Car dealers not only make profits from selling cars, they also make a profit from their finance departments also called F&I.

Dealership F&I departments generate income by selling installement contracts at a premium.

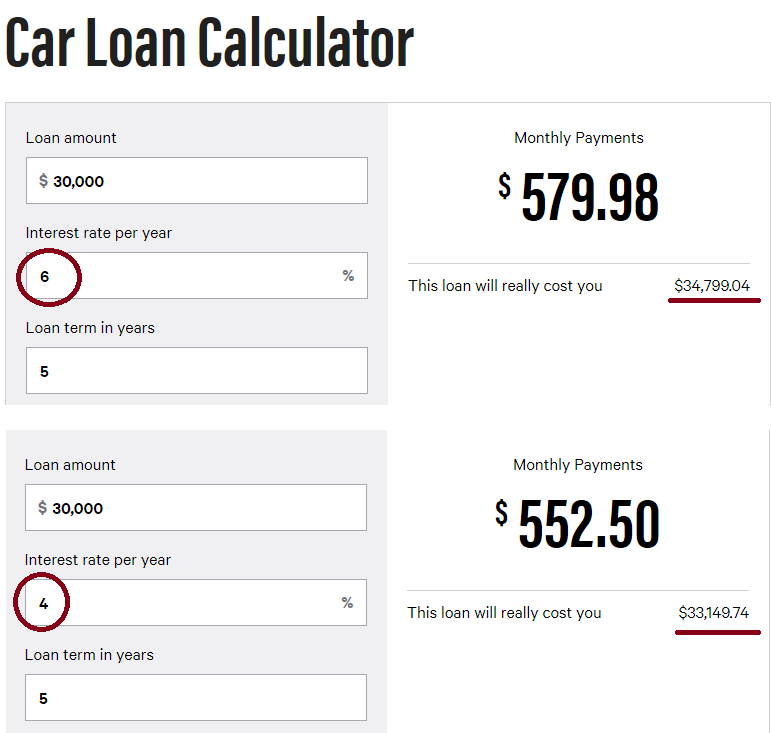

For example, Ally Financial offers 4% APR to car buyers with a 730 credit score or higher. The dealership or middleman will sell the loan to the buyer for 6% and profits 2%.

On a $30,000 car, financed for 5 years, the loan cost is $33,149 at 4% and $34,799 at 6%. In this case, the dealer makes $1,650 when selling the car.

F&I departments also make profit by marking up warranty contracts and selling other instruments such as lo-jack, window etching and service contracts.

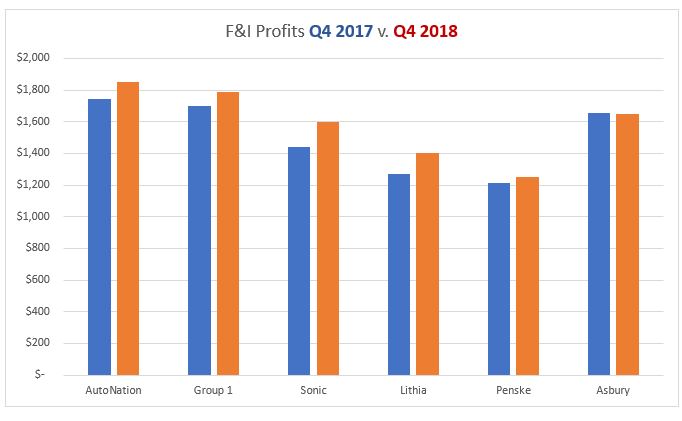

Per vehicle F&I profits are up at most car dealer groups. Below is a table illustrating the change from Q4, 2017 and Q4, 2018.

| Dealer Group | Q4 2017 | Q4 2018 | Change $ | Change % |

| AutoNation | $ 1,741 | $ 1,851 | $ 110.00 | 6.3% |

| Group 1 | $ 1,697 | $ 1,785 | $ 88.00 | 5.2% |

| Sonic | $ 1,442 | $ 1,597 | $ 155.00 | 10.7% |

| Lithia | $ 1,267 | $ 1,400 | $ 133.00 | 10.5% |

| Penske | $ 1,213 | $ 1,250 | $ 37.00 | 3.1% |

| Asbury | $ 1,654 | $ 1,648 | $ (6.00) | -0.4% |