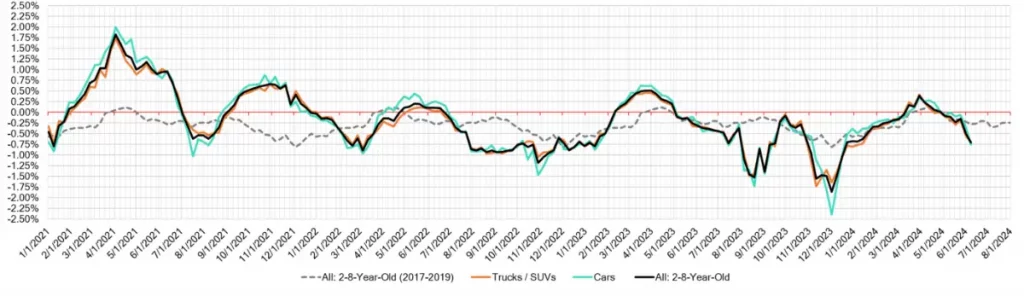

The auto market saw some significant movements last week, with an accelerated depreciation rate across all segments, marking the most substantial decline since mid-December 2023. Notably, the midsize car and midsize crossover/SUV segments experienced the largest declines. Let’s dive into the specifics.

Auto Market Update Week Ending June 08, 2024 (PDF)

Wholesale Prices: A Sharp Decline

For the week ending June 08, 2024, wholesale prices showed a notable depreciation across the board. Here’s a breakdown of the changes:

Overall Market Depreciation Rates:

| | This Week | Last Week | 2017-2019 Average (Same Week) |

| Car segments | -0.76% | -0.34% | –0.39% |

| Truck & SUV segments | -0.69% | -0.55% | –0.21% |

| Market | -0.71% | -0.49% | –0.28% |

This accelerated depreciation is quite a shift, with current rates significantly outpacing the 2017-2019 average for the same week.

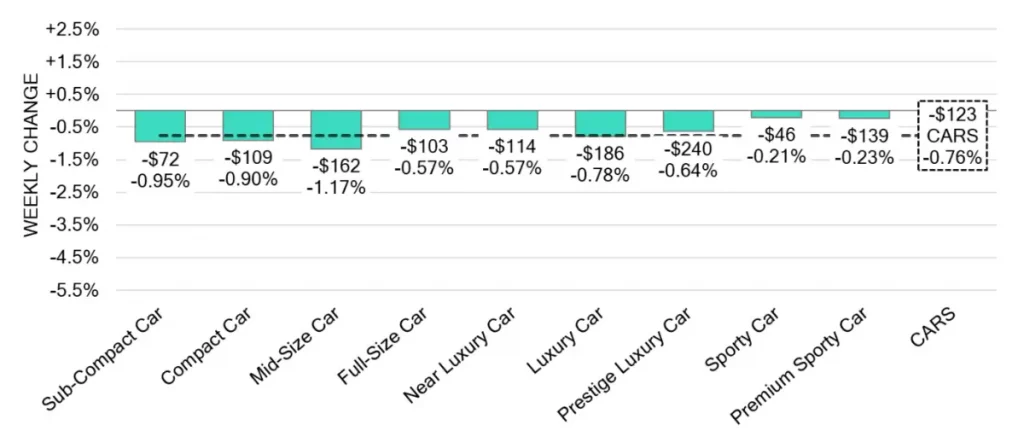

Car Segments: Midsize Cars Lead the Decline

On a volume-weighted basis, the overall car segment decreased by -0.76%, a sharp increase from the previous week’s -0.34%. Let’s break down the key points:

- 0-to-2-year-old cars: Down -0.53%

- 8-to-16-year-old cars: Down -0.27%

- All nine car segments saw increased depreciation.

- Midsize cars experienced the largest depreciation at -1.17%, a significant jump from the prior week’s -0.33%.

- Subcompact and compact cars also saw accelerated depreciation at -0.95% and -0.90%, respectively, marking the ninth straight week of declines for subcompact cars.

- Sporty and premium sporty cars showed declines of -0.21% and -0.23%, respectively, reversing the slight gains seen in the prior week.

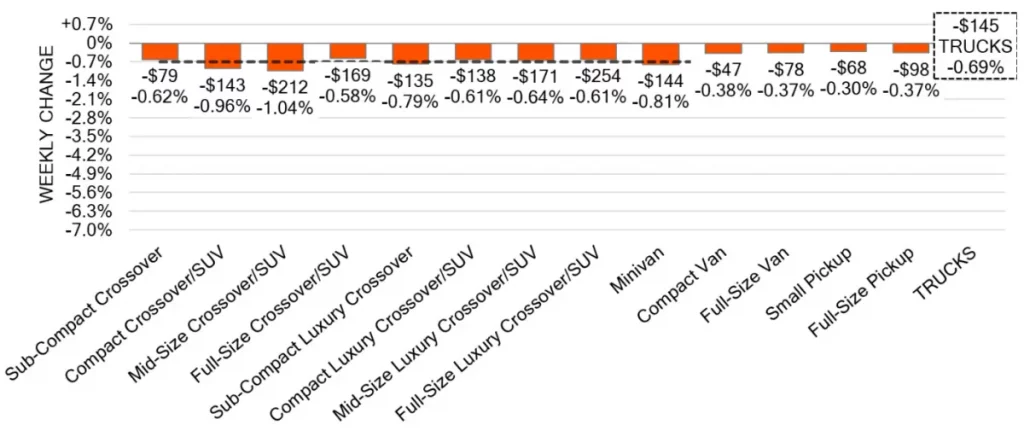

Truck and SUV Segments: Consistent Decline

The truck and SUV segments also saw a significant drop, with the volume-weighted overall truck segment decreasing by -0.69%, compared to a -0.55% decline the previous week. Key details include:

- 0-to-2-year-old models: Down -0.54%

- 8-to-16-year-old models: Down -0.29%

- All thirteen truck segments reported declines.

