The auto market showed a shift this week after ten consecutive weeks of rising wholesale prices.

In this update, you’ll find a clear summary of key trends across car and truck segments, price changes, inventory movements, and what these mean for the industry.

By the end of this article, you’ll understand the current state of the market and how it compares to seasonal norms.

Overall Market Trends

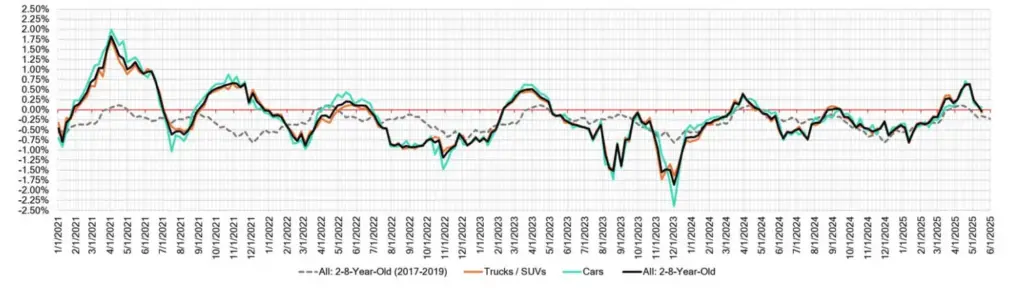

Last week, wholesale prices posted a slight decline of -0.03%. This marks the first dip after a steady ten-week increase. However, the decline remains modest compared to the pre-pandemic seasonal average of -0.16%.

Interestingly, newer used vehicles—those 0 to 2 years old—continued to show positive price growth, with the overall market for these models up +0.03%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.07% | +0.08% | -0.22% |

| Truck & SUV segments | -0.07% | +0.11% | -0.11% |

| Market | -0.03% | +0.11% | -0.16% |

Car Segment Overview

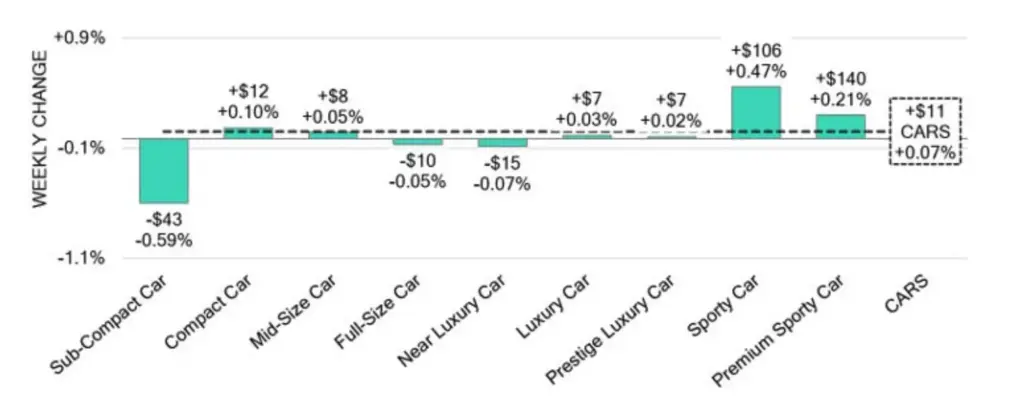

The car segment performed steadily with an overall increase of +0.07%. This is slightly lower than the +0.08% gain recorded the previous week.

Key details:

- 0-to-2-year-old cars rose +0.09%.

- 8-to-16-year-old cars saw a small decrease of -0.04%.

- 6 out of 9 car segments reported price increases.

The Sporty Car segment stood out with a +0.47% gain, marking its ninth consecutive week of growth. The 2-to-8-year-old Full-Size Car segment reversed course, dropping 0.05% after ten weeks of gains. Yet, 0-to-2-year-old Full-Size Cars continued climbing with a +0.54% increase.

