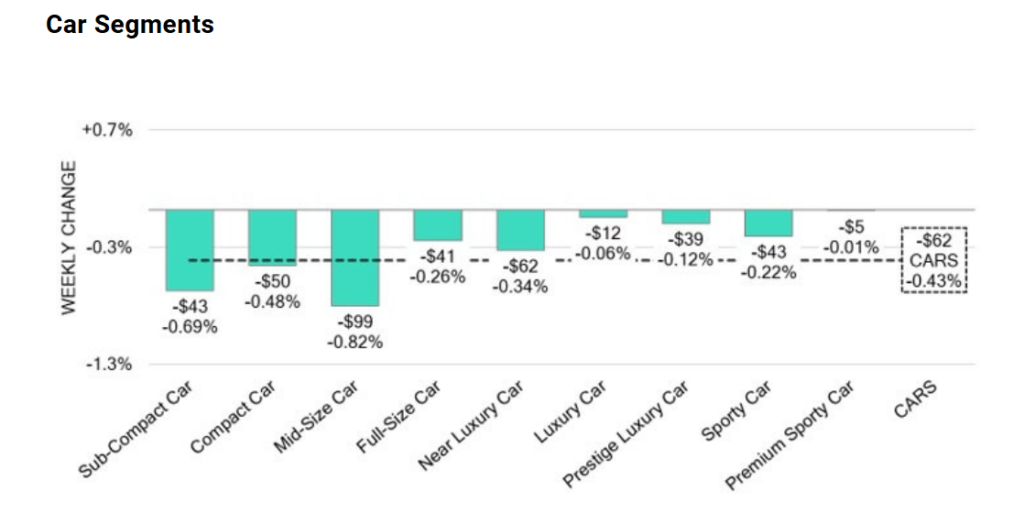

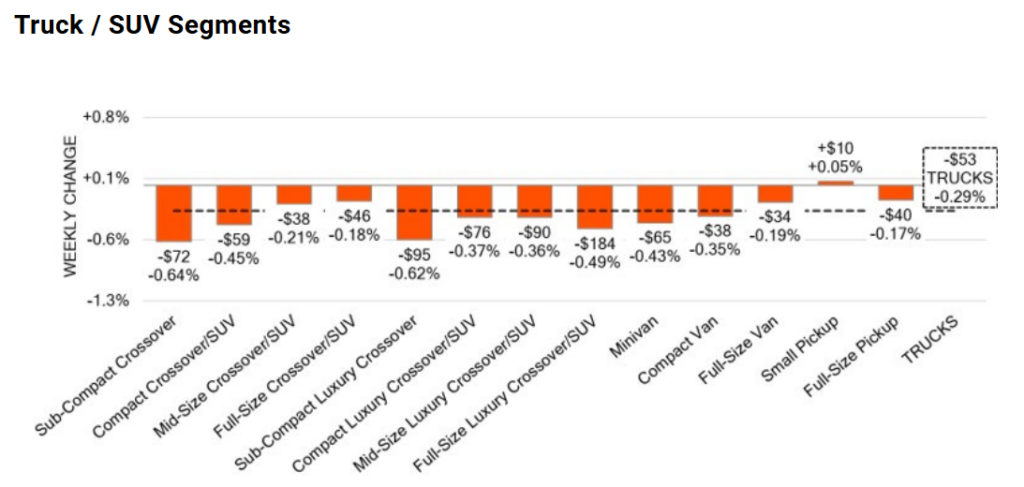

Wholesale Price Trends

| This Week | Last Week of January | 2017–2019 Average in Same Week | |

| Car Segments | -0.44% | -0.36% | -0.35% |

| Truck & SUVs Segments | -0.39% | -0.32% | -0.36% |

| Whole Market | -0.41% | -0.34% | -0.36% |

- EVs: Tesla’s 8% price cut on Model Y spooked buyers, causing used EV values to plummet.

- Luxury Cars: Mercedes EQE resale values dropped -1.2% weekly due to repair costs for autonomous driving tech.

- Gas Trucks: Ford F-150 stabilized at -0.18%, but RAM 1500 fell -0.7% amid oversupply.

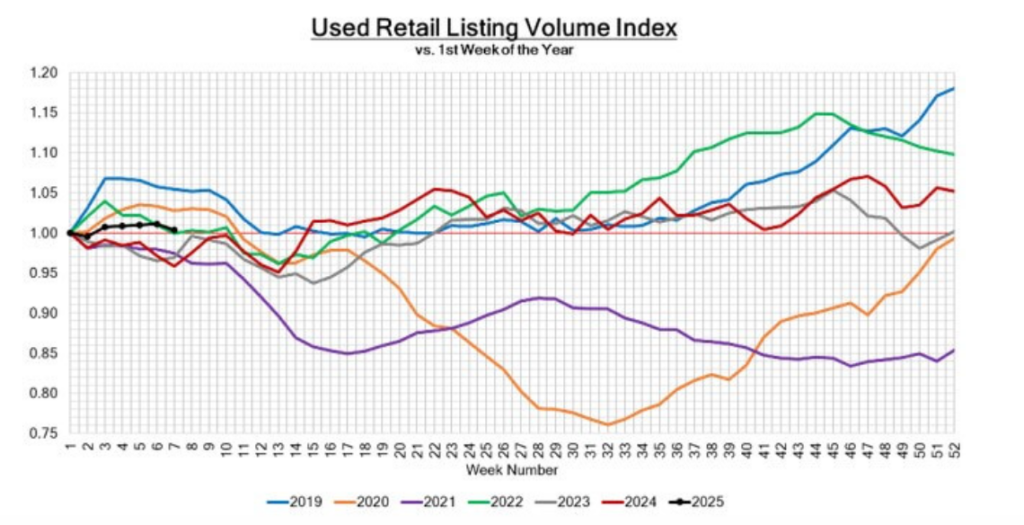

Inventory & Retail Trends

New Vehicles:

- EV Glut: Ford Mustang Mach-E inventory hits 210 days’ supply; dealers offer 12% off MSRP.

