October 2024: Auto Market Update – First Week Trends and Insights

The first week of October 2024 brought notable shifts in the auto market, influenced by several key factors. On the wholesale side, we observed price declines across both car and truck segments. Meanwhile, disruptions from Hurricane Milton in Florida have begun to impact auction activity, leading to uncertainty in vehicle supply and pricing. Additionally, all eyes are on the Mondial de l’Auto in Paris, which is set to showcase the future of electric and autonomous vehicles. Let’s dive into the key trends shaping the market this week.

The average diminished value amount is $6,200. We can help you get what you deserve.

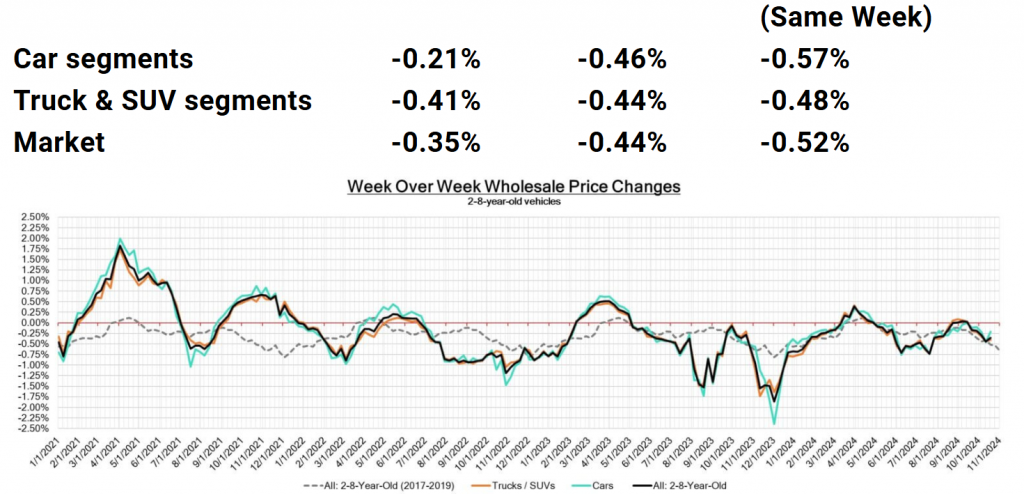

Wholesale Price Trends

During the first week of October 2024, wholesale prices for 2-8-year-old vehicles continued to decline. The overall market saw a -0.44% drop—a steeper decline than the -0.30% experienced last week. This trend is consistent across both car and truck segments.

Compared to the 2017-2019 average for the same week, the market’s decline aligns closely with historical patterns. However, this year’s market activity is slightly more volatile due to external factors like regional weather events.

