The wholesale auto market saw some interesting twists in the week ending September 7th, 2024. The current trend is a departure from the usual seasonal patterns.

While the used car market is cooling down, trucks and SUVs are displaying strong growth. It’s a delicate balance – cars are declining, but trucks and SUVs are moving in the opposite direction.

Weekly Auto Market Update Week Ending September 7th, 2024

The latest numbers are in, and they reveal an evolving story. Wholesale prices rose by 0.03% overall. However, the breakdown is where it gets interesting. Car prices experienced a slight decrease of 0.04%, while truck and SUV prices defied the trend, showing an increase of 0.06%.

Historically, these numbers are unusual for this time of year. Normally, both segments would be cooling down by now, but trucks and SUVs are proving more resilient.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.04% | -0.20% | -0.22% |

| Truck & SUV segments | +0.06% | +0.09% | -0.14% |

| Market | +0.03% | +0.01% | -0.18% |

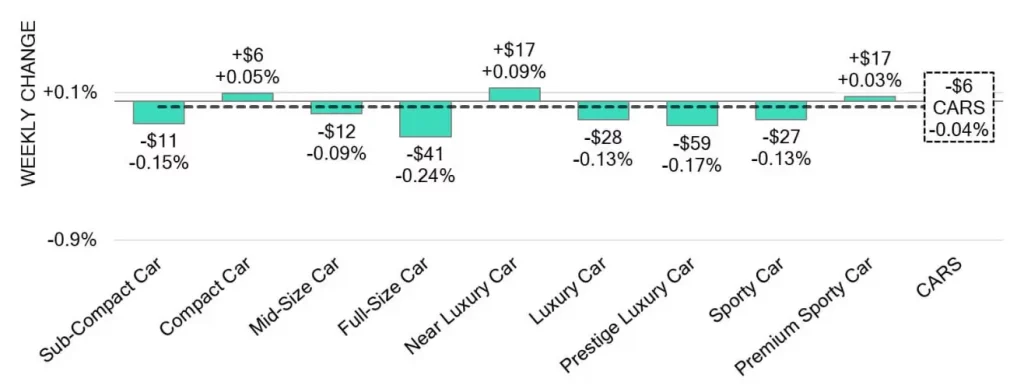

Car Market Update: Small Gains and Declines

On the car side, things aren’t all gloomy. The car segment experienced a minor overall decline of -0.04%, a gentler drop compared to the -0.20% the previous week. However, there’s more to the story.

Compact Cars See Slight Price Increase

Compact cars continue to hold their ground, increasing by +0.05%. This marks the third time in the last four weeks that this segment has shown positive movement, with newer used compact cars (0-2 years old) rising by +0.28% last week.

Full-Size Cars Continue to Decline

Full-size vehicles, however, have not been as fortunate. They declined by -0.24%, although the models aged 0-2 years still managed to experience increases, rising by +0.16% for the third consecutive week.

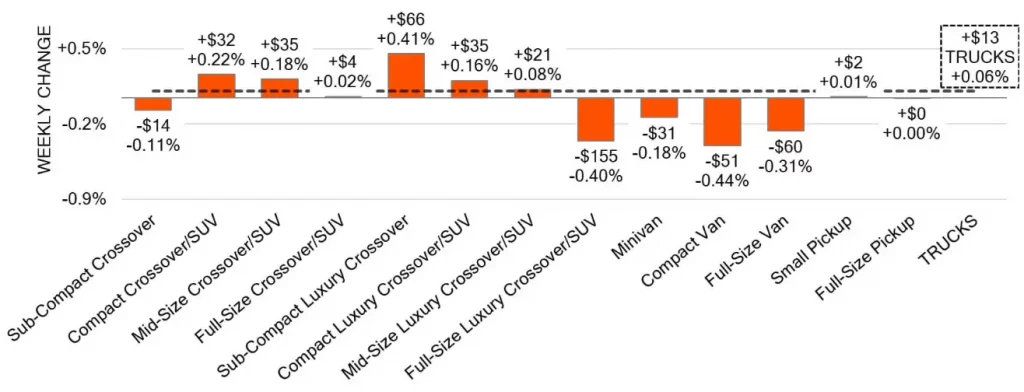

Trucks and SUVs Lead the Market Growth

While cars are seeing mixed results, trucks and SUVs continue to drive forward. Seven of the thirteen tracked segments saw an increase, with the overall segment up +0.06%. Here’s what’s moving the needle:

