Fast forward three years from the COVID-19 pandemic, which drastically impacted new vehicle production, and we find ourselves in a market that’s anything but straightforward. With high interest rates, significant negative equity, and rising new vehicle incentives all playing a role, the wholesale auto market is showing signs of both adjustments and anomalies. This past week, the landscape saw some interesting developments that you won’t want to miss. Let’s dive into the details!

Auto Market Update Week Ending August 17, 2024 (PDF)

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.29% | -0.30% | -0.19% |

| Truck & SUV segments | -0.12% | -0.33% | -0.21% |

| Market | -0.17% | -0.32% | -0.21% |

Wholesale Prices: What’s the Story?

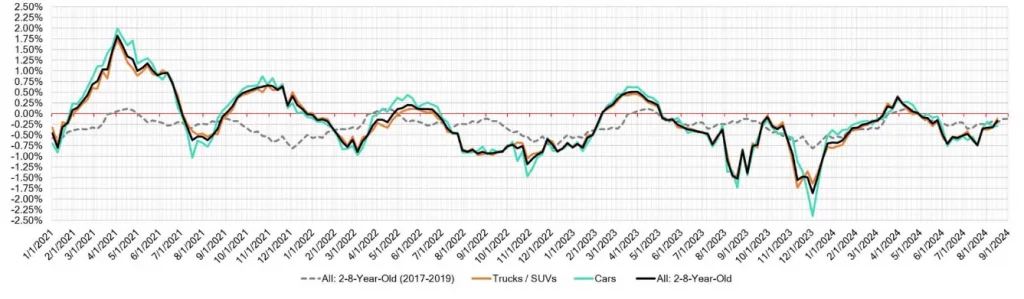

For the week ending August 17, 2024, wholesale prices exhibited a mixed bag of performance across different segments. It’s worth noting that these trends reveal a lot about where the market might be heading next.

Overall Market Performance:

- The market as a whole saw a modest decline of -0.17%, a significant slowdown from the previous week’s -0.32% drop.

- Cars continued their downward trend, albeit at a slower pace, with a -0.29% decrease.

- Trucks and SUVs also dropped, but by a smaller margin of -0.12%, which suggests some segments are holding their ground better than others.

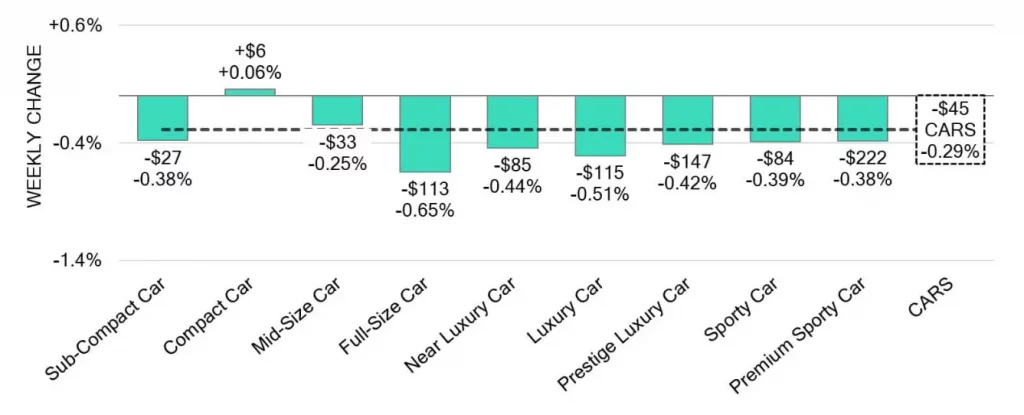

Car Segments: A Closer Look

When we zoom in on the car segments, the data paints a more nuanced picture:

- 0-to-2-year-old Car Segments: These newer models surprisingly increased by +0.05%, marking a slight but notable upturn.

- 8-to-16-year-old Cars: On the other hand, these older models continued their descent, with a -0.44% decrease.

The biggest surprise came from Compact Cars. Despite an overall downward trend in the market, the Compact Car segment bucked the trend, with values rising by 0.06%. Interestingly, this was the third consecutive week of increases for 0-to-2-year-old Compact Cars, jumping by a notable 0.59%. Could this signify a shifting preference toward smaller, more economical vehicles?

And let’s not forget the Mid-Size Car segment. The 0-to-2-year-old category also saw its fourth consecutive week of gains, increasing by 0.76%. This consistency suggests a growing demand in certain car segments, even as the broader market sees declines.

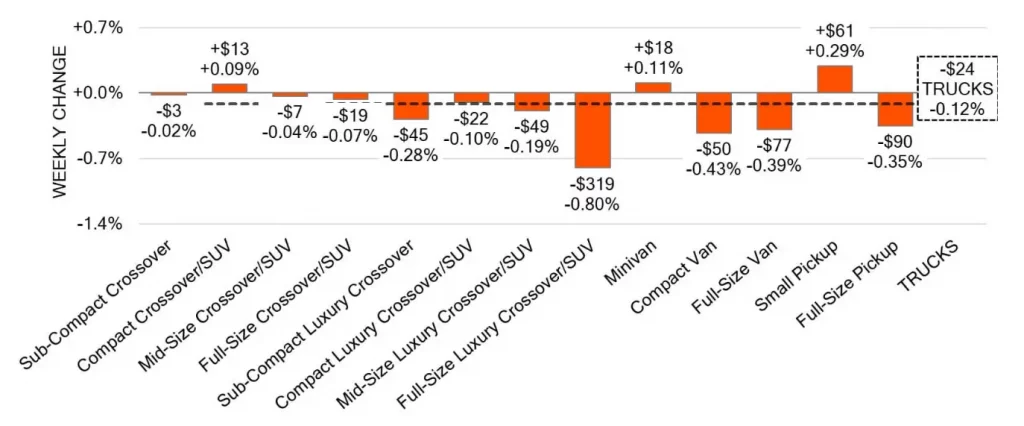

Truck and SUV Segments: Stability or Struggle?

