The auto market for the week ending May 18, 2024, is marked by a sense of stability with subtle yet significant shifts that paint a detailed picture of current trends. While overall prices remain steady, a closer look reveals interesting dynamics across various segments.

Auto Market Update Week Ending May 18, 2024 (PDF)

Stability and Subtle Shifts in Wholesale Prices

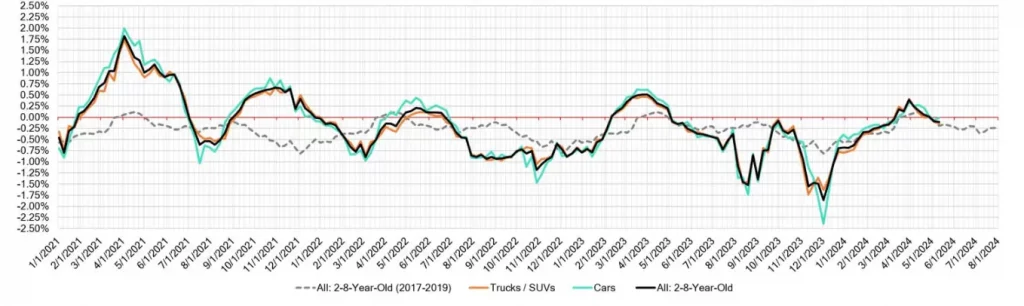

The market is largely described as stable, flat, and unchanging, reflecting a slow and consistent dip following the Spring market period. Notably, the segment for 2-to-8-year-old cars remained unchanged, while both newer used vehicles and the oldest model years saw slight increases, rising by +0.03% and +0.10%, respectively. Conversely, the truck market across all age categories experienced slow declines.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.01% | -0.06% | -0.23% |

| Truck & SUV segments | -0.14% | -0.10% | -0.18% |

| Market | -0.11% | -0.09% | -0.20% |

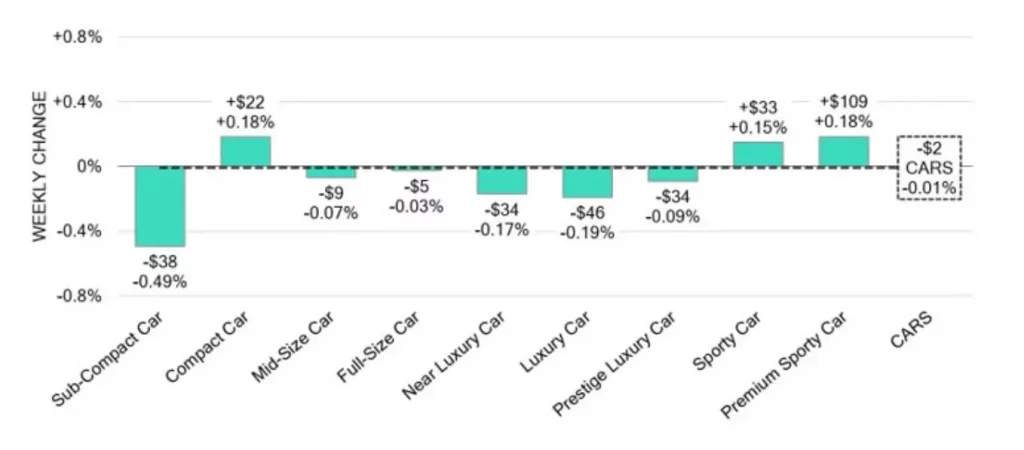

Car Segments: Steady Course with Subtle Variations

Examining the car segments, we see a slight dip of -0.01% on a volume-weighted basis this week, a minor change compared to the previous week’s -0.06% decrease.

- 0-to-2-year-old car segments: Notched a modest gain of +0.03%.

- 8-to-16-year-old cars: Edged up by +0.10%.

- Segments with increases: Out of nine car segments, three registered growth.

The Sub-Compact Car segment had the most notable decline among car categories, dropping by -0.49%. This decline, however, was less sharp than the previous week’s -0.58% fall.

In contrast, the Sporty Car segment maintained its positive momentum, climbing by +0.15%. This segment has been on a steady rise for seven consecutive weeks, boasting an average weekly growth of +0.33%.

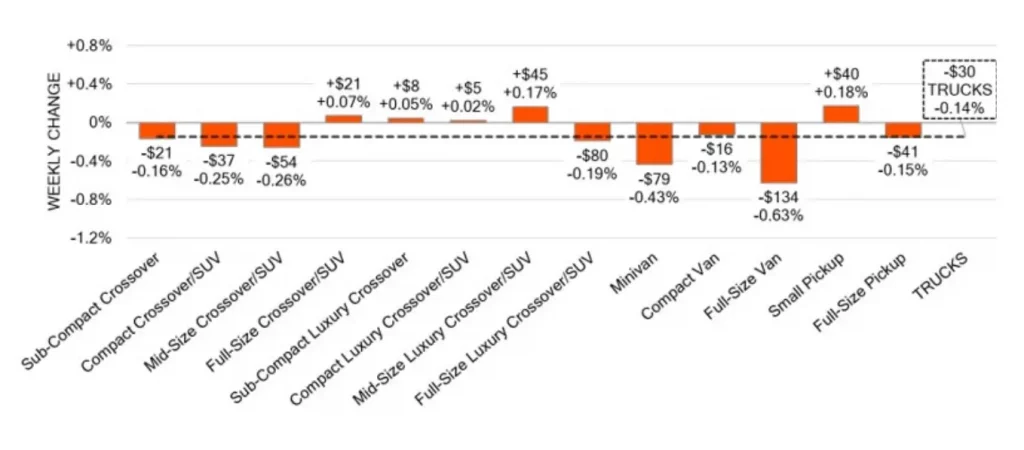

Truck / SUV Segments: Slow Declines Persist

The overall Truck segment decreased by -0.14% compared to the prior week’s decline of -0.10%.

