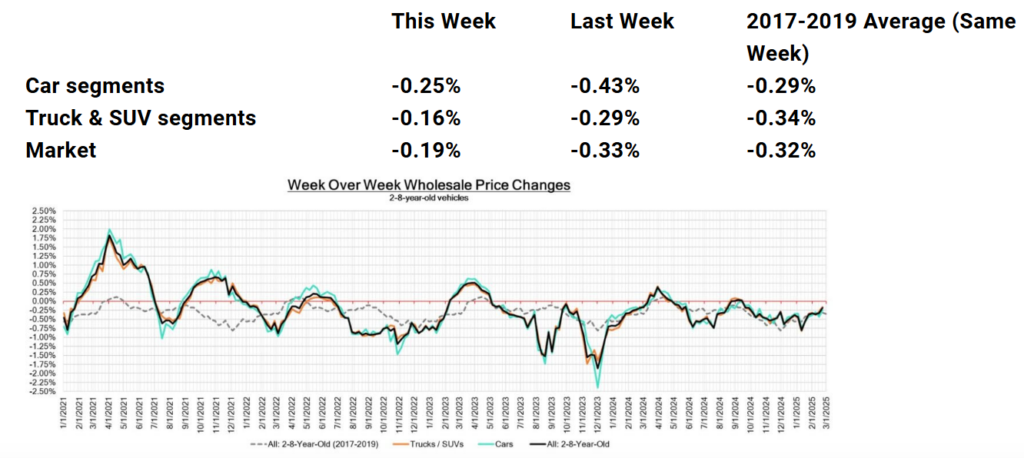

Wholesale Price Trends

Market depreciation slowed, aligning with seasonal norms, but challenges linger for older models:

| Category | This Week | Last Week | 2017–2019 Average |

|---|---|---|---|

| Car Segments | -0.25% | -0.43% | -0.29% |

| Truck & SUV Segments | -0.16% | -0.29% | -0.34% |

| Whole Market | -0.19% | -0.33% | -0.32% |

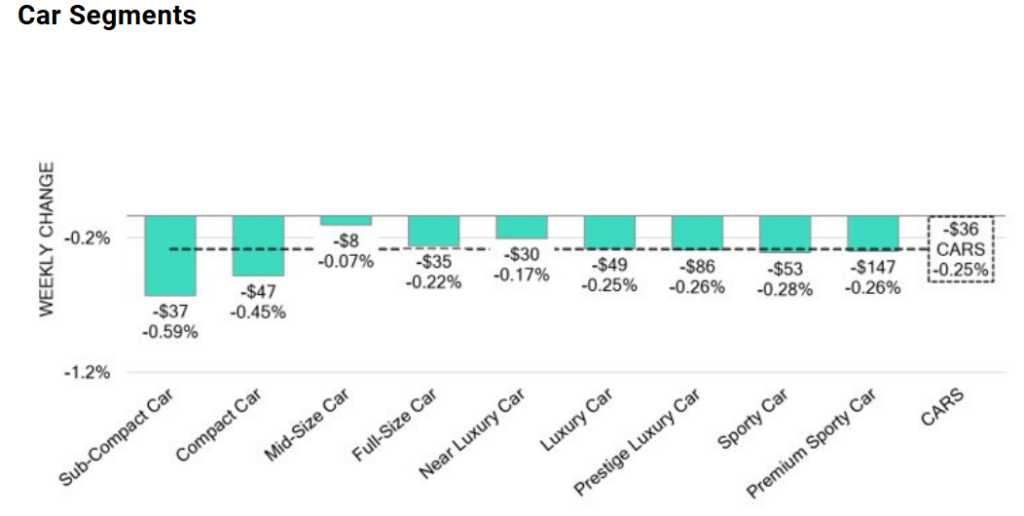

Car Trends

Newer models stabilize, but older vehicles face steep declines:

- 0-to-2-Year-Old Cars: Near positive territory with a minimal -0.02% dip. Mid-Size Cars led gains, rising +0.51% (e.g., Toyota Camry, Honda Accord).

