Auto Market Insights – Week Ending October 14, 2023

Auto Market Update Week Ending Oct 14, 2023 (PDF)

In a constantly shifting automotive landscape, the industry grapples with the ongoing United Auto Workers (UAW) strike, a backdrop to recent developments in the auction market.

As we tread carefully through this period of negotiations with industry giants such as Ford, Stellantis, and General Motors, both buyers and sellers exhibit a sense of prudence in the market, contributing to nuanced shifts in auction dynamics.

Auction Activity

The past week witnessed a measured deceleration in auction activity, with buyers exercising caution amidst the ongoing negotiations. Encouragingly, progress seems to be brewing as major automakers respond with counteroffers, injecting a glimmer of hope into an otherwise uncertain atmosphere.

In response to the prior week’s positive auction performance, sellers have strategically increased their floor prices, harnessing the momentum of boosted valuations and conversion rates.

Market Trends

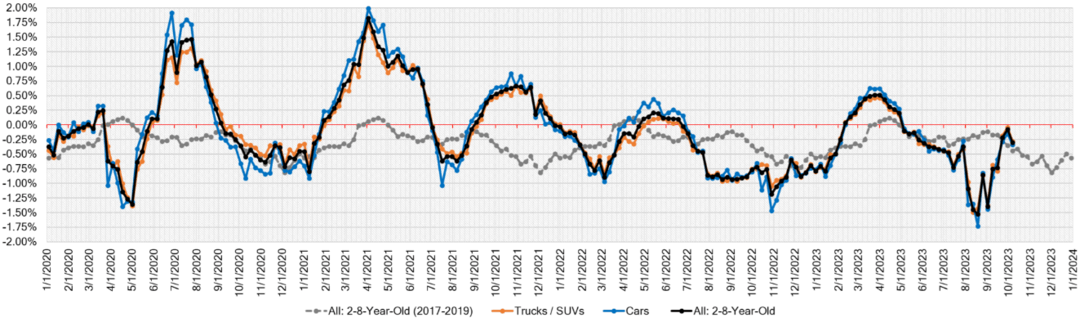

Here, we dissect the market dynamics. This week, the market experienced a 0.32% decline, reflecting a cautious sentiment amidst labor unrest. In comparison, the previous week noted a milder 0.08% decline, while the average for the same week between 2017 and 2019 stood at 0.44%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.34% | -0.15% | -0.52% |

| Truck & SUV segments | -0.31% | -0.05% | -0.39% |

| Market | -0.32% | -0.08% | -0.44% |

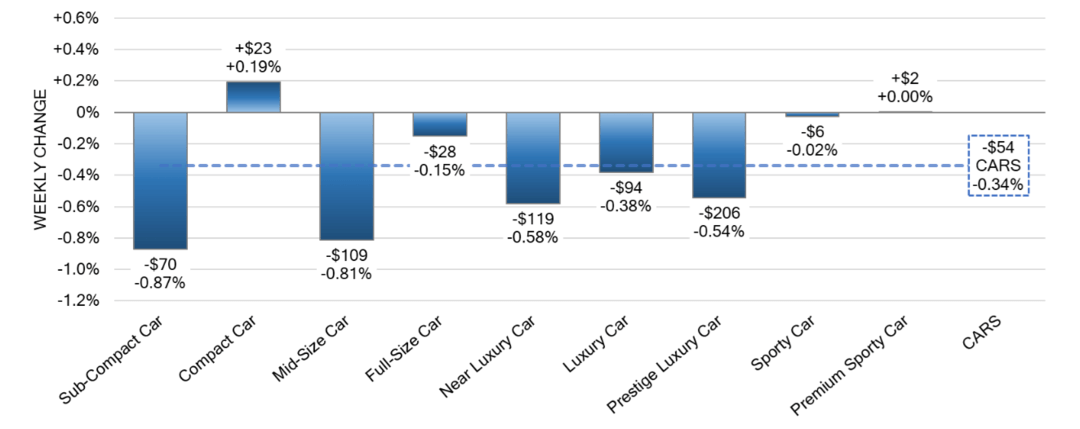

Car Segments:

On a volume-weighted basis, the overall Car segment witnessed a 0.34% decrease, modest compared to the preceding week’s 0.15% dip. Age-wise analysis reveals that 0-to-2-year-old Cars dipped by 0.32%, while 8-to-16-year-old Cars registered a 0.23% decline.

Seven of the nine Car segments saw declines, with Sub-Compact (-0.87%) and Mid-Size Cars (-0.81%) experiencing the most significant downturns. On a positive note, Compact Car displayed resilience, marking a second consecutive weekly increase of 0.19%.

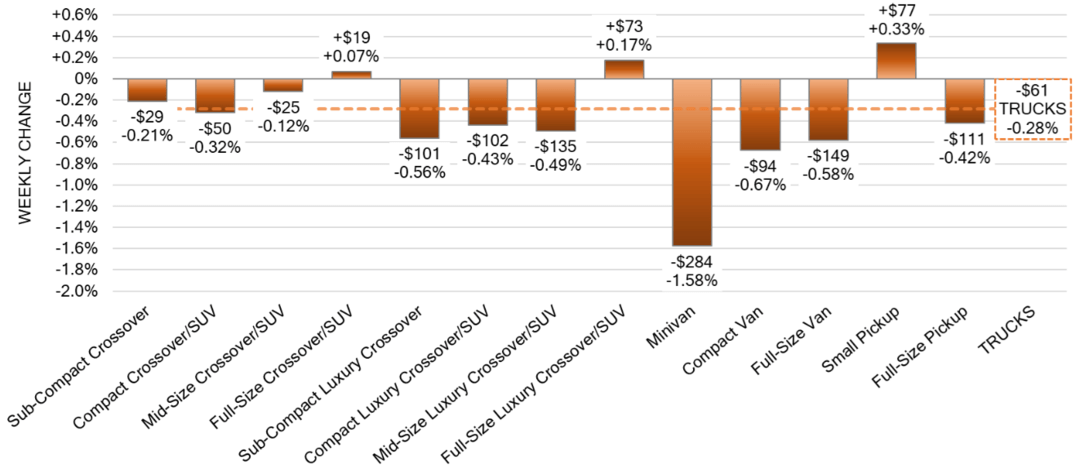

Truck & SUV Segments:

