This auto market update for August 2025 shows a rapid correction. Used vehicle prices are continuing a steep decline. Their drop is far exceeding what we normally see this time of year. This report gives you a full look at the August 2025 auto market. It covers trends from car segments to auction activity.

Whether you are looking to buy, sell, or just stay informed, understanding today’s used car market outlook is key. It will help you make a smart decision.

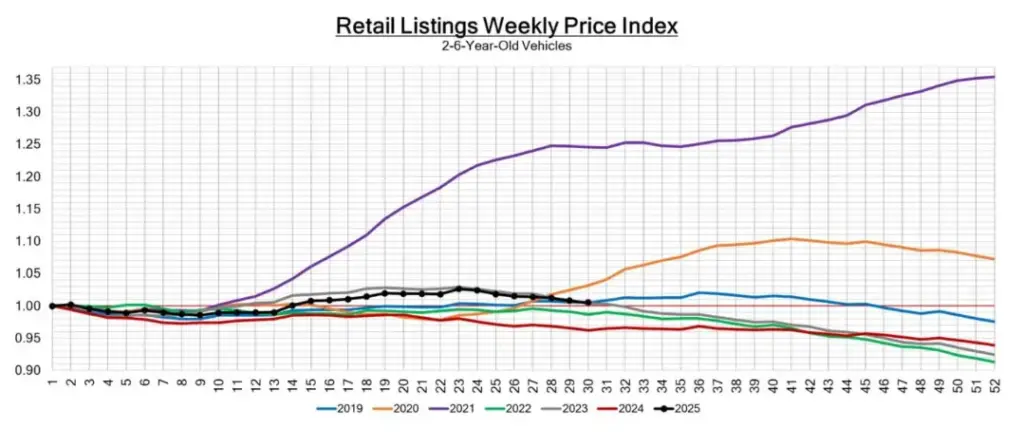

The Big Picture: Accelerating Depreciation

The biggest trend we see in this Auto Market Update for August 2025 is how fast prices are falling. The national average price drop hit 0.58% this week. This is a sharp increase from 0.50% the week before. This fast decline shows that supply now beats demand in some key segments. The current drop is almost twice what we normally see for the season. This tells us the market is shifting fast.

Key Takeaways at a Glance:

- National Average Price Drop: -0.58% (up from -0.50% last week).

- Wholesale Market: Down 0.58%.

- Car Segments: Down 0.57%.

- Truck/SUV Segments: Down 0.59%.

- Auction Conversion Rate: 59% (maintaining strength despite falling prices).

A Deeper Dive into Vehicle Segments and Depreciation Rates

While the overall market is trending down, used car depreciation rates vary significantly by segment.

| Vehicle Segment | Weekly Depreciation (%) |

|---|---|

| Sub-Compact Cars | -0.95 |

| Premium Sporty Cars | 0.00 |

| 0–2 Year Cars | -0.45 |

| 8–16 Year Cars | -0.42 |

| Full-Size Pickups | -0.30 |

| Small Pickups | -0.12 |

| Compact Crossovers | -0.55 |

Passenger Cars: The Sharpest Declines

Sub-compact cars remain the hardest hit. They saw a staggering 0.95% drop this week. In fact, this segment has been on a downward slide for three months straight. In contrast, premium sporty cars stayed strong. Some late-model versions even saw a slight increase in price. This special demand for luxury and performance, consequently, continues to go against the general auto market trends.

Trucks and SUVs: Mixed Signals

The truck and SUV segments show mixed trends. For example, full-size pickups saw their price drop slow to -0.30%. This is an improvement from the -0.41% drop the week before. However, compact crossovers took a major hit. They posted their sharpest weekly decline since January at -0.55%. Therefore, this is a key insight for anyone in the market, as it gives buyers an edge in this segment.

The Wholesale Dynamic

The wholesale market is where dealers buy and sell cars at auction. It is a key indicator of future retail prices. This week’s 0.58% drop shows a clear downward path for vehicle values. This rapid decline puts big pressure on wholesale prices. In turn, it sets the stage for a similar price change in the retail sector.

Auction and Lot Activity

Despite falling prices, the auction conversion rate remains strong at 59%, indicating that dealers are actively buying to replenish their stock. Franchised dealers, in particular, are focused on acquiring mid-size and full-size models, as well as EVs and crossovers, where their inventory is low. Meanwhile, independent lots are strategically targeting older, more affordable vehicles priced under $20,000 to cater to budget-conscious buyers. This steady demand is reflected in the average days-to-turn for inventory, which is holding around 41 days, showing that while vehicles aren’t moving as fast as they did during the peak, they are still not sitting on lots for extended periods.

The Retail Dynamic

Furthermore, we are now seeing the effects of the wholesale market at the retail level. As a result, used car prices have dropped by 0.3%. This is a slower but still big drop. It shows that retail prices are slowly catching up to wholesale trends. Consequently, the gap between wholesale and retail prices is shrinking. This means you can expect to see more aggressive prices on dealer lots in the coming weeks.

We see this same trend at auctions and dealerships. The 59% auction conversion rate shows that dealers are still actively buying cars. Specifically, they need to fill their lots. Franchised dealers want to buy mid-size and full-size models, as well as crossovers and EVs. Their stock is low. Meanwhile, independent lots focus on buying older, more affordable cars. They are buying cars priced under $20,000 for budget-conscious buyers.

Auction Activity: Demand Holds Steady

Despite falling prices, the auction conversion rate remains strong at 59%. This indicates that dealers are actively buying, driven by a need to replenish their inventory. Franchised dealers are particularly interested in mid-size and full-size models, as well as EVs and crossovers, where their stock is low. Meanwhile, independent lots are focused on more affordable, older vehicles priced under $20,000, catering to budget-conscious buyers. The current average days-to-turn for inventory is holding steady around 41 days, showing that while vehicles aren’t flying off the lots, they aren’t sitting for extended periods either.

What This Means for You

The current market is defined by a rapid return to normal depreciation.

- For Buyers: This is an increasingly favorable market. Prices are falling, and a wider selection of vehicles is becoming available. Patience and informed research will be your biggest assets.

- For Sellers: The clock is ticking, especially if you own an economy model or a compact crossover. The best time to sell was yesterday. For sellers of high-end pickups and luxury SUVs, the market is showing signs of stabilization, but values are still likely to decline.

Expert Outlook: What’s Next?

The August 2025 auto market outlook shows a fast return to normal price drops. For the full picture on vehicle values and market trends, keep reading our weekly Auto Market Update August 2025.

- For Buyers: This market is getting better for you. Prices are falling, and you have more cars to choose from.

- For Sellers: Time is not on your side, especially if you own a compact car or crossover. The best time to sell was yesterday.

The market has a lot of change right now. Factors like interest rates, new car discounts, and new models will shape the next few weeks. Staying updated on these weekly shifts is key for anyone looking to make a move in the auto market.