The 2025 auto market remains a battleground of volatility: wholesale prices inched upward this week (+0.17%) despite tariff tensions, while retail demand struggles to keep pace with tightening inventory. Below, we dissect Georgia-specific implications for diminished value claims amid shifting valuations and policy risks.

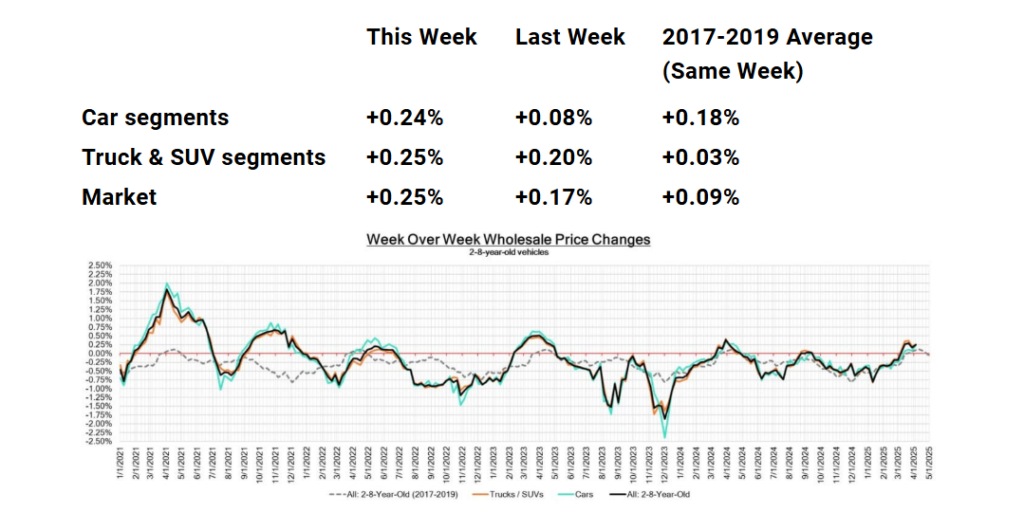

Week Over Week Wholesale Price Changes

- Market: +0.17% WoW (vs. +0.24% prior week), driven by tax refund-fueled spring demand.

- Trucks/SUVs: +0.20% (Mid-Size Crossovers lead at +0.52%, Full-Size SUVs +0.36%).

- Cars: +0.08%, with Full-Size Cars (+0.36%) outperforming Prestige Luxury (-0.60%) and Sub-Compacts (-0.13%).

- Key Insight: Tariff fears (25% on imports effective April 3) are propping up domestic used truck values, while luxury EVs face steeper depreciation.

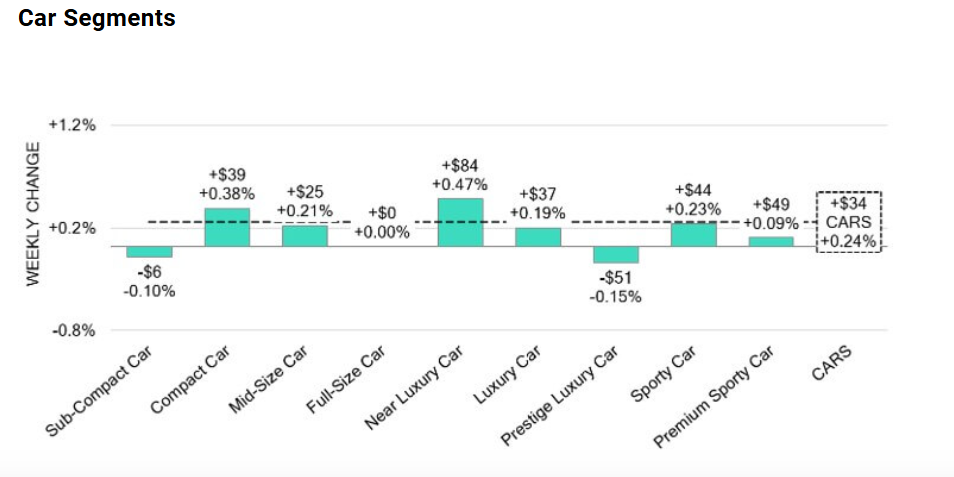

Car Segments

- Winners: Full-Size Cars (+0.36%), Near Luxury (+0.40% for 0-2yo models).

- Losers: Prestige Luxury (-0.60%), Sub-Compacts (-0.13%).

- Trend: Older vehicles (8-16yo) depreciate faster (-0.10%) as buyers prioritize newer, tariff-proof inventory.

