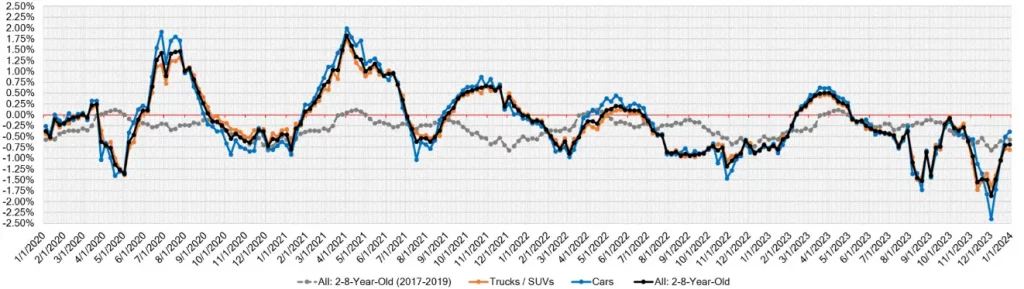

As 2023 came to a close, the auto industry witnessed fluctuations that could only be likened to a rollercoaster ride post-Thanksgiving. The wholesale market, in particular, experienced significant weekly declines, signaling a shift in the auto market landscape. Despite the presence of robust auctions and a bountiful inventory, sellers found themselves in a position where they had to adjust their reserve prices in search of a new pricing equilibrium. This recalibration of expectations was a reflection of the evolving market dynamics, as sellers aimed to align with the anticipated consumer spending behavior.

As the festive cheer of December settled in, a discernible shift was observed mid-month. The declines, which had been quite steep, showed signs of tapering off, staying under the 2% mark. This was a marked improvement and could be interpreted as the market finding its footing. However, with the holidays inching closer, auction activity inevitably took a backseat. This pause in activity was critical, as it set the stage for a pivotal final week, which would ultimately shape the market’s trajectory as we steered into the new year.

Auto Market Update December 2023: Trends & Data (PDF)

| Segment | Week Ending 12/2 | Week Ending 12/9 | Week Ending 12/16 | Week Ending 12/23 |

| Car | -2.40% | -1.72% | -1.03% | -0.51% |

| Truck & SUV | -1.64% | -1.40% | -1.06% | -0.78% |

| Market | -1.86% | -1.49% | -1.05% | -0.70% |

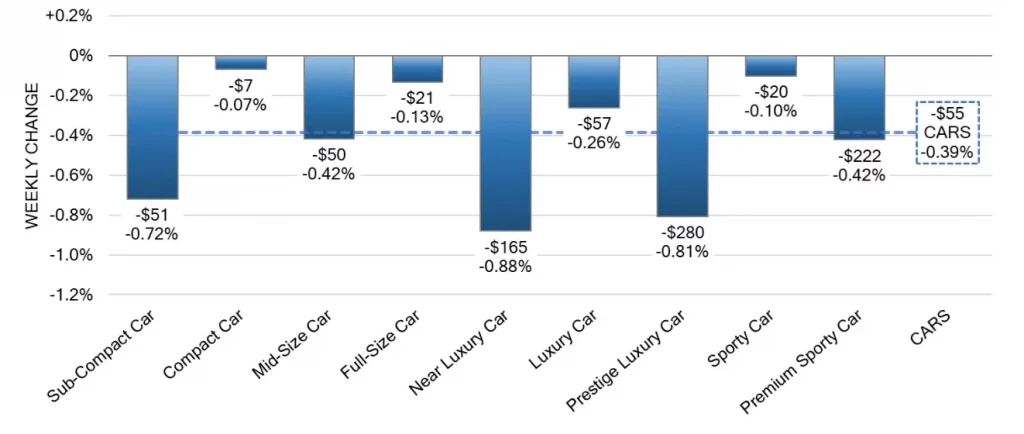

Car Segments: A Detailed Analysis

The car segment, when evaluated on a volume-weighted basis, saw a decline of -0.39%, which was less compared to the -0.51% decrease witnessed in the preceding week. Breaking it down further, the newer car segments (0-to-2 years) experienced a -0.42% downturn, while the older segments (8-to-16 years) saw a slightly steeper decline of -0.51%. Notably, all nine car segments experienced depreciation last week.

The Near Luxury Car segment, in particular, recorded the largest depreciation of -0.88%, which was a slight increase from the -0.76% observed the week before. On the other end of the spectrum, the Compact Car segment showed the least depreciation at -0.07%, marking the segment’s smallest weekly decline since early October. Another segment that saw a significant slowdown in depreciation was the Sporty Car segment, which dropped by a mere -0.10%, a stark contrast to its average weekly depreciation of -2.02% over the previous six weeks.

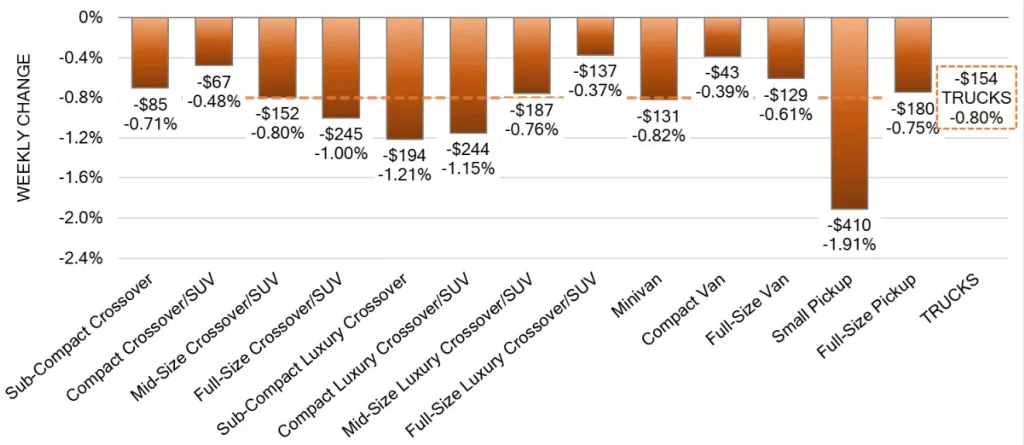

Truck and SUV Segments: Market Movements

On the truck and SUV front, the volume-weighted overall segment witnessed a depreciation of -0.80%, which was marginally higher than the -0.78% from the prior week. Analyzing by age, the newer models (0-to-2 years) saw an average decline of -0.73%, and the older models (8-to-16 years) depreciated by -0.74% on average.