- Aging Vehicles: 8-to-16-year-old Cars fell -0.64%, with Sub-Compact Cars (e.g., Nissan Versa) averaging -0.74% weekly declines over eight weeks.

- Luxury Challenges: All nine car segments declined, reflecting softer demand for sedans and high-maintenance luxury models.

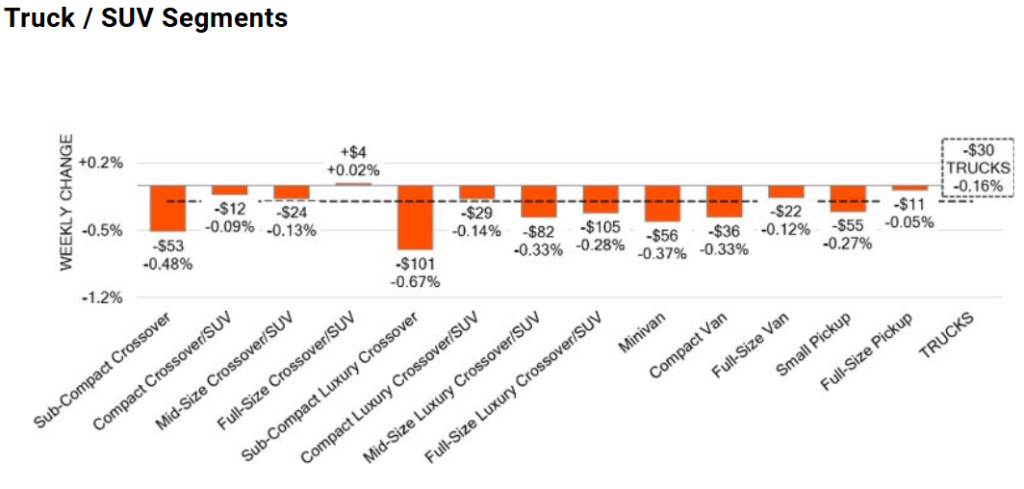

Truck & SUV Trends

Full-Size segments show early spring strength:

- Full-Size Crossovers/SUVs: Entered positive territory for the first time this year (+0.02%), led by models like Chevrolet Tahoe and Ford Expedition.

- Full-Size Pickups: 0-to-2-year-old trucks (e.g., Ford F-150, RAM 1500) saw a +0.01% uptick, three weeks earlier than 2024’s first gain.

- Older Models: 8-to-16-year-old Trucks/SUVs dropped -0.51%, with Compact Crossovers (e.g., Honda CR-V) struggling at -0.45%.

Stat to Watch:

- Auction Conversion Rate: Held steady at 58%, but inventory dipped due to fewer Canadian exports.

