The wholesale vehicle market saw a shift this week after 11 straight weeks of gains. For the week ending May 13, 2025, prices dipped slightly, with key segments beginning to reflect seasonal patterns and broader correction signals.

In this update, you’ll find a clear breakdown of price changes, segment-specific trends, and auction activity. Whether you’re managing inventory, pricing claims, or tracking the DV market, this summary highlights the most important movements to help you stay ahead.

Wholesale Prices Dip for the First Time in Nearly 3 Months

After nearly three months of consistent appreciation, the market posted a -0.07% overall decline. The same percentage drop applied to both 0-to-2-year-old and 2-to-8-year-old vehicles.

Older 8-to-16-year-old units experienced deeper depreciation at -0.20%. This is typical as aging inventory sees sharper value adjustments when momentum shifts.

Segment Performance: Cars and Trucks

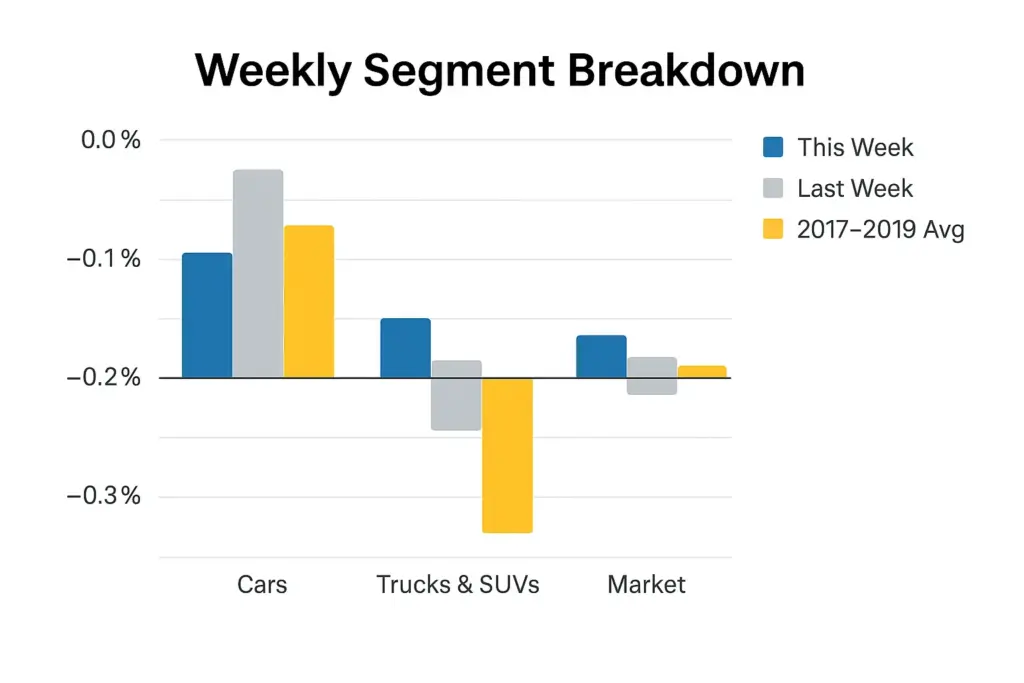

The weekly segment breakdown showed mixed performance:

| Segment | This Week | Last Week | 2017–2019 Avg (Same Week) |

|---|---|---|---|

| Cars | -0.09% | +0.07% | -0.33% |

| Trucks & SUVs | -0.07% | -0.07% | -0.09% |

| Market Overall | -0.07% | -0.03% | -0.19% |

Cars, in particular, reversed last week’s gains. Trucks remained flat week-over-week but inched downward compared to the broader trend.

Weekly Wholesale Price Index: Softening Begins

The Wholesale Price Index, which tracks 2-to-6-year-old vehicles, showed a clear plateau. After peaking in late April, values are now softening in line with historical seasonal trends.

This shift signals the end of early-spring momentum and the beginning of a slower price phase heading into summer.

