Wondering how the auto market is shaping up as we head into the summer? Well, you’re in the right place! This week’s update uncovers some intriguing trends that most websites gloss over. Let’s dive into the data and see what’s happening in the world of cars and trucks.

Auto Market Update Week Ending May 25, 2024 (PDF)

Wholesale Prices: Week Ending May 25, 2024

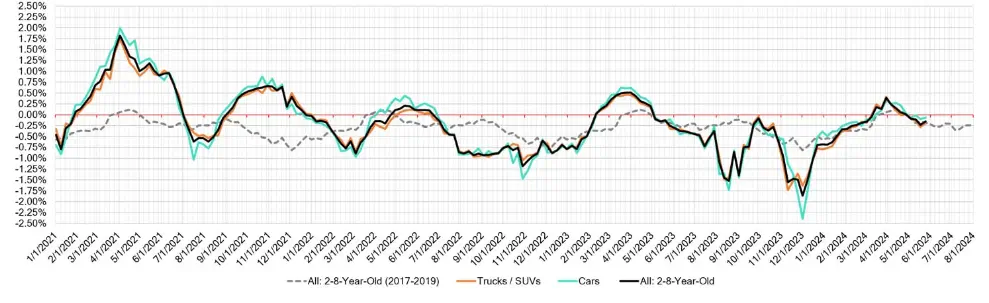

The overall market is showing signs of stability, with price declines aligning closely with pre-pandemic patterns. However, it’s not a one-size-fits-all scenario. Auction inventory and conversion rates vary widely, influenced by seller strategies and the specific inventory they offer.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

|---|---|---|---|

| Car segments | -0.06% | -0.09% | -0.33% |

| Truck & SUV segments | -0.19% | -0.29% | -0.09% |

| Market | -0.15% | -0.24% | -0.19% |

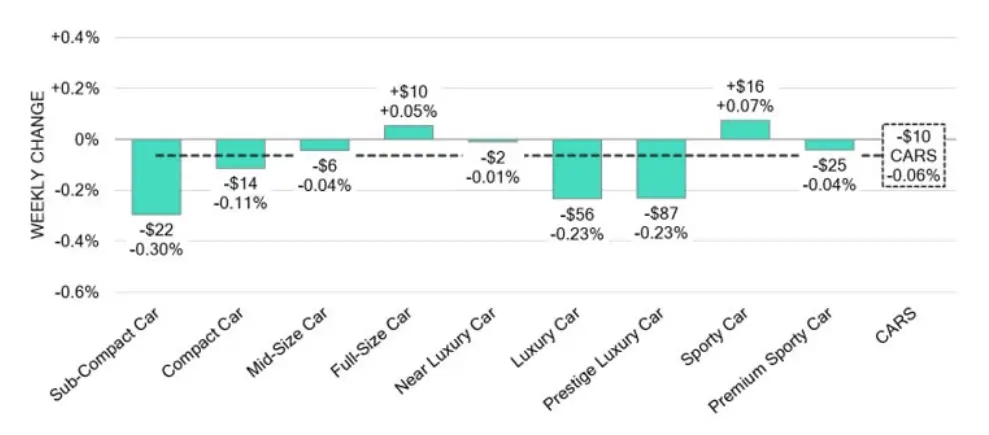

Car Segments

On a volume-weighted basis, the car segment saw a slight dip of -0.06%. While this might seem negligible, it’s a marked improvement from the -0.09% drop last week.

- The 0-to-2-year-old car segments were down by -0.05%.

- The 8-to-16-year-old car segments decreased by -0.10%.

Interestingly, two of the nine car segments bucked the trend and saw increases last week. The Full-Size Car segment, aside from a minor dip in early May, has been on an upward trajectory for thirteen of the past fourteen weeks, averaging a +0.15% growth per week. Last week, it climbed by a modest +0.05%.

Another highlight is the Sporty Car segment, which has been on a roll for nine straight weeks, growing by +0.07% last week. This upward momentum is worth noting for anyone eyeing this market niche.

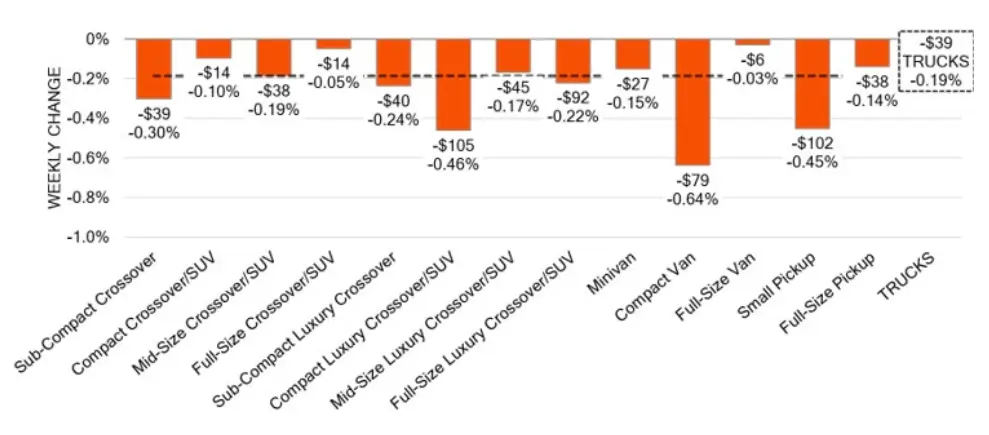

Truck and SUV Segments

The truck and SUV segment experienced a more pronounced decline, dropping by -0.19% compared to -0.29% the previous week. Here’s a closer look:

- The 0-to-2-year-old models saw an average decline of -0.22%.