- Mid-size crossovers/SUVs saw the largest depreciation at -1.04%, the sixth consecutive week of declines and the most significant drop following the previous week’s -0.67%.

- Sub-Compact Luxury Crossovers fell by -0.79%, a notable increase from the previous week’s -0.21%.

- Mid-size luxury crossovers/SUVs declined by -0.64%, up from a -0.22% drop the week before.

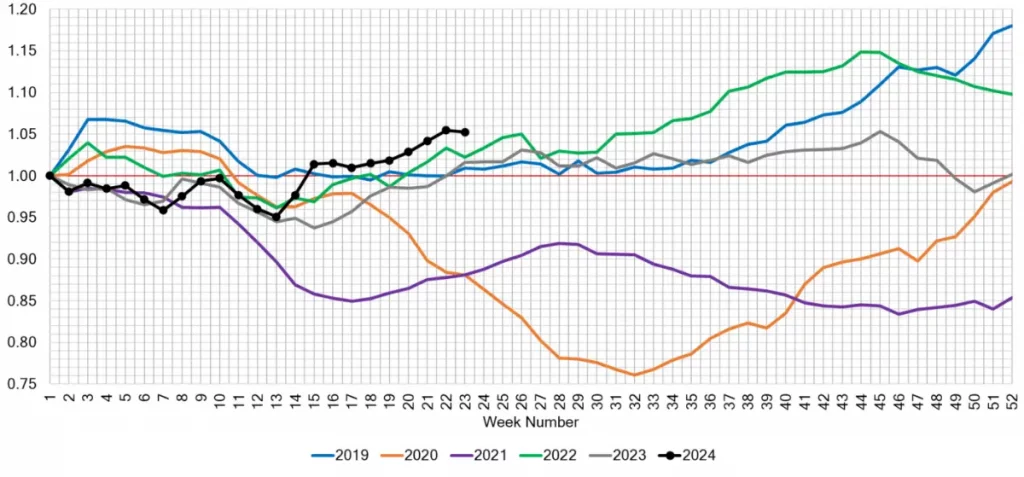

Used Retail Market: Inventory and Turnover Insights

The Used Retail Active Listing Volume Index, based on inventory analysis from independent and franchised dealerships, is normalized to the first week of the year. Current trends show:

- Days-to-Turn estimate: Around 40 days.

- Rising inventory levels at auction, marking the third consecutive week of increases, largely driven by growth in OEM lanes while dealer lanes saw a decline.

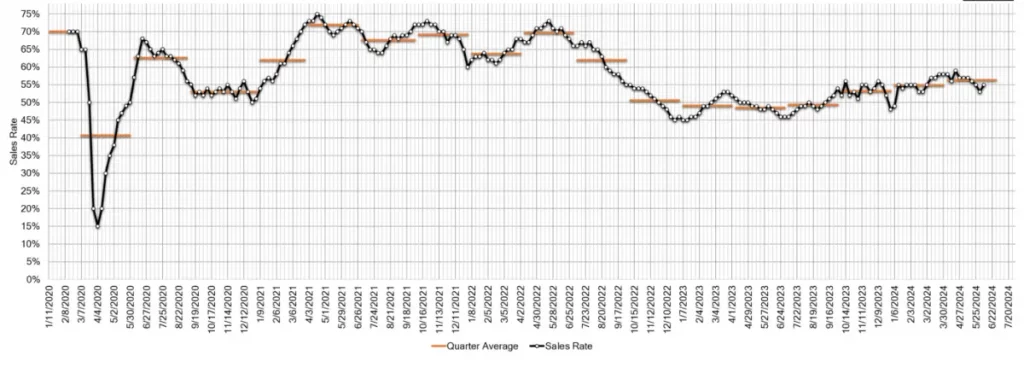

- Auction conversion rates increased last week, with the average auction sales rate reaching 55%, up by 2% from the previous week.

Wholesale Market: Trends and Auction Dynamics

The first full week of June saw significant depreciation in the wholesale market, with notable declines across both car and truck segments. Specific trends include:

- Mid-size cars and mid-size crossovers/SUVs experienced the most considerable drops, each declining just over -1%.

- Auction conversion rates rose compared to the previous week.

- Inventory levels continued to rise at auctions, particularly in the OEM lanes, while dealer lanes saw a slight decrease.

Our team of analysts is continually monitoring the market for developing trends and gathering insights to keep you informed.

Final Thoughts

The auto market is experiencing some noteworthy trends, with accelerated depreciation rates and rising auction inventories marking significant shifts. These changes have important implications for both buyers and sellers, indicating potential opportunities and challenges in the weeks ahead. What do you think about the current trends in the auto market?