Retail Trends & Inventory Snapshot

- Retail Prices: While retail prices haven’t dropped yet, the softening in wholesale values will likely show up in retail listings by early June.

- Days-to-Turn: Currently at 34 days, suggesting vehicles are still moving quickly on dealer lots.

- Inventory Levels: Listings have stabilized. Dealers aren’t aggressively restocking, pointing to cautious positioning.

Winners and Losers: What Moved This Week

Gainers:

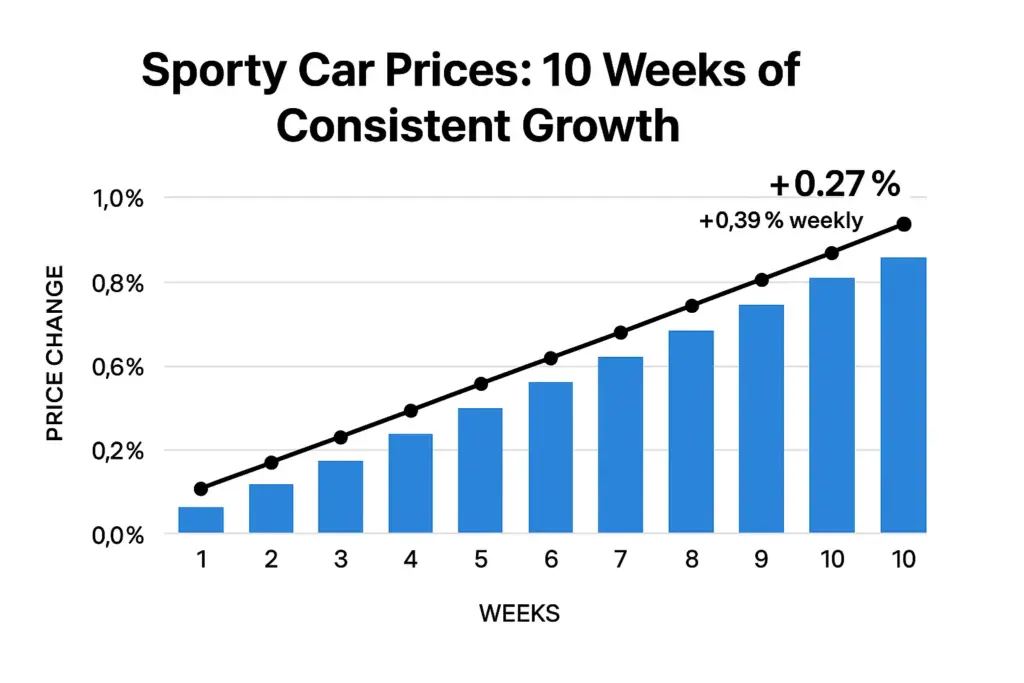

- Sporty Cars: Up +0.27%, continuing a 10-week streak of appreciation.

- Full-Size SUVs: Gained +0.66%, showing strength among newer models.

- Full-Size Pickups: Edged up +0.05%, though the pace is slowing compared to prior months.

Decliners:

- Sub-Compact Cars: Fell sharply by -1.27%. This is the third consecutive weekly decline.

- Older Crossovers & Sedans: Dropped faster than newer models, driven by soft demand and inventory buildup.

Auction Activity: Supply Up, Demand Holding

This week marked the first time since February that both the car and truck segments declined simultaneously. However, auctions still showed resilience:

- Inventory: Increased week-over-week.

- Conversion Rates: Improved by 2%, rising to 60%.

- Buyer Activity: Remained solid despite segment softening.

Final Takeaway: A Cooling, Not a Collapse

The week ending May 13 brought a shift, but not a drop-off. What we’re seeing is a seasonal correction rather than a market downturn. High-performing segments like Sporty Cars and Full-Size SUVs continue to show demand, while aging inventory adjusts.

Expect modest softening over the next few weeks, especially in underperforming segments. Keep a close eye on auction trends, retail lag, and segment-specific moves as the market continues to normalize.