Auto Market Update: A Closer Look at the Week Ending February 17, 2024

In the heart of February 2024, amidst the hustle and bustle of daily life, an undercurrent of change subtly moves through the auto market. It’s a realm where numbers tell tales of resilience, trends whisper of the past, and every percentage point is a character in an ongoing narrative of recovery and adaptation.

This isn’t just about cars and trucks; it’s about how we, as a society, keep moving forward. This week, we delve into the latest chapter of this story, examining the nuances of the auto market’s performance for the week ending February 17, 2024, and uncovering the tales that numbers can tell.

Auto Market Update Week Ending Feb 17, 2024 (PDF)

The Pulse of the Market

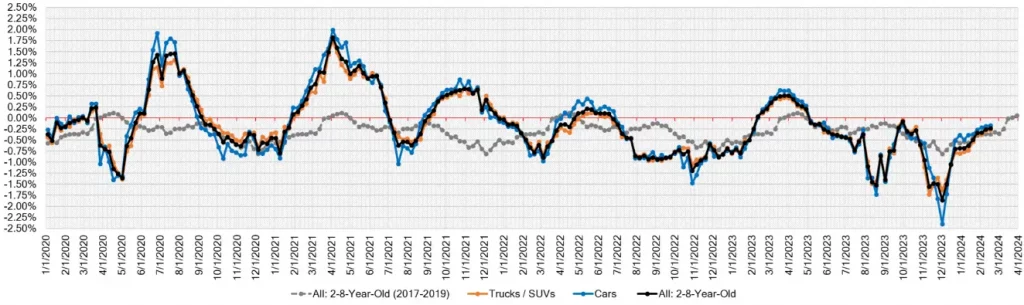

Last week presented a mixed bag of results across different segments of the auto market. Despite fewer market segments showing strength, the overall market maintained a semblance of stability, with a slower rate of depreciation at -0.23%, marking a subtle improvement from the -0.26% observed the previous week. When we compare these figures to the pre-COVID average for this period, which stood at -0.37%, it’s clear that the market is faring relatively well.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.17% | -0.18% | -0.38% |

| Truck & SUV segments | -0.26% | -0.29% | -0.36% |

| Market | -0.23% | -0.26% | -0.37% |

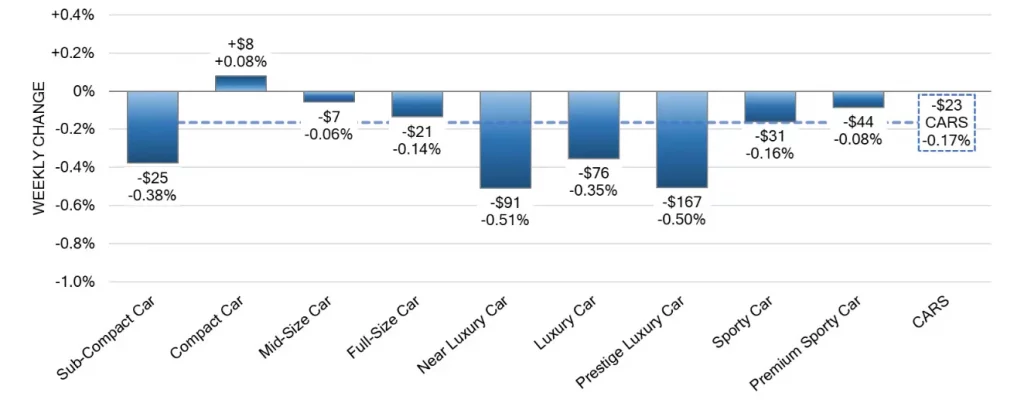

Car Segments

Diving deeper into the car segments, we noticed a volume-weighted decrease of -0.17% overall. Interestingly, the Compact Car segment bucked the trend with a +0.08% rise, marking its sixth consecutive week of appreciation for vehicles aged between 2 to 8 years old.

This segment has experienced an average weekly increase of 0.13% over the past six weeks. On the other end, the Sub-Compact category is depreciating faster than the broader Car segment, although it saw a deceleration in its decline to -0.38% last week.