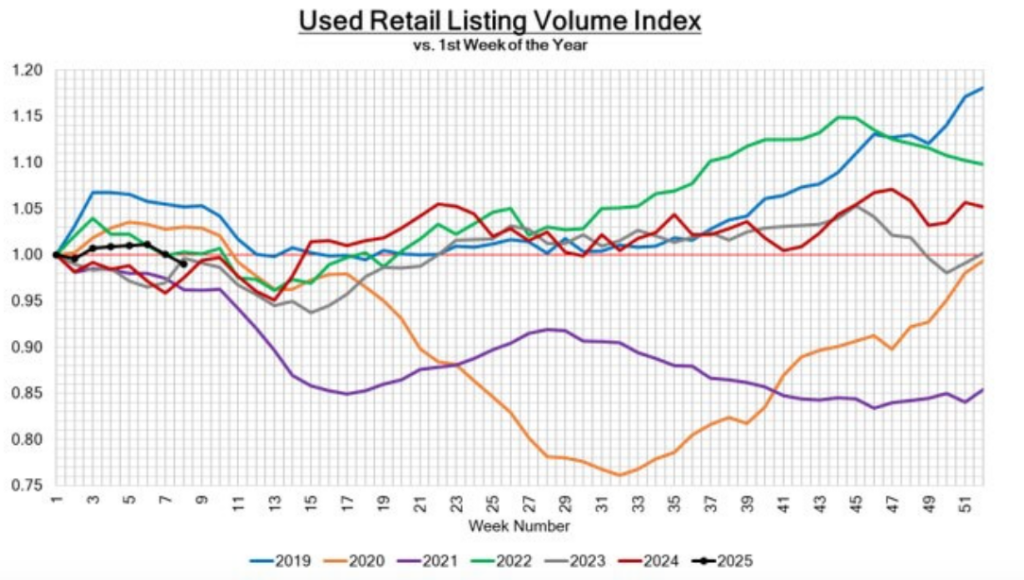

Inventory & Retail Trends

- Auction Inventory: Declined slightly, with uncertainty around potential tariff hikes slowing dealer acquisitions.

- Retail Pricing: Transparent “no-haggle” strategies stabilized retail listings, with 2-to-6-year-old vehicles indexed to seasonal norms.

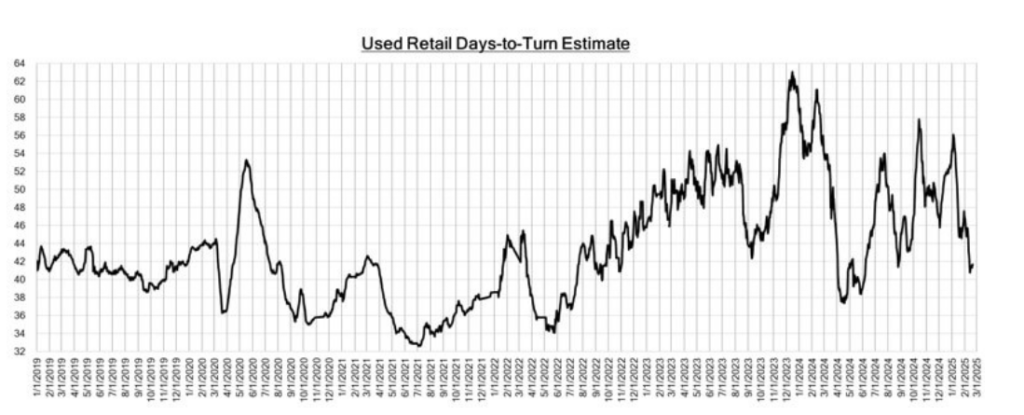

Used Vehicles

- Days-to-Turn: Estimated at 42 days, reflecting steady demand for newer inventory.

- Retail Price Index: 2-to-6-year-old vehicles show resilience, particularly in the Mid-Size Car and Full-Size Truck segments.

3 Trending News of the Week

- Tariff Anxiety: Proposed U.S.-Canada auto tariffs threaten auction liquidity, with dealers holding 15% fewer cross-border units.

- Mid-Size Car Resurgence: Dealers report increased demand for 0-to-2-year-old sedans like the Honda Accord, reversing a five-year decline.

- AI-Driven Pricing: Retailers adopt dynamic pricing tools, narrowing profit margins for older inventory.

Legislative & Economic Insights

- Trade Policy Watch: Looming tariff decisions could disrupt auction flows, particularly for Full-Size Trucks reliant on Canadian imports.

- Interest Rates: Steady at 6.8%, but subprime loan approvals dip, pressuring 8-to-16-year-old vehicle sales.

Georgia-Specific Insights

- Full-Size Pickup Demand: Savannah and Augusta construction booms drive +0.6% gains for used Silverado 2500HD models.

- Luxury SUV Slump: Atlanta’s 8-to-16-year-old luxury SUV inventory (e.g., Cadillac Escalade) sits unsold for 60+ days.

- Rural Challenges: Southeast Georgia dealers report 25% slower turnover for older models vs. metro areas.

Action Steps for Owners

- Prioritize Newer Inventory: 0-to-2-year-old vehicles offer faster turnover and stronger margins.

- Audit Aging Stock: Use Black Book’s VIN-specific tools to price 8-to-16-year-old models competitively.

- Monitor Tariffs: Diversify sourcing to offset potential Canadian import disruptions.