It was observed that all thirteen truck segments experienced a decline last week. However, only four of these reported declines exceeding the 1% threshold. The Small Pickup segment took the hardest hit, with a significant drop of -1.91%, marking the most considerable single-week decline for the segment since May 2020. The Full-Size Luxury Crossover/SUV segment, after enduring substantial declines averaging -2.23% each week for six weeks, saw a noticeable slowdown in depreciation, closing the week at just -0.37%.

Retail Insights: Used Vehicles in the Spotlight

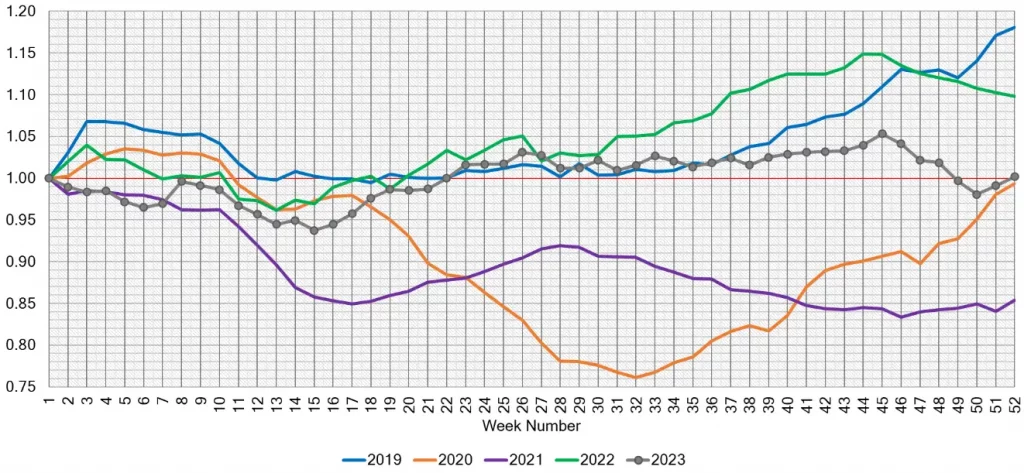

As the year wrapped up, the Used Retail Active Listing Volume Index dipped below the starting point of the year. The Days-to-Turn estimate—a measure of how quickly vehicles are sold—settled at around 61 days by the end of 2023. This indicates a longer period for vehicles to move off the lot, which could be reflective of changing consumer preferences or a more cautious approach to spending in the used vehicle market.

The Wholesale Perspective: Preparing for 2024

The final quarter of 2023 painted a starkly different picture compared to the rest of the year. We witnessed a level of depreciation that had not been seen in recent times, with pronounced declines across all reported segments. This unprecedented trend brings a curious anticipation for the onset of 2024.

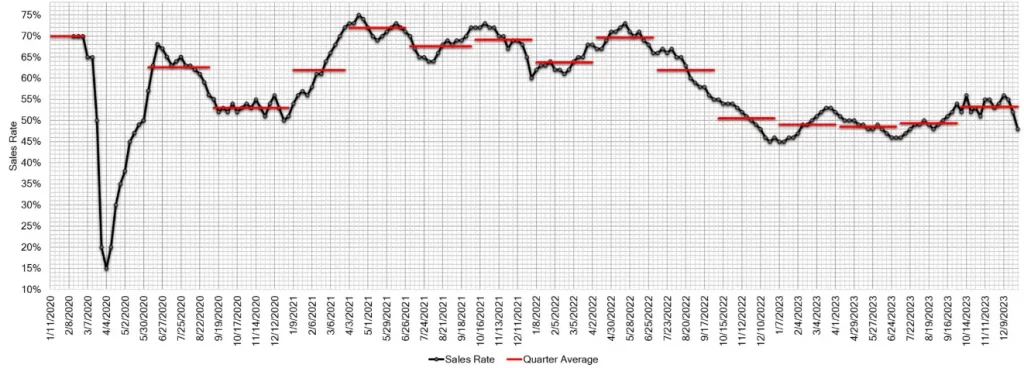

The auction inventory levels are expected to remain high as we enter the new year, attributed to the lower conversion rates observed in the final weeks of 2023. The estimated Average Weekly Sales Rate saw a decrease to 48% during the last week, suggesting a more cautious approach from buyers as they strategize for the year ahead.

Prognosis for 2024: What Lies Ahead?

As industry experts and market analysts look towards 2024, the questions loom large: Will the market stabilize with the high inventory levels? How will consumer behavior influence the direction of car sales? The answers to these will unfold in the weeks to come, but one thing is clear—the auto market’s resilience will be tested as we navigate through the new year’s uncertainties. With a keen eye on market trends and an adaptive strategy, stakeholders can turn these challenges into opportunities for growth and innovation.

For those seeking to keep their finger on the pulse of the auto market, it’s essential to track these trends and prepare for the shifts that lie ahead. As always, staying informed and agile will be key to navigating the ever-changing tides of the auto industry.