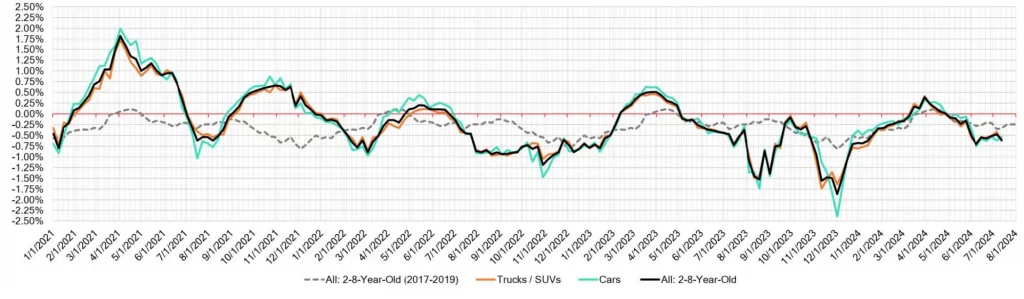

Despite rising auction conversion rates, the days to turn on dealership lots are consistently increasing. In terms of valuations, the market continues to decline at a pace that surpasses pre-pandemic norms for this time of year.

| This Week | Last Week | 2017-2019 Average(Same Week) | |

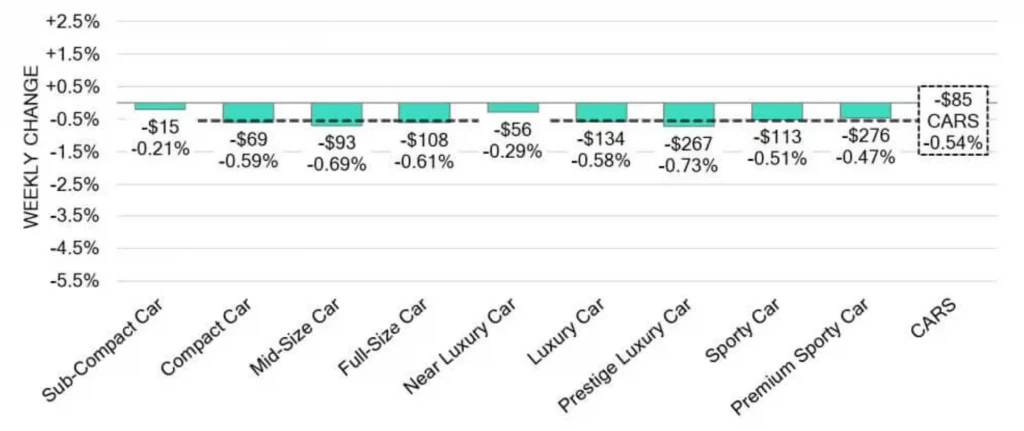

| Car segments | –0.54% | –0.62% | –0.39% |

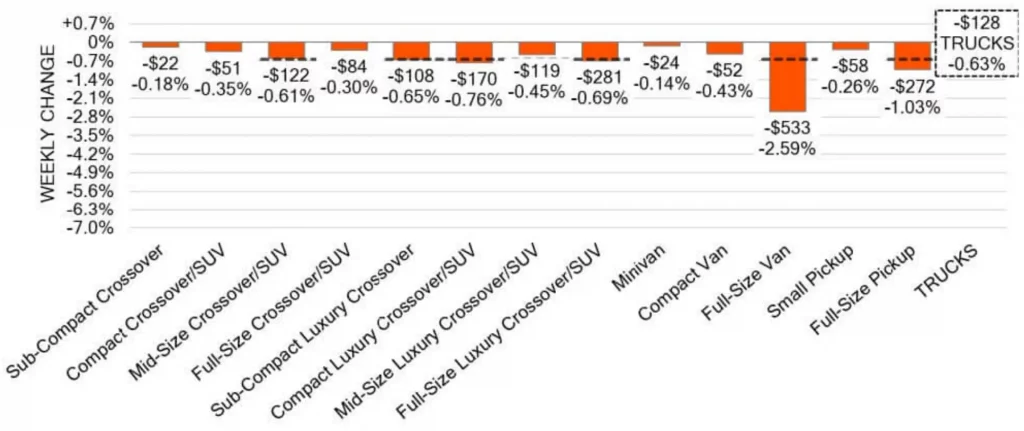

| Truck & SUV segments | –0.63% | –0.42% | –0.28% |

| Market | –0.60% | –0.47% | –0.33% |

Auto Market Update Week Ending July 13, 2024 (PDF)

Car Segments: Trends and Insights

On a volume-weighted basis, the overall car segment saw a decrease of -0.54%. For reference, in the previous week, cars decreased by -0.62%. Notably, the 0-to-2-year-old car segments were down by -0.31%, while the 8-to-16-year-old cars experienced a sharper decline of -0.72%. This was the largest single-week decline for the 8-to-16-year-old cars since the last week of December. The mid-size car segment was a significant factor in this decline, with a drop of -1.12%.

All nine car segments reported declines last week, with Prestige Luxury Cars experiencing the largest drop of -0.73%, compared to the prior week’s decline of -0.53%. The Premium Sporty Car’s depreciation also picked up pace with a drop of -0.47%, marking the largest single-week decline since early March. However, not all news was negative; the 0-to-2-year-old Sporty Car segment increased marginally, gaining +0.01%.