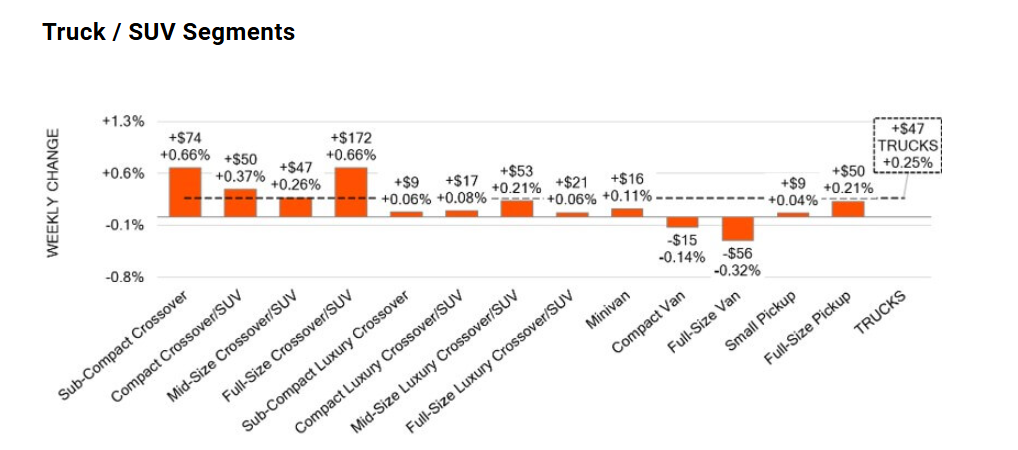

Truck & SUV Segments

- Top Gainers: Mid-Size Crossover/SUVs (+0.52%), Small Pickups (+0.24%).

- Decliners: Full-Size Vans (-0.30%), Luxury Crossovers (-0.61%).

- Why It Matters: Georgia’s truck-heavy market (Atlanta/Fulton County) sees increased demand for domestic models like Ford F-150 and Ram 1500 amid tariff uncertainty.

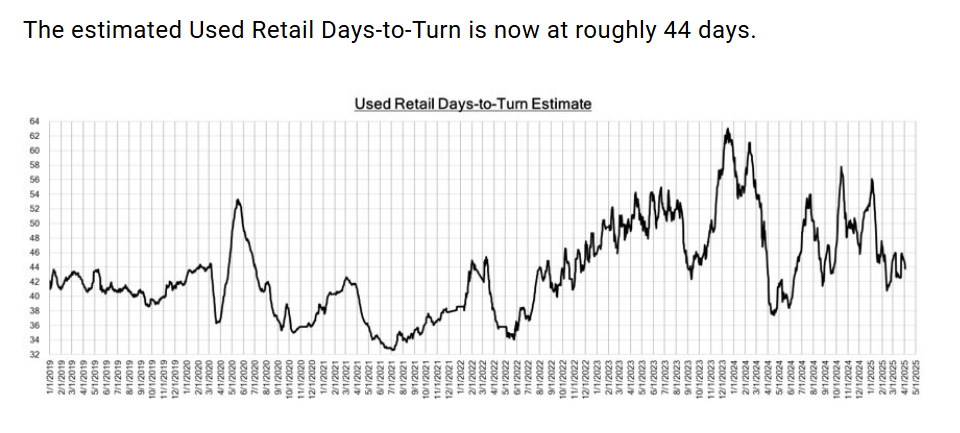

Inventory and Retail Trends

- Retail Prices: +0.17% WoW, driven by tax refunds and spring demand.

- Days-to-Turn: 43 days (up from 42 in March), signaling tighter inventory and cautious buyers.

- Wholesale Inventory: Declined 12% MoM, with auction conversion rates at 66%—the highest of 2025.

Industry News Highlights

25% Import Tariffs Shake Market

Trump’s 25% tariff on imported vehicles took effect April 3, inflating prices for non-domestic models (e.g., Toyota Camry, Honda Civic). Dealers report a 15% surge in used truck demand as buyers pivot to avoid tariff costs.

EV Depreciation Accelerates

Luxury EVs (Tesla Model S, Mercedes EQS) depreciate 42% faster post-accident vs. gas cars. Georgia’s expanded EV tax credits (up to $7,500) fail to offset resale losses, complicating diminished value claims.

Auction Liquidity Declines

Total auction inventory dropped 8% in March, with “average condition” vehicles struggling to sell. Exporters of Canadian-used cars gained traction, narrowing price gaps with U.S. units.

Conclusion: Georgia-Specific Takeaways

- Diminished Value Claims: Luxury EVs and older vehicles face heightened risk; demand USPAP appraisals to counter insurer lowballing.

- Local Market: Atlanta’s used truck values (+0.36%) outpace cars, but tariff-driven volatility demands swift action.

- Act Now: Georgia’s 4-year statute of limitations (O.C.G.A. § 33-4-6) still applies—secure appraisals before 2026 reforms.

Need Help? Get a Free 2025 Appraisal to navigate this shifting landscape.