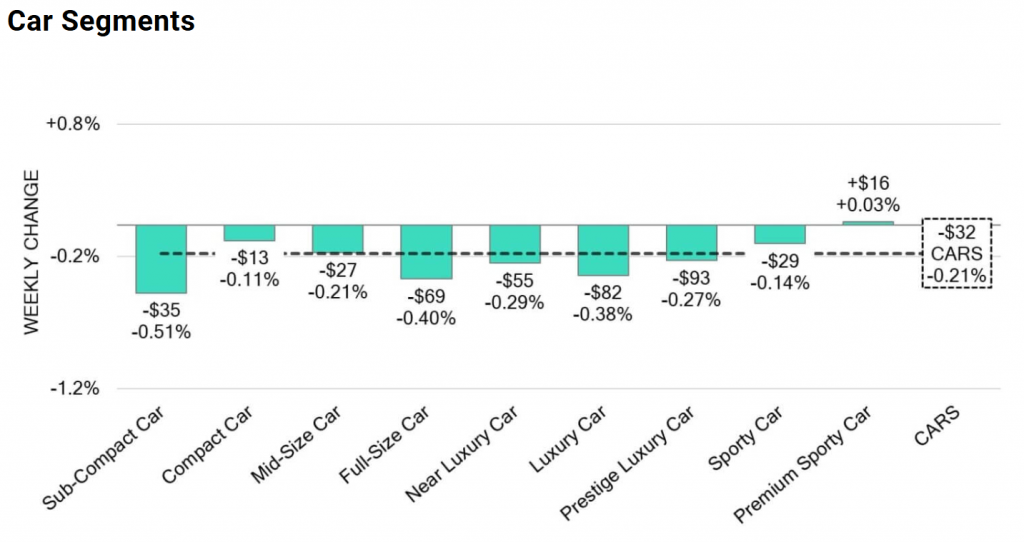

Car Segments Breakdown

The car segments experienced a significant dip of -0.46% this week, a steeper decline than the -0.22% seen last week.

- Premium Sporty and Prestige Luxury Car segments were the exceptions this week, posting modest gains of +0.07% and +0.05%, respectively.

- After ten consecutive weeks of growth, the Compact Car segment (0-2 years old) declined by -0.05%, while the older 8-16-year-old cars saw a sharper drop of -0.40%.

- The Sporty Car segment for 8-16-year-olds marked its third consecutive week of gains, up +0.18%, showing continued consumer interest in older sporty models.

Seven out of nine car segments reported decreases, with the Full-Size Car and Luxury Car segments seeing some of the steepest drops of -0.77% and -1.02%, respectively.

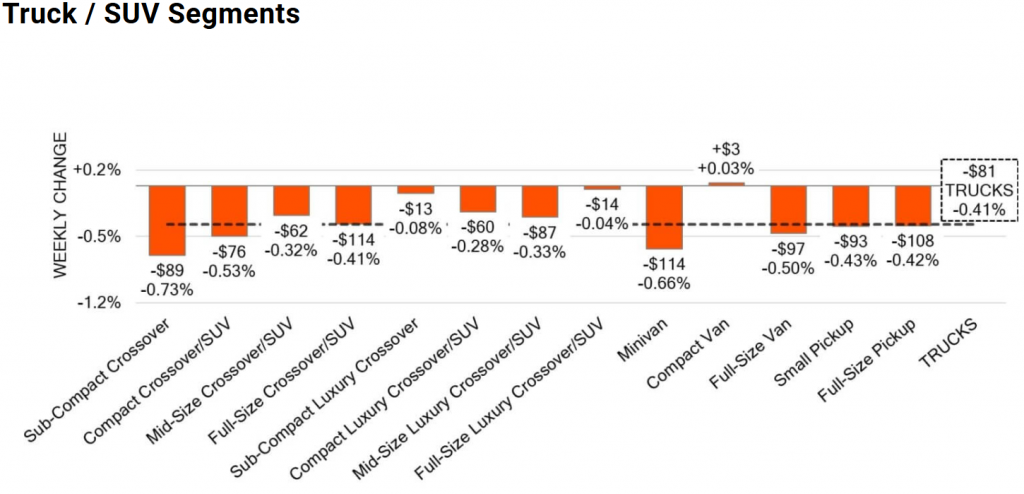

Truck/SUV Segments Breakdown

On the Truck and SUV side, we also saw a continued downward trend, with an overall decline of -0.44%, slightly more severe than last week’s -0.32%.

- The Compact Crossover/SUV segment experienced a notable drop of -0.79%, worsening from last week’s -0.44%.

- In contrast, the Compact Luxury Crossover saw a much smaller decline of -0.06%, showing resilience compared to other truck/SUV segments.

- The Small Pickup segment has now posted its second consecutive week of declines after enjoying seven weeks of growth, with this week’s drop standing at -0.35%.

All 13 truck segments reported declines, and as a result, we see a broad downward trend continuing in this category.

