV production, factory utilization rates are expected to plummet, leading to significant inefficiencies. Let’s dive into the numbers, the reasons behind this trend, and what it means for the future of auto manufacturing.

EV Production to Cause Auto Factory Underutilization by 2030 (PDF)

The Current State of Auto Factory Utilization

As of 2023, North American auto factories are operating at an average capacity utilization of 70%, according to GlobalData. While this might seem like a healthy figure, it’s important to note that automakers typically aim for a utilization rate of around 80% to ensure optimal efficiency and profitability. The current rate is already 10 points below this target, reflecting the lingering effects of the COVID-19 pandemic and the global semiconductor shortage.

However, the situation is set to worsen in the coming years. GlobalData forecasts that capacity utilization will drop to 65% by 2030 and further decline to 63% by 2035. This trend is driven by the uneven transition to EV production, which is creating significant challenges for automakers.

Projected Decline in Factory Utilization

The following table illustrates the projected decline in factory utilization rates for both ICE and EV production over the next decade:

| Year | ICE Utilization | EV Utilization | Total Utilization |

|---|---|---|---|

| 2024 | 75% | 42% | 70% |

| 2025 | 73% | 45% | 68% |

| 2026 | 73% | 49% | 67% |

| 2027 | 74% | 49% | 66% |

| 2028 | 74% | 52% | 65% |

| 2029 | 73% | 56% | 65% |

| 2030 | 70% | 60% | 65% |

| 2031 | 66% | 62% | 64% |

| 2032 | 65% | 63% | 64% |

| 2033 | 62% | 64% | 63% |

| 2034 | 61% | 66% | 63% |

| 2035 | 58% | 67% | 63% |

| 2036 | 56% | 68% | 63% |

This table highlights a concerning trend: while EV utilization is expected to increase steadily, it will still fall short of the levels needed to offset the declining utilization of ICE production. By 2035, EV plants are projected to operate at 67% capacity, while ICE plants will drop to just 58%.

Factors Contributing to Underutilization

1. The Slow Transition to EVs

Despite the growing interest in electric vehicles, their adoption has been slower than some automakers anticipated. As of May 2023, EVs accounted for only 7% of new vehicle registrations in the U.S., although this figure is expected to exceed 50% by 2035. This gradual transition means that many automakers are stuck with underutilized ICE plants while EV demand ramps up.

2. The Pigeonholing of Production Facilities

Automakers have taken different approaches to adapting their factories for EV production. Some have dedicated specific plants solely to EVs, while others have continued producing ICE vehicles.

This “pigeonholing” strategy limits the flexibility of automakers to shift production based on market demand. As a result, plants that are designated for ICE production are likely to become increasingly underutilized as demand for combustion vehicles dwindles.

3. Regulatory Uncertainty

The regulatory environment for automotive emissions is in flux, with governments around the world implementing stricter emissions standards and offering incentives for EV adoption. However, the pace and specifics of these regulations vary widely, creating uncertainty for automakers.This uncertainty makes it difficult for companies to plan their production strategies effectively, leading to mismatches between production capacity and actual demand.

4. The Complexity of Mixed Propulsion Systems

Manufacturing vehicles with multiple propulsion systems (ICE, hybrid, and EV) within the same plant adds another layer of complexity. While it might seem like a flexible approach, it often results in inefficiencies.

For example, a plant that is set up to produce both ICE and EV vehicles may struggle to reach optimal utilization rates because the production processes for these different types of vehicles are not easily interchangeable.

Impact on Automakers

The projected decline in factory utilization will have significant implications for automakers. Here’s a breakdown of how some major players in the industry are expected to fare:

| Automaker | 2030 Utilization Rate | Expected Challenges |

|---|---|---|

| Honda Motor Co. | 70% | High ICE utilization; slower EV transition |

| Hyundai Motor America | 72% | Balanced EV and ICE production, but risks inefficiencies in mixed production plants |

| Mercedes-Benz | 71% | Strong EV focus, but potential underutilization of ICE facilities |

| Toyota | 70% | Robust ICE production but needs to ramp up EV capacity |

| Volkswagen Group | 70% | Leading in EV production, but ICE decline will impact overall utilization |

| General Motors | 64% | Lower utilization rates due to slow EV ramp-up and declining ICE demand |

| Ford Motor Co. | 63% | Struggling to balance ICE and EV production |

| BMW Group | 62% | Challenges in scaling EV production to offset declining ICE output |

| Renault-Nissan-Mitsubishi | 64% | Similar issues with balancing ICE and EV production, leading to underutilization |

These figures suggest that while some automakers are better positioned to navigate the transition to EVs, others will face significant challenges in maintaining efficient production levels.

Strategies for Mitigating Underutilization

As the industry grapples with these challenges, automakers will need to adopt innovative strategies to mitigate the impact of underutilization. Here are a few approaches that could help:

1. Flexible Manufacturing Facilities

Investing in flexible manufacturing facilities that can easily switch between ICE and EV production is one way to address underutilization. By designing plants that can handle a mix of propulsion systems, automakers can better respond to fluctuations in market demand.

2. Strategic Partnerships

Collaborations between automakers, technology companies, and governments can play a key role in optimizing production strategies. For example, partnerships could focus on developing shared platforms for EVs, reducing the need for each automaker to invest in separate production lines.

3. Improved Demand Prediction Through Advanced Analytics

By embracing cutting-edge data analytics and predictive modeling, automakers can gain sharper insights into evolving consumer demand. This proactive approach allows for more precise adjustments to production strategies, minimizing the chances of both overproduction and shortfalls. In turn, this enhanced foresight can significantly boost factory efficiency and ensure that production levels align more closely with market needs.

4. Streamlined Product Portfolios

Automakers may need to streamline their product portfolios to focus on the most profitable and in-demand models. By reducing the number of variants and focusing on core models, companies can achieve higher utilization rates and improve operational efficiency.

The Road Ahead: A Complex Journey

The road to 2030 and beyond will be anything but straightforward for the automotive industry. As EV production ramps up, the challenges of underutilization will become increasingly pronounced. However, with strategic planning and a willingness to adapt, automakers can navigate these turbulent times and emerge stronger on the other side.

The key takeaway? Flexibility and innovation will be crucial in ensuring that factories remain efficient and profitable in an era of rapid technological change. Will automakers rise to the challenge or be left with underutilized factories and dwindling profits?