Hey there, auto enthusiasts! This week’s auto market update is packed with insights you won’t find elsewhere. We’re diving deep into the latest trends, focusing on wholesale prices, car and truck segments, and the factors driving these changes. So buckle up and let’s get started!

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | –0.75% | –0.54% | –0.29% |

| Truck & SUV segments | –0.73% | –0.63% | –0.22% |

| Market | –0.74% | –0.60% | –0.25% |

Auto Market Update: Week Ending July 20, 2024 (PDF)

Wholesale Prices: What’s the Buzz?

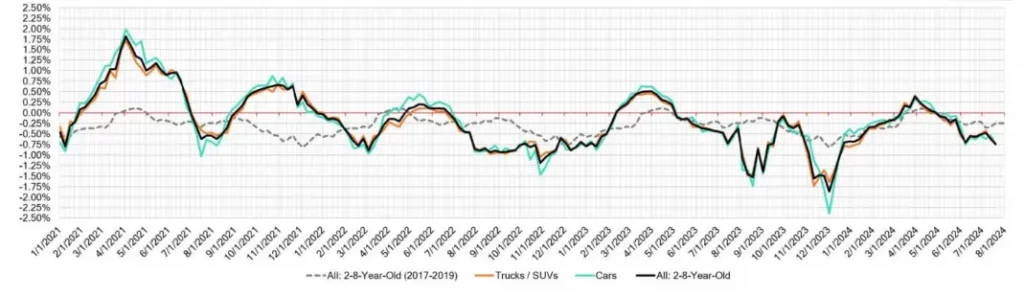

The market’s experiencing a notable shift, with depreciation rates accelerating faster than a sports car on an open road. Last week, we saw a -0.74% drop, a stark contrast to the pre-pandemic average of -0.25%. What’s causing this surge? Let’s break it down.

Car Segments: What’s Going Down?

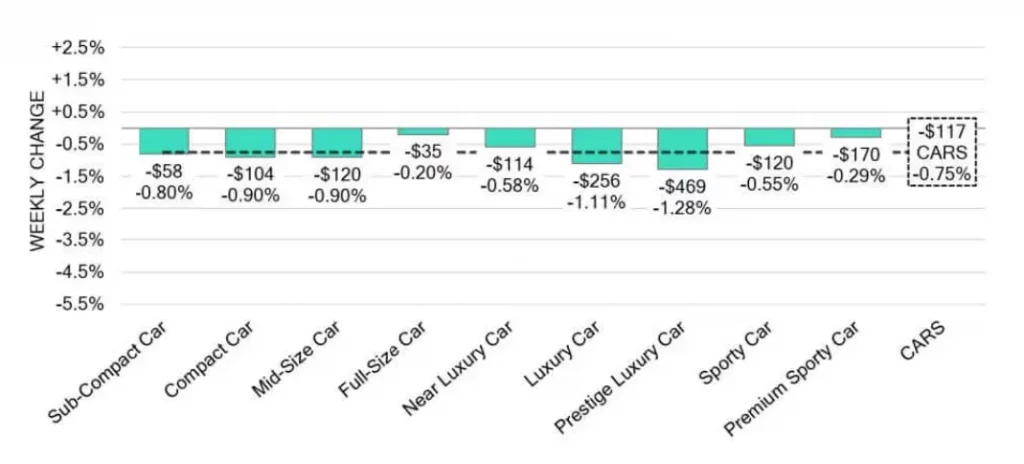

On a volume-weighted basis, the overall Car segment took a sharper downturn, sliding by -0.75%. To put this in perspective, it was a steeper descent compared to the previous week’s -0.54%. Specifically, the 0-to-2-year-old cars experienced a -0.43% drop, while their older counterparts, the 8-to-16-year-olds, recorded a -0.37% decline.

Interestingly, all nine car segments reported declines, with Prestige Luxury Car and Luxury Car taking the hardest hits at -1.28% and -1.11%, respectively. But here’s a twist: the Full-Size Car segment slowed its depreciation to -0.20%, significantly less than the previous week’s -0.61%. Even more intriguing, the 8-to-16-year-old Full-Size Car segment actually gained +1.01%. Who saw that coming?

