October 2024 Auto Market Update—Week Ending October 29th

Introduction

In the final week of October, the auto market continued to adjust as wholesale prices softened across both car and truck segments. With seasonal demand stabilizing, certain segments saw sharper price declines, influenced by broader inventory levels and steady auction activity. Additionally, industry news made waves as Volkswagen, Brabus, and Apple each announced major updates impacting the automotive landscape. Below, we’ll cover the latest trends and provide insights into the week’s top stories.

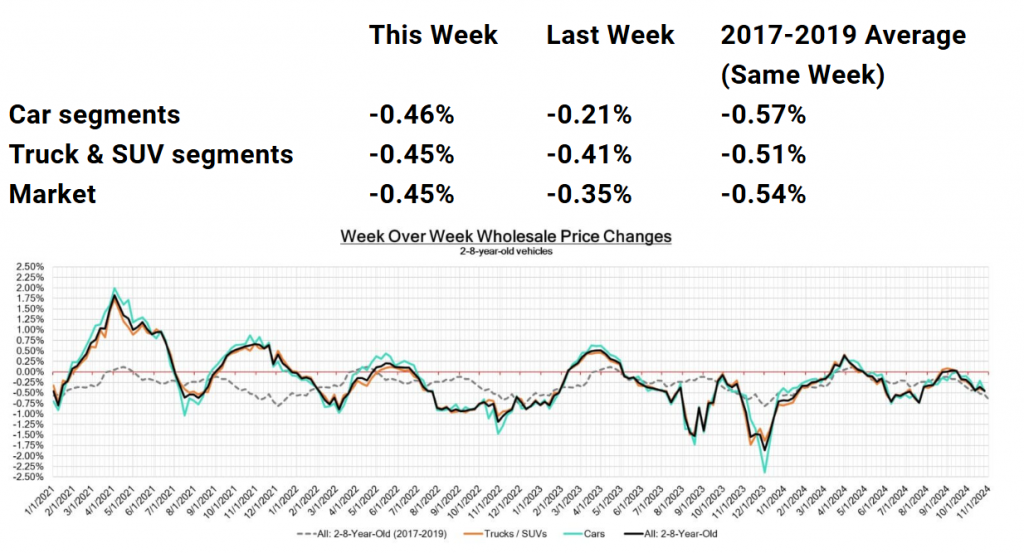

Wholesale Price Trends

In the week ending October 29, 2024, wholesale prices showed a consistent downward trend. Here are the key insights:

- Overall Market Decline: The market saw a volume-weighted decline of -0.45%, aligning with previous weeks’ seasonal trends.

- Car Segment: Prices for cars dropped by -0.46%, a slight deceleration from prior weeks.

- Truck/SUV Segment: Truck and SUV segments saw a more significant drop of -0.45%, highlighting a stronger seasonal softening in larger vehicle categories.

These adjustments align with typical fall market behavior, where price declines are expected to continue as inventory levels stabilize.

The average diminished value amount is $6,200. We can help you get what you deserve.

Detailed Segment Analysis

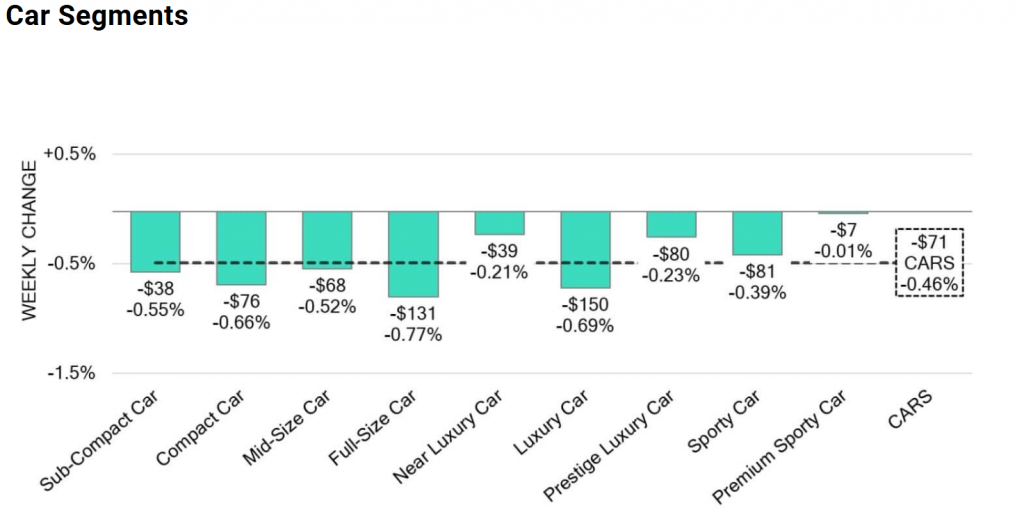

Car Segments Breakdown

- Near Luxury Car Segment: This category saw a -0.21% decrease, reflecting a cooling demand for premium vehicle segments.

