Revolutionizing the Road: China’s EV Market Set to Dominate by 2030 (PDF)

In recent years, the automotive industry has witnessed an unprecedented transformation, largely driven by the electrification of vehicles. While Western automakers have been at the forefront of this shift, a recent report by UBS Group analysts suggests that they are now facing a formidable challenge from China’s electric vehicle (EV) manufacturers. The rise of Chinese EV makers, led by BYD, threatens to disrupt the global automotive landscape, potentially causing Western automakers to lose a significant portion of their market share.

Chinese EVs: A Cost Advantage Over Western Competitors

At the heart of the Chinese EV manufacturers’ remarkable success lies a decisive factor: their significant cost advantage. The UBS report underscores this competitive edge, revealing that BYD, China’s premier automotive brand, boasts an impressive 25 percent cost advantage over its North American and European counterparts. This formidable cost efficiency not only empowers BYD but also positions it to strategically challenge established rivals on their own home ground as it continues its global expansion.

A closer look at a 2022 BYD Seal sedan, analyzed by UBS, reveals a surprising fact: 75 percent of the vehicle’s components are manufactured in-house. This figure is double the global average and provides BYD with a significant cost advantage. The Seal is nearly entirely made in China, with just around 10 percent or less of parts sourced from foreign suppliers. This impressive level of vertical integration is a testament to the engineering prowess of Chinese engineers and the dividends it brings.

With a vast workforce of 600,000 employees, including 90,000 engineers—five times larger than Tesla’s—BYD has not only achieved self-sufficiency in vehicle production but also manufactures its batteries and semiconductors. This comprehensive approach further solidifies its competitive edge in the industry.

Implications for Western Automakers

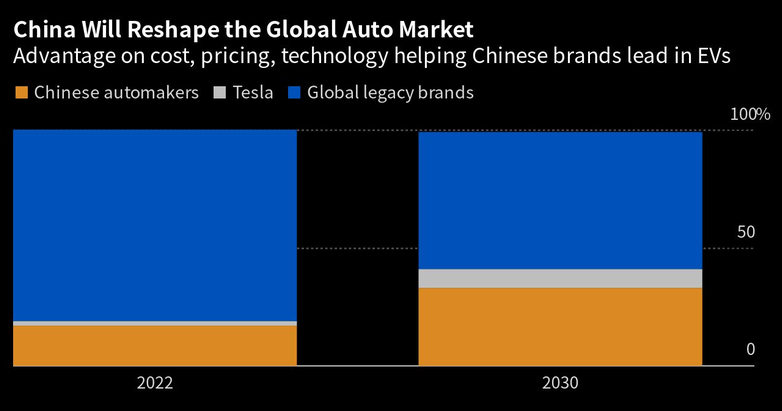

The UBS report paints a challenging picture for Western automakers. It predicts that by the end of the decade, Chinese automakers, spearheaded by BYD, will nearly double their share of the global auto market, reaching 33 percent. In contrast, Western automakers are expected to see a drastic decline in their global market share, dropping from 81 percent to 58 percent by 2030.

This shift could be considered a crisis moment for Western legacy companies. Even Tesla, which is often seen as an industry disruptor, is projected to see its share rise from 2 percent to 8 percent, largely due to the competitive pricing of Chinese-made EVs.

Western Response to the Chinese Challenge

In response to the threat posed by Chinese EV makers, Western automakers are speeding up their transition to electric vehicles. For example, BMW unveiled its prototype Neue Klasse electric car, equipped with features like a digital display projected onto the windscreen and advanced voice command capabilities—features that cater to the expectations of Chinese consumers.

Of the three major German luxury brands—BMW, Mercedes, and VW’s Audi—BMW is demonstrating a keen focus on EVs, with its battery-powered models outselling the competition in China. However, there is still work to be done in areas like smart cockpit and autonomous driving, where Chinese EV makers have taken the lead.

The Future of the Automotive Industry

The UBS report provides a clear indication that the global auto industry is on the cusp of significant changes. While Chinese EV makers may not make substantial inroads into the U.S. market or certain other regions with strong domestic incumbents, their dominance in other global markets is undeniable. Western automakers must adapt quickly to remain competitive in this evolving landscape.

In the end, the rise of Chinese EV makers represents a compelling case study in how innovation and cost-efficiency can disrupt even the most established industries. As the decade unfolds, the automotive world will continue to witness seismic shifts, and the battle for supremacy in the electric vehicle market will be one of the defining narratives of the era. Western automakers have a challenging road ahead, but it’s one they must navigate with determination and innovation to stay relevant in the face of this formidable Chinese challenge.