Auto Market Update Week Ending September 16th, 2023 (PDF)

Last week in the auto market was marked by some intriguing developments, with both challenges and opportunities emerging as we approach the end of September. Here’s a breakdown of the key trends and data that are shaping the market:

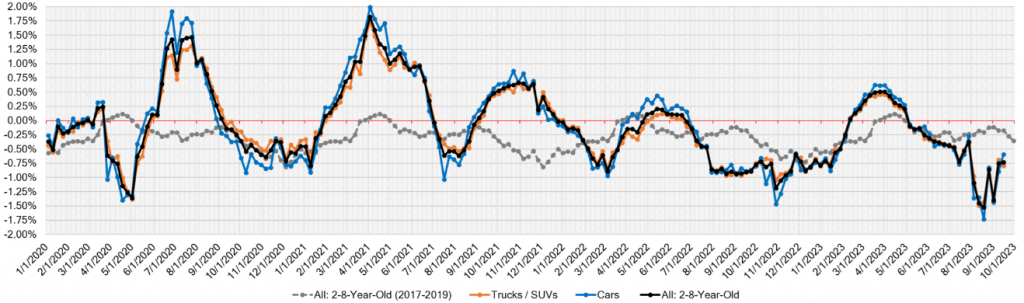

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.59% | -0.89% | -0.25% |

| Truck & SUV segments | -0.79% | -0.69% | -0.12% |

| Market | -0.73% | -0.75% | -0.17% |

UAW Strike Influence

The most significant headline of the week was the initiation of a strike by the United Auto Workers (UAW) at several assembly plants. This strike has the potential to impact various aspects of the automotive market. The extent of its impact will largely depend on its duration. Back in 2019, when a similar strike occurred, its brevity and the presence of a surplus of new inventory meant there was minimal impact on used car values.

However, this time around, the supply levels had only recently returned to a semblance of “normal” after the pandemic. Consequently, an extended strike could exert upward pressure on used car prices in the short term.

Market Performance

In terms of market performance, the data for the week ending September 16th, 2023, indicates some noteworthy changes:

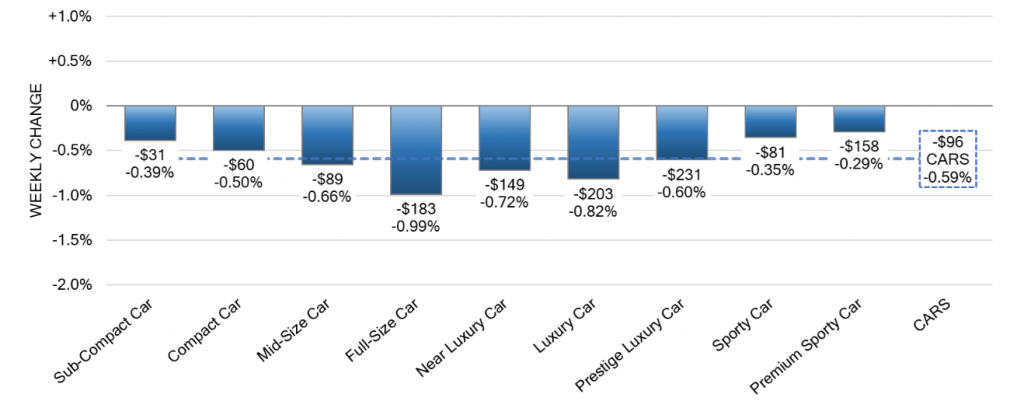

Car Segments

Within the Car segment, when considering volume-weighted metrics, there was a modest decline of -0.59%. This represents a slight improvement compared to the prior week’s -0.89% decrease. Of particular interest was the performance of Full-Size Car, which experienced the sharpest decline at -0.99%, maintaining an average weekly drop of -1.24% over the past six weeks. In contrast, Compact Car demonstrated resilience against the backdrop of rising fuel prices, experiencing a notable deceleration in depreciation, with only a -0.50% decline.