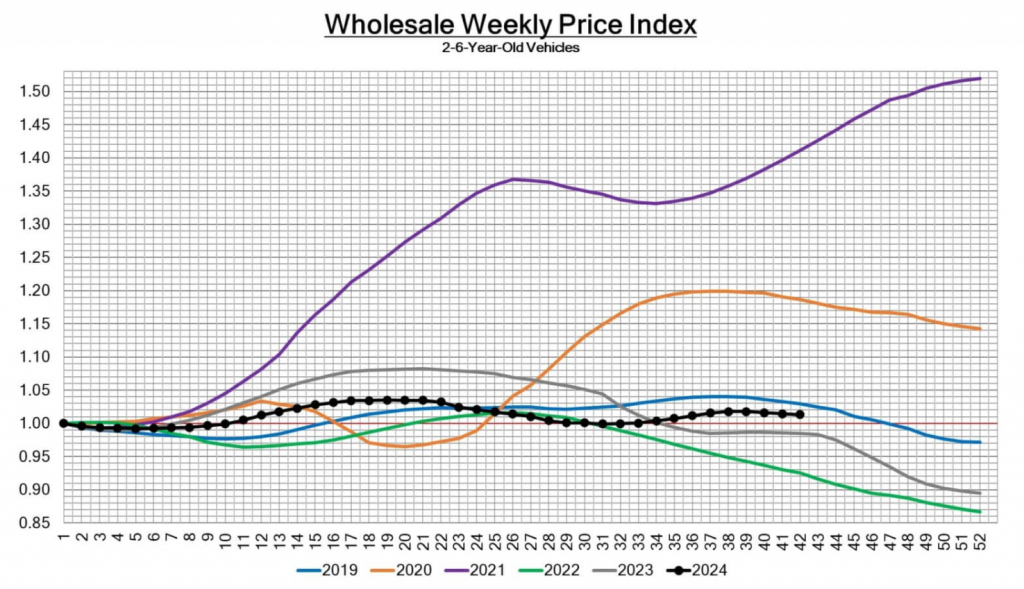

Weekly Wholesale Price Index

The Wholesale Weekly Price Index for 2-6-year-old vehicles shows that while 2024 has had its fluctuations, price trends remain fairly stable this week.

As the graph illustrates, 2024 price movements are tracking closely with 2022, suggesting a relatively calm market despite broader external pressures like weather events. However, the market remains more volatile than the steady patterns observed in 2019 and 2020, pre-pandemic.

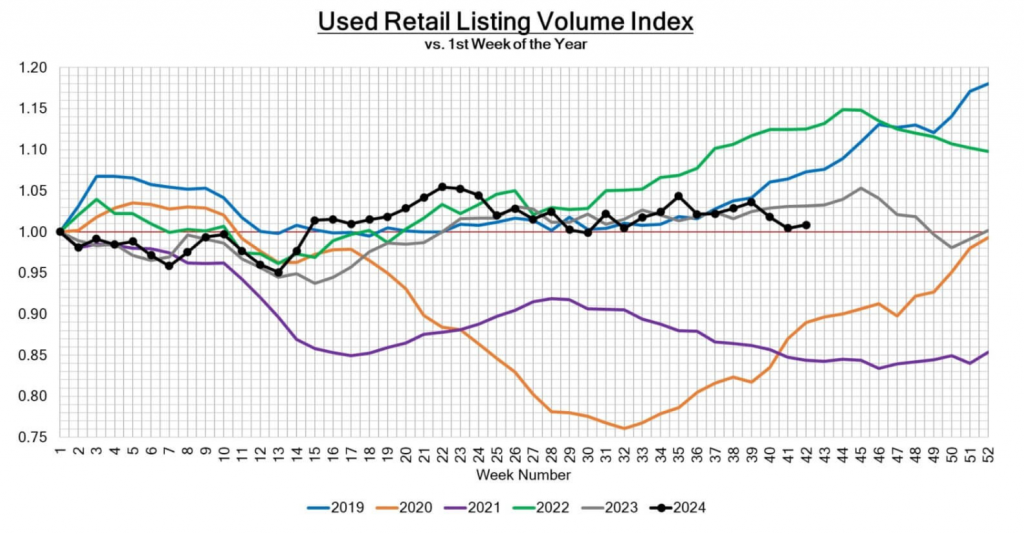

Used Retail Listing Volume

In the Used Retail Listing Volume Index, we continue to see increased inventory across most dealerships in the U.S., with active listings steadily rising.

