Navigating the Auto Market Landscape: Post-Strike Insights for Week Ending November 11, 2023

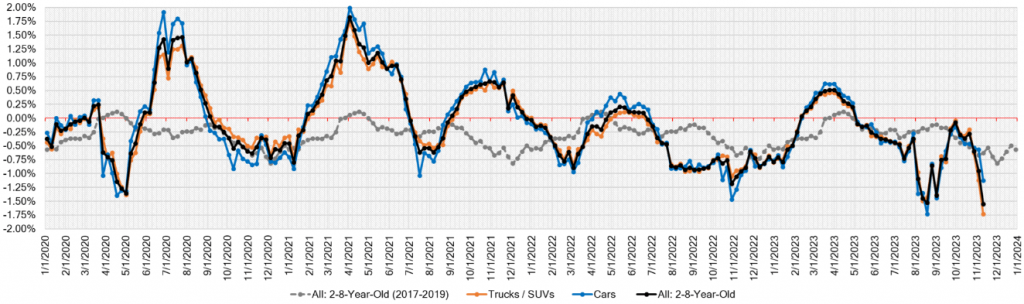

Emerging from the shadow of recent strikes, the automotive market is undergoing a course correction, notably within the Truck and SUV sectors. This week’s update unveils unprecedented single-week depreciation in Full-Size Vans and Full-Size Trucks, setting new records.

Across diverse segments, declines are prevalent, surpassing 1%, with some exceeding the two and three percent marks.

Auto Market Update Week Ending Nov 11, 2023 (PDF)

Market Dynamics (Percentage Decline Trends)

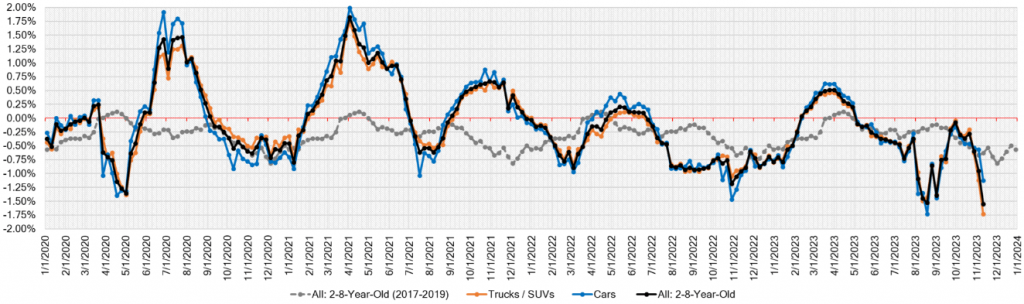

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -1.13% | -0.57% | -0.65% |

| Truck & SUV segments | -1.73% | -1.12% | -0.62% |

| Market | -1.55% | -0.95% | -0.63% |

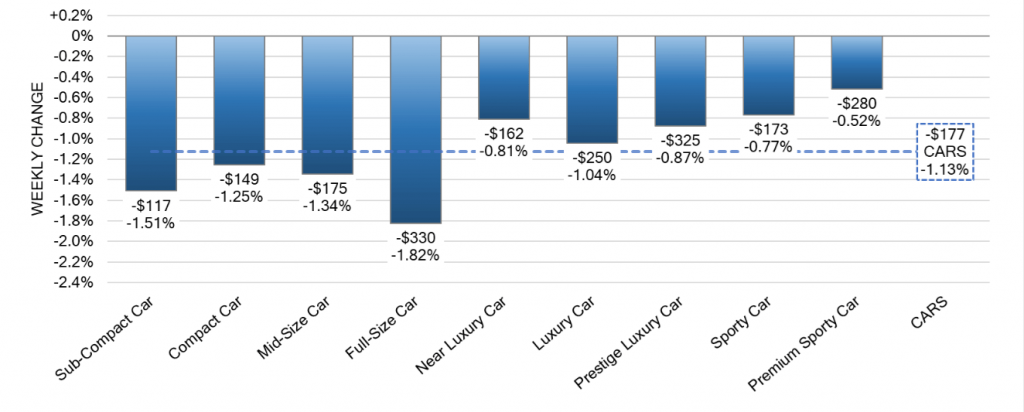

Car Segments

On a volume-weighted scale, the Car segment witnessed a -1.13% decrease this week, compared to the previous week’s -0.57%. Key insights include:

- 0-to-2-year-old Car segments down by -0.96%, while 8-to-16-year-old Cars declined by -0.93%.

- All nine Car segments reported declines, with five exceeding the 1% threshold.

