Auto Market Update Week Ending August 12th, 2023 (PDF)

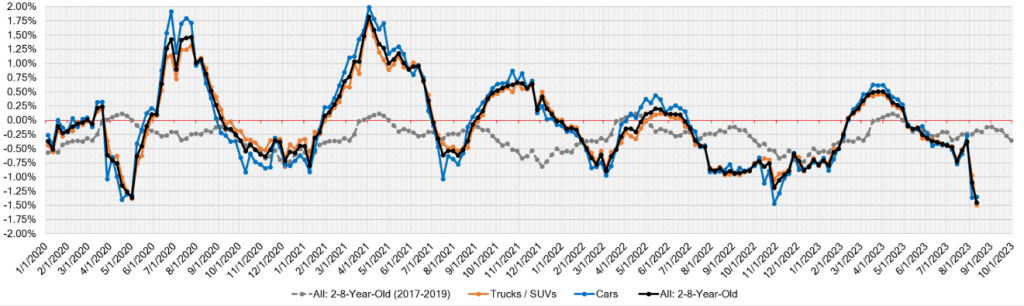

In this week’s auto market update, wholesale price adjustments have taken center stage, reflecting a fervent push by remarketers to facilitate quicker vehicle turnover. The past week witnessed a notable surge in price corrections across a spectrum of segments, most prominently affecting Compact Cars and Full-Size Trucks. These adjustments come as dealers grapple with augmented new inventory levels and a simultaneous uptick in incentives, collectively inducing a downward pressure on wholesale prices, setting the stage for potential declines in used retail prices in the imminent future.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -1.35% | -1.36% | -0.15% |

| Truck & SUV segments | -1.49% | -0.98% | -0.19% |

| Market | -1.45% | -1.10% | -0.18% |

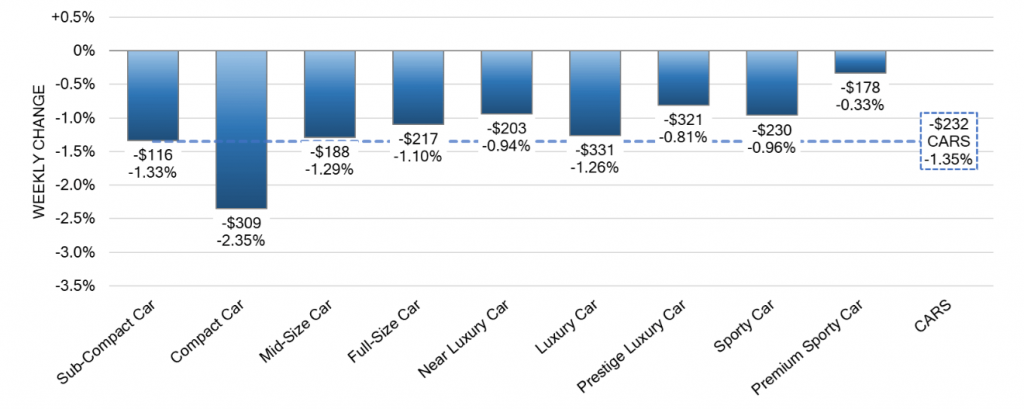

Car Segments Analysis

- Segment Performance: The Car segment experienced a collective decrease of -1.35% on a volume-weighted basis this week. This compares to the previous week’s slide of -1.36%, indicating a persistent trend.

- Age-Based Insights: Notably, 0-to-2-year-old Car segments dipped by -0.97%, while 8-to-16-year-old counterparts recorded a decline of -1.46%.

- Segment-Specific Observations: All nine Car segments faced descending values, with five segments undergoing declines exceeding the 1% mark. Among these, the Compact Car category stood out with a substantial decline of -2.35%, which follows a preceding week’s decline of -2.12%. Contrarily, the Premium Sporty Car segment witnessed a more typical -0.33% depreciation, a seasonal pattern.

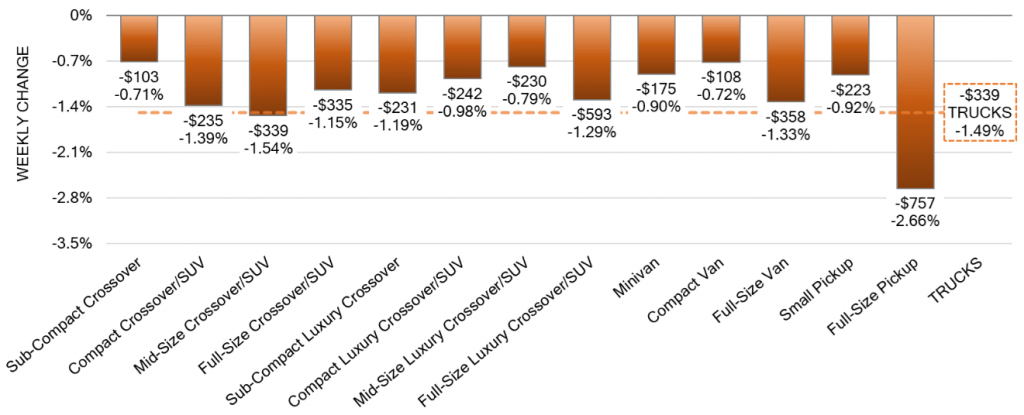

Truck / SUV Segments Insights

- Overall Truck Segment: The Truck segment as a whole experienced a pronounced decrease of -1.49%, representing an escalation from the prior week’s -0.98% drop.