- The 8-to-16-year-old models decreased by -0.20%.

Every single one of the thirteen truck segments reported a decline. The Compact Van segment was hit the hardest, with a -0.64% drop, closely mirroring the previous week’s -0.62% decrease.

Despite a sharp decline in April, the Full-Size Van segment has stabilized, showing a negligible week-over-week decrease of -0.03%. Interestingly, Full-Size Vans aged 0 to 2 years saw a slight uptick of +0.03%.

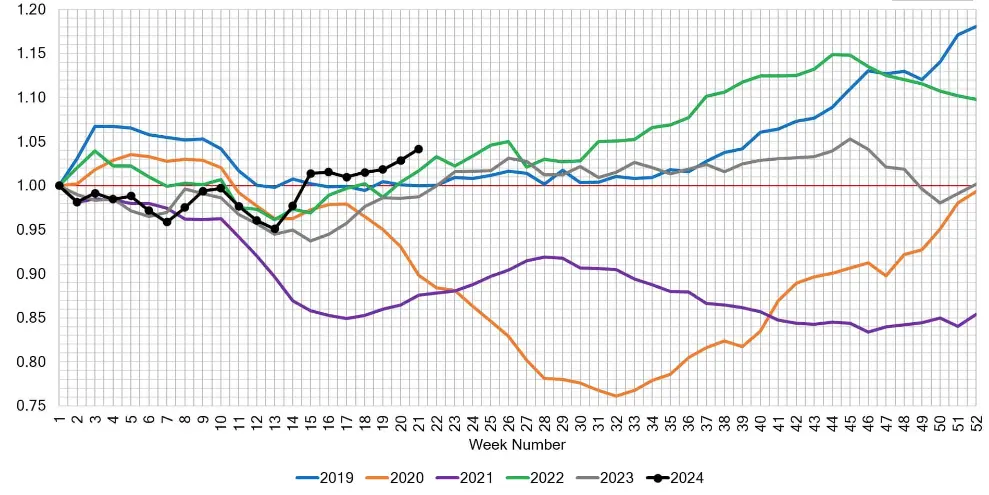

Used Retail Market

Tracking inventory levels across independent and franchised dealerships, the Used Retail Active Listing Volume Index offers a goldmine of insights into market dynamics. By normalizing data to the year’s starting point, this index provides a clear picture of annual trends. This approach is a game-changer for dealerships, enabling them to manage their inventories with precision and stay ahead of market fluctuations.

Wholesale Market Insights

As Memorial Day approaches, the wholesale market is displaying some intriguing trends. Overall prices are trending downward, yet full-size and sporty cars are bucking the trend with price increases. This divergence could be attributed to factors like shifting consumer preferences, seasonal demand spikes, or supply constraints.

On the flip side, all truck segments are experiencing price drops, potentially making them more attractive to buyers looking for holiday deals. These patterns are crucial for dealerships, fleet buyers, and individual consumers as they plan their purchases and manage inventory leading up to the holiday weekend, often a peak time for sales and promotions.

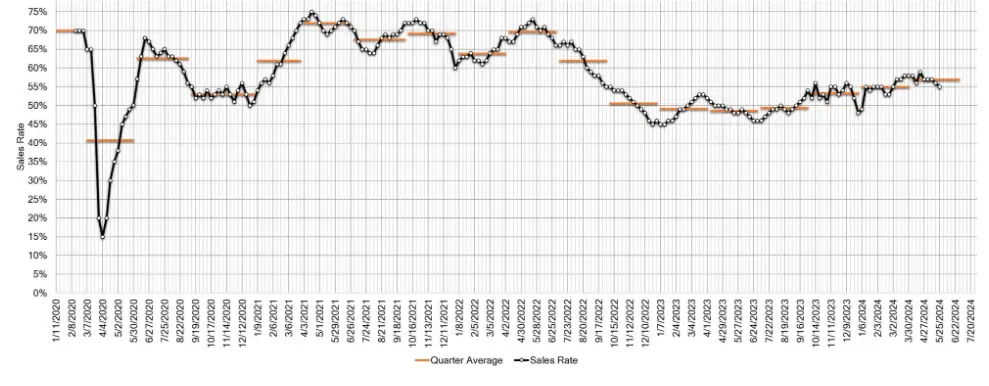

Auction Sales Rates

The average auction sales rate this week was 55%, down 1% from the previous week. This slight decrease suggests a cautious market, with sellers perhaps holding back or buyers becoming more selective.

Wrapping It Up

Our deep dive into the auto market for the week ending May 25, 2024, reveals a fascinating landscape. While overall prices are stabilizing, certain segments like full-size and sporty cars are showing surprising resilience. Trucks and SUVs, however, continue to see price declines, presenting opportunities for savvy buyers.

As always, our analysts are keeping a close watch on these trends, ensuring you stay informed. How will these shifts influence your next automotive decision?