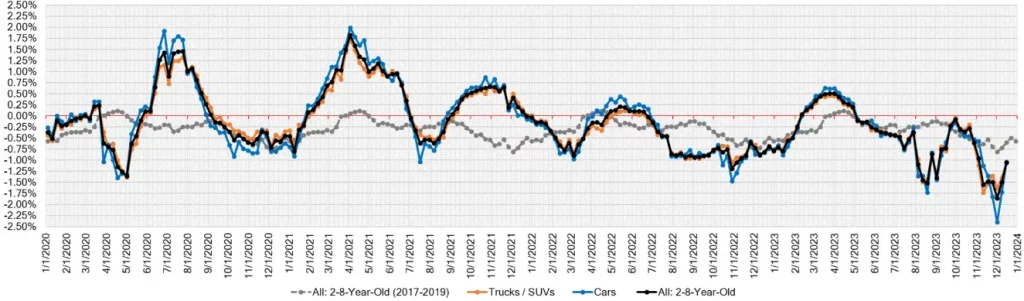

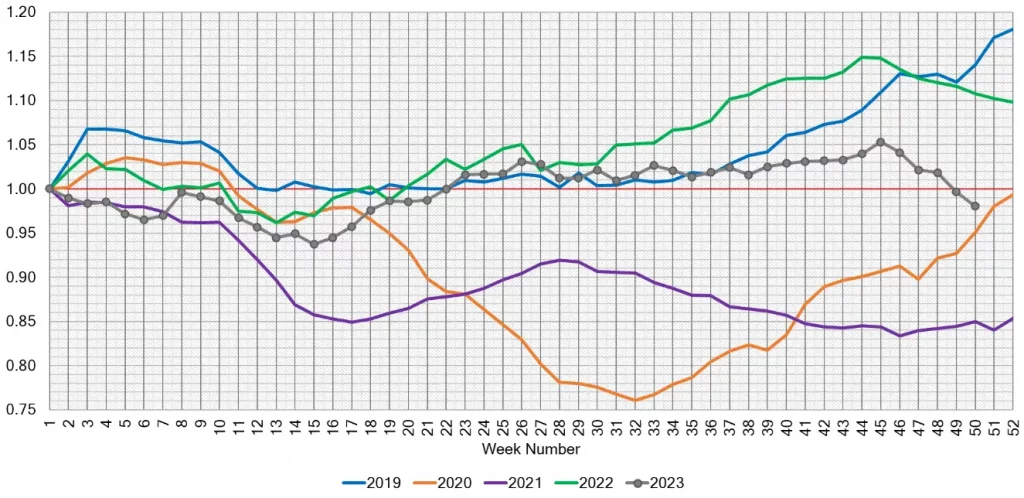

The automotive market has been on a rollercoaster ride, but there are signs of stabilization as declines slowed last week, with all segments experiencing depreciation of less than 2% for the first time since the last week of October.

Auto Market Update Week Ending Dec 16, 2023 (PDF)

Overview of Market Trends

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -1.03% | -1.72% | -0.53% |

| Truck & SUV segments | -1.06% | -1.40% | -0.65% |

| Market | -1.05% | -1.49% | -0.60% |

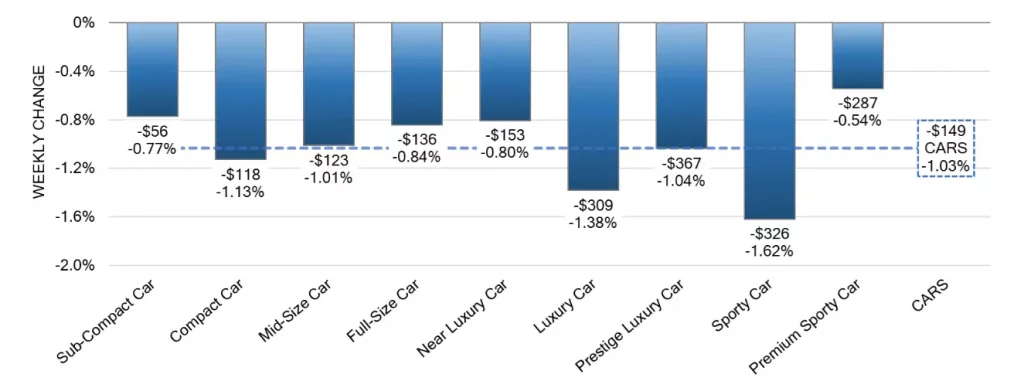

Car Segments

On a volume-weighted basis, the overall Car segment experienced a -1.03% decrease, showing improvement compared to the previous week’s -1.72% decline.