While cars are seeing mixed results, trucks and SUVs continue to drive forward. Seven of the thirteen tracked segments saw an increase, with the overall segment up +0.06%. Here’s what’s moving the needle:

Small Pickups Maintain Growth for the Fourth Week

Small pickups continue their upward trend, posting a +0.01% gain last week, though the rate of growth is slowing compared to previous weeks, where they grew by +0.59%.

Minivans Show Mixed Results Across Model Years

Minivans had a mixed performance. While older models (8-16 years old) saw declines, newer ones (0-2 years old) continue to rise. They’ve increased in eight of the last nine weeks, climbing another +0.08% last week.

Key Industry News This Week

Volkswagen Recalls Nearly 99,000 EVs Due to Door Handle Issues

Volkswagen has issued a recall for nearly 99,000 electric vehicles in the U.S., citing an issue with the door handles. The problem lies in the fact that the door handles can open unexpectedly while driving, posing a serious safety risk for drivers and passengers.

Affected models include the ID.4 electric SUV, and Volkswagen has urged all owners to visit their nearest dealer for a fix. This recall adds to the growing list of EV safety concerns as manufacturers strive to perfect their electric models amid increased scrutiny.

New U.S. Rule Proposed to Reduce Pedestrian Deaths

In a bid to improve road safety, the U.S. government has proposed a new rule aimed at reducing pedestrian deaths. The National Highway Traffic Safety Administration (NHTSA) is looking to enforce stricter safety standards for vehicles, including enhanced braking systems, pedestrian detection technology, and improved vehicle design to mitigate accidents.

This comes as pedestrian fatalities have been on the rise, particularly in urban areas. Automakers will need to adapt quickly to these regulations if approved, which could also drive up the cost of new vehicles.

Financing Trends: Increasing Share of New Vehicles with Financing

According to recent data, a growing share of new vehicles in the U.S. is being purchased with financing. As of 2024, nearly 85% of new vehicles are being financed, up from previous years. This rise can be attributed to high vehicle prices, increased interest rates, and longer loan terms, which make financing a more attractive option for buyers.

Dealerships are offering incentives such as low APRs and extended payment plans to ease the burden, but the trend reflects the broader challenges of affordability in today’s auto market.

USAA Diminished Value Claims Guide Released

When filing a diminished value claim with USAA, policyholders often encounter challenges such as biased appraisers or undervalued compensation. To maximize your claim, it’s crucial to gather comprehensive documentation and seek an independent appraisal.

USAA’s claim process may seem complex, especially with their formula often favoring the insurer. By understanding the appraisal clause and hiring an independent appraiser, you can ensure a fair payout, even if you hit roadblocks in the process.

→ Read: https://diminishedvalueofgeorgia.com/usaa-diminished-value-claims-guide/

The Cheapest Car of 2024: Latest Insights

The ChangLi S1-Pro has taken the spotlight as the cheapest car of 2024, offering essential features at an incredibly low price. Despite its compact size, this electric vehicle is equipped with basic functionality, making it a cost-effective option for budget-conscious buyers.

Although it lacks the high-end amenities of pricier models, it delivers on practicality and affordability, making it a game-changer for those looking for a simple, no-frills vehicle.

→ Read: https://diminishedvalueofgeorgia.com/cheapest-car-of-2024/

Conclusion: Auto Market Trends to Watch for Next Week

As we move into mid-September, it’s clear the market isn’t behaving the way it usually does this time of year. Trucks and SUVs continue to gain value while cars remain in a holding pattern, especially older models.

The shift towards financing and the steady flow of 2024 models hitting dealerships are factors to watch closely. What does all this mean for you? If you’re eyeing a used truck or SUV, now could be the ideal time to make a move.

What trends will shape the market in the coming weeks?