Auto Market Update – December 10, 2024

The first week of December saw a significant increase in market depreciation rates following the brief stabilization observed during Thanksgiving week. Vehicles across various age groups experienced declines, with 2-to-6-year-old vehicles showing a depreciation of 0.37%, compared to 0.31% the prior week. Cars declined by 0.44%, while Trucks and SUVs decreased by 0.33% on average. This marks a continued trend in seasonal depreciation as we approach the year’s end.

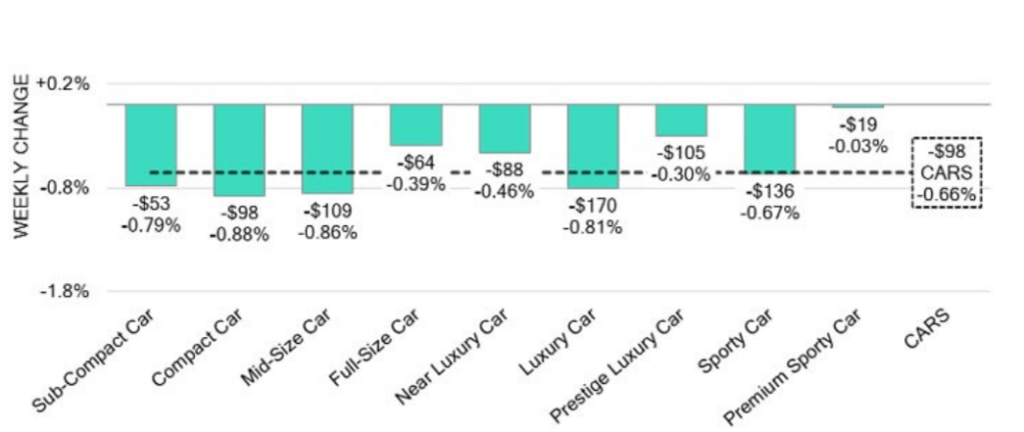

Car Segments

- Compact and Midsize Cars experienced significant drops, with Compact Cars declining by 0.54%, marking the steepest weekly decline since October.

- The 2-to-6-year-old age group showed an average depreciation of 0.51%, while 16-year-old vehicles fared better with a smaller decline of 0.29%.

- Demand for sports and premium vehicles remained relatively stable, reporting minor fluctuations compared to broader market trends.

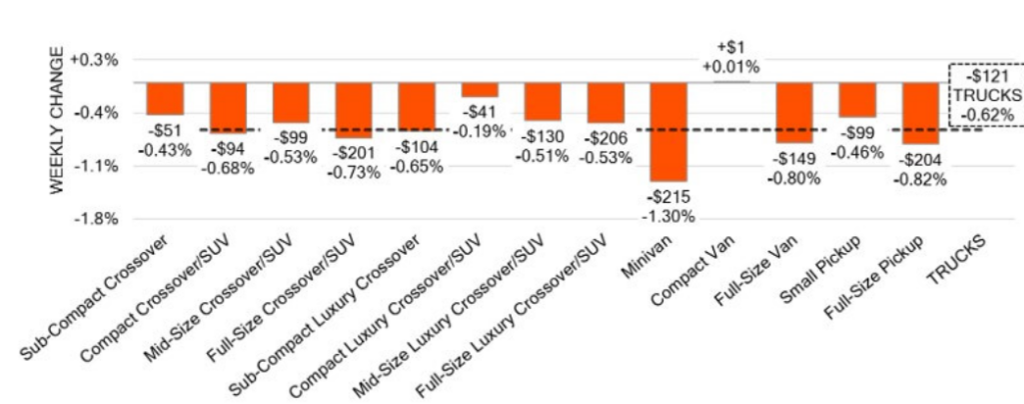

Truck & SUV Segments

- Truck segments saw a 0.33% average decline, with Full-Size Trucks experiencing the largest depreciation at 0.43%.