The index shows that 2024 has outpaced 2023 in terms of listings, with levels trending upward as more vehicles hit the market. This increased volume signals healthy supply, though it could indicate softer demand or pricing competition as dealers push to move inventory. If this trend continues, it could lead to more aggressive pricing strategies for used vehicles in the coming weeks.

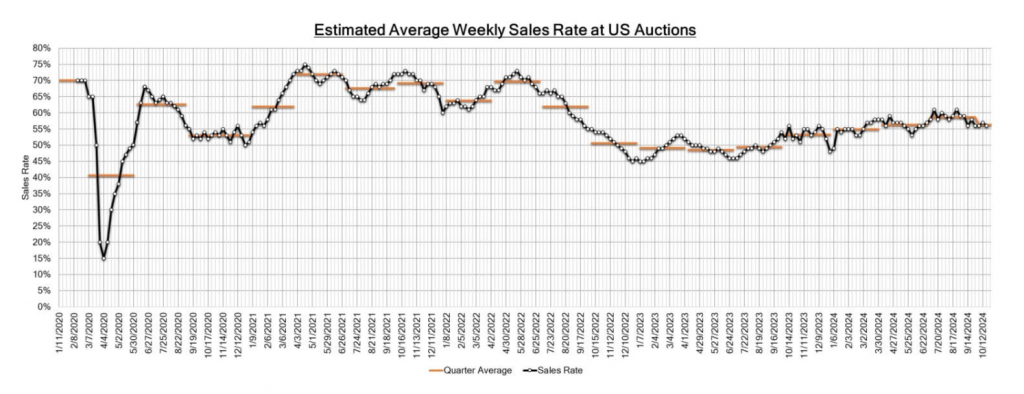

Auction Sales Rate Trends

The auction conversion rate saw a minor improvement this week, rising to 57%, up by 1% compared to last week.

While the sales rate shows some stabilization, this increase comes amidst disruptions caused by Hurricane Milton, which affected auction operations across the Southeast. We’re likely to see more volatility in the coming weeks as auction houses adapt to inventory challenges and vehicle condition assessments in hurricane-affected regions.

Biggest Auto Market News of the Week

1. Impact of Hurricane Milton on the Auto Market

Hurricane Milton’s landfall in Central Florida has led to significant disruptions in auction operations, with many facilities either closed or adjusting their processes. As a result, vehicle supply in the region is expected to tighten, and prices could fluctuate in the short term due to reduced availability.

Auction houses are urging buyers to closely inspect vehicles for storm damage, as this could affect resale values and performance, especially for vehicles exposed to flooding. The full extent of the damage is still being assessed.

2. Mondial de l’Auto in Paris: Spotlight on Electric Vehicles

The Mondial de l’Auto, one of the world’s largest and most influential auto shows, kicked off in Paris this week. Running from October 17-27, the event is expected to attract over 1 million visitors, with a focus on the future of mobility, particularly in the areas of electric and autonomous vehicles.

Leading automakers are unveiling their latest models, with sustainability and innovation taking center stage. Electric vehicles (EVs) are the stars of the show, reflecting the global push toward cleaner transportation solutions.

3. Growing Demand for Used EVs in the US Market

The U.S. market is seeing a surge in demand for used electric vehicles (EVs). With fuel prices remaining elevated and government incentives encouraging EV adoption, more consumers are turning to the used market to find affordable electric alternatives.

This growing trend is pushing up prices for used EVs, and dealerships are responding by increasing their EV inventory. Expect to see more focus on electric options in the used car market as the shift toward sustainable vehicles accelerates.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion

The first week of October 2024 presented several key trends in the auto market, from ongoing wholesale price declines to disruptions caused by Hurricane Milton. Meanwhile, the international stage is buzzing with innovation as the Mondial de l’Auto in Paris showcases the next generation of electric and autonomous vehicles.

As we move forward, we’ll be keeping an eye on the impact of weather events on auction activity and the continued rise in demand for used electric vehicles in the U.S. Stay tuned for further updates as we track these developments in the coming weeks.