Electric vehicles (EVs) are steadily gaining traction in the automotive market, thanks in part to various incentives aimed at promoting their adoption. But how do these incentives impact the resale prices of EVs? Let’s explore the effects of increased incentives on EV resale values and what this means for consumers and the industry.

The Effect of Increased Incentives on EV Resale Prices (PDF)

Understanding EV Incentives

Incentives for EVs come in many forms, including federal tax credits, state rebates, and manufacturer discounts. These incentives reduce the initial purchase price, making EVs more accessible to a broader range of consumers. However, their impact on the secondary market, particularly on resale prices, is a complex and evolving story.

The Immediate Impact of Incentives

In the short term, increased incentives can lead to a decrease in resale prices. When new EVs are heavily subsidized, the perceived value of used models drops. Consumers may prefer to buy new, incentivized vehicles rather than opting for used ones. This shift in preference can result in a surplus of used EVs, driving down their prices.

EV Residual Values Expected to Improve

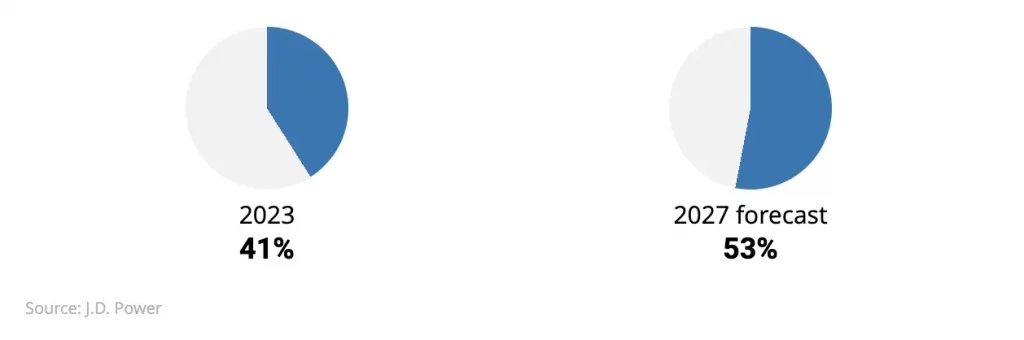

In 2023, electric vehicles (EVs) saw a resale value retention of just 41%, whereas internal combustion engine (ICE) vehicles and EVs together held 66% of their value. Looking ahead, the growing popularity of EVs is likely to boost their residual values over the coming years.

Long-term Effects and Market Dynamics

While the immediate impact of incentives might seem negative for resale prices, the long-term effects can be more nuanced. As more consumers adopt EVs, the secondary market for these vehicles expands. Over time, increased familiarity and acceptance of EVs can lead to more stable and predictable resale values.

Example: Tesla’s Price Cuts

Tesla’s significant price reductions for the Model 3 and Model Y have sparked concerns about the trickle-down effect on used EV values. Such drastic price cuts can create volatility in the resale market, but they also illustrate how incentives and pricing strategies can reshape consumer behavior and market dynamics.

Incentives and Depreciation Rates

The rate at which EVs depreciate is another critical factor influenced by incentives. Traditional internal combustion engine (ICE) vehicles have established depreciation curves, but EVs are still defining theirs. Incentives that lower the initial cost can lead to steeper depreciation in the early years, but this may level off as the market matures.

The Role of Federal and State Incentives

Federal and state incentives play a significant role in shaping the EV market. Federal tax credits, such as the $7,500 credit in the United States, significantly reduce the cost of new EVs. State incentives vary widely but can include additional rebates, tax credits, and perks like access to carpool lanes.

These incentives collectively lower the barrier to entry for new EV buyers, but they also affect the used car market. As new EVs become more affordable, the appeal of buying used diminishes unless the depreciation rates are adequately adjusted.

Future Predictions for EV Resale Values

Experts predict that as the market for EVs grows, resale values will become more stable and predictable. According to J.D. Power, EVs that return to the market after a standard 36-month lease term are expected to retain an average of 53% of their value by 2027. This is a significant improvement from the 41% retention seen in 2023.

Brand Loyalty and Resale Values

Brand loyalty can also impact resale values. As consumers become more familiar with and loyal to specific EV brands, the resale market for those brands may strengthen. This loyalty can mitigate some of the depreciation effects seen with increased incentives.

Conclusion

Increased incentives for electric vehicles undoubtedly influence their resale prices, creating both challenges and opportunities. While these incentives can initially depress resale values, the growing acceptance and adoption of EVs are likely to stabilize the market over time. For consumers and industry stakeholders, understanding these dynamics is crucial for making informed decisions in the evolving EV landscape.

What do you think the future holds for EV resale prices in your region?