As the sun sets on another week in the world of automotive commerce, it leaves behind a trail of subtle yet significant changes. The recent trends in vehicle depreciation, a topic often overlooked in mainstream discussions, are painting a fascinating picture of the market’s evolution. This week, we delve deeper into these shifts, offering insights rarely explored in the automotive sphere.

Auto Market Update Week Ending Jan 20, 2024 (PDF)

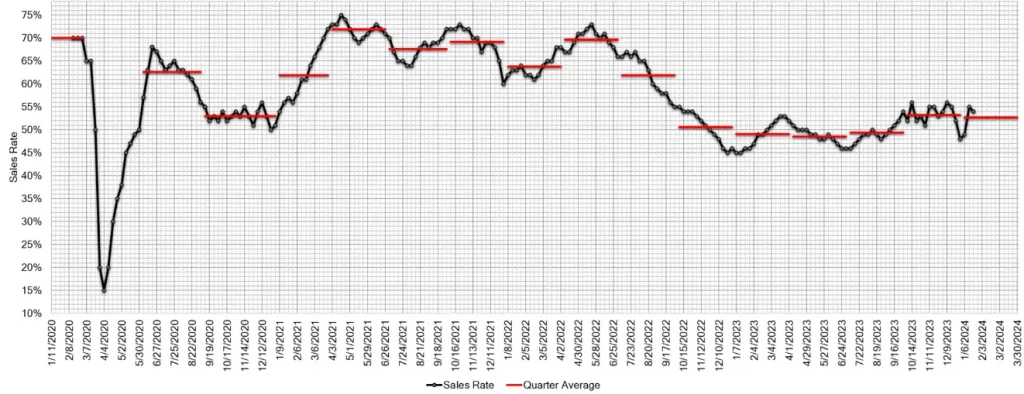

A Glimpse of Market Stabilization

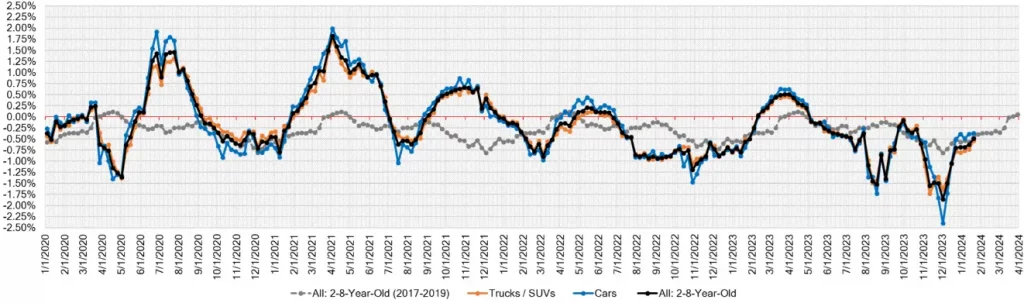

The story of this week is one of continued deceleration in overall market depreciation, a phenomenon not observed since the vibrant hues of mid-October last year. The overall market depreciation fell below half a percent, signaling a trend that may reshape buyer and seller strategies in the coming months.

Age-Specific Trends: A Tale of Two Buckets

In a remarkable turn of events, vehicles aged 8 to 16 years showcased an average decline of just -0.35%, contrasting with the -0.49% noted in the relatively younger 2-to-8-year-old category. This variance speaks volumes about the market’s nuanced behavior, encouraging a more granular analysis of investment and sales approaches.

| Segment | This Week | Last Week | 2017-2019 Avg (Same Week) |

|---|---|---|---|

| Car Segments | -0.37% | -0.39% | -0.49% |

| Truck & SUV Segments | -0.53% | -0.73% | -0.39% |

| Market Overall | -0.49% | -0.63% | -0.43% |

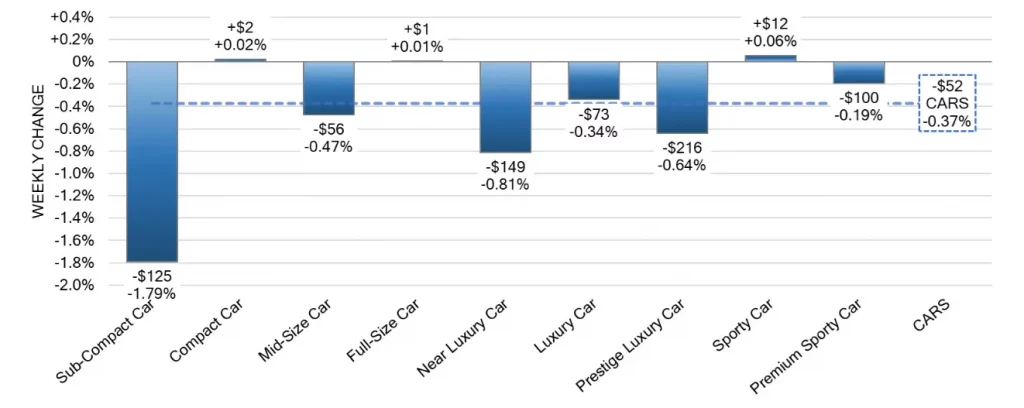

Diving into Car Segments

The car segment, on a volume-weighted basis, decreased by -0.37%. Notably, three out of nine car segments reported positive growth last week, with the Compact Car segment continuing its upward trajectory for a second consecutive week. However, the Sub-Compact Car segment witnessed a significant decline of -1.79%, highlighting the segment’s volatility.

