The auto market’s always buzzing with activity, and the week ending August 03, 2024, is no exception. In this update, we’re diving into the nitty-gritty of wholesale prices, car and truck segment performances, and the state of the used retail market. We’re not just rehashing the same old data; we’re bringing you insights and trends that often fly under the radar. Buckle up and let’s hit the road!

Auto Market Update: Week Ending August 03, 2024 (PDF)

Wholesale Prices: A Steady Ride

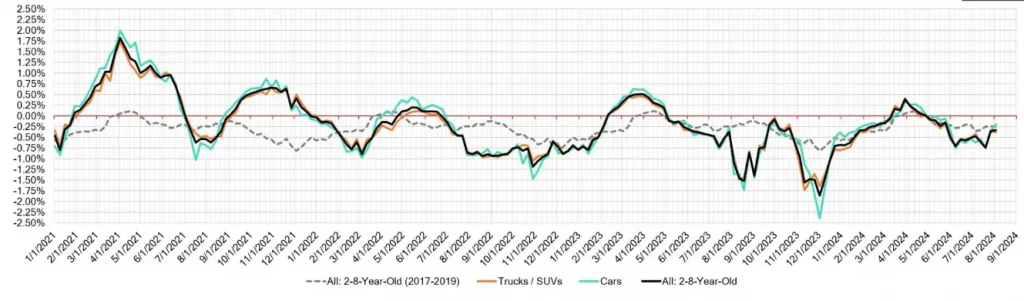

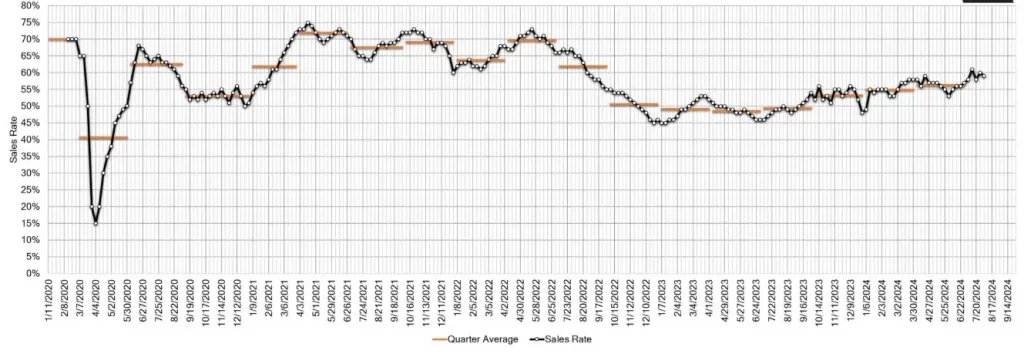

After a rollercoaster summer, things are finally stabilizing. Remember that CDK outage earlier this season? It threw a wrench in the works, but now, depreciation is back on track with typical seasonal patterns. Auction attendance is robust, and conversion rates are solid, chilling in the high 50-percent range.

Here’s the breakdown:

| Week Ending | Car Segments | Truck & SUV Segments | Overall Market |

|---|---|---|---|

| This Week | -0.19% | -0.38% | -0.33% |

| Last Week | -0.34% | -0.36% | -0.36% |

| 2017-2019 Average (Same Week) | -0.31% | -0.20% | -0.25% |

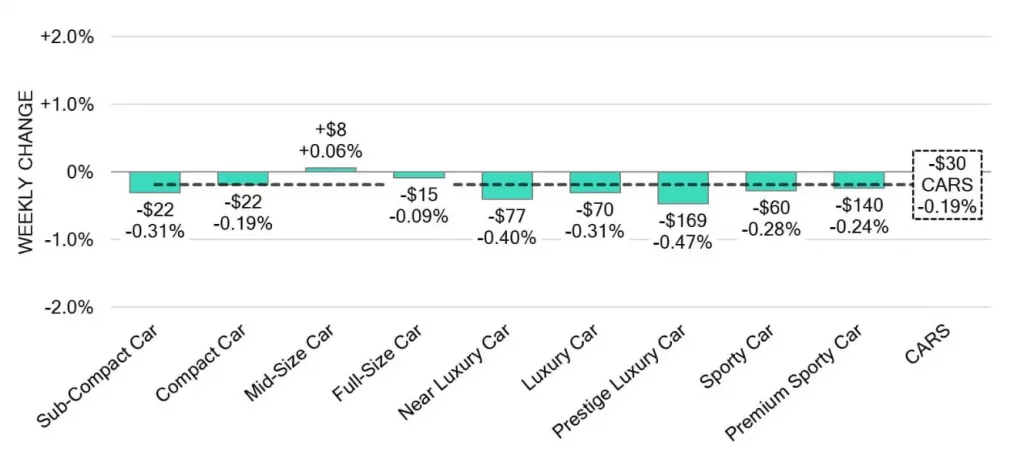

Car Segments: A Mixed Bag

On a volume-weighted basis, car segments saw a slight dip of -0.19%, a welcome improvement from the previous week’s -0.34%. Notably, 0-to-2-year-old car models declined by -0.25%, while 8-to-16-year-old cars saw a -0.27% drop.

