Auto market updates are often filled with predictable patterns and familiar trends. But every so often, the numbers reveal shifts that catch even seasoned analysts by surprise. The week ending August 24, 2024, was one of those times.

While many continued to grapple with the impact of high interest rates, negative equity, and rising incentives in the new vehicle market, some segments defied the odds, and others showed signs of an impending stabilization that could turn the tide.

Auto Market Update Week Ending August 24, 2024 (PDF)

Wholesale Market Overview: A Mixed Bag of Trends

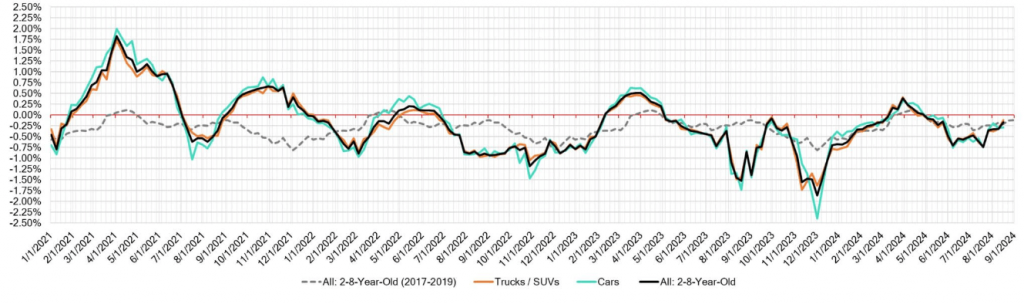

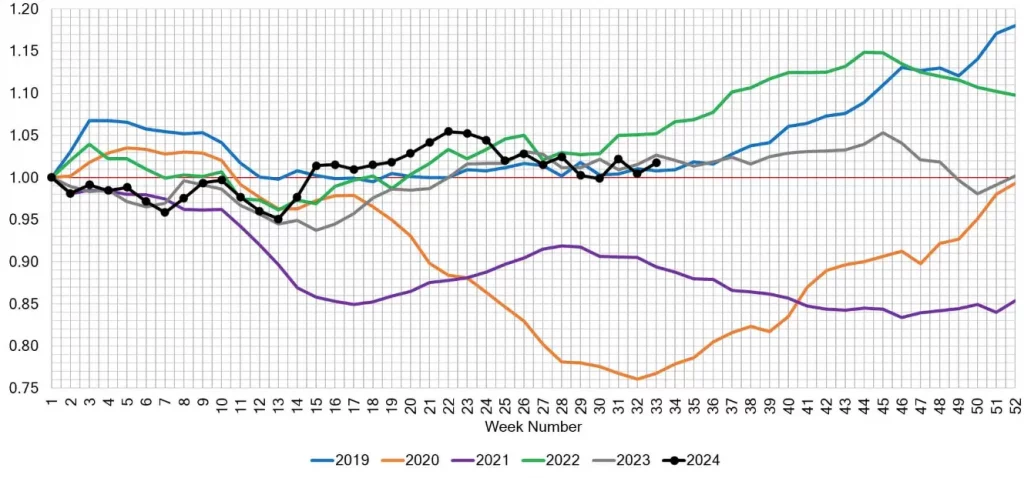

The wholesale market has been on a roller coaster ride for the past few years, especially since the COVID-19 pandemic disrupted new vehicle production. Now, three years later, the industry is still adjusting to this “new normal.” For the week ending August 17, 2024, wholesale prices presented a mixed picture, with some segments doing well while others continued their downward slide.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.29% | -0.30% | -0.19% |

| Truck & SUV segments | -0.12% | -0.33% | -0.21% |

| Market | -0.17% | -0.32% | -0.21% |

Car Segments: Compact and Mid-Size Cars on the Rise

On a volume-weighted basis, the overall Car segment decreased by -0.29%, a slight improvement from the previous week’s -0.30% drop. However, this seemingly small shift masks some noteworthy movements within specific car segments.

- Compact Cars: One of the stars of the week, the Compact Car segment saw its values increase by 0.06%, marking the third consecutive week of growth. More impressively, the 0-to-2-year-old Compact Cars rose by a robust 0.59%. With three straight weeks of gains, could this segment be signaling a broader trend in consumer preferences?

- Mid-Size Cars: Following closely, the Mid-Size Car segment, particularly the 0-to-2-year-old models, recorded a 0.76% increase. This is the fourth week in a row that mid-size cars have seen price gains, reflecting a growing demand in this segment.

Interestingly, while newer car models are showing strength, the older 8-to-16-year-old cars continue to lose value, declining by -0.44%. This divergence between the performance of new and older models may indicate a shift in consumer priorities, with buyers possibly seeking out more recent, reliable vehicles in an uncertain economic climate.