While the overall Truck and SUV segments saw a decline of -0.12%, the devil’s in the details:

- 0-to-2-year-old models: A small decline of -0.07%, suggesting that newer trucks and SUVs are still in demand, just not as strongly as before.

- 8-to-16-year-olds: A larger drop of -0.26%, indicating that older models are losing their appeal faster.

However, there’s a silver lining for Small Pickups, which posted their first increase since early May. The 0-to-2-year-old models rose by +0.32%, while the 2-to-8-year-olds followed suit with a +0.29% rise. This uptick could indicate a renewed interest in more versatile, cost-effective vehicles amid economic uncertainty.

But not all trucks and SUVs are faring well. The Full-Size Luxury Crossover/SUV segment continues to struggle, dropping by -0.80%. This marks its sixteenth straight week of declines. Even the non-luxury Full-Size Crossover/SUV segment isn’t immune, although its rate of decline has slowed considerably, with a drop of just -0.07% last week.

Used Retail: Inventory Insights

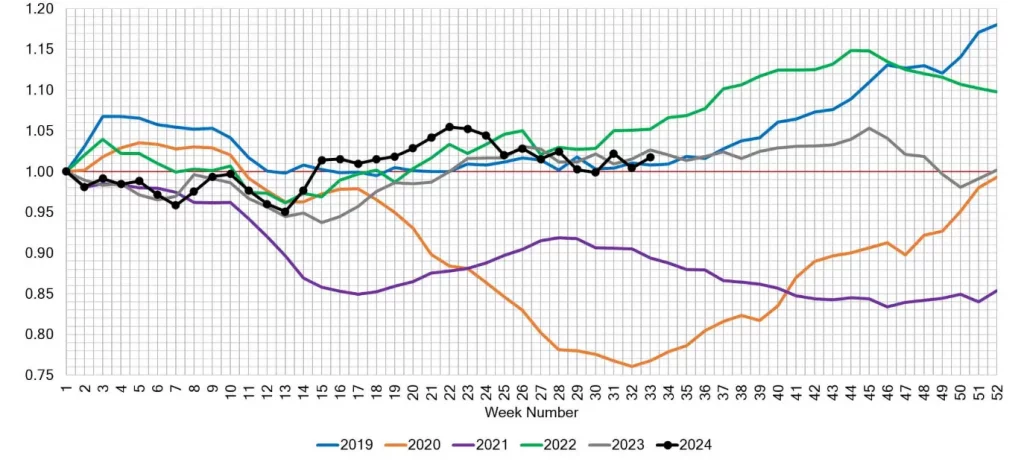

Switching gears to the retail side, the Used Retail Active Listing Volume Index, which tracks inventory levels at both independent and franchised dealerships across the U.S., has settled at around 48 days for the Days-to-Turn metric. This is a crucial figure to watch as it provides a glimpse into how quickly vehicles are moving off the lot and could signal broader market trends.

Wholesale Market Trends: A Slowdown in Depreciation?

In a somewhat unexpected twist, the first half of August saw a notable slowdown in depreciation. While the overall trend remains negative, the rate of decline has eased considerably. What’s more, some segments even experienced positive movement, with one car segment and three truck segments posting gains.

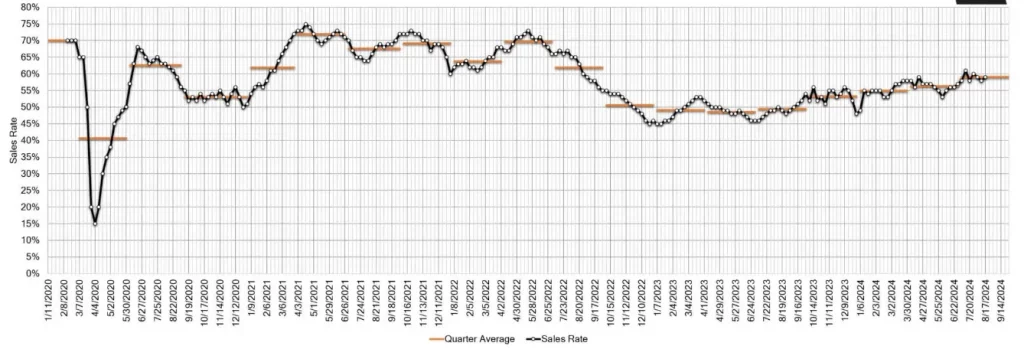

This trend raises an interesting question: Are we witnessing the early stages of a market stabilization, or is this merely a blip on the radar? The stable auction inventory and improved conversion rates—up 1% from the previous week to 59%—further add to the speculation that the market might be on the cusp of a turnaround.

Wrapping It Up: What’s Next for the Auto Market?

As we reflect on the auto market’s performance for the week ending August 17, 2024, it’s clear that the landscape is evolving in unexpected ways. While some segments continue to struggle, others are showing signs of resilience or even growth. The slowdown in depreciation, coupled with stable auction inventories, hints at the possibility of a market that’s beginning to find its footing after years of turbulence.

That said, it’s still too soon to declare this a lasting trend. The next few weeks will be critical in revealing whether these encouraging signs lead to a steady recovery or if more ups and downs are on the horizon. As ever, staying sharp and adaptable is essential for anyone keeping pace with the current auto market.

So, what do you think—are we on the brink of a market rebound, or is this just the calm before the storm?