Auto Market Update Week Ending Jun 10, 2023 (PDF)

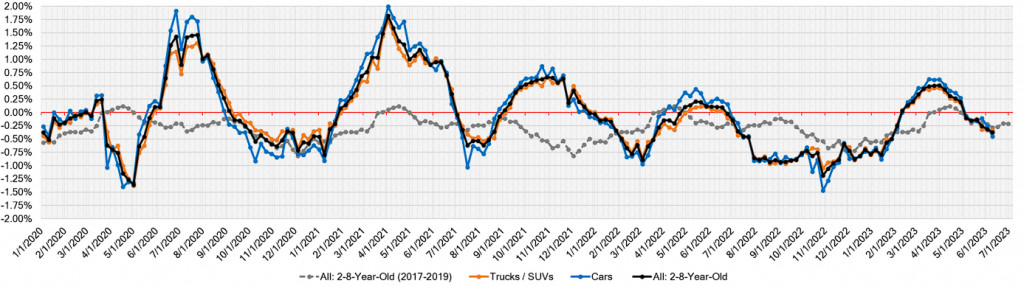

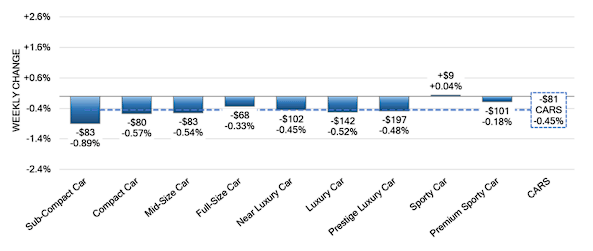

In the latest Auto Market Update, the industry witnessed a continuation of declines across most segments, highlighting a trend that surpasses typical expectations for this time of year, especially when compared to pre-COVID market conditions. However, amidst the downward trajectory, the Sporty Car segment emerged as the sole exception, experiencing a modest increase of +0.04%. Let’s delve deeper into the key highlights and notable trends observed during the week.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.45% | -0.26% | -0.39% |

| Truck & SUV segments | -0.34% | -0.34% | -0.21% |

| Market | -0.37% | -0.31% | -0.28% |

Market Performance

- On a volume-weighted basis, the overall Car segment witnessed a decline of -0.45% last week, surpassing the previous week’s decrease of -0.26%. It’s worth noting that only one out of the nine Car segments showed an increase.

- The Sporty Car segment, although exhibiting signs of slowing growth, managed to achieve a marginal increase of +0.04% compared to the prior week’s +0.38% surge.

- Conversely, the Sub-Compact Car segment experienced the most significant decline within the Car category, dropping by -0.89%. This decline marked the steepest week-to-week decrease for the segment, following a -0.63% decline in the previous week.

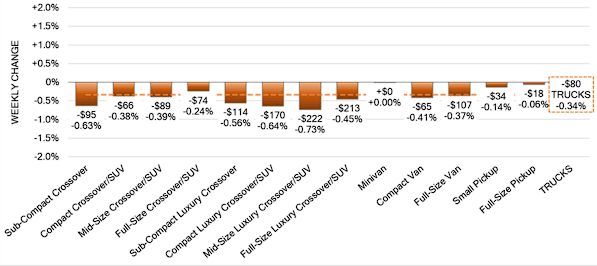

- Similar to the Car segment, the volume-weighted overall Truck segment recorded a decline of -0.34%, mirroring the preceding week’s decrease of -0.34%.

- All thirteen Truck segments reported decreases in sales for the week.

- The Mid-Size Luxury Crossover segment faced the most substantial decline within the Truck category, with sales dropping by -0.73%.

Used Retail Prices

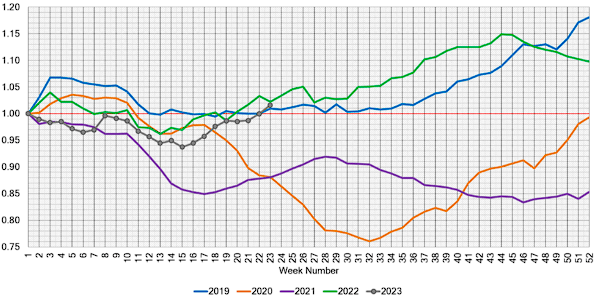

Used Retail Prices have become increasingly accessible, thanks to the prevalence of ‘no-haggle pricing’ in the used-vehicle retailing sector. This transparency in pricing has made the car buying process more enjoyable for customers. Throughout the past year, Used Retail Prices displayed a fluctuating pattern. Initially, prices increased slightly, followed by a drop in April. They reached a low point in the late spring months before experiencing an upturn in late summer, coinciding with a scarcity of new vehicle inventory. During the third quarter of the year, retail prices rose at a slower rate but regained momentum in the fourth quarter. The year concluded with the retail listing price index closing 36% higher than the year’s beginning. In CY2022, the retail listing price index remained relatively stable, with declines in Q4 that were not as pronounced as in the wholesale price index.

Wholesale Market

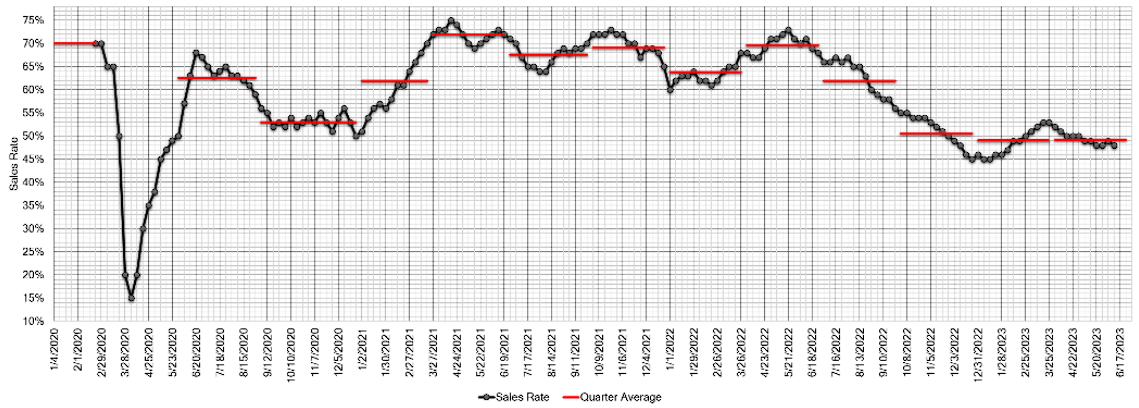

The wholesale market exhibited mixed signals last week. While some lanes reported strong sales in the 85-90% range, others struggled to achieve rates as low as 30-40%. Prices displayed significant variation, but the demand for low mileage and high condition grade vehicles remained consistent, commanding a premium. The Estimated Average Weekly Sales Rate decreased to 48% during the week, emphasizing the need to closely monitor developing trends and insights.

Adapting to Shifting Trends and Seizing Opportunities

As the week ending June 10, 2023, unfolded, the auto market witnessed a widespread decline across its segments, defying the anticipated seasonal patterns and outpacing pre-COVID market conditions. Amidst this challenging landscape, the Sporty Car segment emerged as a beacon of hope with a modest yet notable increase. In the face of evolving market dynamics, industry professionals must remain vigilant, adapt swiftly to emerging trends, and navigate this ever-changing landscape with resilience and determination.