Auto Market Update – September 2023: Navigating the UAW Strike and Market Resilience (PDF)

In the heart of September 2023, the automotive market stands at a crossroads. The United Auto Workers (UAW) strike continues to loom large, impacting production, supply chains, and buyer sentiment.

Yet, amidst this uncertainty, the market displays remarkable resilience and adaptability. In this comprehensive market update, we’ll explore the latest trends, pricing shifts, and what the future holds.

Market Stability Amid UAW Strike

The UAW strike, which commenced weeks ago, has had a profound impact on the automotive landscape. Thousands of UAW union members actively participated in the strike, affecting numerous manufacturing plants. However, despite this disruption, the market has found its footing, showcasing signs of stability.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.15% | -0.29% | -0.42% |

| Truck & SUV segments | -0.05% | -0.19% | -0.31% |

| Market | -0.08% | -0.22% | -0.35% |

Pricing Trends

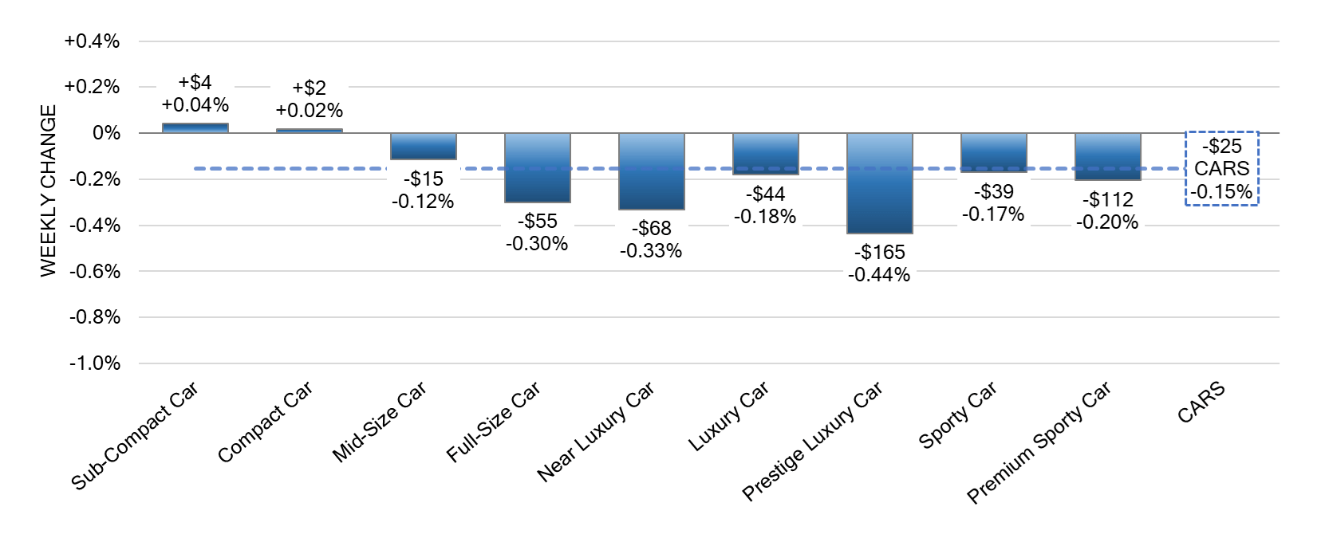

Car Segments:

On a volume-weighted basis, the overall car segment has experienced a modest decline of -0.15%. This marks an improvement compared to the prior week when cars witnessed a more substantial decrease of -0.29%.

Notably, the Sub-Compact and Compact car segments emerged as bright spots, posting increases of +0.04% and +0.02%, respectively. These positive shifts are particularly significant given their previous declines.

The Compact Car segment, in particular, had been on a consistent downward trajectory for eighteen consecutive weeks, with an average weekly change of -0.94%. However, last week’s increase indicates a potential reversal of this trend. On the flip side, Prestige Luxury Cars faced the largest decline at -0.44%, compared to the prior week’s -0.25%.