- Age-Related Trends: Noteworthy trends include a -1.25% depreciation for 0-to-2-year-old models and a more significant decline of -1.42% for 8-to-16-year-old vehicles, a stark contrast to the previous week’s -0.55% adjustment.

- Segmental Variations: All thirteen Truck segments faced declines this week, with seven segments suffering losses greater than 1%. Of note, Full-Size Trucks endured a substantial decline of -2.66%, surpassing the initial pandemic-induced declines. The surge in retail market incentives, especially for models like the Ram 1500, has ignited pressure on the used market.

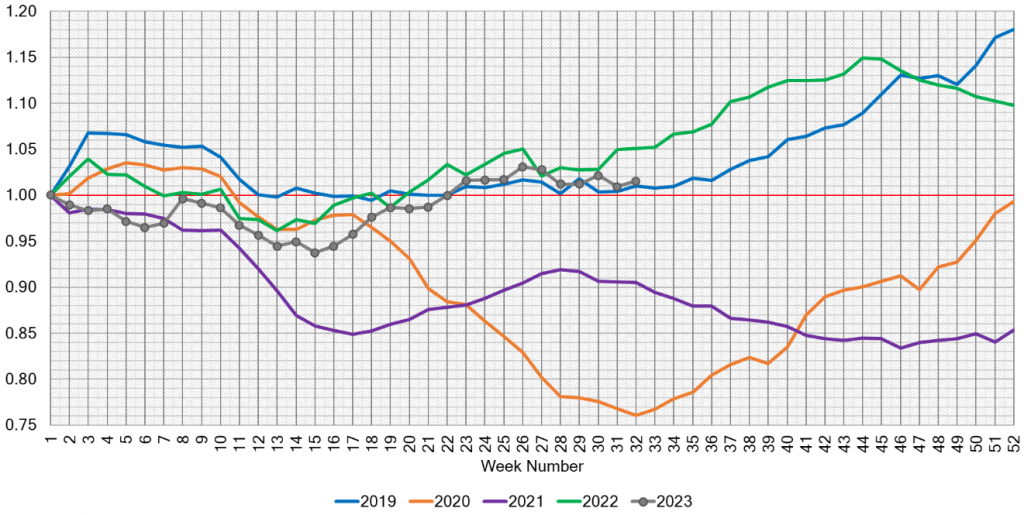

Used Retail Active Listing Volume Index

Presently standing at 1.02 points, this index offers a glimpse into the state of used retail listings.

Wholesale Values Assessment

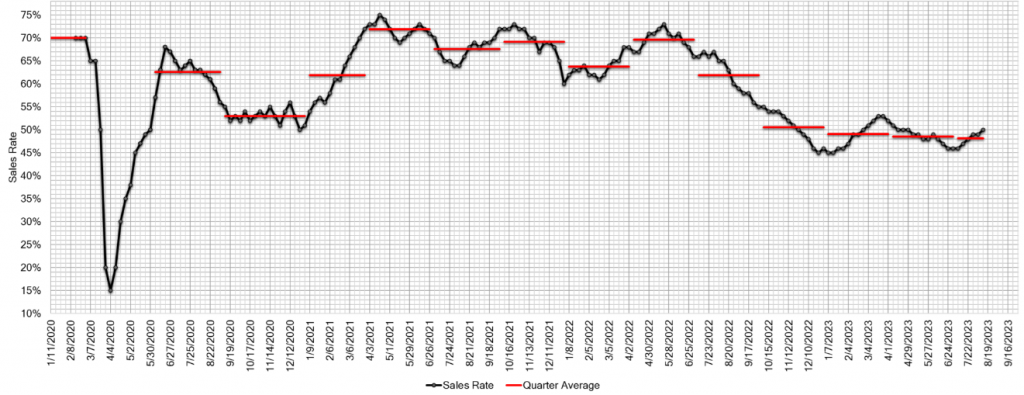

For two consecutive weeks, the market has undergone substantial wholesale value reductions. Full-Size Trucks and Compact Cars faced the most considerable declines across all segments. A bright spot, however, is an upswing in total auction conversion rates, signaling strong demand for appropriately priced vehicles. Sellers have adjusted their pricing floors to expedite inventory movement. The critical question now is whether these price adjustments have hit their lower limits or if further declines are on the horizon. Notably, the estimated Average Weekly Sales Rate improved to 50%, reflecting a moderate uptick in transaction activity.

In closing, the auto market landscape remains dynamic, navigating shifts in wholesale prices driven by evolving inventory dynamics and changing consumer preferences. As remarketers recalibrate their strategies to align with these changes, the coming weeks promise to shed light on whether these adjustments will sustain or yield further fluctuations. Stay tuned for our next week’s update, as we continue to monitor and analyze the pulse of the auto market.