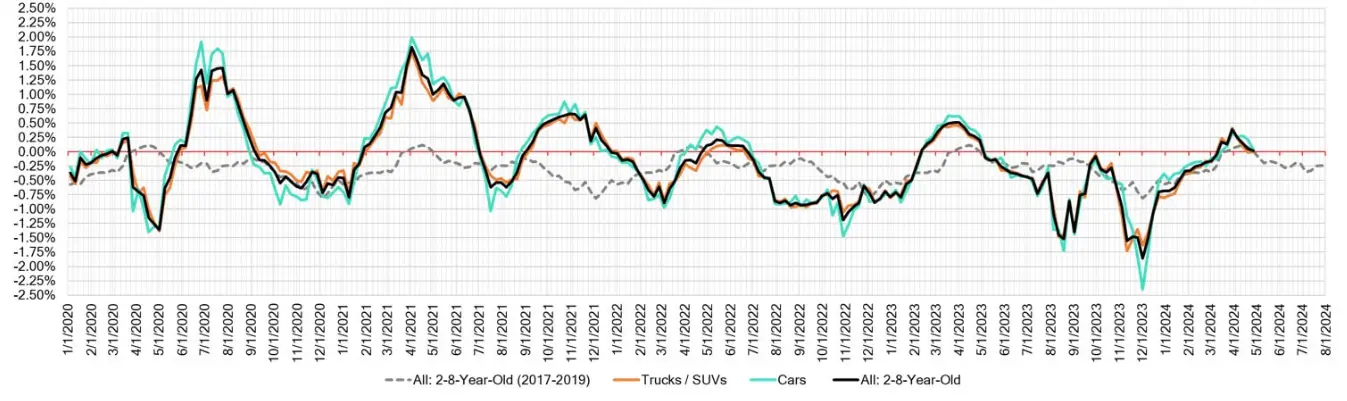

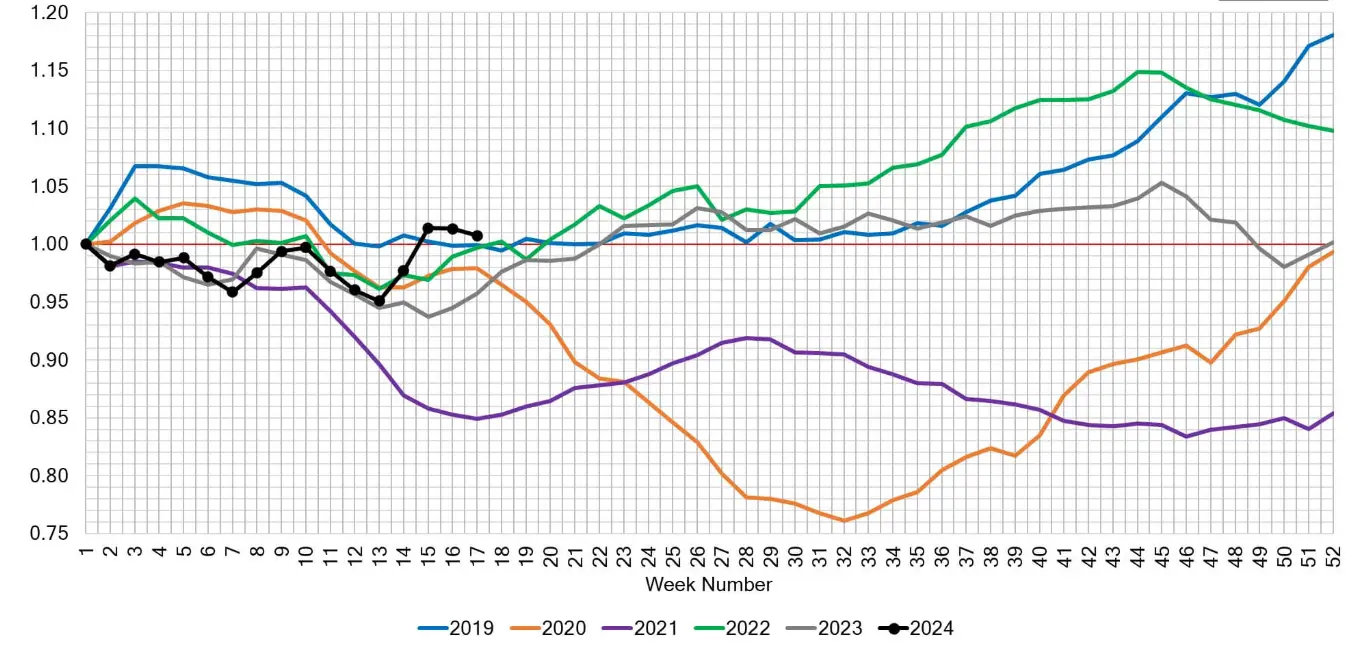

Last week painted a picture of subtle tranquility in the broader market, with a whisper-thin increase of just 0.01%. It’s like the gentle hum of a well-oiled engine running in the background. But beneath this calm surface, the currents of change are stirring, particularly in the realms of luxury vehicles, Full-Size Vans, and electric vehicles (EVs).