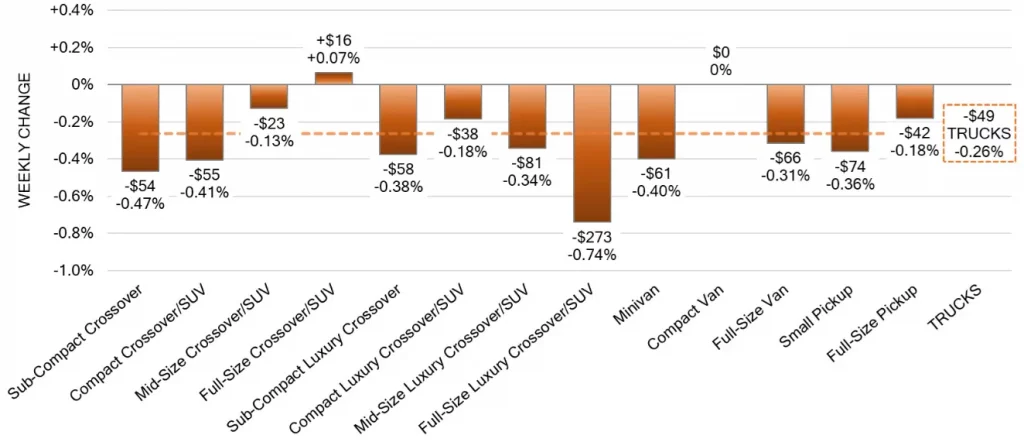

Truck and SUV Segments

The Truck segment, on a volume-weighted basis, decreased by -0.26%, showing a slight improvement over the previous week’s -0.29%. Notably, the Full-Size Luxury Crossover/SUV segment experienced the steepest drop at -0.74%, a sharp increase in the rate of depreciation compared to the past four weeks’ average of -0.05%. Meanwhile, the mainstream Full-Size Crossover/SUV category continued to see growth, albeit modestly, with a +0.07% increase.

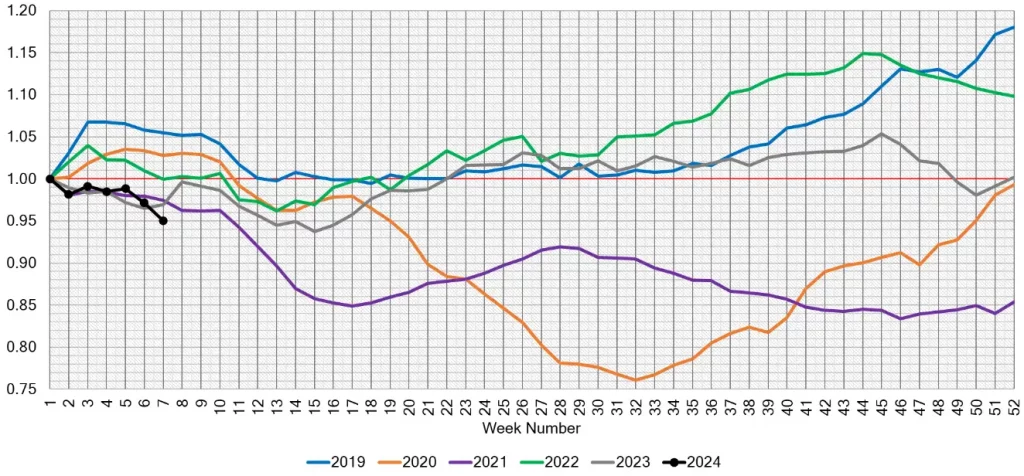

The Used Retail Landscape

On the retail front, the Used Retail Active Listing Volume Index offers insight into the inventory levels across the majority of US dealerships. With no significant shifts in prices noted over the past three weeks, the market appears stable.

However, auction conversion rates have dipped slightly, accompanied by a decrease in auction inventory, suggesting sellers are holding out for potentially higher values in the near future.

Wholesale Insights

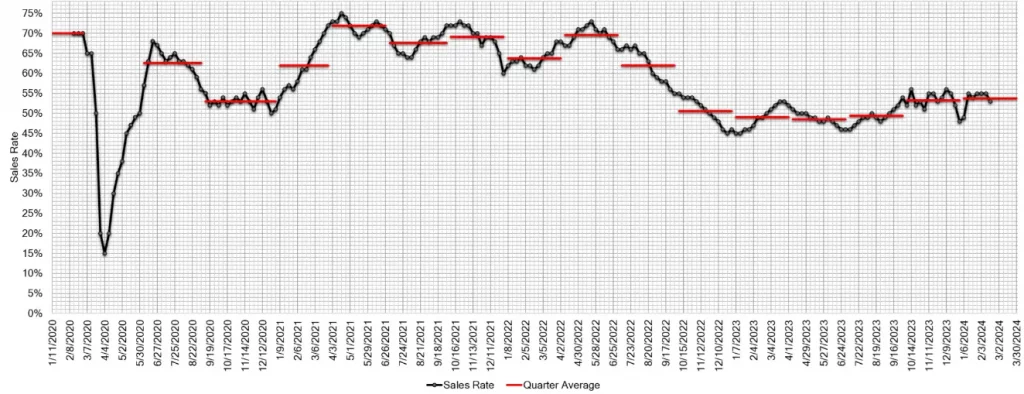

The wholesale market reflects this stability, with sellers sticking to their reserve prices in anticipation of possible value increases. The estimated Average Weekly Sales Rate took a slight dip to 53% last week, indicating cautious optimism among sellers.

Conclusion: What Lies Ahead?

As we wrap up this week’s auto market update, it’s clear that the industry is navigating through a period of cautious stability and nuanced shifts. The resilience of the Compact Car segment, the challenges facing luxury SUVs, and the steady optimism in the retail and wholesale markets paint a picture of an industry in flux, yet firmly grounded.

As we move forward, one question remains: How will these trends shape the future of mobility and consumer choices in the weeks to come?