Auto Market Update Week Ending Sep 2, 2023 (PDF)

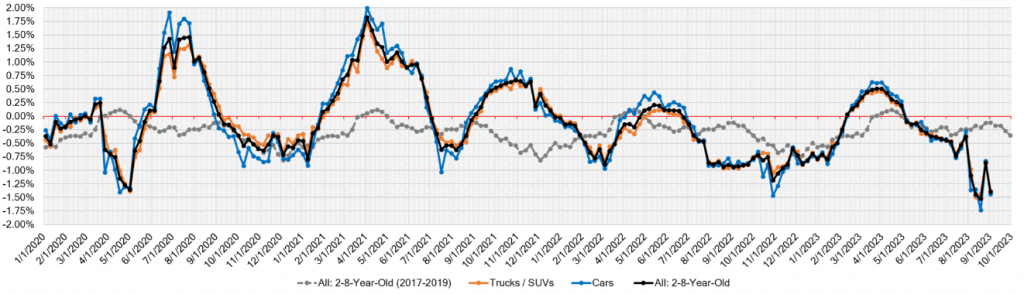

In the ever-evolving automotive landscape, this week’s market update paints a picture of accelerated depreciation, despite a surge in auction activity. The specter of a potential UAW strike looms large, with industry players closely monitoring developments that could reshape the industry and intensify the demand for used vehicles.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -1.44% | -0.83% | -0.11% |

| Truck & SUV segments | -1.38% | -0.87% | -0.12% |

| Market | -1.40% | -0.86% | -0.12% |

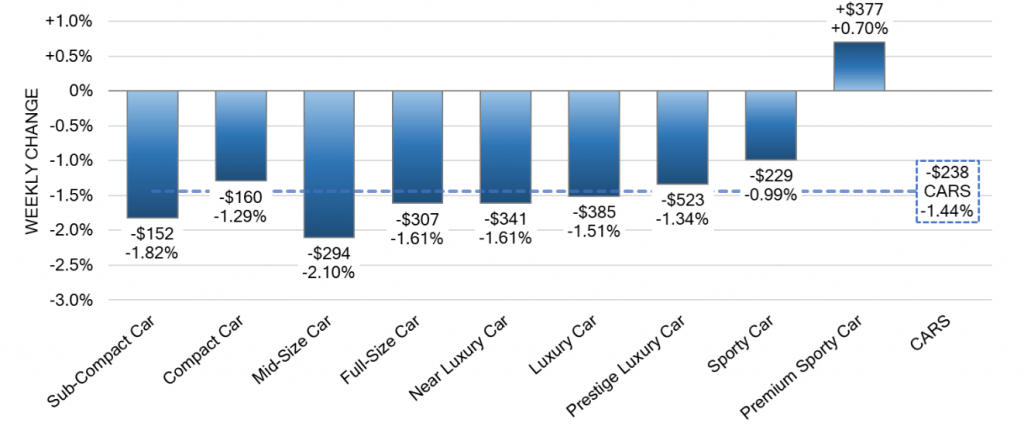

Car Segments

The Car segment experienced a volume-weighted decline of -1.44% this week, marking a stark contrast to the -0.83% drop in the prior week. Notably, 0-to-2-year-old Car segments recorded a -0.94% dip, while 8-to-16-year-old Cars saw a decline of -1.57%. Eight out of nine Car segments witnessed decreases, with seven of them exceeding the 1% mark.

On a brighter note, the Premium Sporty Car segment defied the trend, posting a +0.70% increase, propelled by collectors’ enduring interest in the previous generation Chevrolet Corvette. The Mid-Size Car segment took the hardest hit, down -2.10%. Compact Cars, while still experiencing depreciation at -1.29%, showed signs of deceleration compared to the early weeks of August when rates exceeded 2%.

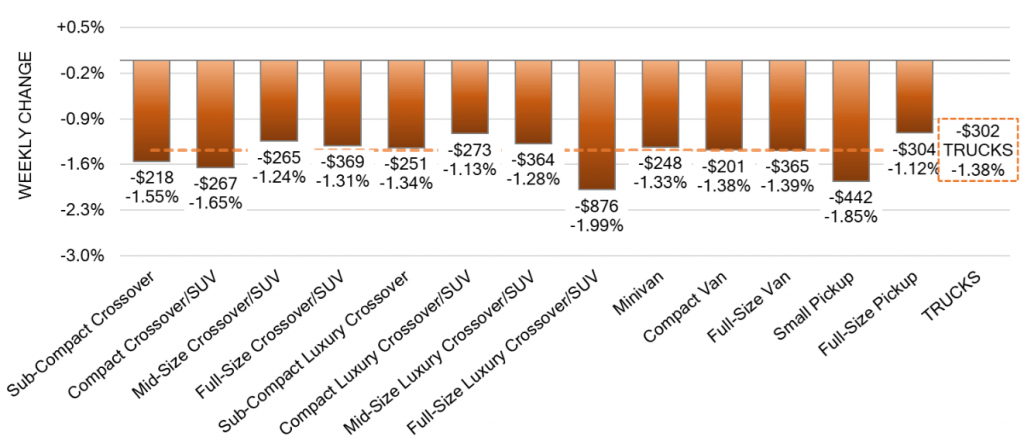

Truck & SUV Segments

The overall Truck segment faced a more pronounced decline of -1.38% this week, compared to the -0.87% drop in the previous week. Parallel to the Car segments, both 0-to-2-year-old and 8-to-16-year-old models registered depreciation, with declines of -1.00% and -1.26%, respectively. All thirteen Truck segments reported declines exceeding 1%.

