April 26, 2025

The 2025 auto market has hit a historic milestone: all 22 vehicle segments reported wholesale price increases this week, marking the first time since November 2021 that every category saw simultaneous growth. Driven by tight inventory and tariff uncertainties, this surge signals a resilient market despite economic headwinds. Below, we break down key trends impacting Georgia drivers and diminished value claims.

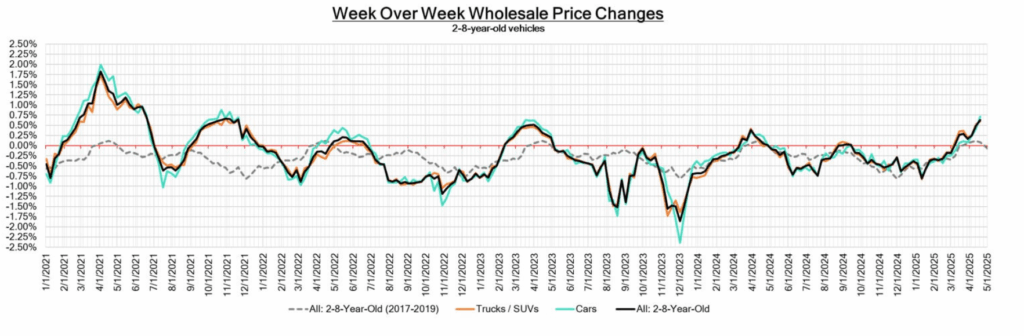

Week Over Week Wholesale Price Changes

| This Week | Last Week | 2017~2019 Same Week Average | |

| Cars | +0.72% | +0.41% | +0.17% |

| Trucks and SUVs | +0.60% | +0.51% | +0.02% |

| Market | +0.63% | +0.48% | +0.08% |

- Market: +0.63% WoW (vs. +0.48% prior week), outpacing the 2017-2019 average of +0.08%.

- Car Segments: +0.72% (up from +0.41% last week), led by Mid-Size Cars (+1.22%) and Prestige Luxury Cars (+0.47%).

- Truck/SUV Segments: +0.60% (vs. +0.51% prior week), with Sub-Compact Crossovers (+1.02%) and Compact Crossovers (+0.98%) leading gains.

- Key Insight: Mid-Size Cars saw their largest weekly jump since October 2021, while Prestige Luxury Cars hit a 3-year high for growth.

Car Segments

- Top Performers:

- Mid-Size Cars: +1.23% (0-2yo models) driven by tariff-driven demand for fuel-efficient sedans.

- Prestige Luxury Cars: +0.47%, the strongest weekly gain since April 2022.

- Older Vehicles: 8-16yo cars rose +0.18%, reflecting demand for budget-friendly options under $20k .

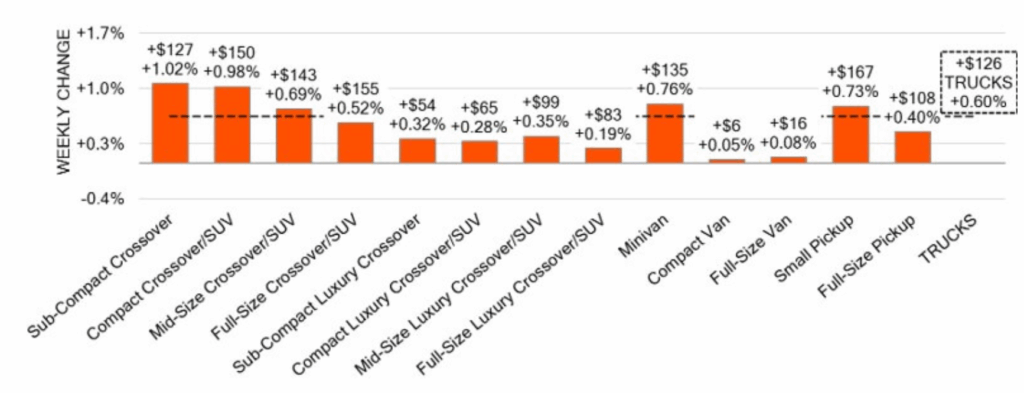

Truck & SUV Segments

- Top Gainers:

- Sub-Compact Crossovers: +1.02% (2-8yo models) as urban buyers prioritize affordability.

- Compact Crossovers: +0.98%, with 0-2yo models up +1.0% for the second straight week.

- Strugglers: Full-Size Vans dipped -0.30% due to oversupply in commercial fleets.

