What is Diminished Value?

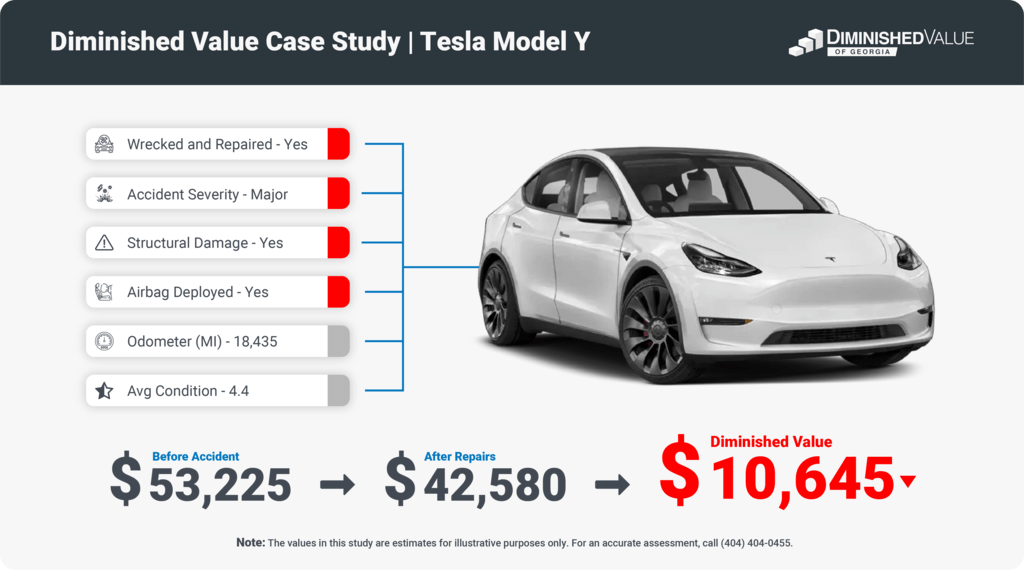

Diminished value is the reduction in your vehicle’s resale value after it has been involved in an accident and repaired. Even with expert repairs, a car with an accident history often is worth less than an identical model without one. Buyers typically expect a discount to cover potential risks associated with past damage, impacting your car’s market value.

Filing a diminished value claim can help you recover the financial difference between what your car was worth before the accident and what it’s worth now. However, not every driver knows this type of claim exists, as insurance companies don’t usually mention it unless you ask.

Even when they do, 80% of the time, it’s a lowball offer due to an inaccurate valuation or because insurers know that policyholders are often unaware of their rights, allowing them to profit from this lack of knowledge.

Knowing about diminished value can empower you to seek fair compensation for the loss in your car’s market value.

When Should You Sue for Diminished Value After a Car Accident?

Yes, you can sue for diminished value, but most cases settle before reaching this point. Lawsuits for diminished value (DV) claims are typically rare, as they usually only escalate to legal action if all settlement options have been exhausted. Here’s how the process generally unfolds:

1. Exhaust All Negotiation Options First

Start by filing a diminished value claim directly with the at-fault driver’s insurance. They’ll assess the damage and typically offer a settlement, though initial offers are often lower than the vehicle’s actual loss.

To support your claim, an independent appraisal report serves as proof to show what your vehicle is really worth. This report documents the reduction in value post-accident and strengthens your negotiation position, helping ensure the settlement accurately reflects your loss.

2. Consider Mediation if Negotiation Stalls

If direct negotiation doesn’t yield a fair outcome, mediation can be an effective next step. Many insurance policies include an appraisal clause, which can also be useful for resolving disputes.

An appraisal clause allows both you and the insurer to each hire an independent appraiser to determine the fair value of the claim. If the two appraisers disagree, an impartial umpire can be appointed to make the final decision, ensuring a fair assessment without needing legal intervention.

3. Small Claims Court for Modest Amounts

For smaller claims, small claims court is a more straightforward option than a full lawsuit. This informal process allows you to present your case without needing an attorney, making it both cost-effective and efficient.

When a Lawsuit Becomes Necessary

- After Exhausting All Settlement Options: If you’ve attempted negotiation, mediation, and possibly small claims court without success, filing a lawsuit may be the next step.

- Insurance Company Refusal: If the insurer denies a valid claim outright, legal action may be necessary to obtain the compensation you’re owed.