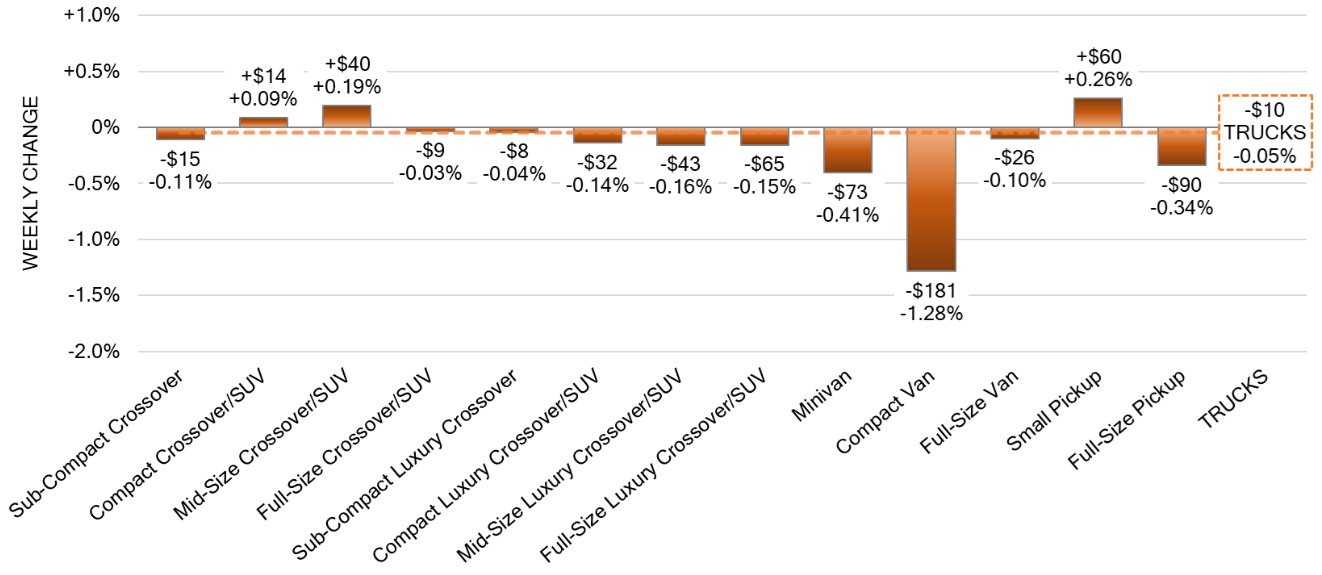

Truck & SUV Segments:

The truck segment, which includes SUVs, experienced a milder decrease of -0.05%, a noticeable improvement from the -0.19% depreciation observed in the previous week. Key highlights include Small Pickup (+0.26%), Mid-Size Crossover (+0.19%), and Compact Crossover (+0.09%) segments, all reporting positive movements.

Compact Van, however, witnessed the most substantial decline, dropping by -1.28%. This segment has been on a declining streak for twenty-five consecutive weeks, averaging a weekly decline of -0.62%.

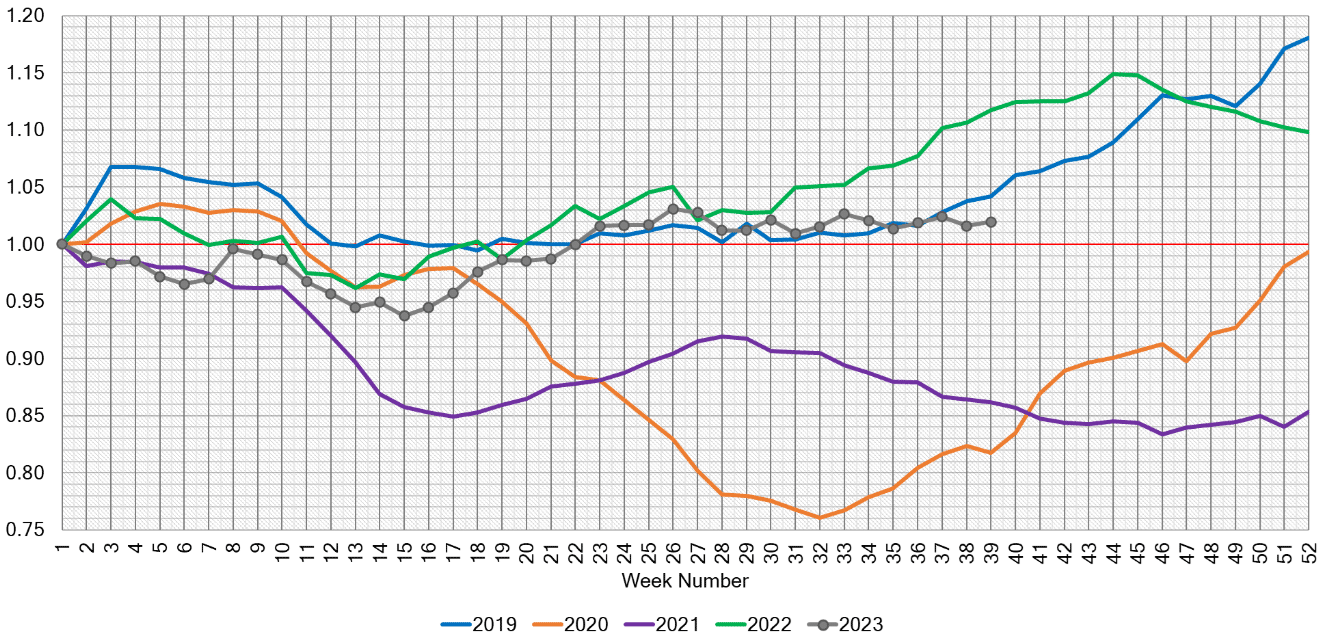

Used Retail

In the used retail market, the Active Listing Volume Index currently stands at a stable 1.02 points. This signifies a consistent presence of used vehicles available for buyers. The estimated Used Retail Days-to-Turn hovers around 45 days, suggesting equilibrium between supply and demand.