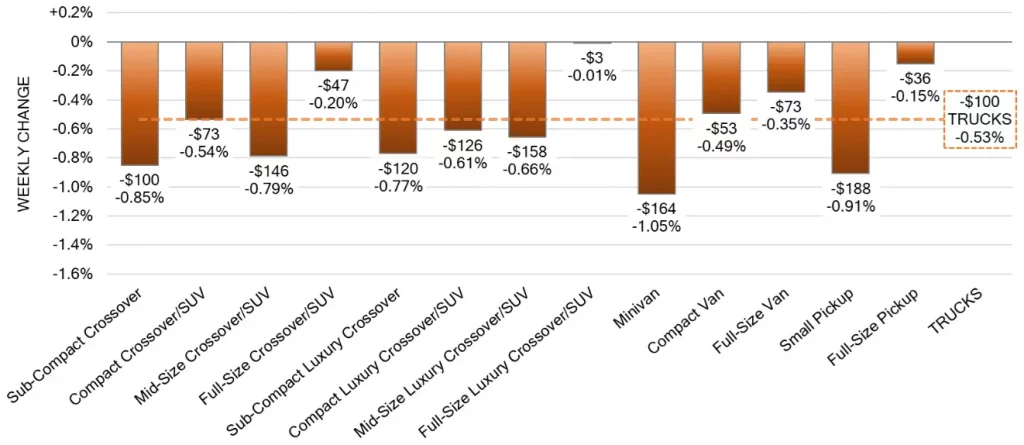

Truck/SUV Segments: A Mixed Bag

The truck segment, despite an overall decrease of -0.53%, presented a diverse picture. Full-size pickups showed resilience, with the smallest weekly decline since June 2023. In contrast, Small Pickups experienced an increased rate of depreciation, underlining the segment-specific fluctuations within the market.

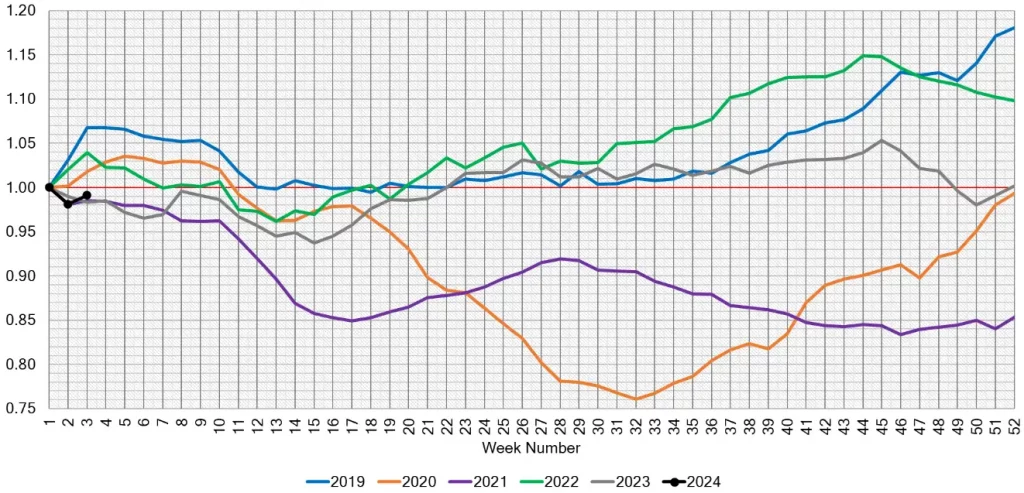

Used Retail and Wholesale Markets: Indicators of Change

The Used Retail Active Listing Volume Index, a crucial marker of the retail sector’s pulse, continues to provide valuable insights into inventory shifts across U.S. dealerships. Meanwhile, in the wholesale arena, a noticeable slowdown in depreciation is observed alongside emerging trends of new inventory influx and increasing incentives.

Conclusion: A Market in Flux

As we observe the ebb and flow of the automotive market, it’s clear that each segment tells a unique story, weaving together a tapestry of market dynamics. With new inventory rising and incentives becoming more prevalent, the industry stands at a crossroads.

What do these trends indicate for the future of the automotive market? How will these shifts influence your buying or selling decisions?