Auto Market Update – November 26, 2024

As we near the end of November, the auto market reflects typical late-year patterns, with depreciation trends stabilizing and a focus on high-demand segments. This week’s highlights include an in-depth look at price trends across segments, the used retail market, and an analysis of auction conversion rates. Additionally, key industry news—from Nissan’s financial challenges to KTM’s debt restructuring—paint a vivid picture of ongoing shifts in the global auto landscape.

Quick Stats

- Car Segments: -0.41% (This Week), -0.61% (Last Week)

- Truck & SUV Segments: -0.48% (This Week), -0.47% (Last Week)

- Overall Market: -0.46%

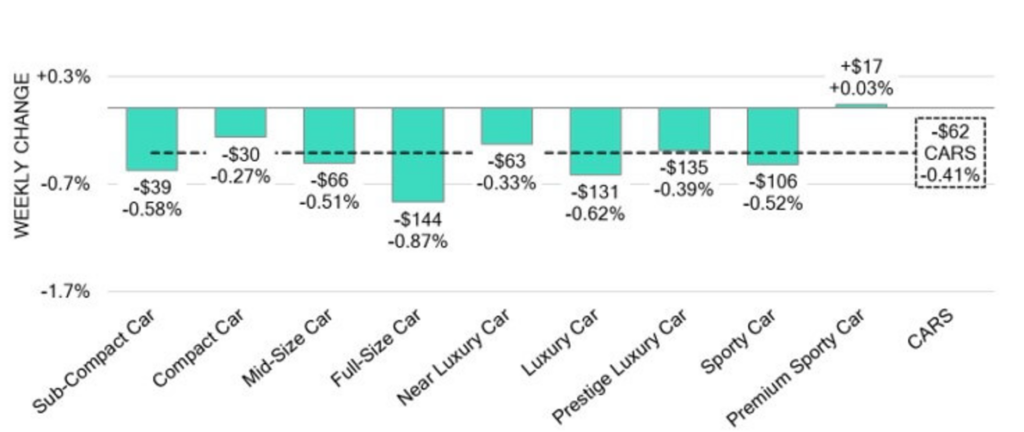

Car Segments

- On a volume-weighted basis, the overall car segment declined by -0.41%, identical to the previous week’s change.

- Almost all subsegments showed a decrease, with the most notable being the Full-Size Car, which declined by -0.87%, reflecting increased volatility.

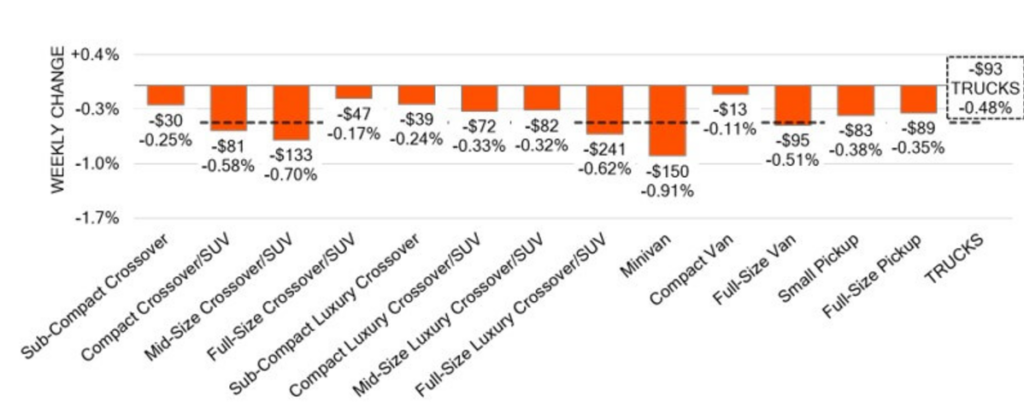

Truck & SUV Segments

- Trucks and SUVs decreased by -0.48% this week.

- The Compact Van showed resilience with a minimal decline of -0.11%, while the Minivan faced the steepest drop at -0.91%.

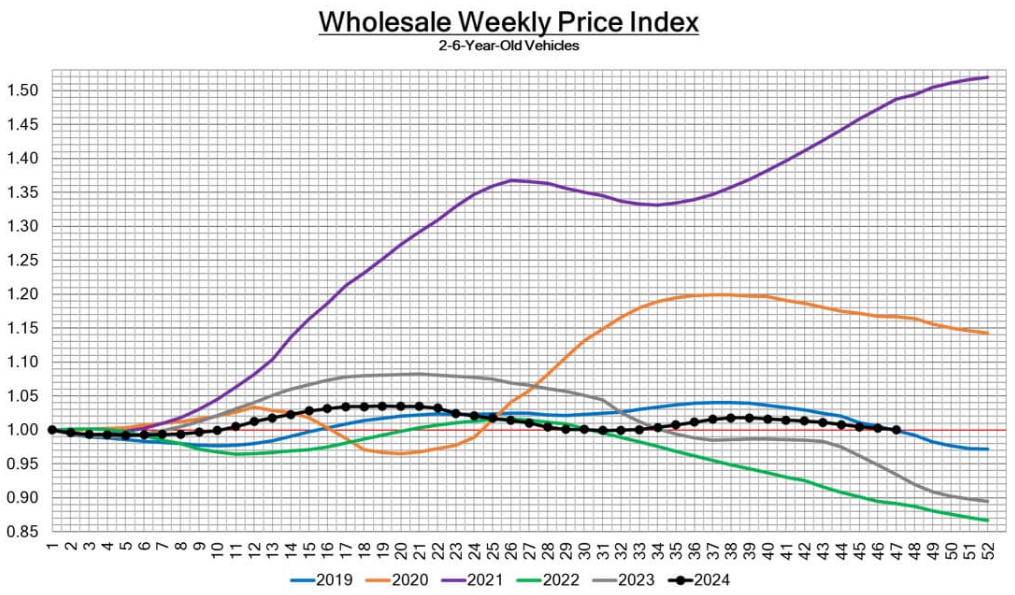

Weekly Wholesale Price Index

Wholesale prices for 2-to-6-year-old vehicles continue their steady decline. The index highlights the broader market depreciation while factoring in seasonal adjustments.