Truck and SUV Segment Overview

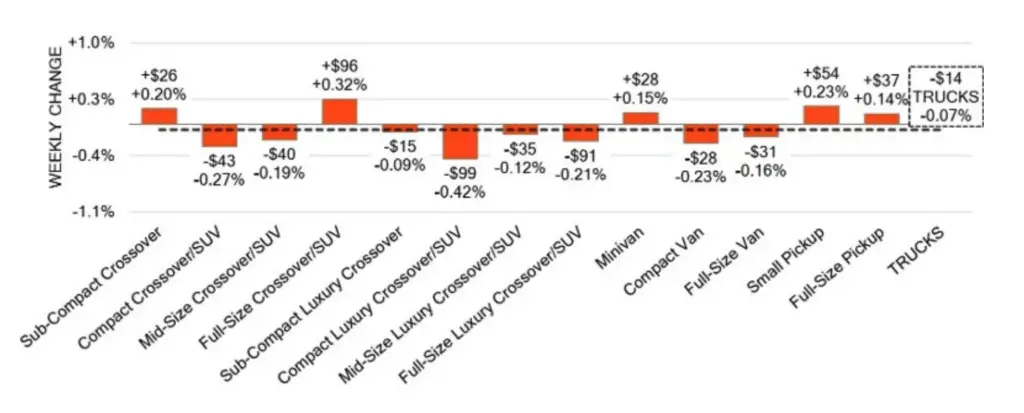

Unlike cars, the overall Truck and SUV segment declined by -0.07%. This follows a previous weekly gain of +0.11%.

Key highlights:

- 0-to-2-year-old trucks increased slightly by +0.02%.

- 8-to-16-year-old trucks declined -0.11%.

- 5 of 13 truck segments posted price increases.

The Minivan segment slowed dramatically, with a small +0.15% gain, compared to an average +0.92% weekly increase over the last month. Newer Minivans declined -0.13%, but older models rose +0.35%.

Notably, the Compact Luxury Crossover segment saw the largest drop at -0.42%, ending a six-week streak of increases.

Wholesale Market Insights

The wholesale market is showing early signs of a broader slowdown. While some sub-segments remain strong, others have started to dip.

Key metrics:

- Auction conversion rate fell to 58%, the lowest since February.

- Auction inventory matched levels last seen in January.

These changes suggest a shift in both market activity and buyer demand.

Used Retail Market and Inventory

Retail prices are now more transparent thanks to no-haggle pricing. This helps track retail trends more accurately.

Current inventory trends:

- The Used Retail Active Listing Volume Index remains stable.

- Vehicles are taking an estimated 35 days to turn at retail.

This balance of supply and demand offers consumers more options while signaling possible price adjustments ahead.

Key Takeaways

The market’s slight decline of -0.03% signals the end of a significant 10-week streak of consistent price increases. This change, while modest, is an early indicator of potential shifts in buyer behavior and market supply.

Passenger cars are currently showing greater resilience than trucks and SUVs. While the car segment continues to post steady gains, many truck and SUV categories are either leveling off or beginning to decline. This divergence may reflect shifting consumer preferences, possibly influenced by fuel prices or seasonal factors.

Certain sub-segments remain particularly strong, notably Sporty Cars, which have enjoyed nine straight weeks of increases. Conversely, others like Compact Luxury Crossovers are experiencing notable declines after a period of growth. These contrasting trends underscore the importance of segment-specific analysis when evaluating market conditions.

Lastly, inventory trends and auction conversion rates point to emerging changes in market dynamics. The drop in conversion rates and stabilization of retail inventory suggest that sellers may face longer holding times, while buyers could gain more leverage in negotiations as supply steadies.

Conclusion

This week’s developments represent a notable pivot in the wholesale and retail automotive markets. After months of consistent price growth, the first signs of softening are emerging, particularly in trucks and select SUV segments. These shifts could signal a transition from a seller’s market to one with more balanced conditions.

For buyers, this may present new opportunities to negotiate better deals, especially in segments showing recent declines. For dealers and industry professionals, staying attuned to these evolving trends will be essential for inventory planning and pricing strategies.

Overall, the market remains in flux, with both upward and downward pressures at play. Continued monitoring of wholesale prices, retail inventories, and auction dynamics will be crucial in anticipating the market’s next moves. Stay tuned for next week’s update, where we’ll track whether these early signs of decline continue or stabilize.