As we move further into November, the automotive market continues to experience the seasonal fluctuations and trends that shape vehicle pricing and inventory dynamics. This week, we’re diving into the latest wholesale price movements, truck and SUV segment activity, and retail inventory patterns, alongside a look at Tesla’s groundbreaking innovations unveiled at the “We, Robot” event.

Wholesale Price Trends

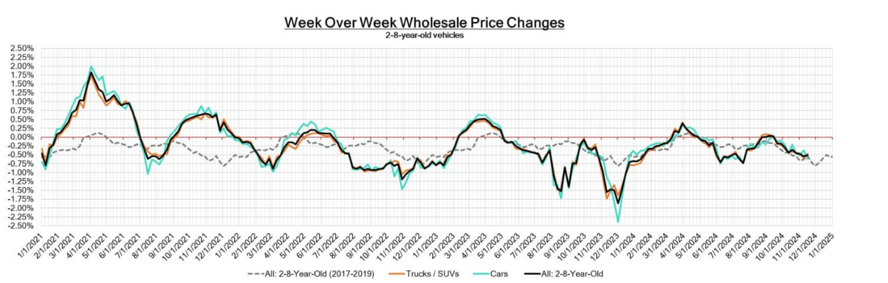

For the week ending November 16, 2024, wholesale vehicle prices across all segments followed typical end-of-year depreciation patterns. Here’s a breakdown of the numbers:

- Car Segments: Decreased by -0.61%, a sharper drop compared to the -0.38% decline last week.

- Truck & SUV Segments: Declined by -0.47%, consistent with last week’s decrease of -0.60%.

- Overall Market: Experienced a decline of -0.51%, close to the -0.53% weekly average observed in the 2017-2019 pre-pandemic period.

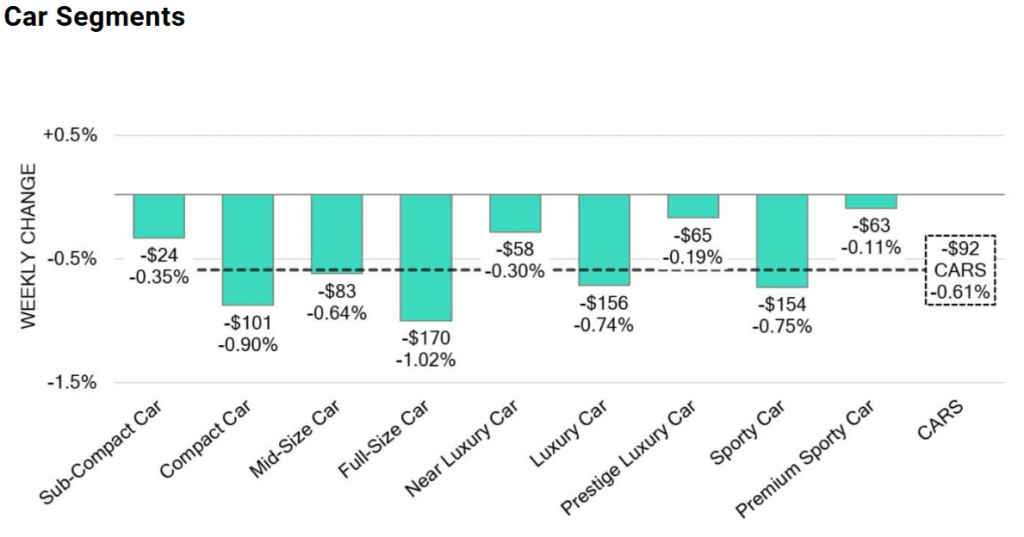

Car Segments Overview

- On a volume-weighted basis, overall car segments experienced a significant decline of -0.61%!

- Premium Sporty Cars: Continued to show resilience with minimal depreciation of -0.11%. This marks their strongest performance in weeks.

- Full-Size Cars: Posted the steepest decline at -1.02%, highlighting increased depreciation pressures for large vehicles.