- Subcompact SUVs displayed resilience, recording the smallest change with a decline of 0.17%.

- Seasonal adjustments are influencing SUV inventory movements, particularly as demand for smaller SUVs increases during the winter months.

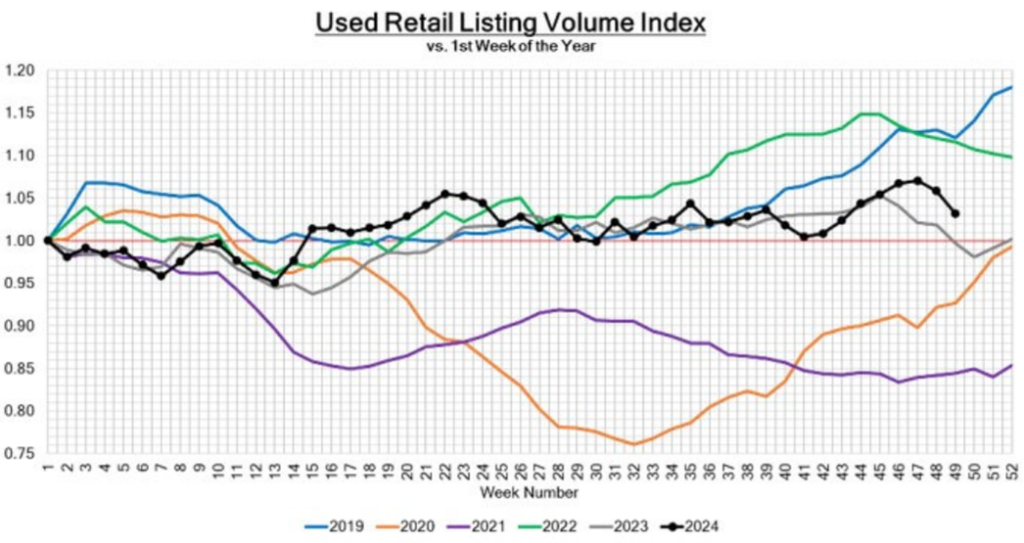

Used Retail Price Index

Used retail prices remain competitive, supported by increased transparency and online platforms, making the market more favorable for consumers. The Active Listing Volume Index continues to rise, with retail prices closely tracking inventory dynamics.

Key Metric: Estimated Days to Turn

- Current: 47 days, signaling slightly faster inventory movement than this time last year.

Industry News Highlights

1. Rivian Rises: Stock Surges Amid Industry Recognition

Rivian’s stock saw a 13% surge, bolstered by industry analysts labeling the EV manufacturer as a key contender in the market over the next decade. Rivian recently launched an open EV charging network, starting in Joshua Tree, California, and has partnerships with Amazon and Volkswagen, cementing its strong position in the industry.

2. Google Maps Integration for Hyundai and Kia

Hyundai, Kia, and Genesis announced an exciting Google Maps Platform integration for their infotainment systems, enhancing navigation with over 250 million points of interest. This move underscores the automakers’ shift toward software-defined vehicles (SDVs) and aims to provide drivers with a richer, more connected driving experience.

3. Tenstorrent and BOS Unveil Automotive AI Chips

In a step toward revolutionizing in-vehicle AI, Canadian startup Tenstorrent and Hyundai-backed BOS Semiconductors revealed their cutting-edge “Eagle-N” chiplets, which debut at CES 2025. These modular chips allow automakers to customize performance while lowering costs, making them a strong challenger to established players like Qualcomm.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion and Outlook

The auto market is navigating seasonal fluctuations, with depreciation rates climbing and auction dynamics stabilizing. As innovative technologies reshape the industry, partnerships like those of Rivian, Hyundai, and BOS point toward a future driven by enhanced connectivity and sustainable mobility.

As always, our team remains focused on tracking these trends to provide actionable insights for consumers, dealers, and industry stakeholders alike.

Auction Conversion Rate (Week Ending December 7): 66%