- 0-to-2-year-old models: Declined by -0.06% on average.

- 8-to-16-year-olds: Decreased by -0.23% on average.

- Segments with increases: Five out of thirteen truck segments saw growth.

Full-Size Vans maintained their downward trajectory, though the pace of decline moderated last week to -0.63%, compared to -0.90% the week before. On average, the last seven weeks have seen a weekly decline of 1%.

The rate of depreciation for Minivans has accelerated, with the segment experiencing a -0.43% drop last week, marking its steepest weekly decline since the final week of January.

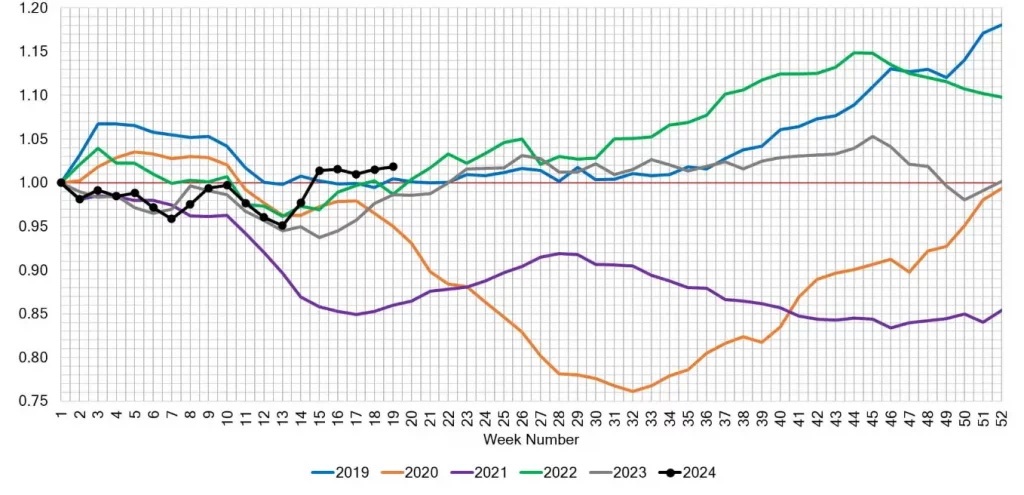

Used Retail and Wholesale Insights

The Used Retail Active Listing Volume Index is based on inventory analysis from the majority of independent and franchised dealerships in the U.S. It is normalized to the first week of the year to identify annual market movements.

Wholesale Market Overview: Another week of stability indicates moderate activity in the wholesale market with an overall lack of notable price changes. Consistent pricing across car and truck categories suggests a period of equilibrium. However, the Sub-Compact Car and Full-Size Van segments deviated from this trend, facing the most significant price declines within their categories.

A reduction in auction inventory at some of the larger auctions this week may indicate a slight shift in market dynamics. This decrease could be attributed to various factors such as seasonal changes, which affect the number and types of vehicles being sold, shifts in supply and demand, dealer inventory strategies, or broader economic conditions.

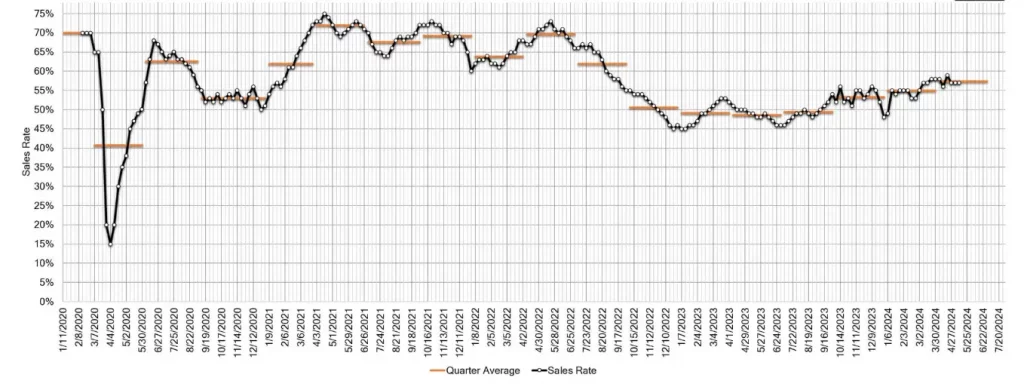

The average auction sales rate remained stable last week at 57%.

Conclusion

As the market continues to navigate through a period of stability, it’s crucial to keep an eye on the subtle shifts and trends that could signal future changes. The consistent price trends across car and truck categories reflect a balanced market, but the slight increases and declines in specific segments provide valuable insights into underlying dynamics.

What trends do you think will shape the auto market in the coming months?