Auto Market Update Week Ending Apr 29, 2023 (PDF)

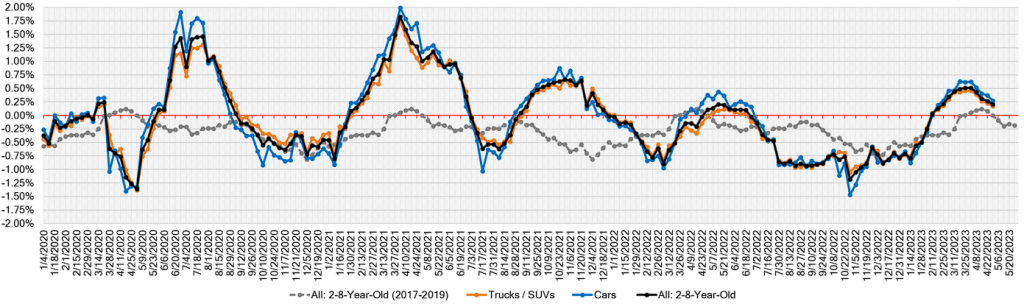

Market gains continued last week, but at a slower rate than they have been for the past few weeks. Seven of the twenty-two segments we track reported declines last week, the highest number since mid-February for segments reporting declines. The market is now showing more signs of softening.

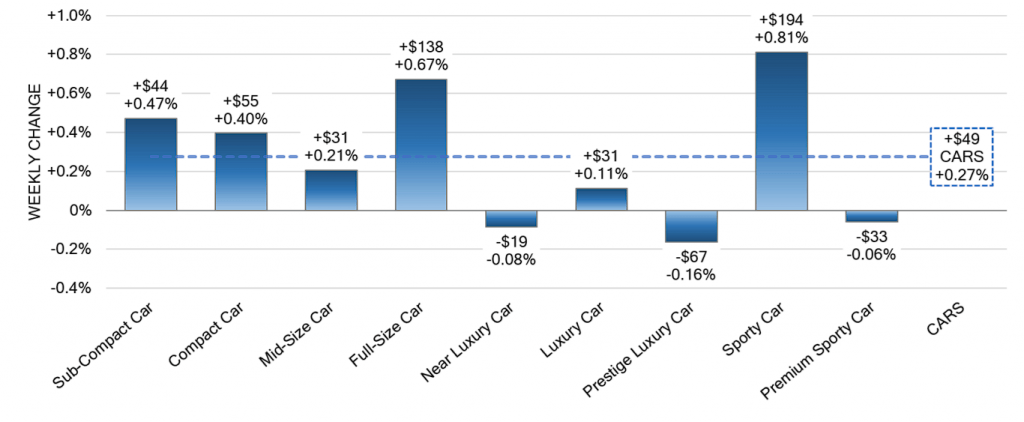

- Last week, six of the nine-car segments increased.

- Volume-weighted, the overall Car segment increased by +0.27%. The previous week, cars increased by +0.37%.

- With an average weekly gain of +0.64%, Sporty Car experienced the largest increase last week, up +0.81%.

- Car segments in the Prestige Luxury (-0.16%), Near Luxury (-0.08%), and Premium Sporty (-0.06%) segments reported declines.