Truck & SUV Segments: Stability Amidst Declines

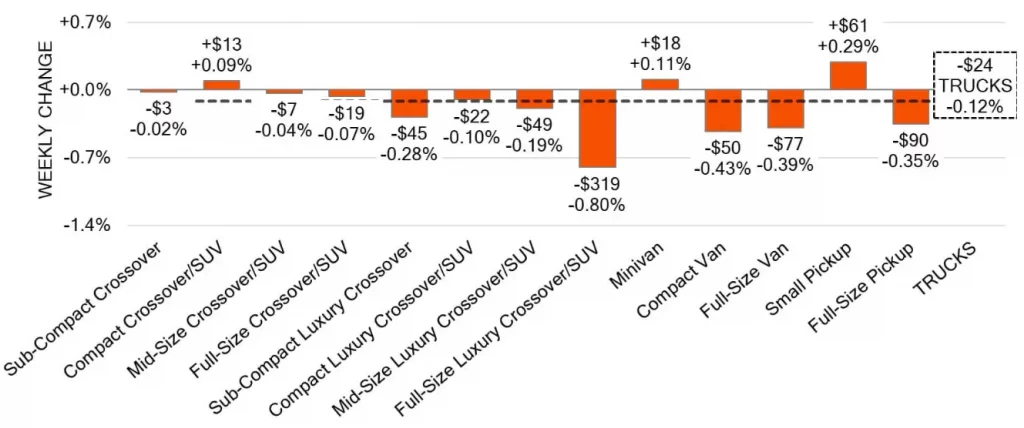

The Truck and SUV segments also presented a mixed picture, with an overall decline of -0.12%, an improvement from the previous week’s -0.33% drop. While the general trend remains downward, there were pockets of positive movement.

- Small Pickups: After months of decline, the Small Pickup segment finally saw an uptick. The 0-to-2-year-old Small Pickups increased by +0.32%, and the 2-to-8-year-olds weren’t far behind with a +0.29% rise. This growth is a welcome change for a segment that has struggled since early May.

- Full-Size Luxury Crossover/SUV: On the other end of the spectrum, the Full-Size Luxury Crossover/SUV segment continues to face challenges, falling by -0.80%. This marks the sixteenth consecutive week of decline, highlighting ongoing difficulties in the luxury market, likely exacerbated by high interest rates and the general tightening of consumer budgets.

The Broader Market Picture: Signs of Stabilization?

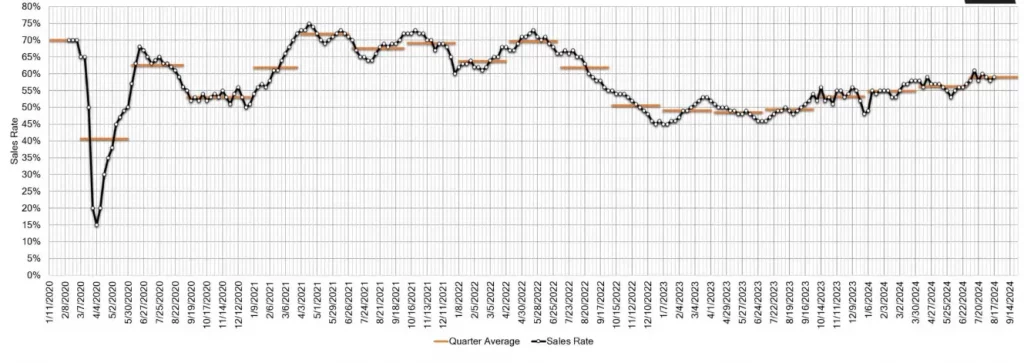

While the overall market continued to trend downward, there are emerging signs that the rate of decline is slowing. For instance, the auction conversion rate increased slightly to 59%, up 1% from the previous week. This improvement, coupled with the stabilization in auction inventory, suggests that the market might be approaching a turning point.

Inventory Insights: What’s Moving and What’s Not

Inventory levels are always a key indicator of market health, and the recent data provides some intriguing insights.

Used Retail Market: Holding Steady

The Used Retail Active Listing Volume Index, which tracks inventory across most independent and franchised dealerships in the U.S., remained steady. The estimated Used Retail Days-to-Turn, a measure of how long it takes for a vehicle to sell, is currently around 48 days. This figure indicates that while the market isn’t exactly booming, it’s also not in freefall—dealers are moving inventory at a relatively stable pace.

Wholesale Market: A Slowing Decline

In the first half of August, depreciation in the wholesale market has notably slowed down. While the overall trend remains in decline, some segments have shown positive movement, with one car segment and three truck segments turning positive last week. This shift might indicate that the worst of the depreciation is behind us, although it’s too early to declare a full recovery.

What’s Driving These Trends?

Several factors are contributing to the current state of the market. The combination of high interest rates, significant negative equity among many car buyers, and rising incentives on new vehicles has created a challenging environment. However, these same conditions may also be driving the demand for more affordable, compact, and mid-size vehicles, which are seeing a resurgence in the used market.

Moreover, the stabilization in auction inventory and conversion rates could be early signs that the market is beginning to adapt to these new economic realities. If this trend continues, we might see a more balanced market in the coming months, with fewer sharp declines and more gradual adjustments.

Looking Ahead: What to Expect in the Coming Weeks

As we move forward, the key question is whether the stabilization we’re seeing in certain segments will spread across the broader market. Will the compact and mid-size car segments continue to rise, or will they level off? And what about the luxury market—can it recover from its extended slump?

Dealers, buyers, and analysts alike will be watching these trends closely. For those in the market for a vehicle, whether buying or selling, staying informed will be crucial. The next few weeks could bring more surprises, and being prepared will be key to making smart decisions.