Notably, the Full-Size Luxury Crossover/SUV segment bore the brunt, with a significant -1.99% decline, setting a new record for single-week declines. Small Pickup trucks also saw amplified depreciation, down -1.85% compared to the previous week’s -0.62%. Full-Size Vans followed suit with a substantial -1.39% decline, narrowly missing the record set in December 2019 at -1.45%.

Used Retail

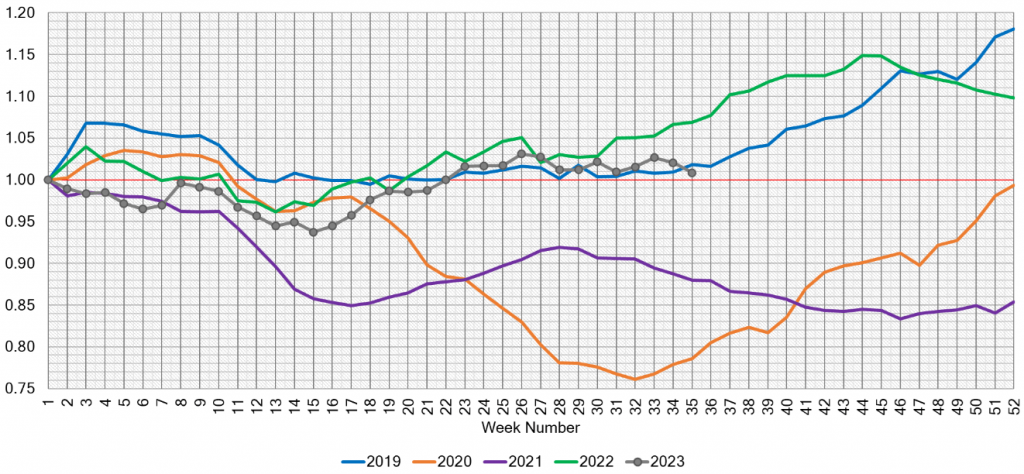

In the realm of used retail, the metrics speak volumes. Currently, the Used Retail Active Listing Volume Index maintains its equilibrium at 1.01 points, while the Days-to-Turn estimate for pre-owned vehicles hovers persistently around the 49-day mark.

Wholesale

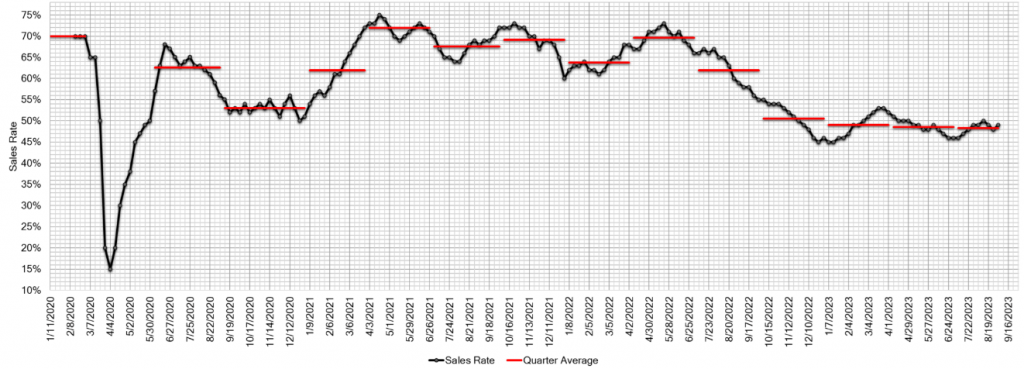

Dealers have been proactive in the wholesale market, driven by the potential UAW strike and recent natural disasters across the country. Surprisingly, despite these challenges, the market is witnessing a pronounced downturn. Experts interpret this as a move towards “normalization” rather than an impending crisis. The estimated Average Weekly Sales Rate has increased to a noteworthy 49%, indicating that dealers are swiftly adapting to the evolving market dynamics.

Overall, the automotive industry is navigating uncharted waters. With the looming possibility of a UAW strike and external factors reshaping pricing and demand, the market’s resilience and adaptability are being put to the test. This period of turbulence may ultimately lead to a recalibration of industry norms.

Stay tuned as we continue to monitor and report on the dynamic shifts in the automotive marketplace.