- Compact Cars: Reported a more moderate decrease of -0.44%, reflecting relative stability in this segment.

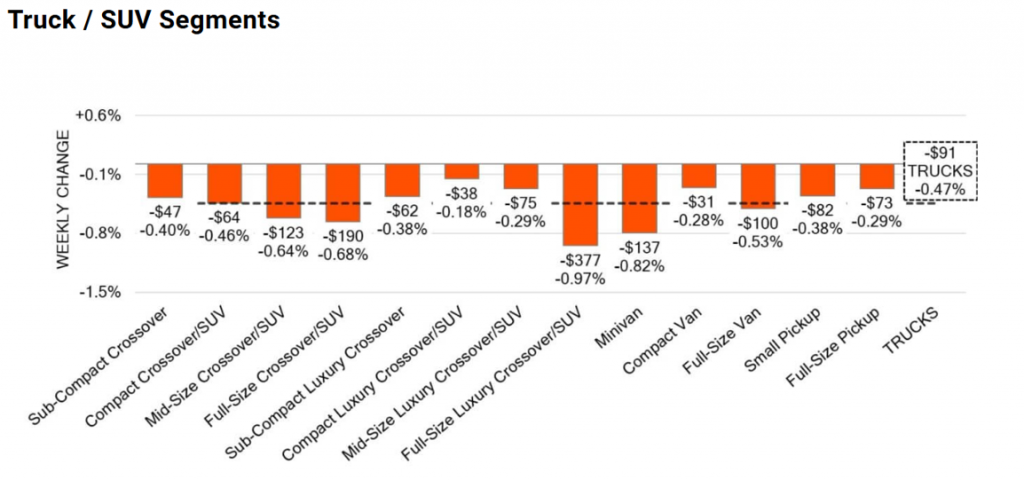

Truck & SUV Segments Overview

- The volume-weighted Truck & SUV segment saw a decline of -0.47%, maintaining a consistent depreciation trend compared to the previous week.

- Full-Size Vans: Recorded the largest drop at -0.97%, reflecting softening demand for larger commercial vehicles.

- Sub-Compact Crossovers: Posted a relatively minor decline of -0.21%, indicating stronger consumer interest.

- Compact Luxury SUVs: Demonstrated resilience with a smaller-than-average decrease of -0.14%.

Inventory Trends

Used Retail Listing Volume Index

- Retail inventory has remained stable, with the Days to Turn metric averaging around 48 days.

- Active retail listings showed consistent patterns, reflecting steady dealer activity in sourcing and marketing used vehicles.

Graph Placement: Insert the Used Retail Listing Volume Index Graph here to illustrate trends in active listings and days to turn.

Wholesale Auction Activity

- The auction conversion rate stood at 57%, unchanged from last week, highlighting consistent buyer activity despite seasonal adjustments.

Tesla’s Game-Changing Innovations

Tesla dominated headlines this week with groundbreaking announcements at its “We, Robot” event. Among the highlights were the Robovan and Robotaxi, two autonomous vehicle innovations poised to revolutionize transportation.

- The Robovan: A fully autonomous multipurpose vehicle designed for passengers and goods, featuring futuristic design and advanced suspension systems.

- The Robotaxi: A two-seater, self-driving car priced under $30,000, aimed at making autonomous technology accessible to more consumers.

These innovations underscore Tesla’s commitment to reshaping urban mobility, solidifying its position as a leader in transportation technology.

Key Takeaways

- Vehicle depreciation remains consistent with historical norms as we near year-end, with wholesale prices and auction activity reflecting typical seasonal patterns.

- Compact and luxury SUV segments show resilience, while larger commercial vehicles face increased depreciation pressures.

- Retail inventory trends remain steady, with no major shifts in listing volume or days-to-turn metrics.

- Tesla’s Robovan and Robotaxi demonstrate bold strides toward the future of autonomous transportation, blending functionality with cutting-edge design.