The volume-weighted Truck segment noted a 0.28% decrease, indicating an uptick in depreciation compared to the previous week’s 0.05%. Like Car segments, 0-to-2-year-old models bore a decline of 0.28% on average, while their older counterparts aged 8-to-16 years declined by 0.23%.

Notably, three of the thirteen Truck segments displayed resilience, with Small Pickup (+0.33%), Full-Size Luxury (+0.17%), and Full-Size Crossover/SUV (+0.07%) showing increases. Conversely, the Minivan segment experienced a substantial decline of 1.58%, marking seventeen consecutive weeks of depreciation with an average weekly change of -0.81%.

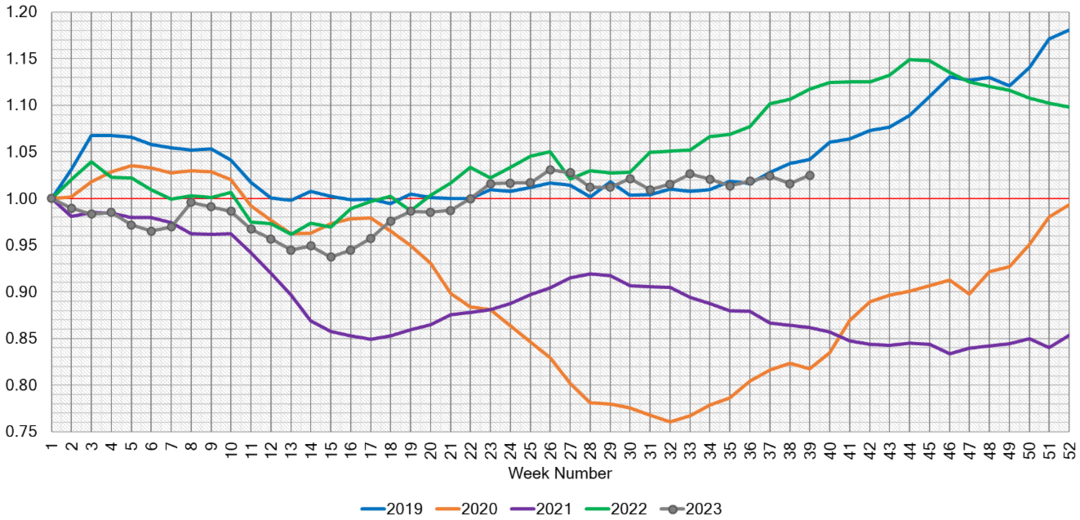

Used Retail and Wholesale Markets

Used Retail

The Used Retail Active Listing Volume Index currently stands at 1.02 points, while the Used Retail Days-to-Turn estimate hovers around 45 days.

Wholesale

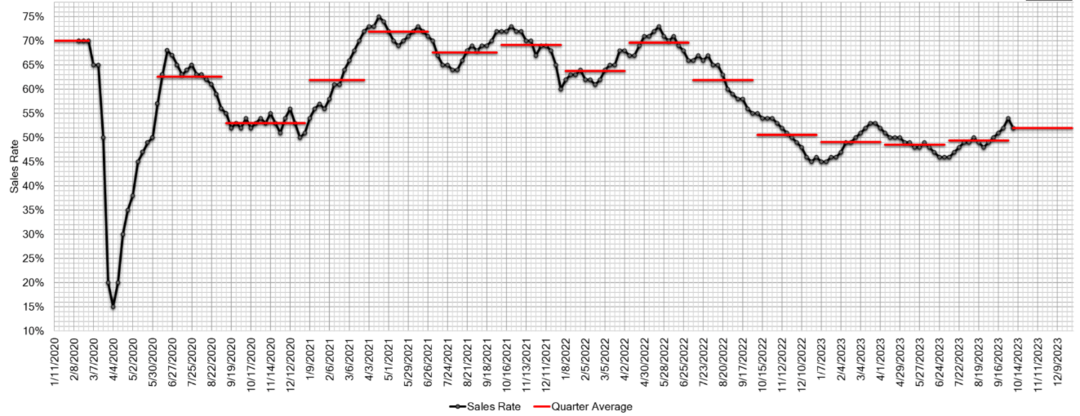

The persistent UAW strike casts a shadow over the wholesale market. Last week, auction conversion rates dipped, and inventory levels across the nation surged, reflecting uncertainty. The estimated Average Weekly Sales Rate receded to 52% amidst this prevailing ambiguity.

As we navigate the intricate auto market, the UAW strike remains an influential backdrop. However, ongoing negotiations and strategic maneuvers by market players hold the promise of gradual transformation.

The coming weeks hold the key to more clarity and potential opportunities in this ever-evolving industry landscape. Keep an eye out for further insights as we continue to monitor and analyze the dynamic auto market.