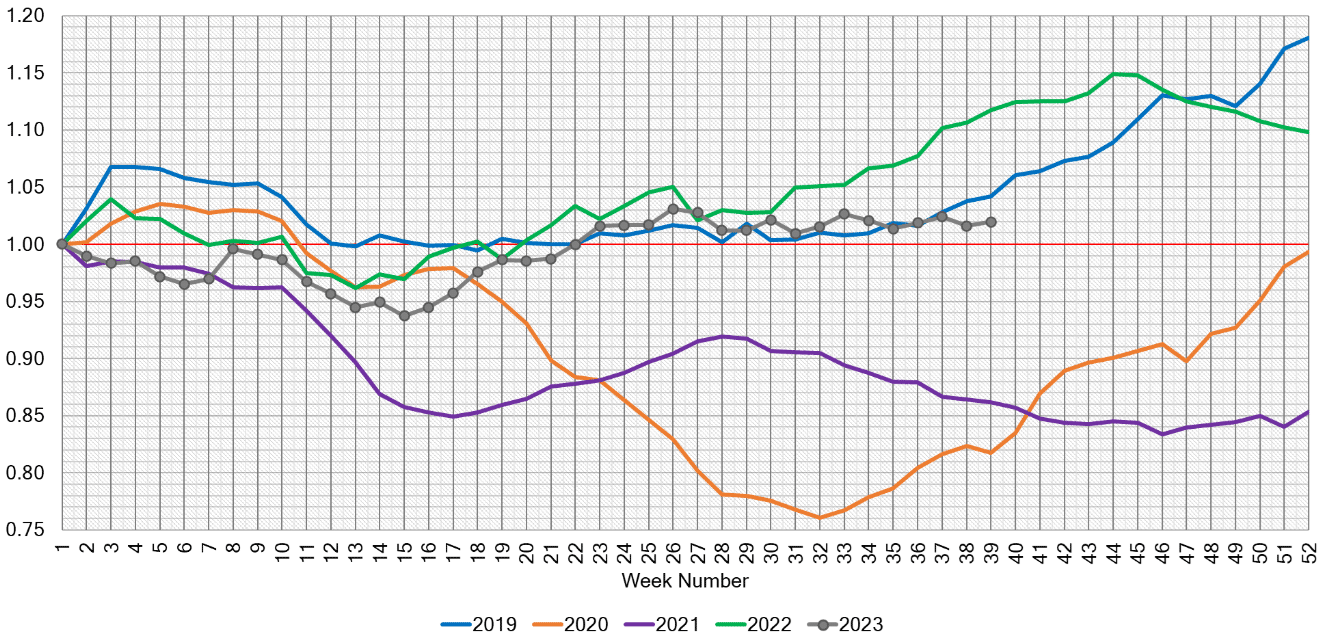

Wholesale Market: Navigating Supply Disruptions

With the UAW strike now in its third week and more plants being affected, the wholesale market is bracing for potential supply disruptions. Approximately 25,000 UAW union members are actively participating in the strike, adding complexity to an already intricate market landscape. However, there is optimism amidst the challenges.

A surge in demand at auctions signifies a proactive reaction to the looming supply constraints. In the recent week, numerous segments exhibited promising upticks, notably including Compact Cars, Sub-Compact Cars, Compact Crossover/SUVs, Mid-Size Crossover/SUVs, and Small Pickups.

It’s worth noting that all these segments, with the exception of Mid-Size Crossovers, had faced declines in the preceding week. Encouragingly, the estimated Average Weekly Sales Rate saw a notable increase, reaching a robust 54%.

Conclusion: Navigating Uncertainty with Resilience

As the UAW strike continues to shape the automotive industry in September 2023, the market stands as a testament to resilience and adaptability. Pricing trends have displayed a degree of stability, with select segments showing promising rebounds.

The used vehicle market maintains a balance between supply and demand, while the wholesale market readies itself for potential challenges in the weeks ahead.

In this dynamic landscape, staying informed and adaptable is key. September 2023 unfolds with a mix of challenges and opportunities, and we’ll be here to provide you with the latest insights as the month progresses.