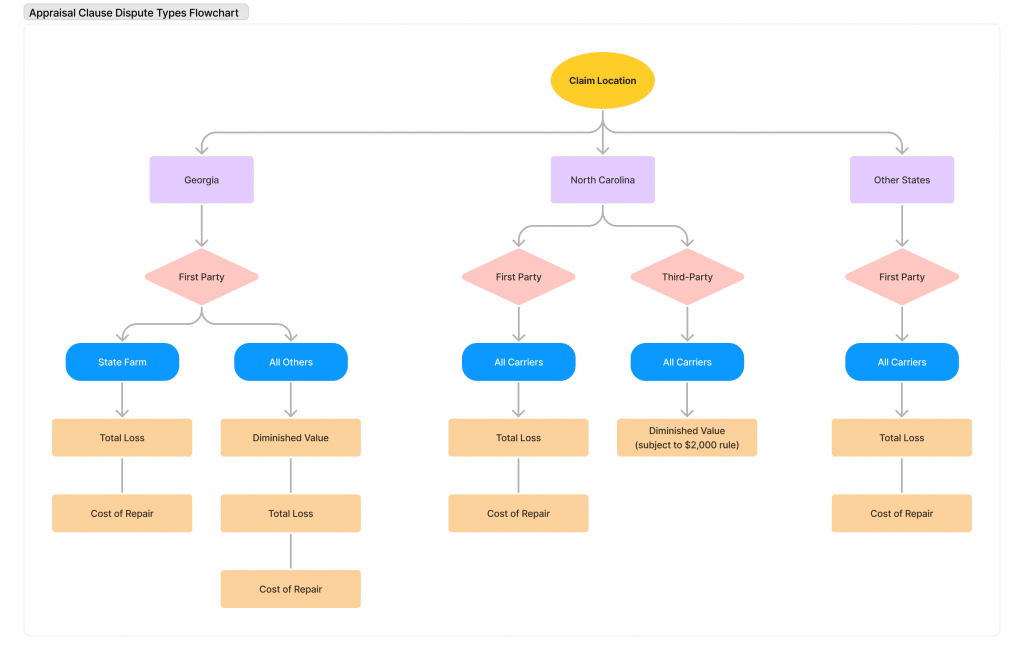

Note: State laws on diminished value vary, with Georgia being the only state allowing first-party DV claims (where you claim directly with your own insurer). For other states, DV claims typically go through the at-fault driver’s insurance, and it’s best to consult an expert to ensure you’re following the proper steps in your area.

Steps to Filing a Diminished Value Claim Without an Attorney

Filing a diminished value claim can help you recover the loss in your vehicle’s market value after an accident. Follow these steps to maximize your chances of a successful claim:

1. Determine Fault in the Accident

The first step is to establish who was at fault. Diminished value claims are generally only possible if the other party is 100% responsible for the accident.

Outside of Georgia, you can only file a diminished value claim against the at-fault driver’s insurance, as there is no law that allows first-party (comprehensive) diminished value claims.

However, in Georgia, you have the unique advantage of being able to file a claim against your own insurance carrier, even if you are at fault.

2. Check Your Eligibility for Filing a Claim

Before filing, make sure your vehicle qualifies. Generally, vehicles that are less than 10 years old, have not had prior accidents, and do not have a salvage title are eligible for diminished value claims. Your insurance policy may also influence eligibility, so it’s worth reviewing the details.

This list includes several circumstances which may disqualify you from making a diminished value claim for your car:

- Your vehicle does not have a substantial market value (cars under $7,000)

- You’ve already signed a release of liability form

- The accident caused minimal damage (usually under $500)

- The vehicle has excessive mileage (more than 30K miles per year)

- Your vehicle is too old (normally 10 years or older)

- Your vehicle has a branded title (salvage or rebuilt)

- Your vehicle had multiple previous accidents with greater damage

- Your vehicle was declared a total loss

- The statute of limitation has lapsed

- If you’re outside Georgia and courts have ruled against DV

To learn more about the Diminished Value qualification process, click here.