- Luxury Car Segment: Luxury vehicles had the sharpest decline within cars, down by -0.69%, as demand wanes for higher-priced models.

- Sub-Compact Car Segment: This budget-friendly segment experienced a smaller decrease of -0.55%.

Overall, all car segments reported declines, with high-end categories seeing the most substantial drops.

How about letting our team get you the best value for your insurance claim?

- Discover your car’s true value

- No payment upfront

- Vehicle history report

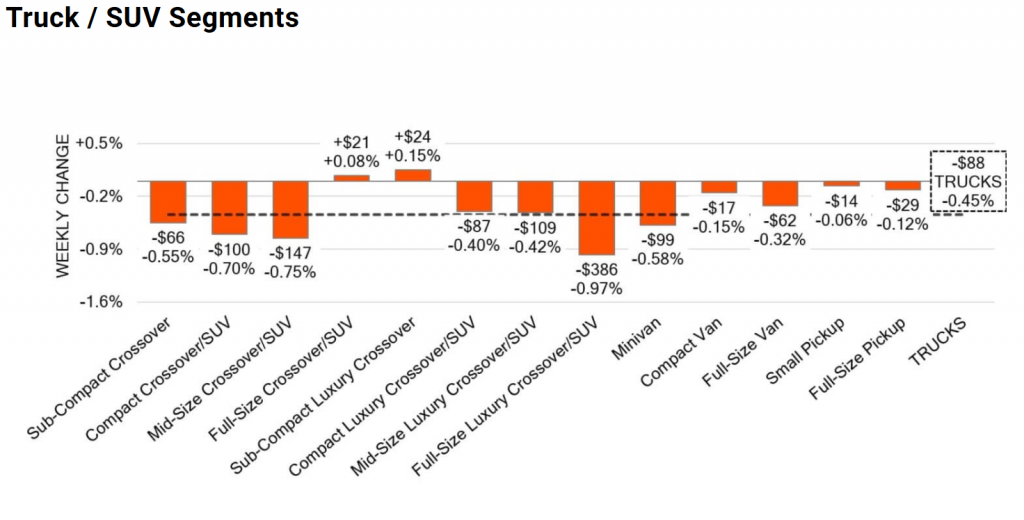

Truck/SUV Segments Breakdown

- Sub-Compact Crossover: This segment saw a drop of -0.55% as consumer demand softened in compact SUVs.

- Mid-Size Crossover: Mid-size crossovers continued to decline with a -0.75% change, reflecting the broader market trend for trucks and SUVs.

- Full-Size Crossover: This category posted a +0.08% increase, indicating moderate interest.

- Minivans: Minivans also experienced a decline of -0.58%, following previous weeks’ adjustments in family vehicle demand.

With all truck segments reporting declines, the broader truck and SUV market continues to align with seasonal expectations, with full-size luxury and mid-size crossovers seeing the largest percentage decreases.

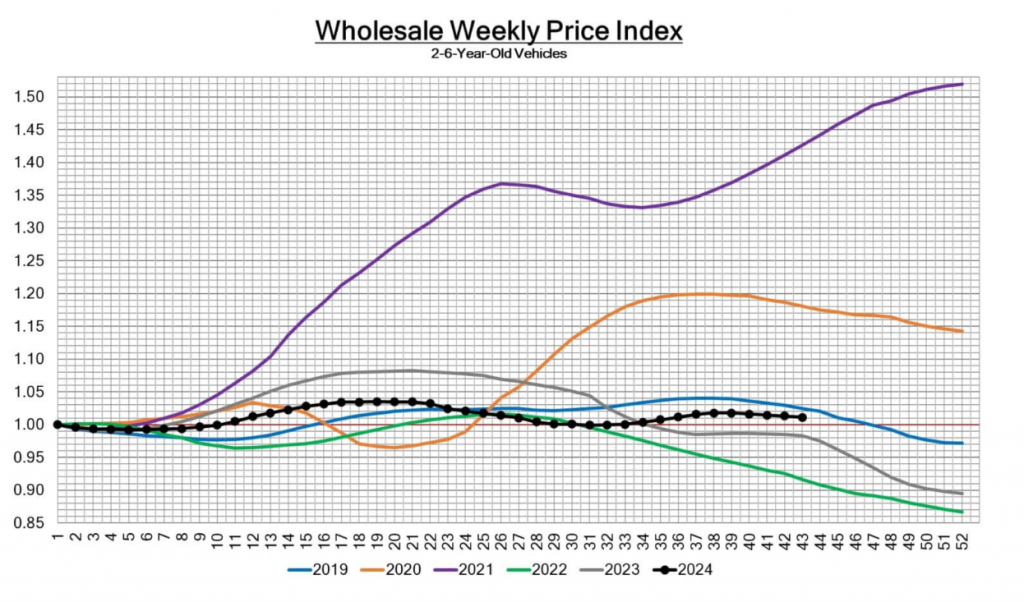

Wholesale Weekly Price Index

The Wholesale Weekly Price Index for 2-6-year-old vehicles reflects a gradual seasonal decline, closely tracking 2024’s trends with previous years. This week’s index further emphasizes a return to pre-pandemic price stability and seasonal price adjustments that are in line with historical averages from 2019 and 2021.