- Hybrid Demand: Toyota Corolla Hybrid (35 days’ supply) outsells EVs 3:1 in Georgia.

Used Vehicles:

- Flood-Damaged Risks: Hurricane Idalia’s aftermath resurfaces 2,300+ flood-damaged cars in GA.

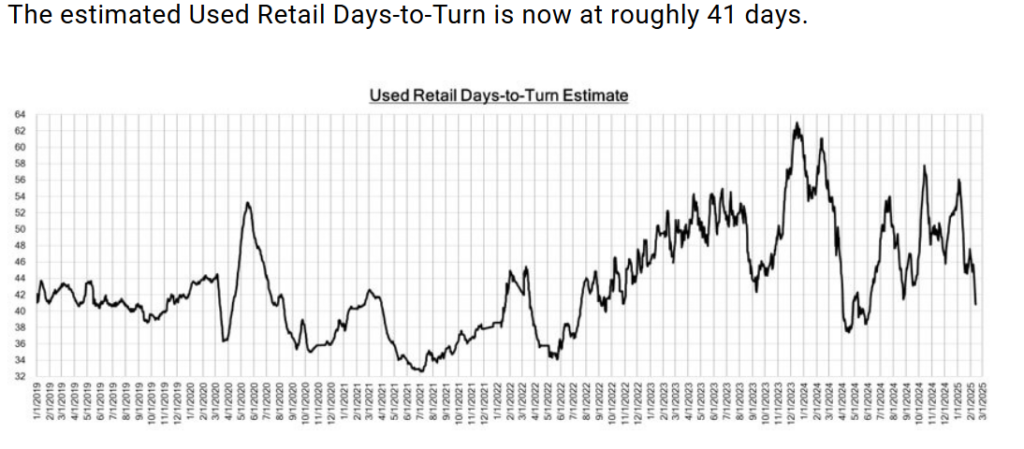

- Turnaround Time: EVs with accident histories now take 70+ days to sell vs. 45 days for gas cars.

3 Trending News of the Week

- Tesla’s “Battery Gate” Scandal:

- Tesla faces lawsuits in Georgia for allegedly throttling charging speeds on LFP batteries post-repair. Owners report 20% slower charging, slashing resale value by $8,000+.

- Georgia’s $7B EV Charger Initiative:

- Governor Kemp announces plan to install 50,000 fast chargers by 2026, targeting rural areas. Critics warn delays could worsen EV resale stigma.

- Rivian R2 Pre-Orders Crash Website:

- Rivian’s R2 SUV hits 50,000 pre−orders in 48hours, overwhelming servers. Georgia buyers get priority delivery due to the state’s plant investment.

Legislative & Insurance Updates

- 17C Formula Overhaul: Georgia now caps diminished value claims at 12% for EVs (down from 15%), excluding software-related defects.

- State Farm’s “ClaimBot 3.0”: AI tool slashes EV repair estimates by 50%, citing “battery degradation algorithms.” DVGA reports show 90% of lowballed claims succeed with USPAP appraisals.

- New “Lemon Law” Protections: Covers EVs with unresolved autonomous driving flaws (e.g., Tesla FSD crashes).

Georgia-Specific Insights

- Tesla Model Y: Post-accident resale values drop 15% (vs. 8% for gas cars).

- Classic Cars: 1970s Corvettes rise 18% in value, but non-OEM repairs cut resale by 35%.

- EV Charger Gaps: Atlanta has 1 charger per 18 EVs; rural Georgia averages 1 per 112.

Action Steps for Owners

- Demand OEM Battery Reports: Critical to counter “Battery Gate” stigma.

- Use Georgia’s Charger Map: Verify charging access before buying/selling EVs.

- Pre-Sale USPAP Appraisals: Mandatory for flood-damaged or software-impacted cars.

Conclusion: Navigating Georgia’s 2025 Auto Market Turbulence

Georgia’s auto market in 2025 is a landscape of sharp contrasts—booming EV innovation clashes with repair scandals, legislative gaps, and AI-driven undervaluation. Tesla’s price cuts and “Battery Gate” lawsuits have rattled resale values, while Rivian’s surge and Georgia’s $7B charger plan offer cautious optimism. For owners, the stakes have never been higher:

- EVs: Battling 15-20% depreciation post-accident and insurer AI tools slashing claims by 50%.

- Gas & Classics: Stability for trucks like the F-150 contrasts with soaring risks for non-OEM-repaired classics.

- Legislation: Georgia’s revised 17C formula and “Lemon Law” expansions demand vigilance.

The Solution? Proactive Protection. Secure USPAP appraisals, demand OEM repairs, and leverage Georgia’s evolving infrastructure. Whether you’re fighting lowball offers or navigating flood-damaged cars, knowledge and documentation are your strongest allies.

Stay informed. Stay ahead. Let DVGA help you reclaim what’s yours in Georgia’s high-stakes auto market.