- The 0-to-2-year-old Car segments declined by -0.77%, while 8-to-16-year-old Cars experienced a decline of -1.58%.

- All nine Car segments reported decreases, with five of them seeing declines greater than 1%.

- Premium Sporty Cars showed a more typical seasonal decline, decreasing by -0.54% last week. Over the past six weeks, this segment has averaged a weekly decline of -0.49%, in contrast to the Sporty Car segment, which has averaged -2.10%.

- The Compact Car segment, which had seen high depreciation in recent weeks, slowed its rate of decline to -1.13%. The Luxury Car segment also experienced a notable decline, down -1.38%.

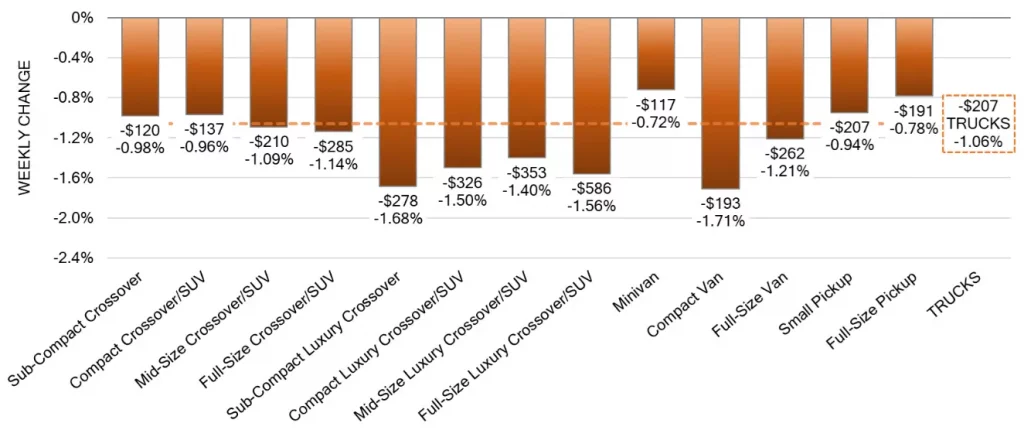

Truck / SUV Segments

The volume-weighted, overall Truck segment decreased by -1.06%, an improvement from the prior week’s -1.40% depreciation.

- 0-to-2-year-old models in the Truck segment declined by -0.97% on average, while 8-to-16-year-olds decreased by -0.96% on average.

- All thirteen Truck segments declined, with eight of them seeing declines greater than 1%, though none exceeded a 2% decline—marking the first time since the last week of October.

- The Minivan segment reported the smallest decline, dropping -0.72%, while the Compact Van segment continued to experience large declines, although the rate of decline slowed to -1.71% last week.

Inventory and Retail Trends

Used Retail

The Used Retail Active Listing Volume Index is now below the year’s starting point, and the Used Retail Days-to-Turn estimate stands at approximately 62 days.

Wholesale

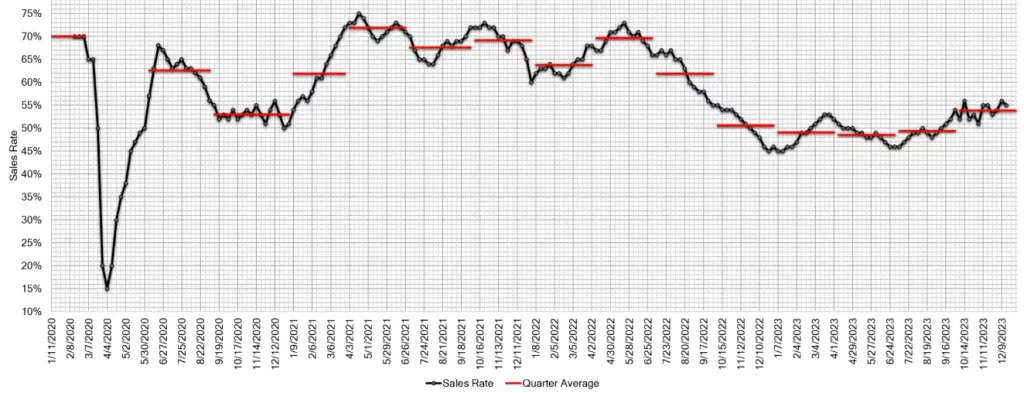

As we enter the second week of December, the wholesale market shows a slower decline. With only two weeks left in the year, we anticipate a more stable market to close out 2023.

Auction inventory increased, and auction conversion rates dropped by -1% as cautious buyers sought to avoid overpaying during a period of expected price decreases. The estimated Average Weekly Sales Rate decreased to 55% last week.