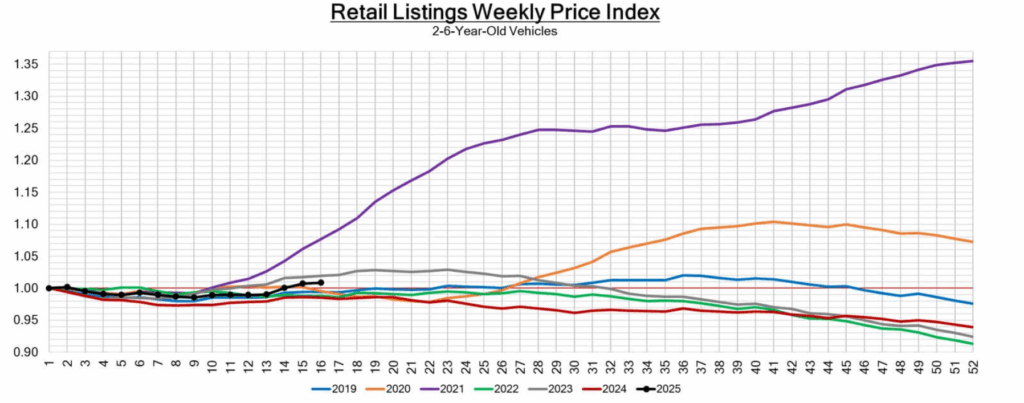

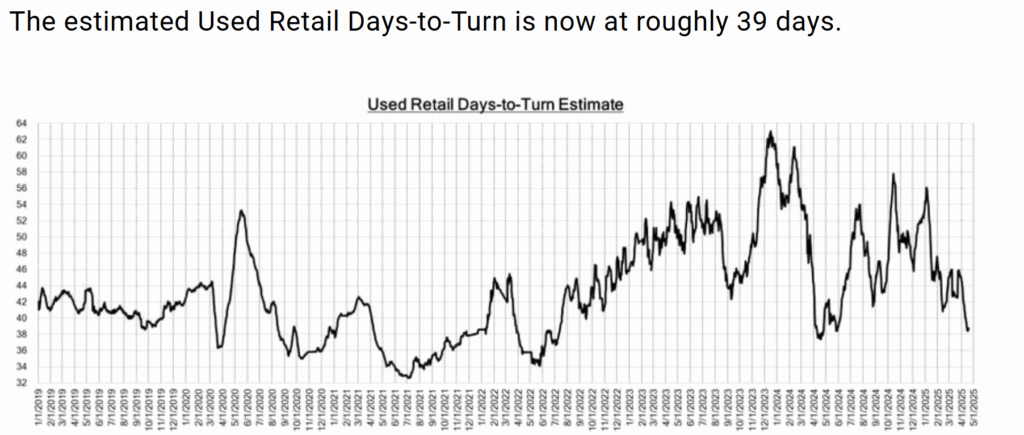

Inventory and Retail Trends

- Retail Prices: Steady climb, with Days-to-Turn at 39 days (down from 43 days in mid-April).

- Auction Activity: Conversion rates held at 62% despite a -3% inventory dip, signaling robust dealer demand.

- Wholesale vs. Retail Gap: Wholesale prices now trail retail by 12%, the narrowest margin since 2021 .

Industry News Highlights

- Tariff Anxiety Fuels Spring Surge

Buyers are rushing to avoid potential 25% tariffs on imports, spiking demand for domestic trucks and EVs. Compact Crossovers (e.g., Ford Escape) are particularly hot, with prices up 9% YTD . - Luxury EVs Defy Depreciation Trends

Prestige Luxury Cars (e.g., Mercedes S-Class) gained +0.47%, countering broader EV depreciation risks. However, post-accident EVs still face 42% value loss—a critical factor for diminished value claims . - Older Cars Outperform Newer Models

Vehicles aged 8-16 years rose +0.18%, as sub-$20k buyers flock to pre-2015 models amid new-car price hikes .

Georgia-Specific Takeaways

- Diminished Value Risks: Luxury EVs and older vehicles remain vulnerable post-accident. Demand USPAP appraisals to counter insurer lowballing.

- Local Hotspots: Atlanta’s Mid-Size Car demand (+1.23%) mirrors national trends, while Savannah’s truck buyers face tighter inventories.

- Act Now: Georgia’s 4-year statute of limitations (O.C.G.A. § 33-4-6) still applies—secure appraisals before 2026 reforms.