Truck and SUV Segments: Market Movements

The volume-weighted overall truck segment decreased by -0.63% compared to the previous week’s decline of -0.42%. The 0-to-2-year-old models declined by -0.54% on average, and the 8-to-16-year-olds decreased by -0.69% on average. Every single one of the thirteen truck segments reported declines last week.

Full-size vans plummeted last week, dropping by -2.59%. This drop was significantly larger compared to the depreciations experienced in April, when the segment declined by more than a percent per week for three consecutive weeks. Despite the overall downturn, two truck segments in the 0-to-2-year-old category reported increases: Minivan (+0.09%) and Small Pickup (+0.12%), marking the second consecutive week of gains for late-model small pickups.

Inventory Analysis: Used Retail and Wholesale

Used Retail

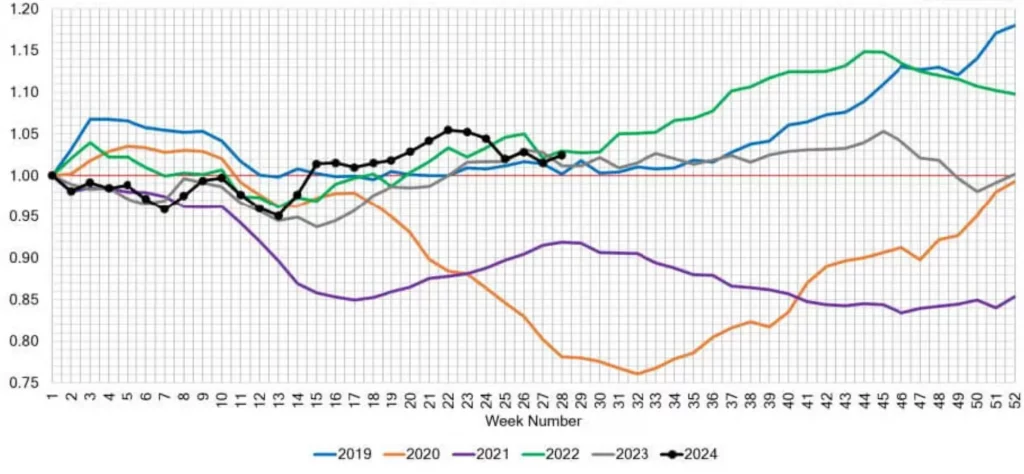

The Used Retail Active Listing Volume Index is based on inventory analysis from the majority of independent and franchised dealerships in the US. It is normalized to the first week of the year to identify annual market movements. The estimated used retail days-to-turn is rising and is now at 50 days, indicating that it’s taking longer for dealerships to sell their inventory.

Wholesale

The car and truck segments continue to see price declines as we conclude the second full week of July. In the car segments, Prestige Luxury cars decreased by -0.73%, while the truck segments experienced a significant drop, particularly in full-size vans by -2.59%. This marks the largest decline this year. The increase in used cargo vans in auction lanes over the past five months has contributed to the downward pressure on prices.

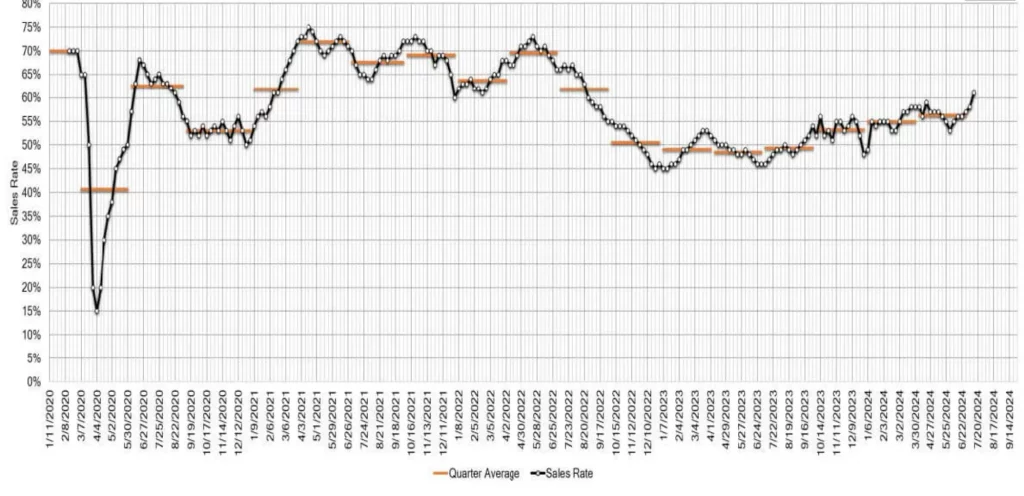

Despite the market’s continued decline in both car and truck segments, the auction conversion rate has increased to 61%, representing a 3% rise from the previous week. This indicates that a higher percentage of vehicles are being sold at auction, even as prices drop.

Keeping an Eye on the Market

Our team of analysts is constantly monitoring the market for developing trends and gathering insights. With the current trajectory, it’s crucial to stay informed and adapt strategies accordingly. The rising auction conversion rates amid declining prices suggest a complex market landscape, where understanding the nuances can make a significant difference.

The continual increase in days to turn on dealership lots, coupled with the steep price declines, points to a challenging environment for both buyers and sellers. As we move further into the year, it will be interesting to see how these trends evolve. Will the market stabilize, or are we in for more fluctuations? Stay tuned for our weekly updates to keep your finger on the pulse of the wholesale market.