Key Highlights:

- Mid-Size Cars: On the up and up, rising +0.06% this week after a +0.14% boost last week.

- Prestige Luxury Cars: The biggest losers with a -0.47% drop, but hey, that’s better than the -1.28% nosedive three weeks ago.

- Compact Cars: Slowed their depreciation to just -0.19%, the smallest weekly decline since May.

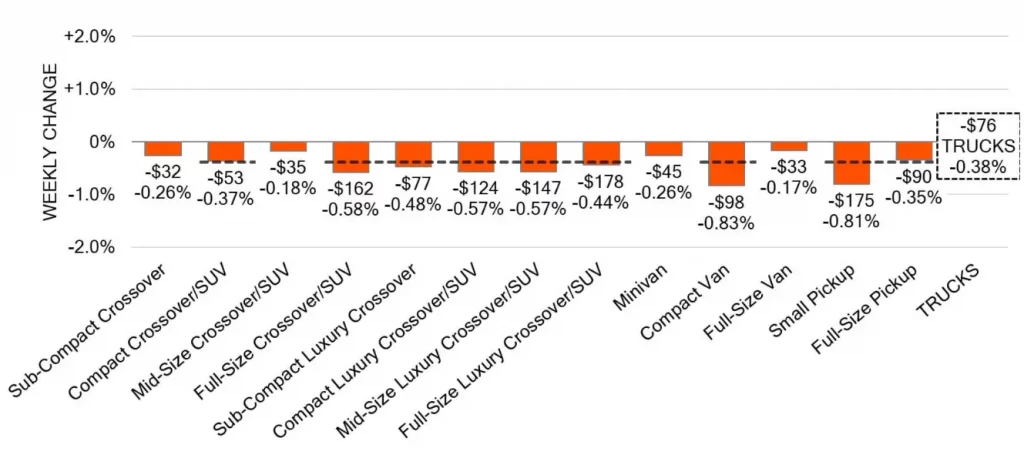

Truck & SUV Segments: Feeling the Squeeze

Trucks and SUVs didn’t have the best week, dipping by -0.38% overall. The younger 0-to-2-year-old models dropped by -0.20%, while their older 8-to-16-year-old counterparts fell by -0.16%.

Noteworthy Observations:

- Compact Vans: Took the hardest hit, dropping -0.83% and averaging a -0.75% decline over the past three weeks.

- Full-Size Vans: Held up the best, with a mere -0.17% dip, the smallest since mid-May.

- Small Pickups: Continually struggling, with a consistent -0.93% weekly depreciation over the last three weeks.

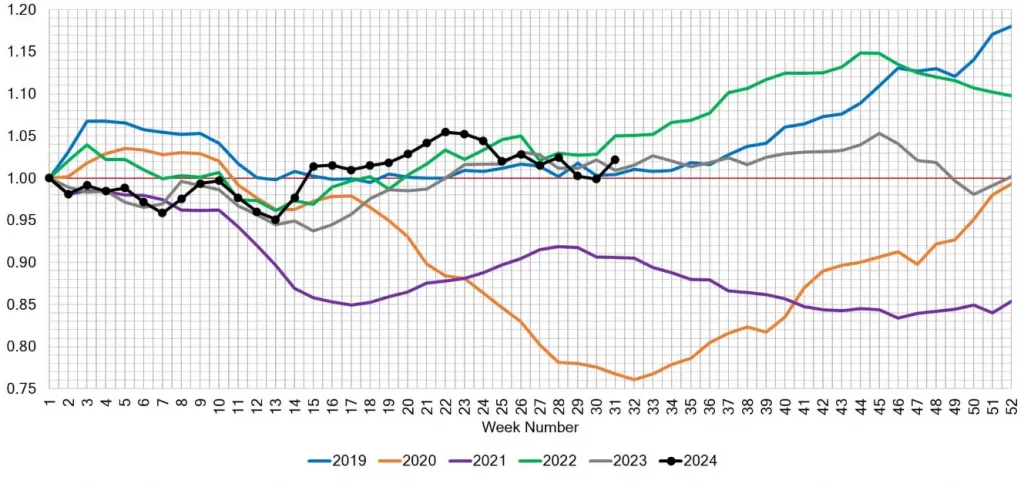

Used Retail: Inventory Insights

In the used retail market, the Active Listing Volume Index is tracking inventory at most independent and franchised dealerships across the US. This index is normalized to the first week of the year to highlight annual trends. The current estimated Used Retail Days-to-Turn is creeping up, now sitting at about 50 days.

Wholesale: Holding Steady

The overall stability of the wholesale market at the start of the month is a positive sign. We’re seeing changes only marginally higher than pre-COVID seasonal norms. Auction lanes are bustling, with conversion rates steady in the high 50-percent range. Last week’s rate was at 59%, down just 1% from the previous week.

Looking Ahead: Staying Informed

As we move further into the second half of 2024, our team of analysts will keep a close watch on the market, looking out for new trends and valuable insights. It’s all about staying ahead of the curve and making sense of the numbers.