GET MORE MONEY FROM THE INSURER

Don’t leave money on the table! Order a FREE Claim Review and discover your car’s true value.

Used Retail and Inventory Insights

In the Used Retail Listing Volume Index, active listings have remained stable, while Days-to-Turn estimates show a slight increase. This uptick indicates that, while inventory remains accessible, retail demand may be softening as dealerships adjust prices to move older stock.

With inventory remaining steady and demand tapering off, dealers are likely to increase incentives and markdowns in the coming weeks.

(Insert Graph: Used Retail Listing Volume Index)

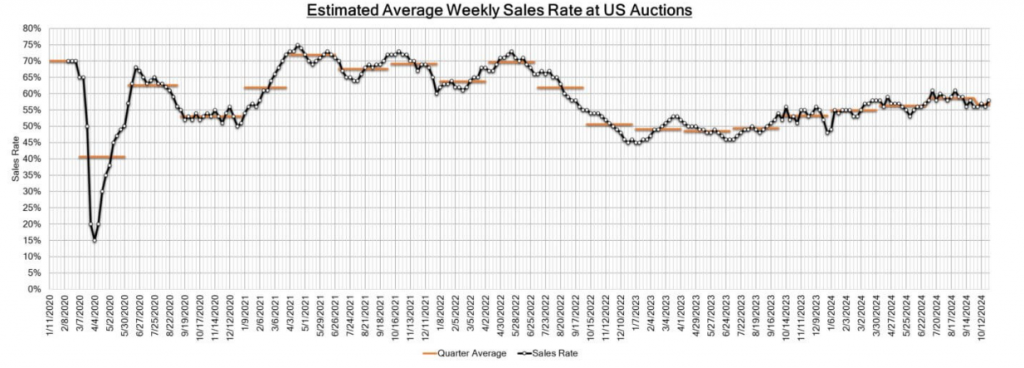

Auction Sales Rate

The auction conversion rate stayed consistent at 57%, indicating steady activity despite price softening across segments. This balance suggests that dealers remain active in the wholesale market, with demand driven by high inventory availability and competitive pricing. Going forward, we may see slight adjustments in auction rates as seasonal factors continue to influence inventory dynamics.

The average diminished value amount is $6,200. We can help you get what you deserve.

Biggest Auto Market News of the Week

1. Volkswagen to Shut EV Factory in Brussels

Volkswagen announced the upcoming closure of its Audi plant in Brussels, where it produces the Audi Q8 E-Tron. The factory is set to close by February 28, 2025, affecting approximately 3,000 jobs. This move follows recent news that VW will also close three plants in Germany as part of a larger restructuring plan, citing challenges in the European EV market and stiff competition from Chinese automakers.

2. Brabus Debuts $1.5M Big Boy 1200 Luxury Motorhome

High-end vehicle customizer Brabus unveiled its first luxury motorhome, the Big Boy 1200, priced at $1.5 million. The motorhome offers 323 square feet of living space, high-end finishes, and tech features like Starlink internet and solar panels. This release marks Brabus’ entry into the RV market, with the Big Boy 1200 designed for both travel and luxury living.

3. Apple and BYD’s Canceled EV Collaboration

Apple and BYD reportedly collaborated on a joint EV project known as “Project Titan,” aimed at developing an autonomous EV. Despite early advancements, Apple canceled the project in February 2024, reallocating its resources to other tech initiatives like AI. This revelation underscores Apple’s past interest in EVs and the ongoing competition in the autonomous and electric vehicle sectors.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion

October ended with consistent market adjustments, as wholesale prices for both car and truck/SUV segments trended downward in line with seasonal patterns. Auction activity remains steady, while retail inventory suggests a potential shift toward more aggressive pricing to clear stock. With Volkswagen’s plant closures, Brabus’ entry into luxury motorhomes, and Apple’s now-canceled EV project with BYD, the industry continues to evolve, bringing new dynamics and challenges for manufacturers and consumers alike.

Looking ahead, the market’s seasonal adjustments are expected to continue, with further price softening likely as inventory levels remain high.