Truck & SUV Segments: More Than Just a Dip

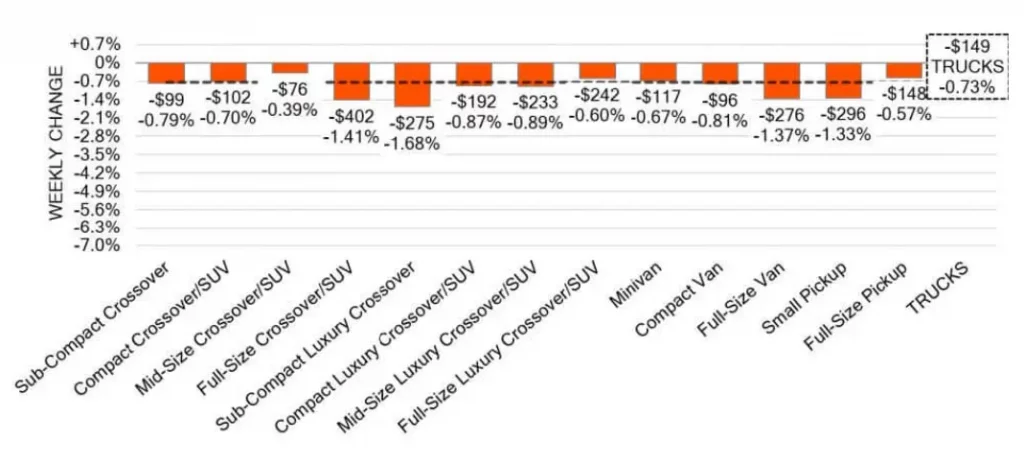

The Truck and SUV segments also saw their fair share of declines. Overall, these segments decreased by -0.73%, compared to the previous week’s -0.63%. The 0-to-2-year-old models dipped by -0.59%, while the 8-to-16-year-olds fell by -0.29%.

Notably, all thirteen Truck segments reported declines, with four experiencing drops over 1%. The Sub-Compact Luxury Crossover segment saw a dramatic plunge of -1.68%, the biggest drop since early January. Another eye-opener: the Small Pickup segment’s depreciation accelerated to -1.33%, the steepest decline since late 2023.

Used Retail: What Are the Dealers Saying?

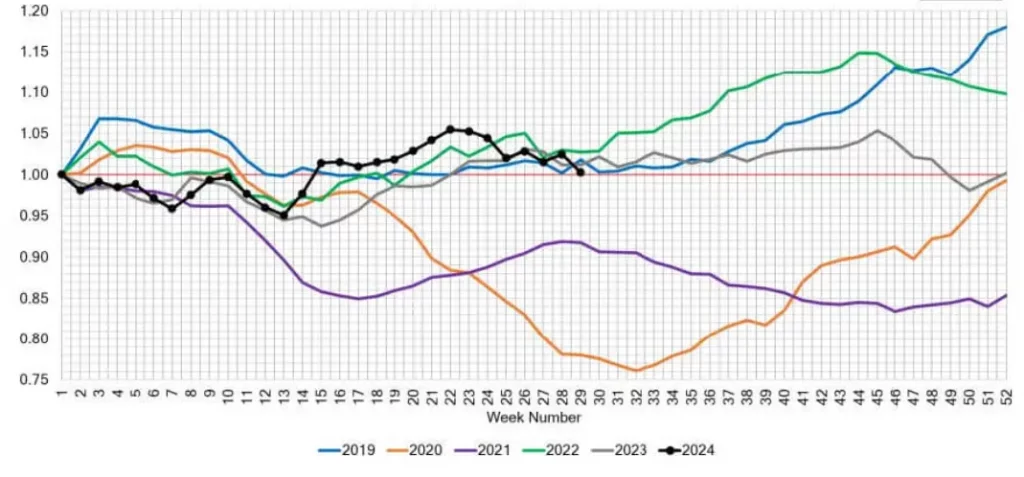

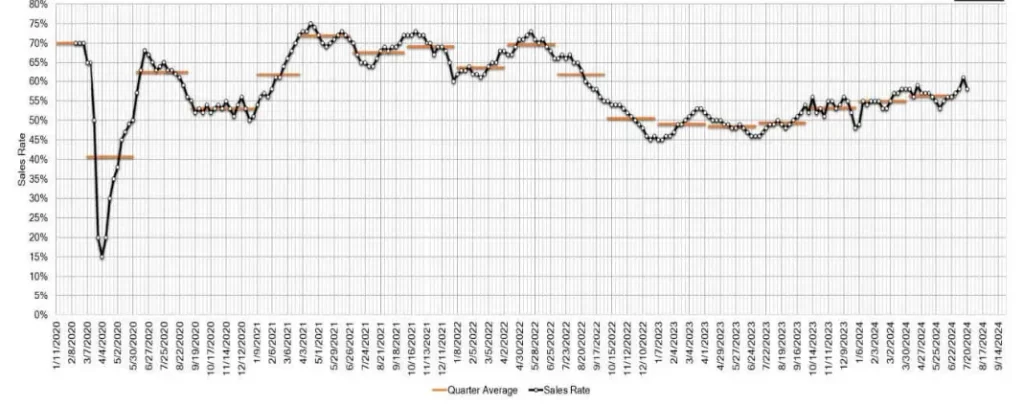

The Used Retail Active Listing Volume Index, which tracks inventory across dealerships, shows significant movement. This index helps us understand annual market shifts and right now, it’s signaling an increase in auction inventory across the nation. This surge in inventory is likely pushing wholesale prices down, with the auction conversion rate dropping to 58% from the previous week’s 61%.

What’s Driving These Changes?

Several factors are at play here. The rise in auction inventory is a major one, as more cars hitting the market can drive prices down. Additionally, market analysts are keeping a close watch on these trends, providing insights that help us understand the bigger picture.

Wrap-Up: What’s the Bottom Line?

In a nutshell, the auto market is showing a clear trend of accelerated depreciation, especially in certain car and truck segments. The increases in auction inventory and changes in the auction conversion rates are significant drivers of these shifts. As always, staying informed and understanding these trends can give you a leg up whether you’re buying, selling, or just keeping tabs on the market.

Have you noticed any interesting trends in your local auto market? Let us know!