These segments, often seen as the bellwethers of consumer taste and economic shifts, are currently navigating a downward trend, offering a complex story of supply, demand, and shifting market dynamics.

Auto Market Update Week Ending April 27, 2024 (PDF)

Weekly Performance Insights

The general market’s slight uptick contrasts with more pronounced movements within specific segments. Here’s a breakdown of the latest changes:

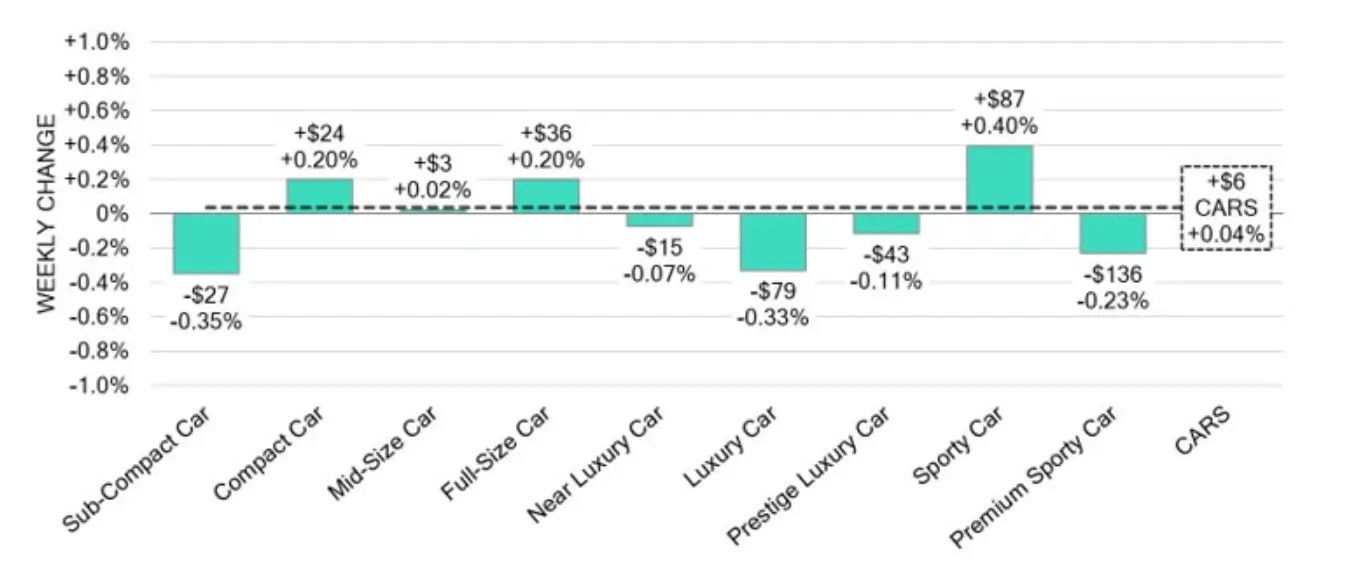

- Car Segments: On a volume-weighted basis, the overall car segment ticked up by +0.04%, a slight cooling from the +0.21% rise the previous week. Notably, while older cars (8-to-16 years) saw a modest increase of +0.15%, nearly new cars (0-to-2 years old) dipped by -0.06%. The decline was particularly evident in luxury vehicles, alongside drops in the Sub-Compact and Mid-Size categories.