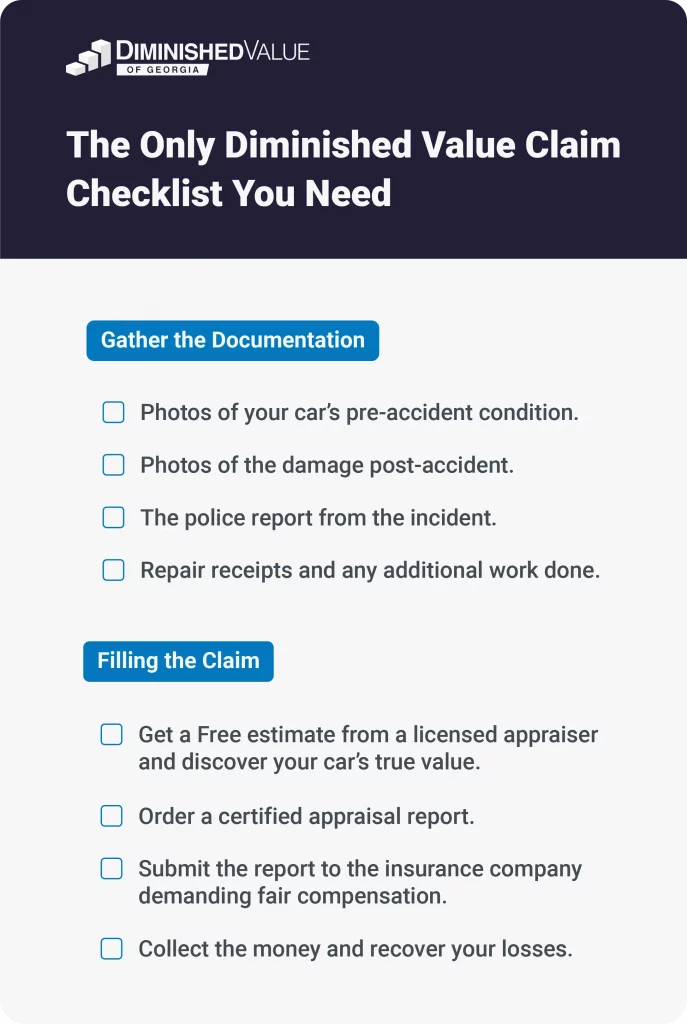

3. Gather Necessary Documentation

Collect all relevant documents, including the police report, repair receipts, photographs of the damage, and any estimates of repair costs.

Having thorough documentation can strengthen your claim and make it harder for the insurance company to offer a low settlement.

4. Calculate Your Vehicle’s Diminished Value

This is one of the most important steps you can take. Instead of relying on insurance company appraisers, who may have a conflict of interest, consider hiring an independent appraiser. A professional appraiser will provide a fair estimate of your car’s true diminished value.

Independent appraisers aren’t tied to the insurance company, so their evaluation is more likely to reflect the actual loss in your vehicle’s worth. For a quick estimate, you can also use our Diminished Value Calculator.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

5. Understand Your Policy and State Laws

In Georgia, you’re able to file both first-party and third-party diminished value claims, which makes it easier to recover the full loss in value. However, this varies by state. Some states only allow third-party claims, meaning you can only file against the at-fault driver’s insurance.

Knowing the specifics of your state’s laws and your insurance policy is essential for maximizing your claim. Review your policy and consult state guidelines to ensure you’re on the right track.

6. Submit the Claim and Negotiate with Insurers

Once you’ve gathered the necessary information and calculated the diminished value, file the claim with the at-fault driver’s insurance company.

Be prepared to negotiate, as insurers often offer low settlements initially. You may need to provide additional documentation or seek legal advice if negotiations stall.

Hiring a professional appraiser can give you the full support you need, faster, cheaper, and more effective than a lawyer. With their experience in dealing with insurers, they can advocate for a fair settlement and make sure you’re not taken advantage of in the process.

Common Challenges in Filling Diminished Value Claims

Filing a diminished value claim isn’t always straightforward, and you may encounter several challenges along the way.

Insurance Company Pushback

Insurance companies often downplay or deny diminished value claims, especially if they know the policyholder may not be familiar with the process.

They might argue that repairs restore the vehicle’s full value or offer a low settlement. Being prepared with solid documentation and an independent appraisal can strengthen your case and reduce the likelihood of pushback.

Low Settlement Offers

Even if an insurance company accepts your claim, the initial offer is likely to be lower than what you deserve. Many insurers rely on methods like the 17c formula, which can undervalue your car’s diminished value. Don’t hesitate to negotiate;

Navigating the Appeals Process

If your claim is denied or you receive an unsatisfactory settlement, you may need to go through an appeals process. This can be time-consuming and may require you to present additional documentation or seek legal advice.

How about letting our team get you the best value for your insurance claim?

- Discover your car’s true value

- No payment upfront

- Vehicle history report

Conclusion

Filing a diminished value claim after a car accident is a crucial step in recovering the financial loss from the reduction in your vehicle’s market value. By understanding the basics of diminished value, knowing when and how to file a claim, and gathering the necessary documentation, you can improve your chances of a fair settlement without needing legal action.

While insurers may offer lower settlements or try to undervalue claims, being informed and prepared to negotiate can make a significant difference. Whether you use an online calculator, hire an independent appraiser, or utilize the appraisal clause, taking proactive steps will help protect your vehicle’s value.

Are you ready to take the next steps to ensure fair compensation for your car’s diminished value?