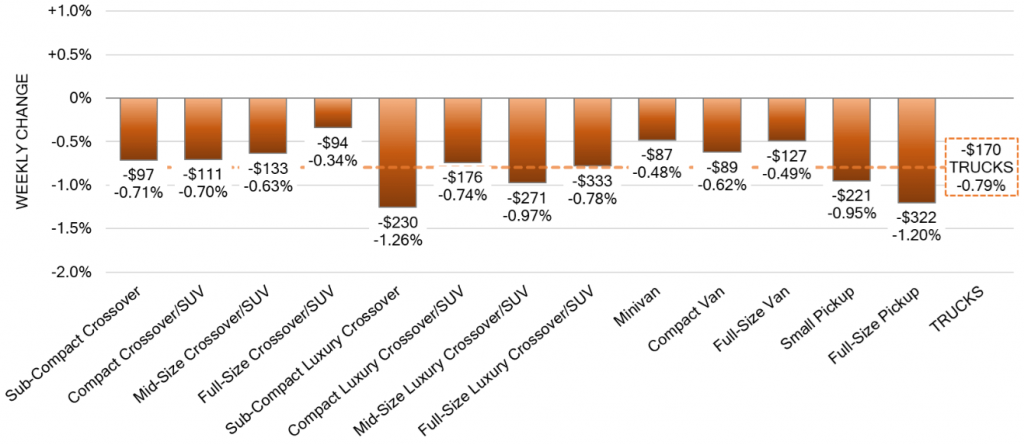

Truck & SUV Segments

In the broader context of the Truck segment, there was a downturn of -0.79%, though this decline proved to be less pronounced than the prior week’s drop of -0.69%. An intriguing observation arises within the Sub-Compact Luxury Crossover segment, where a substantial decline of -1.26% occurred. Notably, this marks the seventh consecutive week in which declines have exceeded the 1% threshold, warranting close attention to this segment’s evolving dynamics.

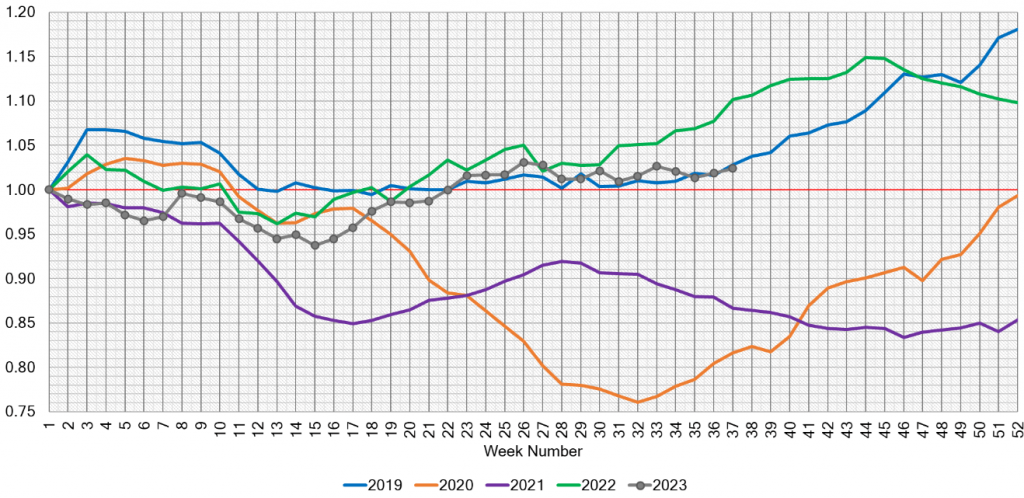

Used Retail

In the domain of Used Retail, the landscape is marked by the resilience of demand for pre-owned vehicles, as evidenced by the current standing of the Used Retail Active Listing Volume Index at 1.02 points. This metric underscores the persistent and robust interest in used automobiles within the market.

Wholesale

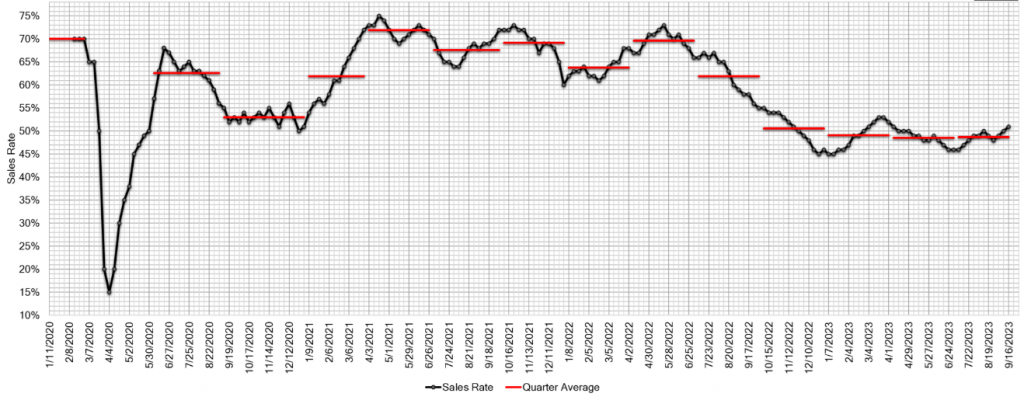

The UAW strike has stirred discussions about its potential impact on wholesale prices. While values remained relatively stable during the strike’s first day, the situation may evolve in the coming weeks. Notably, overall auction conversion rates increased again, with the estimated Average Weekly Sales Rate reaching 51%.

Conclusion

As the automotive market navigates through a challenging period with the UAW strike, dealers, and industry experts are closely monitoring the situation. The potential for short-term price increases in the used car market underscores the importance of staying informed and adaptable in this dynamic environment. In the weeks ahead, we will continue to keep a close eye on developments that could shape the future of the auto market.