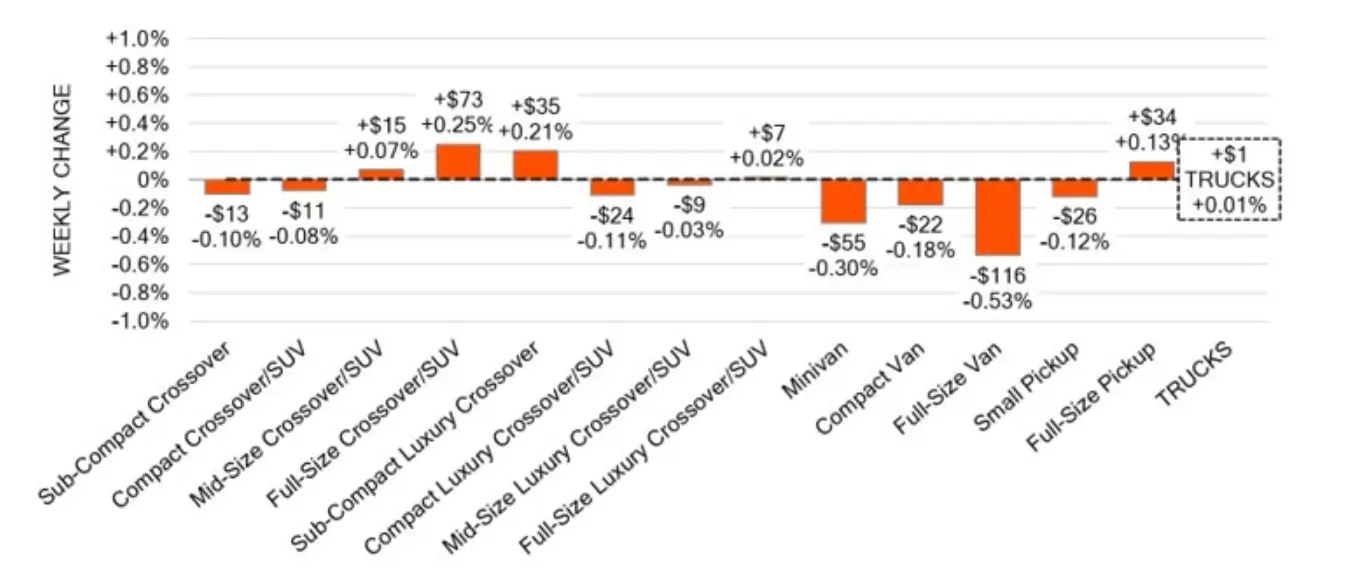

- Truck/SUV Segments: Trucks and SUVs showed minimal growth at +0.01%. This follows a small decline the week prior. The Full-Size Van segment continued its downward trend, though the rate of depreciation slowed to -0.53%, signaling a potential easing of the recent heavy declines.

Here’s how the segments have been performing:

| Segment | This Week | Last Week | 2017-2019 Average |

|---|---|---|---|

| Car Segments | +0.04% | +0.21% | -0.05% |

| Truck & SUV Segments | +0.01% | -0.02% | +0.04% |

| Overall Market | +0.01% | +0.05% | 0.00% |

Retail and Wholesale Dynamics

The retail side of the used car market shows a steady pace with the Days-to-Turn, which measures how quickly vehicles are sold, hovering around 38 days. This stability suggests a balanced supply and demand in the used vehicle market.

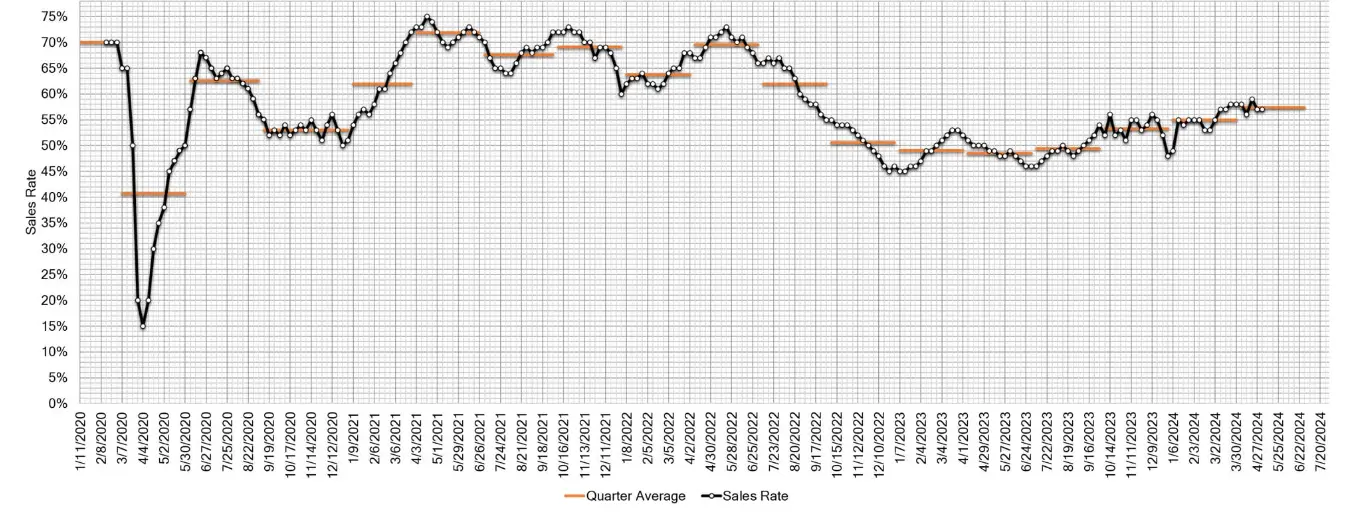

In contrast, the wholesale market remains steady but not without its challenges. Luxury cars and sub-compact vehicles continue to face headwinds, with significant declines in auction conversion rates, which hold steady at 57%, indicating a stable yet cautious buying sentiment among dealers.

Looking Ahead

As the market navigates these nuanced dynamics, it becomes clear that understanding the subtleties of each segment is crucial for predicting future trends. While some areas show promise, others reveal the pressures of an evolving automotive landscape. Our analysts remain vigilant, constantly evaluating the market to provide insights that go beyond the surface level.

The Bigger Picture

In this landscape of slight gains and targeted declines, the automotive market mirrors broader economic indicators: resilient yet cautious, reflective of a world where consumer preferences are swiftly changing and where the industry must adapt swiftly to keep pace. As we watch these trends unfold, one must wonder: What will the next turn in the market reveal about our economic resilience and adaptability?