- The Full-Size Car segment took a significant hit, experiencing a -1.82% decline, well above the previous month’s average of -0.41%.

- Sub-compact cars sustained notable depreciation at -1.51%, up from -0.92% the prior week.

- The Premium Sporty Car segment, previously resilient, reported an increased rate of decline at -0.52%, compared to the six-week average of -0.15%.

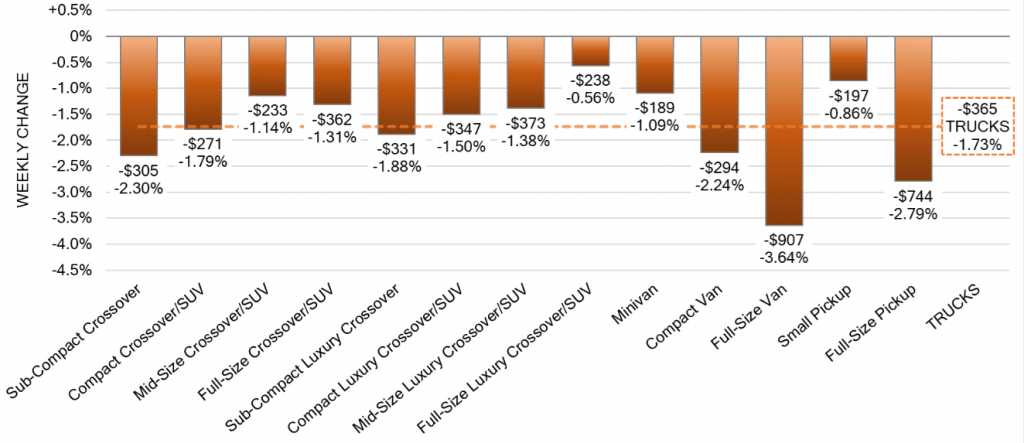

Truck / SUV Segments

- Cars in the 0-to-2-year age range recorded an average decline of -1.34%, while those in the 8-to-16-year category experienced a more substantial decrease of -2.23%.

- Across all thirteen Truck segments, declines were observed, with eleven surpassing the 1% mark and four exceeding 2%.

- Full-size pickups saw a significant downturn, registering a substantial decline of -2.79%. This marks the largest single-week drop on record for this segment, with Ford F150 and Ram 1500 leading the declines.

- Full-Size Van witnessed a substantial decline of -3.64%, while Compact Vans dropped by -2.24%.

Used Retail

As of today, the Used Retail Active Listing Volume Index stands at 1.05 points, illustrating the dynamics of the market. In addition, the intricate dance between supply and demand can be seen in the Estimate of Used Retail Days-to-Turn, gracefully meandering around the 50-day threshold, providing insight into the pace of transactions in the pre-owned auto industry.

Wholesale

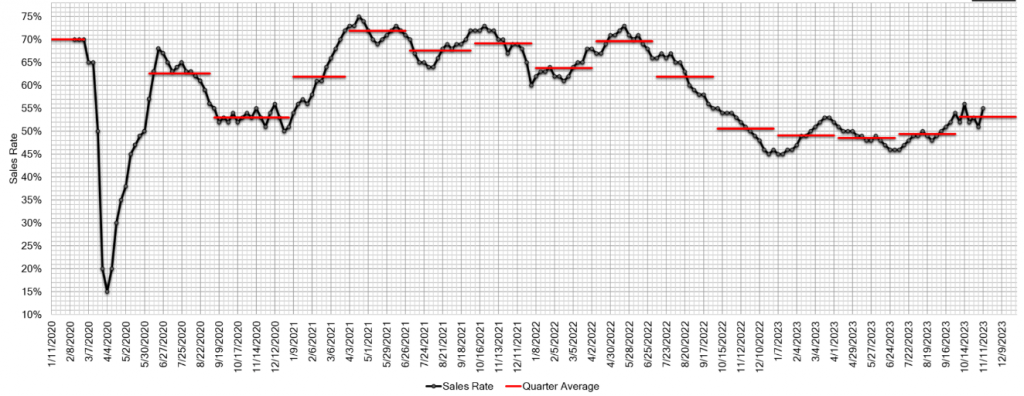

The wholesale market continues its decline, particularly in full-size trucks and cars, prompting sellers to adjust their pricing strategies in anticipation of further drops. Auction conversion rates increased by 3% compared to the prior week.

The estimated Average Weekly Sales Rate surged to 55% last week, indicating a potential trend of declining prices in the coming weeks. All indicators point towards a challenging market environment with sellers bracing for impact.