Inventory

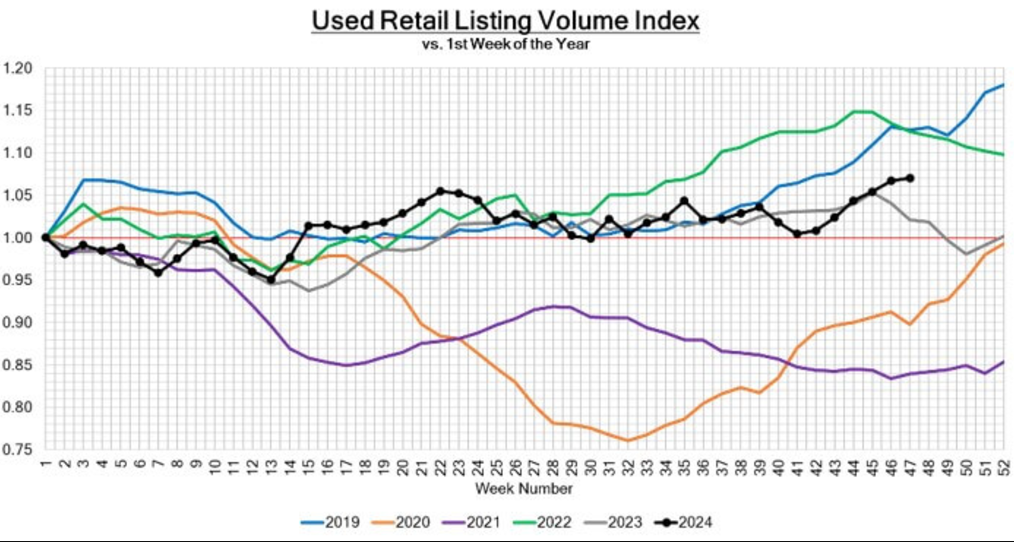

Used Retail

The Used Retail Active Listing Volume Index remains stable, showing increased accessibility for customers. Current inventory trends indicate a normalization of supply, easing pressure on pricing.

- The estimated Days-to-Turn is now roughly 44 days, reflecting improved efficiency in the retail sector.

Wholesale

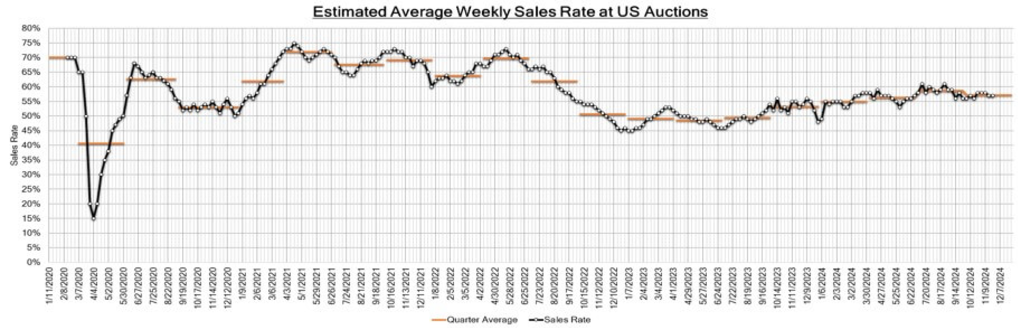

Auction conversion rates remained stable at 57% this week. This consistency highlights robust activity across dealer lots, particularly with 2024 and 2025 models, which maintain strong demand.

News Highlights

1. Nissan Faces Critical Challenges

Nissan’s CEO, Makoto Uchida, announced bold restructuring plans as the automaker grapples with declining growth. Reports suggest the company could survive only 12–14 months at its current pace without significant intervention. A planned 9,000 layoffs and cost-saving measures aim to save billions.

2. KTM Begins Debt Restructuring

Europe’s largest motorcycle manufacturer, KTM, faces severe financial woes, entering a self-administered debt restructuring phase. With sales down 27% in 2024 and €1.4 billion in net debt, the company has 90 days to finalize a new financing plan. CEO Stefan Pierer remains optimistic, calling it a “pit stop for the future.”

3. Toyota Supra’s Farewell Edition

Toyota announced the A90 Supra Final Edition, marking the end of its fifth-generation production in 2025. Limited to 300 units globally, the Final Edition boasts a 320kW engine, carbon-fiber enhancements, and track-ready features. While Australia won’t receive this model, the Supra Track Edition will fill the gap with cosmetic and handling upgrades.

Final Thoughts

As 2024 concludes, the auto market demonstrates a mix of stability and volatility. Segment depreciation remains within predictable ranges, while new developments in the industry highlight the shifting dynamics of global automakers.

Whether it’s Nissan’s survival strategy, KTM’s financial hurdles, or Toyota’s iconic Supra bidding farewell, the industry continues to evolve, offering opportunities and challenges for buyers, sellers, and enthusiasts alike.