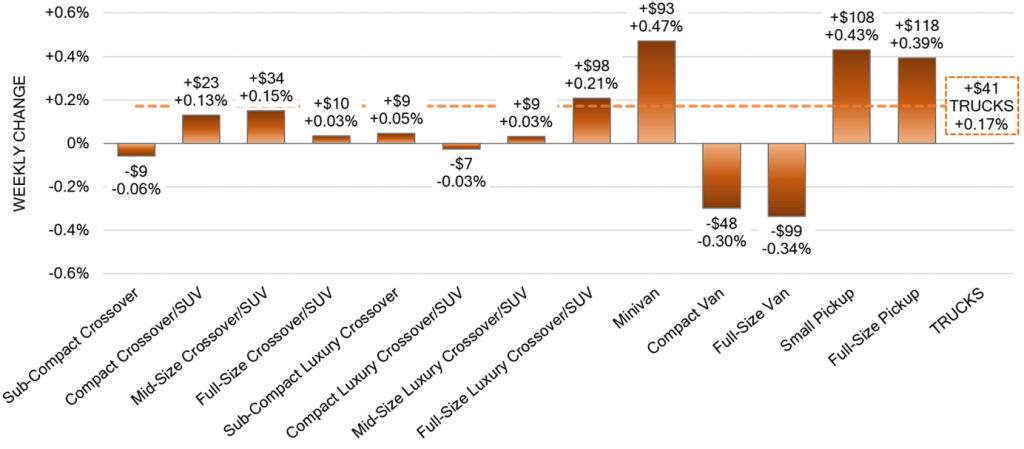

- Last week, nine of the thirteen truck segments reported increases.

- Volume-weighted, overall Truck segment increased +0.17%, compared with +0.22% the previous week.

- Truck segments with the largest gains were Minivans (+0.47%), Small Pickups (+0.43%), and Full-Size Pickups (+0.39%).

- For the first time since early February, Compact Luxury Crossovers (-0.03%) and Sub-Compact Crossovers (-0.06%) declined.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.27% | +0.37% | -0.05% |

| Truck & SUV segments | +0.17% | +0.22% | +0.04% |

| Market | +0.20% | +0.27% | +0.00% |

Retail (Used and New) Insights

- The Chevrolet Bolt will be discontinued at the end of the year, and the Michigan facility will undergo renovations to prepare for the production of all-electric trucks such as the Silverado and Sierra.

- Stellantis is offering voluntary buyouts to more than 30,000 non-union U.S. employees in a move to cut costs as part of its push toward electrification. In addition, General Motors also initiated a buyout program with approximately 5,000 employees opting in.

- OKI Cincinnati Auto Auction has been acquired by Dealers Auto Auction, the fourth-largest auction group in the US. Now known as DAA Cincinnati, the newly acquired auction becomes the group’s eleventh location.

Wholesale

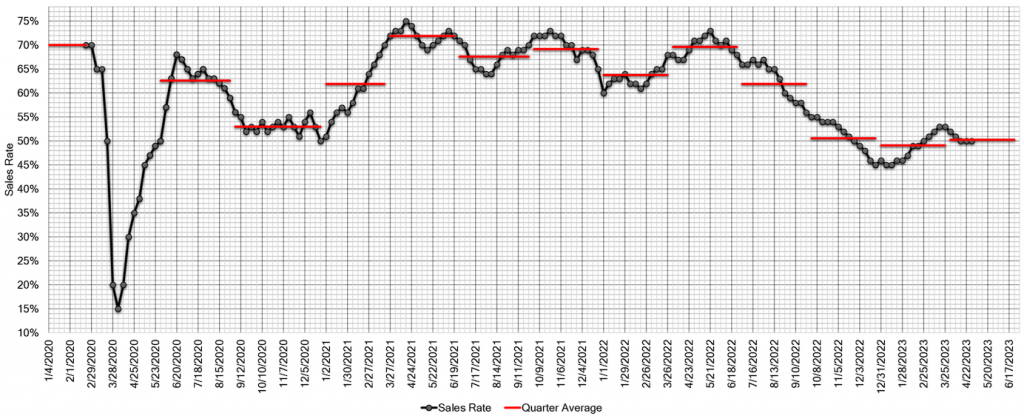

For the second week in succession, auction conversion rates have been steady while prices hint to a downward spiral. We are curious to see if this trend will continue. According to many industry sources, it seems that we should expect strength for a few more months; however, indications from various auctions and diminishing inventory at both open and closed OEM sales point towards otherwise. The Black Book Team will remain vigilant in tracking and reporting these changes as they appear. Notably, the Estimated Average Weekly Sales Rate stood at 50% for last week.